二重圧量的な取引戦略

作者: リン・ハーンチャオチャン,日付: 2023年11月2日 13:56:23タグ:

概要

ダブルプレッシャー定量取引戦略は,ストキャスティックとボリュームインジケーターを組み合わせたトレンドフォロー戦略である.主にストキャスティックKとD線とボリュームインジケーターを組み合わせて,追加信号の移動平均交差で補完された購入・売却信号を生成する.

戦略の論理

購入信号

主要な買い信号は次のとき発信されます.

-

両方のKとD線が過剰販売エリア (例えば20) の下を横切って上向きになり,KとDの両方が上昇しています.

-

容量は限界値を超えている (例えば平均容量の1.4倍)

-

閉じるのは開けるより上 (白いろうそく)

追加的な購入信号は次のものから来ます.

-

黄金十字: 急速なEMAは緩やかなEMAを横断し,両方が上昇

-

KとDの両方が低値から中値に上昇します (例えば20未満から20-80まで)

シグナルを売る

主要なセールシグナルが発信されるのは:

-

KとDの両方が過買い領域に入ります (例えば80以上)

-

死の十字架: 急速なEMAは緩いEMAを下回る

-

KはDを下回り,KとDは2つとも落ちています.

損失を止める

購入価格を下回る割合 (例えば 6%) がストップ・ロースレベルとして設定されます.以下に下がるとストップ・ロースが起動します.

利点分析

- ダブルストカスティックは誤った信号を回避する

- 音量が騒音をフィルタリングし,トレンドを保証します

- 複数の信号が組み合わせられれば,正確性が向上します

- 移動平均は全体的な傾向を支える

- ストップ・ロスト・コントロールリスク

利点1: 双重ストカスティックは誤った信号を回避する

単一のストキャストは多くの誤った信号を生成することができる. 双重ストキャストの組み合わせは誤った信号をフィルタリングし,信頼性を向上させる.

利点2: 音量 は 騒音 を フィルタリング し,傾向 を 確保 する

ボリューム条件は,低ボリュームの非トレンドスポットをフィルターし,閉じ込められるリスクを軽減します.

利点 3: 多数 の 信号 が 精度 を 向上 させる

複数のインジケーターが一致して実際の取引信号を誘発する必要があります. これにより信号の信頼性が向上します.

利点は4 移動平均値が全体的な傾向を支える

二重移動平均値のような規則は 信号が全体的なトレンドと一致することを保証します これは反トレンド取引を避けます

利点は5 ストップ・ロスはリスクをコントロールする

ストップロスの論理は,利益を実現し,単一の取引で損失を制御します.

リスク分析

- パラメータは慎重に最適化する必要があります 不適切な設定は,不良なパフォーマンスにつながる

- ストップ・ロスはギャップリスクを考慮しなければならない.

- 取引手段の流動性リスクは監視されるべきである.

- 異なるタイムフレーム間のバックバック問題

リスク 1 パラメータ は 慎重 に 最適化 さ れる 必要 が あり ます

戦略には複数のパラメータがあり 異なる機器に最適化する必要があります さもないとパフォーマンスが損なわれます

リスク2 ストップ・ロスの投資はギャップリスクを考慮しなければならない

ストップ・ロスは価格格差のシナリオを考慮すべきです. 購入価格にあまり近づいてはいけません.

リスク3:流動性リスクの監視

流動性のない楽器では,ボリュームルールは信号を過剰にフィルタリングすることがあります.ボリュームの

リスク4 タイムフレーム間の振り返り問題

異なる時間枠における信号の誤差が発生する可能性があります.信号の一致を検証する必要があります.

増進 の 機会

戦略は以下のような分野において強化できる:

-

頑丈性のパラメータを最適化

-

適応パラメータのための機械学習を導入する

-

ストップ・ロスの割合を減らすためのストップ・ロスの戦略を改善する

-

取引頻度を減らすためにフィルターを追加します

-

報酬の改善のために条件付きの注文や利益を取ることを探す

チャンス 1: 安定性 の パラメータ を 最適化 する

遺伝子アルゴリズムのような方法では 市場体制の安定性のために パーマータを体系的に最適化できます

機会2: 適応性パラメータのための機械学習を導入する

モデルでは市場状況を評価し,パラメータを調整し,動的最適化を実現できる.

ストップ・ロスの割合を減らすためにストップ・ロスの戦略を改善する

より良いストップ損失アルゴリズムは リスク管理を維持しながら不必要なストップを減らすことができます

機会4 貿易頻度を減らすためにフィルターを追加する

強化されたフィルターは 貿易頻度を削減し コストを削減し 取引回帰を向上させることができます

チャンス 5: 条件付きの注文や利益の取り調べ

市場状況に応じて 条件付きの注文や 利益の引き上げ戦略は リスクをコントロールしながら 利益を最大化することができます

結論

戦略は,トレンド,リスク制御,コスト,その他の側面をバランスする.主な利点は,トレンドのための二重ストカスティックプラスボリューム,リスク制御のためのストップ損失である.次のステップは,より多くの市場体制で安定した利益を生むために,強度,適応性パラメータ,ストップ損失最適化などを強化することである.

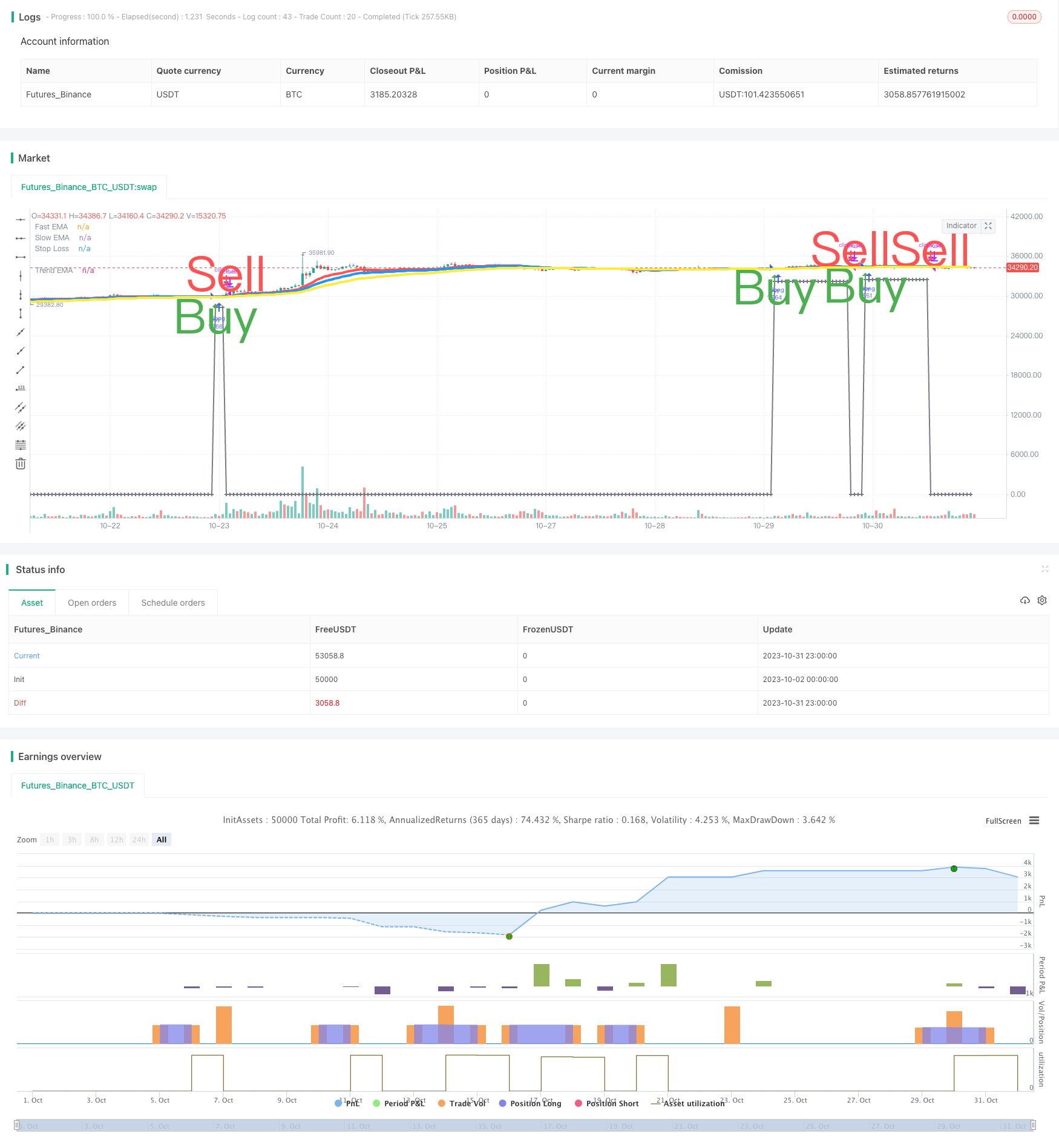

/*backtest

start: 2023-10-02 00:00:00

end: 2023-11-01 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

// SW SVE - Stochastic+Vol+EMAs [Sergio Waldoke]

// Script created by Sergio Waldoke (BETA VERSION v0.5, fine tuning PENDING)

// Stochastic process is the main source of signals, reinforced on buying by Volume. Also by Golden Cross.

// Selling is determined by K and D entering overselling zone or EMA's Death Cross signal, the first occurring,

// and some other signals combined.

// Buy Long when you see a long buy arrow.

// Sell when you see a close arrow.

// This is a version to be tuned and improved, but already showing excelent results after tune some parameters

// according to the kind of market.

// Strategy ready for doing backtests.

// SVE SYSTEM DESIGN:

// Buy Signal Trigger:

// - Both Stoch <= 20 crossing up and both growing and green candle and Vol/sma vol >= 1.40 Avg Vol

// or

// - Both Stoch growing up and Vol/sma vol >= 1.40 Avg Vol and green candle and

// both prior Stoch crossing up

// or

// [OPTIONAL]: (Bad for BTC 2018, excelent for 2017)

// - Crossingover(fast_ema, slow_ema) and growing(fast_ema) and growing(slow_ema) and green candle

// Exit position:

// - Both Stoch <= 20 and Both Stoch were > 20 during position

// or

// - CrossingUnder(Fast EMA, Medium EMA)

// or [OPTIONAL] (Better for BTC 2018, Worse for BNB 1H)

// - CrossingUnder(k, d) and (k and d starting over over_buying) and (k and d descending) and k crossing down over_buying line

//calc_on_every_tick=true,

//calc_on_order_fills=true, (affects historical calculation, triggers in middle of the bar, may be better for automatic orders)

strategy("SW SVE - Stochastic+Vol+EMAs [Sergio Waldoke]", shorttitle="SW SVE", overlay=true, max_bars_back=5000,

default_qty_type=strategy.percent_of_equity, default_qty_value=100, currency="USD",

commission_type=strategy.commission.percent, commission_value=0.25)

//Strategy Parameters

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromYear = input(defval = 2018, title = "From Year", minval = 2009, maxval = 2200)

ToDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

ToMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

ToYear = input(defval = 2030, title = "To Year", minval = 2009, maxval = 2200)

//Indicator Parameters

//Original defaults for 4HS: 14, 3, 80, 20, 14, 23, 40, 20, 40, 3:

stoch_k = input(title="Stoch K", defval=14, minval=1)

stoch_d = input(title="Stoch D", defval=3, minval=1)

over_buying = input(title="Stoch Overbuying Zone", defval=80, minval=0, maxval=100)

over_selling = input(title="Stoch Overselling Zone", defval=20, minval=0, maxval=100)

fast_ema_periods = input(title="Fast EMA (Death Cross)", defval=14, minval=1, maxval=600)

slow_ema_periods = input(title="Slow EMA (Death Cross)", defval=23, minval=1, maxval=600)

trend_ema_periods = input(title="Slowest EMA (Trend Test)", defval=40, minval=1, maxval=600)

volume_periods = input(title="Volume Periods", defval=20, minval=1, maxval=600)

volume_factor = input(title="Min Volume/Media Increase (%)", defval=80, minval=-100) / 100 + 1

threshold_sl_perc = input(title="[Sell Trigger] Stop Loss Threshold %", defval=6.0, type=float, minval=0, maxval=100)

//before_buy = input(title="# Growing Before Buy", defval=2, minval=1)

//before_sell = input(title="# Decreasing Before Sell", defval=1, minval=1)

//stepsignal = input(title="Show White Steps", type=bool, defval=true)

//steps_base = input(title="White Steps Base", defval=242, minval=0)

//Signals

fast_ema = ema(close, fast_ema_periods)

slow_ema = ema(close, slow_ema_periods)

trend_ema = ema(close, trend_ema_periods)

k = stoch(close, high, low, stoch_k)

d = sma(k, stoch_d)

vol_ma = sma(volume, volume_periods)

//REVIEW CONSTANT 1.75:

in_middle_zone(a) => a > over_selling * 1.75 and a < over_buying

growing(a) => a > a[1]

was_in_middle_zone = k == d

was_in_middle_zone := was_in_middle_zone[1] or in_middle_zone(k) and in_middle_zone(d)

//Buy Signal Trigger:

//- Both Stoch <= 20 crossing up and both growing and

// green candle and Vol/sma vol >= 1.40 Avg Vol

buy = k <= over_selling and d <= over_selling and crossover(k, d) and growing(k) and growing(d) and

close > open and volume/vol_ma >= volume_factor

//or

//- Both Stoch growing up and Vol/sma vol >= 1.40 Avg Vol and green candle and

// both prior Stoch crossing up

buy := buy or (growing(k) and growing(d) and volume/vol_ma >= volume_factor and close > open and

crossover(k[1], d[1]) )

//Worse:

// (crossover(k[1], d[1]) or (crossover(k, d) and k[1] <= over_selling and d[1] <= over_selling) ) )

//or

// [OPTIONAL]: (Bad for BTC 2018, excelent for 2017)

//- Crossingover(fast_ema, slow_ema) and growing(fast_ema) and growing(slow_ema) and green candle

buy := buy or (crossover(fast_ema, slow_ema) and growing(fast_ema) and growing(slow_ema) and close > open)

//Debug:

//d1 = close > open ? 400 : 0

//plot(d1+5200, color=white, linewidth = 3, style = stepline)

//Exit position:

//- Both Stoch <= 20 and Both Stoch were > 20 during position

sell = k <= over_selling and d <= over_selling and was_in_middle_zone

// or

//- CrossingUnder(Fast EMA, Medium EMA)

sell := sell or crossunder(fast_ema, slow_ema)

// or [OPTIONAL] (Better for BTC 2018, Worse for BNB 1H)

//- CrossingUnder(k, d) and (k and d starting over over_buying) and (k and d descending) and k crossing down over_buying line

sell := sell or (crossunder(k, d) and k[1] >= over_buying and d[1] >= over_buying and

not growing(k) and not growing(d) and k <= over_buying)

color = buy ? green : red

bought_price = close

bought_price := nz(bought_price[1])

already_bought = false

already_bought := nz(already_bought[1], false)

//Date Ranges

buy := buy and not already_bought

//d1 = buy ? 400 : 0

//plot(d1+6500, color=white, linewidth = 3, style = stepline)

was_in_middle_zone := (not buy and was_in_middle_zone) or (in_middle_zone(k) and in_middle_zone(d))

already_bought := already_bought[1] or buy

bought_price := buy ? close * (1 - threshold_sl_perc/100) : bought_price[1]

trigger_SL = close < bought_price[0]

sell := sell or trigger_SL

sell := sell and

already_bought and not buy and (was_in_middle_zone or trigger_SL)

//plot((sell?400:0)+5200, title="Buy-Sell", color=yellow, linewidth = 3, style = stepline)

already_bought := already_bought[0] and not sell

bought_price := sell ? 0 : bought_price[0]

//plot((was_in_middle_zone?400:0)+5200, title="Buy-Sell", color=yellow, linewidth = 3, style = stepline)

was_in_middle_zone := not sell and was_in_middle_zone

//Plot signals

plot(fast_ema, title="Fast EMA", color=red, linewidth = 4)

plot(slow_ema, title="Slow EMA", color=blue, linewidth = 4)

plot(trend_ema, title="Trend EMA", color=yellow, linewidth = 4)

//Stop Loss

plot(bought_price, color=gray, linewidth=2, style=cross, join=true, title="Stop Loss")

//Y = stepsignal ? lowest(40) : na

//Y = steps_base

//plot(mysignal+Y, title="Steps", color=white, linewidth = 3, style = stepline)

//Unit steps - for debugging

//plot(mysteps+Y, title="Steps2", color=yellow, linewidth = 3, style = stepline)

//Bought or not - for debugging

//plot((already_bought?400:0)+5200, title="Buy-Sell", color=yellow, linewidth = 3, style = stepline)

//plot((sell?400:0)+5200, title="Buy-Sell", color=yellow, linewidth = 3, style = stepline)

plotshape(buy, title="Buy arrows", style=shape.arrowup, location=location.belowbar, color=color, text="Buy", textcolor=color, size=size.huge, transp=30)

plotshape(sell, title="Sell arrows", style=shape.arrowdown, location=location.abovebar, color=color, text="Sell", textcolor=color, size=size.huge, transp=30)

//if n>2000

strategy.entry("buy", strategy.long, when=buy)

strategy.close_all(when=sell)

//plot(strategy.equity, title="Equity", color=white, linewidth = 4, style = line)

//AlertS trigger

//msg = "[SW Magic Signals EMA] BUY/SELL Signal has been triggered." + "(" + tostring(fastema) + ", " + tostring(slowema) + ") on " + tickerid + ", " + period + "."

msg = "SW SVE BUY/SELL Signal has been triggered. (#, #) on EXCH:PAIR, period: #."

alertcondition(buy or sell, title="SW SVE (BUY/SELL SIGNAL)", message=msg)

alertcondition(buy, title="SW SVE (BUY SIGNAL)", message=msg)

alertcondition(sell, title="SW SVE (SELL SIGNAL)", message=msg)

- モメントブレイクは戦略を特定する

- トリプル RSI エクストリーム トレーディング戦略

- ゴールデンクロス・ケルトナー・チャネル 戦略をフォローする

- 月間開設長期と月末閉会戦略

- 2つの移動平均のクロスオーバー取引戦略

- トレンドライン取引戦略

- ストカスティックRSIとボリュームベースの取引戦略

- 量子取引における取引の転換点を特定するための多指標戦略

- ATR トレイリングストップ戦略 (長時間のみ)

- トレンドトラッキングに基づくモメンタム・トレード戦略

企業微信 群ロボットのメッセージ推送 - ブレイクトレンドフォロワー V2

- 移動平均のクロスオーバー戦略に続く傾向

- モメントブレイク 移動平均取引戦略

- Hull移動平均とカルマンフィルターに基づくトレンド追跡戦略

- ゴールデン・クロス 戦略をフォローするトレンド

- 双振動逆転信号/ノイズ比最適化 コンボ戦略

- 典型的な二重トレンド追跡戦略

- 双重逆転取引戦略

- ボリンジャーバンドス振動突破戦略