PPO 価格感受性 モメント ダブルボトム ダイレクト取引戦略

作者: リン・ハーンチャオチャン,日付: 2024-01-29 11時38分42秒タグ:

概要

PPO価格感度モメンタムダブルボトム方向トレード戦略は,PPO (パーセント価格オシレーター) インジケーターによる価格ダブルボトム形成の識別を活用したトレード戦略である.PPOのダブルボトムパターンの認識と価格モメンタム特性を組み合わせ,価格ダブルボトム逆転点を正確に位置づけることを達成する.

戦略の原則

この戦略は,PPOインジケーターを用い,価格のダブルボトム特性を決定し,PPOインジケーターの底盤形成をリアルタイムに監視するための価格最低点判断を組み込む.PPOが上向き逆転のダブルボトムを形成すると,現在の購入機会をシグナル化する.

一方,この戦略は価格の最低値決定と連携し,価格が比較的低い水準にあるかどうかを確認する.PPOが底部パターンを示している間に価格が低いままである場合,購入信号が誘発される.

PPOの逆転特性の検証と価格レベル確認の双重メカニズムにより,潜在的な価格逆転の可能性を効果的に特定し,偽信号をフィルタリングし,信号品質を改善することができます.

利点分析

-

PPOのダブルボタンパターンは 入口点での正確なタイミングを可能にします

-

価格レベル確認を組み合わせることで,比較的高いレベルで発生する偽信号をフィルターで排除し,信号品質を向上させます.

-

PPOは敏感で,価格動向の変化を迅速に把握し,トレンド追跡に適しています.

-

双重確認メカニズムは 取引リスクを効果的に軽減します

リスク と 解決策

-

PPOは誤った信号を生成し,他の指標から確認を必要とする傾向があります.移動平均値や変動指標は確認を支援することができます.

-

ダブルボトム逆転は持続できない可能性があり,さらなる減少のリスクに直面する.ストップロスはポジションサイズ最適化とともに設定することができます.

-

不適切なパラメータ設定は,損益または誤ったエントリにつながる.パラメータ組み合わせの繰り返しバックテストと最適化は必要である.

-

複製で相当なコード量があります.さらにモジュラライゼーションは複製されたコードを減らすのに役立ちます.

オプティマイゼーションの方向性

-

ストップ・ロスのモジュールを組み込み ポジションサイズ戦略を最適化します

-

確認ツールとして移動平均値や変動指標を導入する.

-

冗長な論理判断を避けるためにコードをモジュール化します

-

パラメータ調整を継続して 安定性を高める

-

より多くの製品で分散取引アプリケーションをテストします

結論

PPO価格感度モメンタムダブルボトム方向トレード戦略は,PPO指標のダブルボトム機能と価格レベルポジショニングの二重確認を組み合わせ,価格逆転点を効果的に発見する.単一指標判断と比較して,より高い精度とノイズをフィルタリングする能力の利点を備えています.それでも,誤った信号のリスクは残っており,ライブトレードで安定した収益性を達成する前に,指標組み合わせのさらなる最適化と厳格なポジションサイジング戦術が必要です.

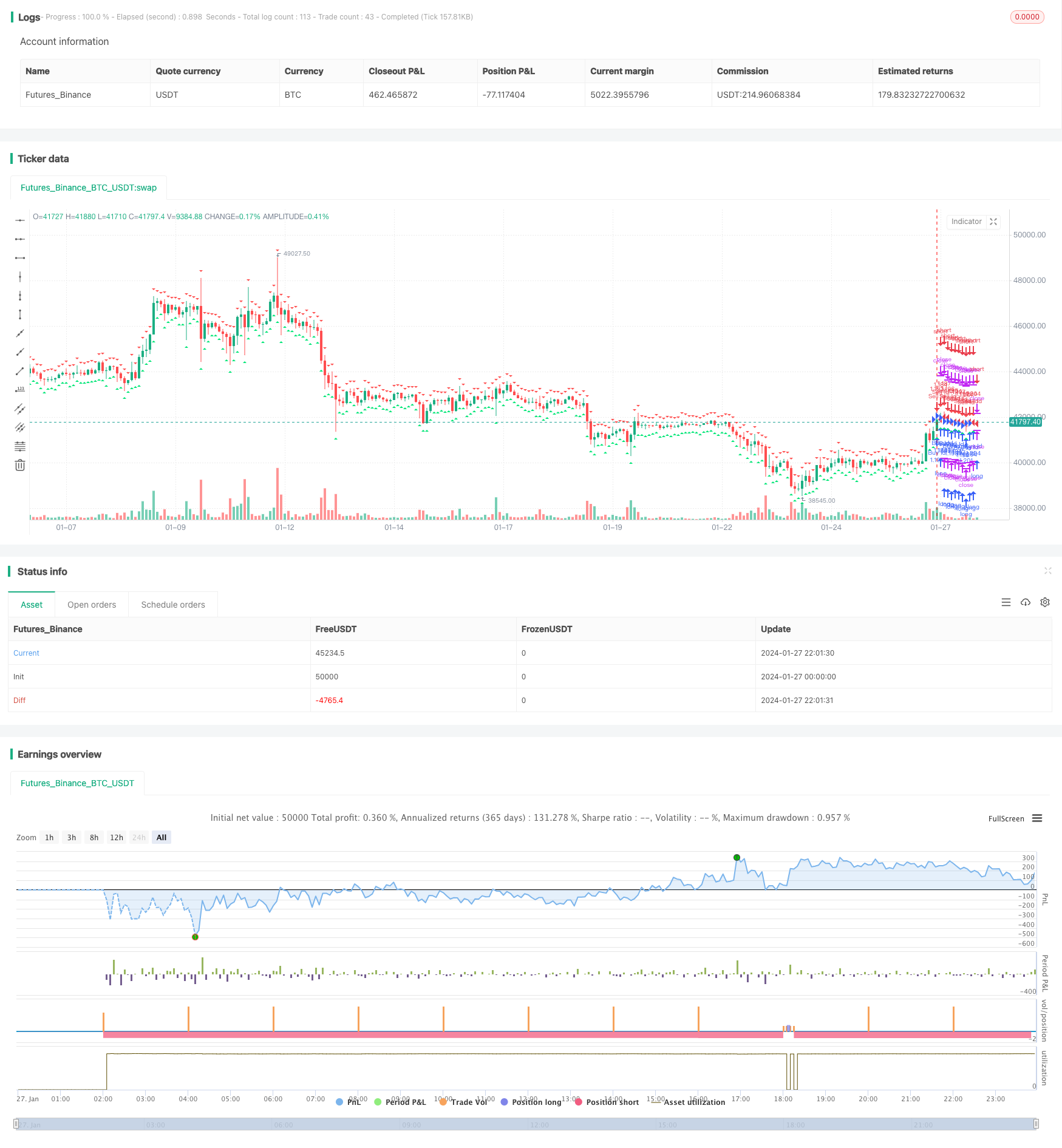

/*backtest

start: 2024-01-27 00:00:00

end: 2024-01-28 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © luciancapdefier

//@version=4

strategy("PPO Divergence ST", overlay=true, initial_capital=30000, calc_on_order_fills=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// time

FromYear = input(2019, "Backtest Start Year")

FromMonth = input(1, "Backtest Start Month")

FromDay = input(1, "Backtest Start Day")

ToYear = input(2999, "Backtest End Year")

ToMonth = input(1, "Backtest End Month")

ToDay = input(1, "Backtest End Day")

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => time >= start and time <= finish ? true : false

source = close

topbots = input(true, title="Show PPO high/low triangles?")

long_term_div = input(true, title="Use long term divergences?")

div_lookback_period = input(55, minval=1, title="Lookback Period")

fastLength = input(12, minval=1, title="PPO Fast")

slowLength=input(26, minval=1, title="PPO Slow")

signalLength=input(9,minval=1, title="PPO Signal")

smoother = input(2,minval=1, title="PPO Smooth")

fastMA = ema(source, fastLength)

slowMA = ema(source, slowLength)

macd = fastMA - slowMA

macd2=(macd/slowMA)*100

d = sma(macd2, smoother) // smoothing PPO

bullishPrice = low

priceMins = bullishPrice > bullishPrice[1] and bullishPrice[1] < bullishPrice[2] or low[1] == low[2] and low[1] < low and low[1] < low[3] or low[1] == low[2] and low[1] == low[3] and low[1] < low and low[1] < low[4] or low[1] == low[2] and low[1] == low[3] and low[1] and low[1] == low[4] and low[1] < low and low[1] < low[5] // this line identifies bottoms and plateaus in the price

oscMins= d > d[1] and d[1] < d[2] // this line identifies bottoms in the PPO

BottomPointsInPPO = oscMins

bearishPrice = high

priceMax = bearishPrice < bearishPrice[1] and bearishPrice[1] > bearishPrice[2] or high[1] == high[2] and high[1] > high and high[1] > high[3] or high[1] == high[2] and high[1] == high[3] and high[1] > high and high[1] > high[4] or high[1] == high[2] and high[1] == high[3] and high[1] and high[1] == high[4] and high[1] > high and high[1] > high[5] // this line identifies tops in the price

oscMax = d < d[1] and d[1] > d[2] // this line identifies tops in the PPO

TopPointsInPPO = oscMax

currenttrough4=valuewhen (oscMins, d[1], 0) // identifies the value of PPO at the most recent BOTTOM in the PPO

lasttrough4=valuewhen (oscMins, d[1], 1) // NOT USED identifies the value of PPO at the second most recent BOTTOM in the PPO

currenttrough5=valuewhen (oscMax, d[1], 0) // identifies the value of PPO at the most recent TOP in the PPO

lasttrough5=valuewhen (oscMax, d[1], 1) // NOT USED identifies the value of PPO at the second most recent TOP in the PPO

currenttrough6=valuewhen (priceMins, low[1], 0) // this line identifies the low (price) at the most recent bottom in the Price

lasttrough6=valuewhen (priceMins, low[1], 1) // NOT USED this line identifies the low (price) at the second most recent bottom in the Price

currenttrough7=valuewhen (priceMax, high[1], 0) // this line identifies the high (price) at the most recent top in the Price

lasttrough7=valuewhen (priceMax, high[1], 1) // NOT USED this line identifies the high (price) at the second most recent top in the Price

delayedlow = priceMins and barssince(oscMins) < 3 ? low[1] : na

delayedhigh = priceMax and barssince(oscMax) < 3 ? high[1] : na

// only take tops/bottoms in price when tops/bottoms are less than 5 bars away

filter = barssince(priceMins) < 5 ? lowest(currenttrough6, 4) : na

filter2 = barssince(priceMax) < 5 ? highest(currenttrough7, 4) : na

//delayedbottom/top when oscillator bottom/top is earlier than price bottom/top

y11 = valuewhen(oscMins, delayedlow, 0)

y12 = valuewhen(oscMax, delayedhigh, 0)

// only take tops/bottoms in price when tops/bottoms are less than 5 bars away, since 2nd most recent top/bottom in osc

y2=valuewhen(oscMax, filter2, 1) // identifies the highest high in the tops of price with 5 bar lookback period SINCE the SECOND most recent top in PPO

y6=valuewhen(oscMins, filter, 1) // identifies the lowest low in the bottoms of price with 5 bar lookback period SINCE the SECOND most recent bottom in PPO

long_term_bull_filt = valuewhen(priceMins, lowest(div_lookback_period), 1)

long_term_bear_filt = valuewhen(priceMax, highest(div_lookback_period), 1)

y3=valuewhen(oscMax, currenttrough5, 0) // identifies the value of PPO in the most recent top of PPO

y4=valuewhen(oscMax, currenttrough5, 1) // identifies the value of PPO in the second most recent top of PPO

y7=valuewhen(oscMins, currenttrough4, 0) // identifies the value of PPO in the most recent bottom of PPO

y8=valuewhen(oscMins, currenttrough4, 1) // identifies the value of PPO in the SECOND most recent bottom of PPO

y9=valuewhen(oscMins, currenttrough6, 0)

y10=valuewhen(oscMax, currenttrough7, 0)

bulldiv= BottomPointsInPPO ? d[1] : na // plots dots at bottoms in the PPO

beardiv= TopPointsInPPO ? d[1]: na // plots dots at tops in the PPO

i = currenttrough5 < highest(d, div_lookback_period) // long term bearish oscilator divergence

i2 = y10 > long_term_bear_filt // long term bearish top divergence

i3 = delayedhigh > long_term_bear_filt // long term bearish delayedhigh divergence

i4 = currenttrough4 > lowest(d, div_lookback_period) // long term bullish osc divergence

i5 = y9 < long_term_bull_filt // long term bullish bottom div

i6 = delayedlow < long_term_bull_filt // long term bullish delayedbottom div

//plot(0, color=gray)

//plot(d, color=black)

//plot(bulldiv, title = "Bottoms", color=maroon, style=circles, linewidth=3, offset= -1)

//plot(beardiv, title = "Tops", color=green, style=circles, linewidth=3, offset= -1)

bearishdiv1 = (y10 > y2 and oscMax and y3 < y4) ? true : false

bearishdiv2 = (delayedhigh > y2 and y3 < y4) ? true : false

bearishdiv3 = (long_term_div and oscMax and i and i2) ? true : false

bearishdiv4 = (long_term_div and i and i3) ? true : false

bullishdiv1 = (y9 < y6 and oscMins and y7 > y8) ? true : false

bullishdiv2 = (delayedlow < y6 and y7 > y8) ? true : false

bullishdiv3 = (long_term_div and oscMins and i4 and i5) ? true : false

bullishdiv4 = (long_term_div and i4 and i6) ? true : false

bearish = bearishdiv1 or bearishdiv2 or bearishdiv3 or bearishdiv4

bullish = bullishdiv1 or bullishdiv2 or bullishdiv3 or bullishdiv4

greendot = beardiv != 0 ? true : false

reddot = bulldiv != 0 ? true : false

if (reddot and window())

strategy.entry("Buy Id", strategy.long, comment="BUY")

if (greendot and window())

strategy.entry("Sell Id", strategy.short, comment="SELL")

alertcondition( bearish, title="Bearish Signal (Orange)", message="Orange & Bearish: Short " )

alertcondition( bullish, title="Bullish Signal (Purple)", message="Purple & Bullish: Long " )

alertcondition( greendot, title="PPO High (Green)", message="Green High Point: Short " )

alertcondition( reddot, title="PPO Low (Red)", message="Red Low Point: Long " )

// plotshape(bearish ? d : na, text='▼\nP', style=shape.labeldown, location=location.abovebar, color=color(orange,0), textcolor=color(white,0), offset=0)

// plotshape(bullish ? d : na, text='P\n▲', style=shape.labelup, location=location.belowbar, color=color(#C752FF,0), textcolor=color(white,0), offset=0)

plotshape(topbots and greendot ? d : na, text='', style=shape.triangledown, location=location.abovebar, color=color.red, offset=0, size=size.tiny)

plotshape(topbots and reddot ? d : na, text='', style=shape.triangleup, location=location.belowbar, color=color.lime, offset=0, size=size.tiny)

//barcolor(bearishdiv1 or bearishdiv2 or bearishdiv3 or bearishdiv4 ? orange : na)

//barcolor(bullishdiv1 or bullishdiv2 or bullishdiv3 or bullishdiv4 ? fuchsia : na)

//barcolor(#dedcdc)

- FNGUのボリンジャー帯とRSIに基づく量的な取引戦略

- Bollinger Bands RSI OBV ストラテジー

- P信号逆転戦略

- RSI アリガタートレンド戦略

- 移動平均値とウィリアムズ指標に基づいた日々のFX戦略

- 移動平均チャネルブレークアウト取引戦略

- 2つの移動平均ストーカスティック戦略

- ドンチアン運河からの脱出戦略

- 移動平均傾向追跡戦略

- RSI指標グリッド取引戦略

- 量とVWAPの確認によるスカルピング戦略

- ADX,MA,EMA ロング・オンリー・トレンド・トラッキング・戦略

- ゴールデンクロス戦略の推進力

- 三重指標衝突戦略

- 自動化された機械学習取引戦略

- 移動平均ターニングポイントクロスオーバー取引戦略

- 複数の指標に基づいたクロスサイクル仲裁戦略

- ボリンジャー・バンドのブレイクアウト戦略は,長時間だけ動力を追求する戦略です.

- ダブルBB指標とRSIをベースにした無欠の勝利量的な取引戦略

- RSIに基づくストップ・ロスト・アンド・テイク・プロフィート戦略