Strategi pelacakan momentum lintas jangka waktu

Penulis:ChaoZhang, Tanggal: 2024-02-01 10:21:09Tag:

Gambaran umum

Strategi ini menggabungkan 123 pembalikan dan indikator MACD untuk mencapai pelacakan momentum lintas kerangka waktu. pembalikan 123 menentukan titik pembalikan tren jangka pendek, dan MACD menentukan tren jangka menengah dan panjang. kombinasi menghasilkan sinyal panjang / pendek yang mengunci tren jangka menengah dan panjang sambil menangkap pembalikan jangka pendek.

Logika Strategi

Strategi ini terdiri dari dua bagian:

-

123 bagian pembalikan: menghasilkan sinyal beli/jual ketika dua candlestick terakhir membentuk puncak/rendah DAN osilator Stochastics berada di bawah/di atas 50.

-

Bagian MACD: menghasilkan sinyal beli ketika garis MACD melintasi di atas garis sinyal, dan sinyal jual ketika melintasi di bawahnya.

Sinyal akhir dipicu ketika kedua belah pihak setuju pada arah perdagangan.

Analisis Keuntungan

Strategi ini menggabungkan pembalikan jangka pendek dan tren jangka menengah hingga panjang, yang memungkinkan untuk mengunci gerakan tren. Ini meningkatkan tingkat kemenangan, terutama di pasar yang berkisar di mana pembalikan 123 membantu menyaring kebisingan.

Parameter juga dapat disetel untuk menyeimbangkan sinyal pembalikan dan tren untuk kondisi pasar yang berbeda.

Analisis Risiko

Strategi ini memiliki beberapa keterlambatan waktu, terutama dengan periode MACD yang lebih lama, yang dapat menyebabkan gerakan jangka pendek yang hilang.

Memperpendek periode MACD atau menambahkan stop dapat membantu mengendalikan risiko.

Arahan Optimasi

Cara yang mungkin untuk mengoptimalkan strategi:

-

Tune 123 reversal parameter untuk meningkatkan reversals.

-

Tune parameter MACD untuk meningkatkan identifikasi tren.

-

Tambahkan filter dengan indikator lain untuk meningkatkan kinerja.

-

Tambahkan stop loss untuk mengontrol risiko.

Kesimpulan

Strategi ini menggabungkan parameter di seluruh kerangka waktu bersama dengan beberapa indikator teknis untuk pelacakan momentum lintas kerangka waktu, menyeimbangkan pro dari strategi pembalikan dan tren-mengikuti.

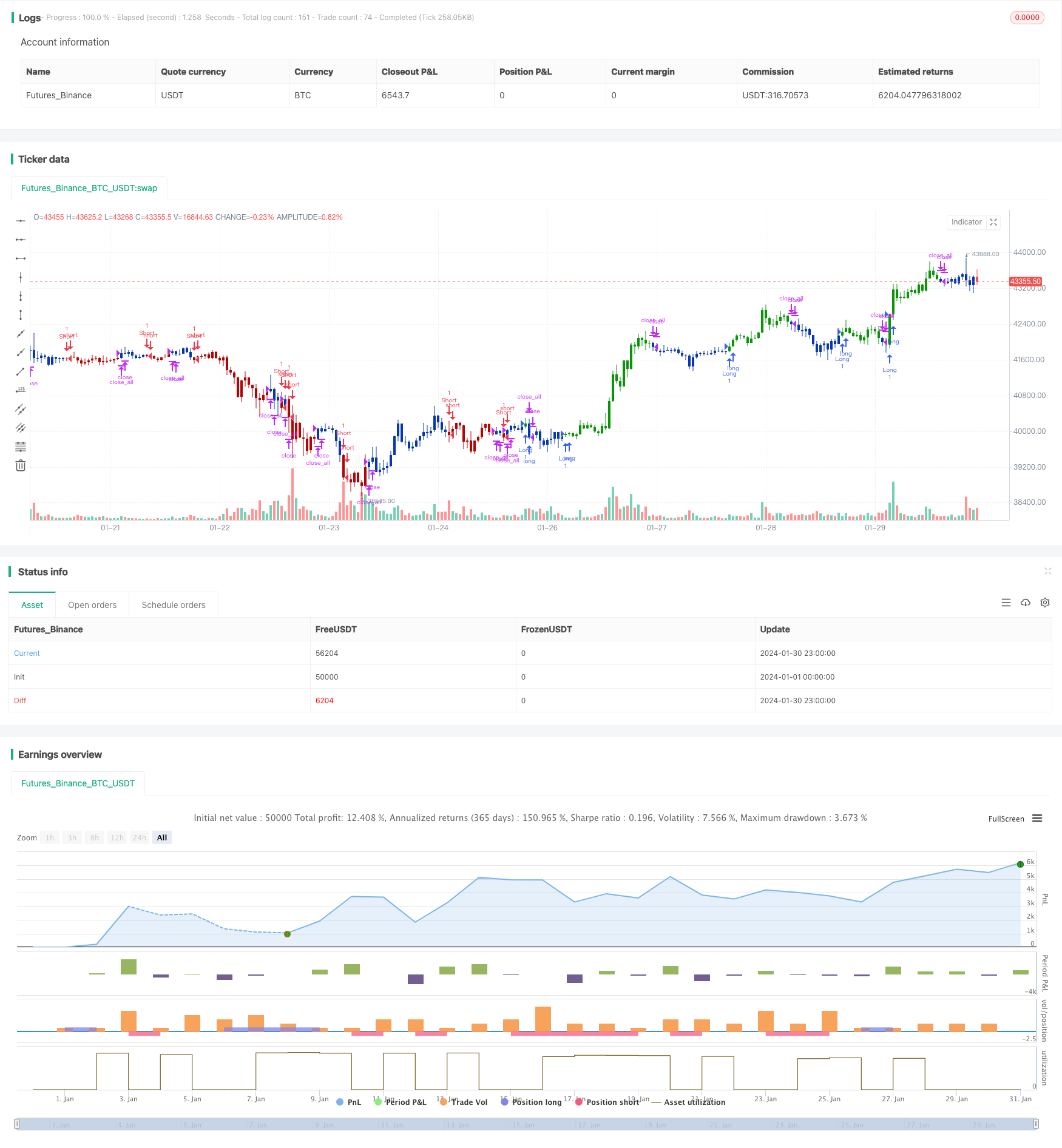

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 28/01/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// MACD – Moving Average Convergence Divergence. The MACD is calculated

// by subtracting a 26-day moving average of a security's price from a

// 12-day moving average of its price. The result is an indicator that

// oscillates above and below zero. When the MACD is above zero, it means

// the 12-day moving average is higher than the 26-day moving average.

// This is bullish as it shows that current expectations (i.e., the 12-day

// moving average) are more bullish than previous expectations (i.e., the

// 26-day average). This implies a bullish, or upward, shift in the supply/demand

// lines. When the MACD falls below zero, it means that the 12-day moving average

// is less than the 26-day moving average, implying a bearish shift in the

// supply/demand lines.

// A 9-day moving average of the MACD (not of the security's price) is usually

// plotted on top of the MACD indicator. This line is referred to as the "signal"

// line. The signal line anticipates the convergence of the two moving averages

// (i.e., the movement of the MACD toward the zero line).

// Let's consider the rational behind this technique. The MACD is the difference

// between two moving averages of price. When the shorter-term moving average rises

// above the longer-term moving average (i.e., the MACD rises above zero), it means

// that investor expectations are becoming more bullish (i.e., there has been an

// upward shift in the supply/demand lines). By plotting a 9-day moving average of

// the MACD, we can see the changing of expectations (i.e., the shifting of the

// supply/demand lines) as they occur.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

MACD(fastLength,slowLength,signalLength) =>

pos = 0.0

fastMA = ema(close, fastLength)

slowMA = ema(close, slowLength)

macd = fastMA - slowMA

signal = sma(macd, signalLength)

pos:= iff(signal < macd , 1,

iff(signal > macd, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & MACD Crossover", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

fastLength = input(8, minval=1)

slowLength = input(16,minval=1)

signalLength=input(11,minval=1)

xSeria = input(title="Source", type=input.source, defval=close)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posMACD = MACD(fastLength,slowLength, signalLength)

pos = iff(posReversal123 == 1 and posMACD == 1 , 1,

iff(posReversal123 == -1 and posMACD == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

- Dual Indicator Mean Reversal Trend Mengikuti Strategi

- Saluran Harga Dinamis dengan Strategi Pelacakan Stop Loss

- Strategi Stop Loss Bollinger Bands yang Dinamis

- Reversal Breakout Bandpass Combo Strategi

- Strategi Crossover Rata-rata Bergerak Dinamis

- EMA Crossover Trend Mengikuti Strategi

- Strategi perdagangan jangka pendek berdasarkan RSI dan SMA

- Momentum Breakout Strategi Perdagangan Intraday

- KDJ Golden Cross Long Entry Strategi

- Strategi Badai Breakback dalam Peluang Tersembunyi

- Trend Rata-rata Bergerak Mengikuti Strategi

- Strategi SuperTrend Pivot di Berbagai Kerangka Waktu

- Pola Lilin Kuantitatif dan Tren Mengikuti Strategi

- Supertrend dikombinasikan dengan strategi perdagangan kuantitatif RSI

- Cape Town 15 menit Candle Breakout Strategi

- Dual ATR Trailing Stop Strategy

- Strategi Pelacakan Pelarian Qullamaggie

- Versi ekstrim dari Noro's Trend Moving Averages Strategy

- Strategi Perdagangan Momentum Rekursif

- Tren Donchian Mengikuti Strategi