상대적 강도 지수 - 격차 - 자유

저자:차오장, 날짜: 2022-05-24 15:24:22태그:RSI

안녕하세요

모든 사람들의 거래 경험을 용이하게 하기 위해 저는 이 스크립트를 만들었습니다. 이 스크립트에서는 RSI가 과잉 구매 및 과잉 판매 조건을 색칠하고, 보너스로 지난 50개의 촛불에서 상승 또는 하락의 오차를 표시합니다. (디폴트로 변경할 수 있습니다.) 스크립트는 오픈 소스이며 코드 일부가 트레이딩 뷰 예제에서 가져옵니다. 제안이 있거나 이미 몇 가지 개선 사항을 수행했다면 댓글에보고하십시오.

좋은 거래와 행운!

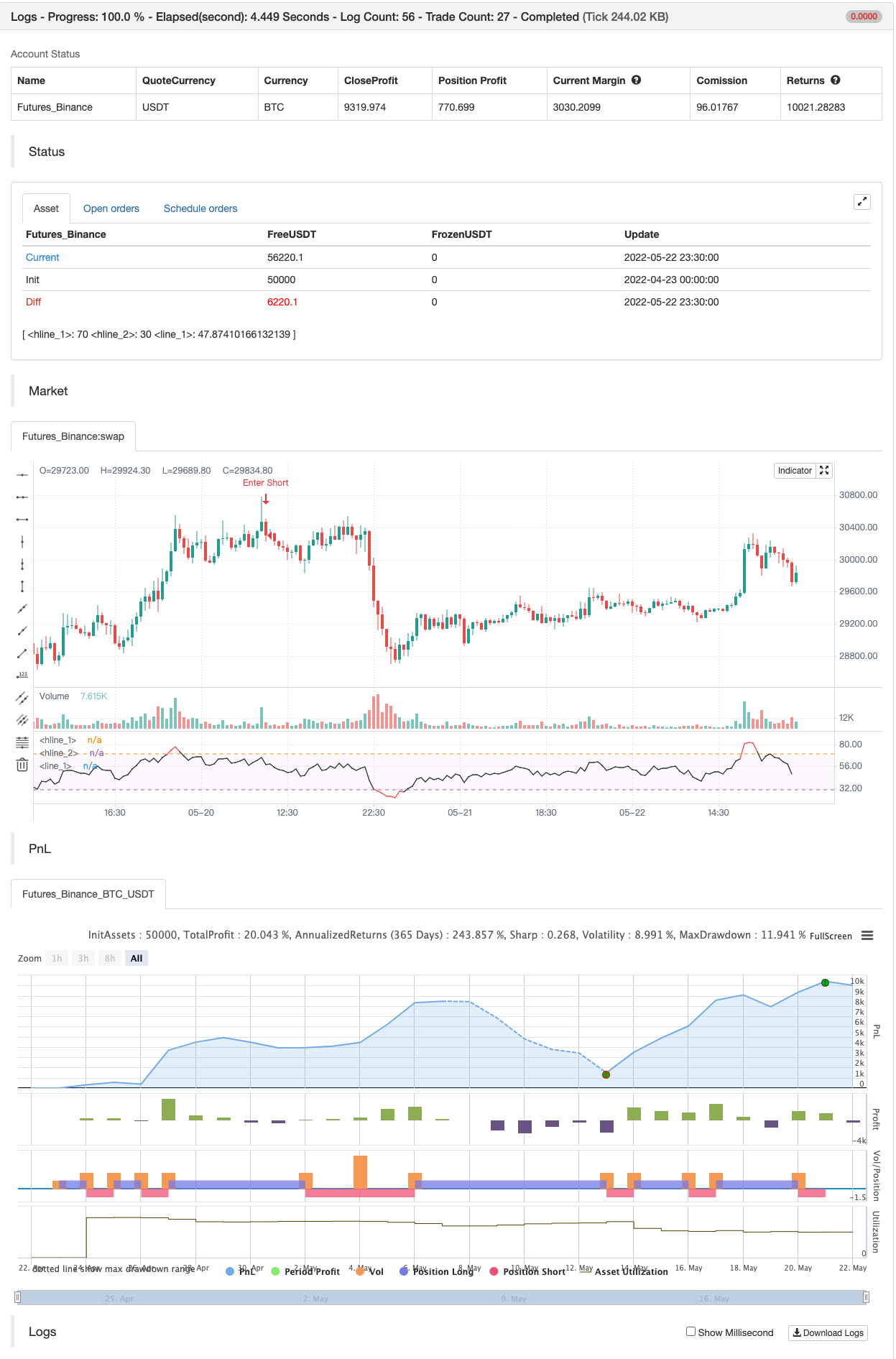

백테스트

//@version=4

// Copyright by Libertus - 2021

// RSI Divergences v3.2

// Free for private use

study(title="Relative Strength Index - Divergences - Libertus", shorttitle="RSI Div - Lib")

len = input(14, minval=1, title="RSI Length")

ob = input(defval=70, title="Overbought", type=input.integer, minval=0, maxval=100)

os = input(defval=30, title="Oversold", type=input.integer, minval=0, maxval=100)

// RSI code

rsi = rsi(close, len)

band1 = hline(ob)

band0 = hline(os)

plot(rsi, color=(rsi > ob or rsi < os ? color.new(color.red, 0) : color.new(color.black, 0)))

fill(band1, band0, color=color.new(color.purple, 97))

// DIVS code

piv = input(false,"Hide pivots?")

shrt = input(false,"Shorter labels?")

hidel = input(false, "Hide labels and color background")

xbars = input(defval=90, title="Div lookback period (bars)?", type=input.integer, minval=1)

hb = abs(highestbars(rsi, xbars)) // Finds bar with highest value in last X bars

lb = abs(lowestbars(rsi, xbars)) // Finds bar with lowest value in last X bars

// Defining variable values, mandatory in Pine 3

max = float(na)

max_rsi = float(na)

min = float(na)

min_rsi = float(na)

pivoth = bool(na)

pivotl = bool(na)

divbear = bool(na)

divbull = bool(na)

// If bar with lowest / highest is current bar, use it's value

max := hb == 0 ? close : na(max[1]) ? close : max[1]

max_rsi := hb == 0 ? rsi : na(max_rsi[1]) ? rsi : max_rsi[1]

min := lb == 0 ? close : na(min[1]) ? close : min[1]

min_rsi := lb == 0 ? rsi : na(min_rsi[1]) ? rsi : min_rsi[1]

// Compare high of current bar being examined with previous bar's high

// If curr bar high is higher than the max bar high in the lookback window range

if close > max // we have a new high

max := close // change variable "max" to use current bar's high value

if rsi > max_rsi // we have a new high

max_rsi := rsi // change variable "max_rsi" to use current bar's RSI value

if close < min // we have a new low

min := close // change variable "min" to use current bar's low value

if rsi < min_rsi // we have a new low

min_rsi := rsi // change variable "min_rsi" to use current bar's RSI value

// Finds pivot point with at least 2 right candles with lower value

pivoth := (max_rsi == max_rsi[2]) and (max_rsi[2] != max_rsi[3]) ? true : na

pivotl := (min_rsi == min_rsi[2]) and (min_rsi[2] != min_rsi[3]) ? true : na

// Detects divergences between price and indicator with 1 candle delay so it filters out repeating divergences

if (max[1] > max[2]) and (rsi[1] < max_rsi) and (rsi <= rsi[1])

divbear := true

if (min[1] < min[2]) and (rsi[1] > min_rsi) and (rsi >= rsi[1])

divbull := true

// Alerts

alertcondition(divbear, title='Bear div', message='Bear div')

alertcondition(divbull, title='Bull div', message='Bull div')

alertcondition(pivoth, title='Pivot high', message='Pivot high')

alertcondition(pivotl, title='Pivot low', message='Pivot low')

if divbull

strategy.entry("Enter Long", strategy.long)

else if divbear

strategy.entry("Enter Short", strategy.short)

// // Plots divergences and pivots with offest

// l = divbear ?

// label.new (bar_index-1, rsi[1]+1, "BEAR", color=color.red, textcolor=color.white, style=label.style_labeldown, yloc=yloc.price, size=size.small) :

// divbull ?

// label.new (bar_index-1, rsi[1]-1, "BULL", color=color.green, textcolor=color.white, style=label.style_labelup, yloc=yloc.price, size=size.small) :

// pivoth ?

// label.new (bar_index-2, max_rsi+1, "PIVOT", color=color.blue, textcolor=color.white, style=label.style_labeldown, yloc=yloc.price, size=size.small) :

// pivotl ?

// label.new (bar_index-2, min_rsi-1, "PIVOT", color=color.blue, textcolor=color.white, style=label.style_labelup, yloc=yloc.price, size=size.small) :

// na

// // Shorter labels

// if shrt

// label.set_text (l, na)

// // Hides pivots or labels

// if (piv and (pivoth or pivotl)) or hidel

// label.delete (l)

// // Colors indicator background

// bgcolor (hidel ? (divbear ? color.new(color.red, 50) : divbull ? color.new(color.green, 50) : na) : na, offset=-1)

// bgcolor (hidel ? (piv ? na : (pivoth or pivotl ? color.new(color.blue, 50) : na)) : na, offset=-2)

// Debug tools

// plot(max, color=blue, linewidth=2)

// plot(max_rsi, color=red, linewidth=2)

// plot(hb, color=orange, linewidth=2)

// plot(lb, color=purple, linewidth=1)

// plot(min_rsi, color=lime, linewidth=1)

// plot(min, color=black, linewidth=1)

관련 내용

- 이중 지표 동력 트렌드 정량화 전략 시스템

- 쌍평선-RSI 다중 신호 트렌드 거래 전략

- 다이내스 트레이딩 최적화 전략, RSI 동력 지표와 결합한 동력 유선 시스템

- 다중 기술 지표 횡단 동력 트렌드 추적 전략

- 동적 조정 스톱 손실 코끼리 기둥 모양 트렌드 추적 전략

- 쌍주기 RSI 추세 동력 강도 전략 피라미드 포지션 관리 시스템

- 다일리얼 크로스 보조 RSI 동적 매개 변수 정량화 거래 전략

- 동적 추세는 RSI의 교차 전략을 결정합니다.

- 다차원 K 근접 알고리즘과

타이 형태의 양적 가격 분석 거래 전략 - 적응형 다전략 동적 스위치 시스템: 융합 트렌드 추적과 구간 격변에 대한 양적 거래 전략

- 다 지표 다 차원 트렌드 크로스 고급 정량화 전략

더 많은 내용

- 스윙 헐/rsi/EMA 전략

- 스칼핑 스윙 거래 도구 R1-4

- 가장 좋은 삼키기 + 탈출 전략

- Bollinger Awesome 알렛 R1

- 다중 거래소 통합 플러그인

- 삼각수당 (작은 통화의 거래 가격 차이)

- bybit 역계약 동적 격자 (特異格子)

- MT4 MT5 + 동적 변수 NOT-REPAINT

- 매트릭스 시리즈

- 슈퍼 스칼퍼 - 5분 15분

- 선형 회귀 ++

- 에너지 바와 함께 레드K 듀얼 바더

- 통합 구역 - 라이브

- 양적 질적 평가

- 이동 평균 크로스 알림, 다중 시간 프레임 (MTF)

- MACD 재충전 전략

- 슈퍼트렌드 이동 평균

- 거래 ABC

- 15MIN BTCUSDTPERP BOT

논 엔트로피 V2