負荷が減る

作者: リン・ハーンチャオチャン, 日付: 2022-05-23 14:54:31タグ:ATR

スーパートレンドは変動率 (ATR) に基づく移動ストップと逆転ラインです.

ストップ・ロスは1%上昇します

ストップ・ロスを突破したときに 取引を終了します

戦略は波動性に基づく線が越えると取引を終了します.

戦略には以下のパラメーターがあります

- ATR 期間- 計算を実行するためにバックバーの数を選択する

- ATR マルチプレイヤー- 変動に多重因数を加えるために

- 初期ストップ損失- 最初のストップに値が入力できます.

- 位置タイプ- 取引の位置を選択することができます.

- バックテスト 期間- 射程を決める

免責事項

- 私はライセンスのある金融アドバイザーやブローカーディーラーではありません.いつ,何を買うか,何を売るか,あなたに言わない.私はこのソフトウェアを開発し,TradingViewを使用して手動または自動化された複数の取引を実行することができます. ソフトウェアは,取引に入るおよび終了する基準を設定することができます.

- 失う余裕がないお金で取引しないでください.

- 私は一貫した利益を保証したり 努力せずにお金を稼ぐこともできませんし 聖杯も売っていません

- どのシステムにも 勝敗の連鎖があります

- お金管理は,あなたの取引の結果に大きな役割を果たします.例えば:ロットサイズ,アカウントサイズ,ブローカーレバレッジ,ブローカーマーージンコールルールはすべて結果に影響を及ぼします.また,個々のペア取引および全体的なアカウントの株式のためのあなたのTake ProfitとStop Loss設定は,結果に大きな影響を与えます.あなたが取引に新しく,これらの項目を理解していない場合は,知識を深めるための教育資料を探することをお勧めします.

あなたとあなたの取引の寛容性にとって 最適な取引システムを 見つけ,使用する必要があります.

このプログラムで取引するためのオプションのツールしか提供していません.

注記

バックテスト

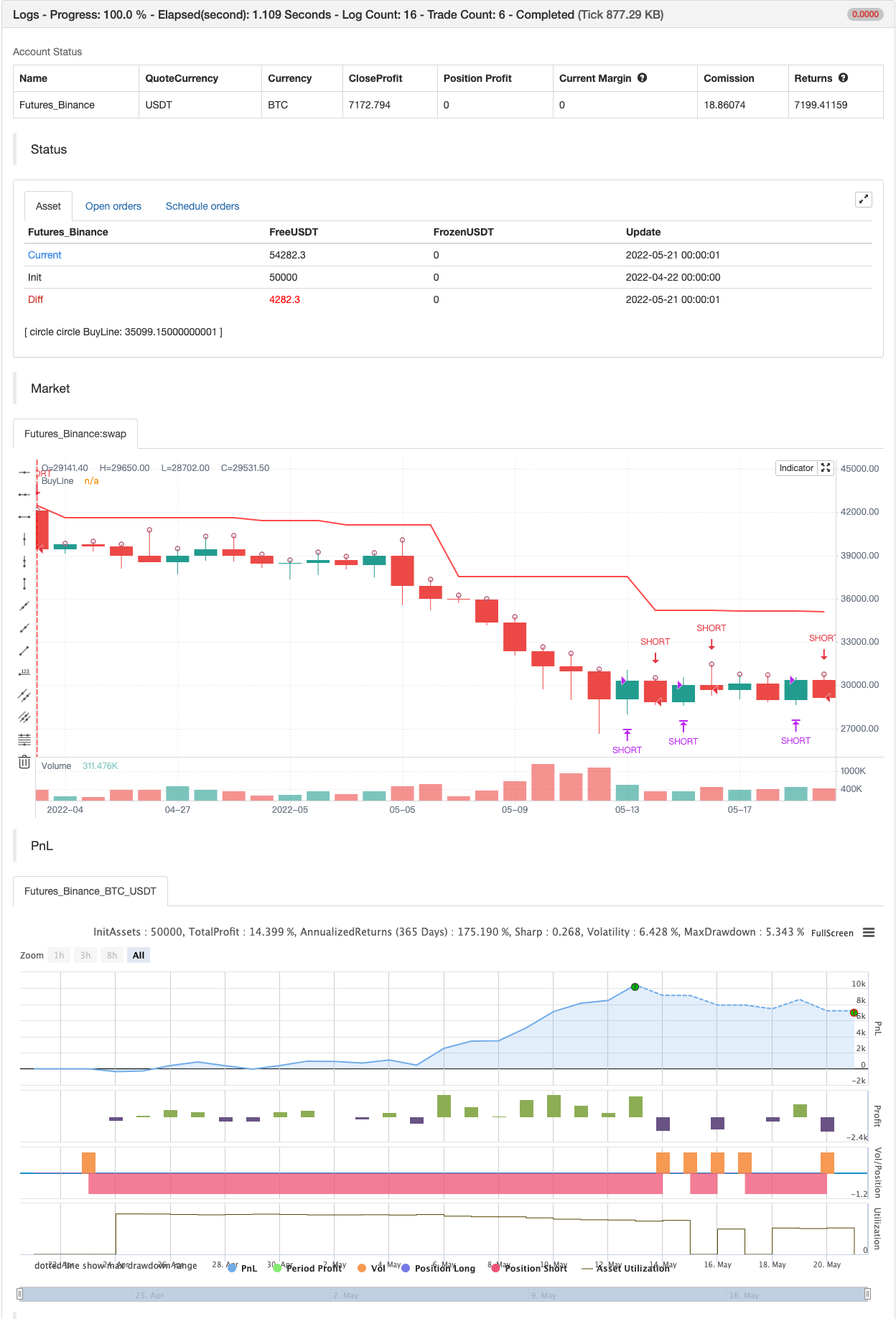

/*backtest

start: 2022-02-22 00:00:00

end: 2022-05-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// -----------------------------------------------------------------------------

// Copyright 2019 Mauricio Pimenta | exit490

// SuperTrend with Trailing Stop Loss script may be freely distributed under the MIT license.

//

// Permission is hereby granted, free of charge,

// to any person obtaining a copy of this software and associated documentation files (the "Software"),

// to deal in the Software without restriction, including without limitation the rights to use, copy, modify, merge,

// publish, distribute, sublicense, and/or sell copies of the Software, and to permit persons to whom the Software is furnished to do so,

// subject to the following conditions:

//

// The above copyright notice and this permission notice shall be included in all copies or substantial portions of the Software.

//

// THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

// EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

// FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM,

// DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

// OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

//

// -----------------------------------------------------------------------------

//

// Authors: @exit490

// Revision: v1.0.0

// Date: 5-Aug-2019

//

// Description

// ===========

// SuperTrend is a moving stop and reversal line based on the volatility (ATR).

// The strategy will ride up your stop loss when price moviment 1%.

// The strategy will close your operation when the market price crossed the stop loss.

// The strategy will close operation when the line based on the volatility will crossed

//

// The strategy has the following parameters:

//

// INITIAL STOP LOSS - Where can isert the value to first stop.

// POSITION TYPE - Where can to select trade position.

// ATR PERIOD - To select number of bars back to execute calculation

// ATR MULTPLIER - To add a multplier factor on volatility

// BACKTEST PERIOD - To select range.

//

// -----------------------------------------------------------------------------

// Disclaimer:

// 1. I am not licensed financial advisors or broker dealers. I do not tell you

// when or what to buy or sell. I developed this software which enables you

// execute manual or automated trades multplierFactoriplierFactoriple trades using TradingView. The

// software allows you to set the criteria you want for entering and exiting

// trades.

// 2. Do not trade with money you cannot afford to lose.

// 3. I do not guarantee consistent profits or that anyone can make money with no

// effort. And I am not selling the holy grail.

// 4. Every system can have winning and losing streaks.

// 5. Money management plays a large role in the results of your trading. For

// example: lot size, account size, broker leverage, and broker margin call

// rules all have an effect on results. Also, your Take Profit and Stop Loss

// settings for individual pair trades and for overall account equity have a

// major impact on results. If you are new to trading and do not understand

// these items, then I recommend you seek education materials to further your

// knowledge.

//

// YOU NEED TO FIND AND USE THE TRADING SYSTEM THAT WORKS BEST FOR YOU AND YOUR

// TRADING TOLERANCE.

//

// I HAVE PROVIDED NOTHING MORE THAN A TOOL WITH OPTIONS FOR YOU TO TRADE WITH THIS PROGRAM ON TRADINGVIEW.

//

// I accept suggestions to improve the script.

// If you encounter any problems I will be happy to share with me.

// -----------------------------------------------------------------------------

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

strategy(title = "SUPERTREND ATR WITH TRAILING STOP LOSS",

shorttitle = "SUPERTREND ATR WITH TSL",

overlay = true,

precision = 8,

calc_on_order_fills = true,

calc_on_every_tick = true,

backtest_fill_limits_assumption = 0,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

initial_capital = 1000,

currency = currency.USD,

linktoseries = true)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// === BACKTEST RANGE ===

backTestSectionFrom = input(title = "═══════════════ FROM ═══════════════", defval = true, type = input.bool)

FromMonth = input(defval = 1, title = "Month", minval = 1)

FromDay = input(defval = 1, title = "Day", minval = 1)

FromYear = input(defval = 2019, title = "Year", minval = 2014)

backTestSectionTo = input(title = "════════════════ TO ════════════════", defval = true, type = input.bool)

ToMonth = input(defval = 31, title = "Month", minval = 1)

ToDay = input(defval = 12, title = "Day", minval = 1)

ToYear = input(defval = 9999, title = "Year", minval = 2014)

backTestPeriod() => (time > timestamp(FromYear, FromMonth, FromDay, 00, 00)) and (time < timestamp(ToYear, ToMonth, ToDay, 23, 59))

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

parameterSection = input(title = "═════════════ STRATEGY ═════════════", defval = true, type = input.bool)

// === INPUT TO SELECT POSITION ===

positionType = input(defval="SHORT", title="Position Type", options=["LONG", "SHORT"])

// === INPUT TO SELECT INITIAL STOP LOSS

initialStopLossPercent = input(defval = 3.0, minval = 0.0, title="Initial Stop Loss")

// === INPUT TO SELECT BARS BACK

barsBack = input(title="ATR Period", defval=1)

// === INPUT TO SELECT MULTPLIER FACTOR

multplierFactor = input(title="ATR multplierFactoriplier", step=0.1, defval=3.0)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// LOGIC TO FIND DIRECTION WHEN THERE IS TREND CHANGE ACCORDING VOLATILITY

atr = multplierFactor * atr(barsBack)

longStop = hl2 - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? max(longStop, longStopPrev) : longStop

shortStop = hl2 + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? min(shortStop, shortStopPrev) : shortStop

direction = 1

direction := nz(direction[1], direction)

direction := direction == -1 and close > shortStopPrev ? 1 : direction == 1 and close < longStopPrev ? -1 : direction

longColor = color.blue

shortColor = color.blue

var valueToPlot = 0.0

var colorToPlot = color.white

if (direction == 1)

valueToPlot := longStop

colorToPlot := color.green

else

valueToPlot := shortStop

colorToPlot := color.red

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

//

// === GLOBAL VARIABLES AND FUNCTIONS TO STORE IMPORTANT CONDITIONALS TO TRAILING STOP

hasEntryLongConditional() => direction == 1

hasCloseLongConditional() => direction == -1

hasEntryShortConditional() => direction == -1

hasCloseShortConditional() => direction == 1

stopLossPercent = positionType == "LONG" ? initialStopLossPercent * -1 : initialStopLossPercent

var entryPrice = 0.0

var updatedEntryPrice = 0.0

var stopLossPrice = 0.0

hasOpenTrade() => strategy.opentrades != 0

notHasOpenTrade() => strategy.opentrades == 0

strategyClose() =>

if positionType == "LONG"

strategy.close("LONG", when=true)

else

strategy.close("SHORT", when=true)

strategyOpen() =>

if positionType == "LONG"

strategy.entry("LONG", strategy.long, when=true)

else

strategy.entry("SHORT", strategy.short, when=true)

isLong() => positionType == "LONG" ? true : false

isShort() => positionType == "SHORT" ? true : false

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

//

// === LOGIC TO TRAILING STOP IN LONG POSITION

if (isLong())

crossedStopLoss = close <= stopLossPrice

terminateOperation = hasOpenTrade() and (crossedStopLoss or hasCloseLongConditional())

if (terminateOperation)

entryPrice := 0.0

updatedEntryPrice := entryPrice

stopLossPrice := 0.0

strategyClose()

startOperation = notHasOpenTrade() and hasEntryLongConditional()

if(startOperation)

entryPrice := close

updatedEntryPrice := entryPrice

stopLossPrice := entryPrice + (entryPrice * stopLossPercent) / 100

strategyOpen()

strategyPercentege = (close - updatedEntryPrice) / updatedEntryPrice * 100.00

rideUpStopLoss = hasOpenTrade() and strategyPercentege > 1

if (isLong() and rideUpStopLoss)

stopLossPercent := stopLossPercent + strategyPercentege - 1.0

newStopLossPrice = updatedEntryPrice + (updatedEntryPrice * stopLossPercent) / 100

stopLossPrice := max(stopLossPrice, newStopLossPrice)

updatedEntryPrice := stopLossPrice

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

//

// === LOGIC TO TRAILING STOP IN SHORT POSITION

if (isShort())

crossedStopLoss = close >= stopLossPrice

terminateOperation = hasOpenTrade() and (crossedStopLoss or hasCloseShortConditional())

if (terminateOperation)

entryPrice := 0.0

updatedEntryPrice := entryPrice

stopLossPrice := 0.0

strategyClose()

startOperation = notHasOpenTrade() and hasEntryShortConditional()

if(startOperation)

entryPrice := close

updatedEntryPrice := entryPrice

stopLossPrice := entryPrice + (entryPrice * stopLossPercent) / 100

strategyOpen()

strategyPercentege = (close - updatedEntryPrice) / updatedEntryPrice * 100.00

rideDownStopLoss = hasOpenTrade() and strategyPercentege < -1

if (rideDownStopLoss)

stopLossPercent := stopLossPercent + strategyPercentege + 1.0

newStopLossPrice = updatedEntryPrice + (updatedEntryPrice * stopLossPercent) / 100

stopLossPrice := min(stopLossPrice, newStopLossPrice)

updatedEntryPrice := stopLossPrice

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

//

// === DRAWING SHAPES

entryPricePlotConditinal = entryPrice == 0.0 ? na : entryPrice

trailingStopLossPlotConditional = stopLossPrice == 0.0 ? na : stopLossPrice

plotshape(entryPricePlotConditinal, title= "Entry Price", color=color.blue, style=shape.circle, location=location.absolute, size=size.tiny)

plotshape(trailingStopLossPlotConditional, title= "Stop Loss", color=color.red, style=shape.circle, location=location.absolute, size=size.tiny)

plot(valueToPlot == 0.0 ? na : valueToPlot, title="BuyLine", linewidth=2, color=colorToPlot)

plotshape(direction == 1 and direction[1] == -1 ? longStop : na, title="Buy", style=shape.labelup, location=location.absolute, size=size.normal, text="Buy", transp=0, textcolor = color.white, color=color.green, transp=0)

plotshape(direction == -1 and direction[1] == 1 ? shortStop : na, title="Sell", style=shape.labeldown, location=location.absolute, size=size.normal, text="Sell", transp=0, textcolor = color.white, color=color.red, transp=0)

alertcondition(direction == 1 and direction[1] == -1 ? longStop : na, title="Buy", message="Buy!")

alertcondition(direction == -1 and direction[1] == 1 ? shortStop : na, title="Sell", message="Sell!")

関連コンテンツ

- 双指標動力傾向量化戦略システム

- 多次元トレンド判断とATR動的ストップ・ロスト戦略

- 高級マルチインデクタルのトレンド 取引戦略の確認

- 移動平均線と日内パターンに基づくスマートトラッキングストップ損失戦略

- 多因子回帰と動的な価格帯戦略の量化取引システム

- マルチスライド均線ダイナミッククロストレンド追跡とマルチ確認量化取引戦略

- RSIから逸脱した大量級フレーズに基づく高度ストップ損失動態追跡戦略

- 多指標協調のトレンドを逆転する取引戦略

- 複数の通路のダイナミックなサポートがケニーの通路戦略に抵抗する

- 超トレンドに適応する機械学習量化取引戦略

- 波動値停止に基づく平均線トレンド追跡取引戦略

もっと見る

- 線形回帰 ++

- レッドK ダュアル・ヴァーダー エネルギーバー

- コンソリデーションゾーン - ライブ

- 定量 定性 評価

- 移動平均のクロスアラート,多時間枠 (MTF)

- MACD 再充電戦略

- 超トレンド移動平均値

- ABC取引

- 15MIN BTCUSDTPERP BOT

- シャノンエントロピー V2

- ボリュームフロー v3

- 暗号期貨は,ma & rsi - ogcheckersで毎時間スカルパー

- ATR スムーズ化

- オーダーブロックファインダー

- トレンドスカルプ-フラクタルボックス-3EMA

- QQE信号

- U位格子振幅フィルタ

- CM MACD カスタム インディケーター - 複数のタイムフレーム - V2

- ホードルライン

- 2 移動平均色方向検知