트렌드 판단과 결합 된 모멘텀 다중 요인 양적 거래 전략

저자:차오장, 날짜: 2023-11-23 14:58:57태그:

전반적인 설명

이 전략은 동력 지표와 트렌드 지표를 결합한 다중 요인 평가 양적 거래 전략입니다. 전략은 여러 이동 평균의 수학적 조합을 계산하여 시장의 전반적인 추세와 동력 방향을 판단하고 임계 조건을 기반으로 거래 신호를 생성합니다.

전략 원칙

- 여러 이동 평균 및 운동 지표를 계산

- 계산 하모닉 이동 평균, 단기 이동 평균, 중기 이동 평균, 장기 이동 평균 및 다른 복수 이동 평균

- 가격 변화의 경향을 반영하기 위해 각 이동 평균 사이의 차이를 계산합니다.

- 가격 변화의 동력을 반영하기 위해 각 이동 평균의 첫 번째 순위 파생식을 계산합니다.

- 추세 방향을 결정하기 위해 시노스 및 코시노스 지표를 계산

- 종합적으로 거래 신호를 판단

- 운동 지표, 트렌드 지표 및 기타 다중 요인의 가중화 계산

- 현재 시장 상태를 결과 값과 임계값 사이의 거리에 따라 판단합니다.

- 장기 및 단기 거래 신호를 발행

이점 분석

- 여러 가지 요인 판단이 신호 정확성을 향상시킵니다.

- 가격, 트렌드, 추진력 및 기타 요인을 종합적으로 고려하십시오.

- 다른 요소는 다른 무게와 구성 될 수 있습니다

- 조정 가능한 매개 변수, 다른 시장에 적응

- 이동 평균의 매개 변수, 거래 범위의 경계는 사용자 정의 될 수 있습니다

- 다른 주기와 시장 환경에 적응 할 수 있습니다.

- 명확한 코드 구조, 이해하기 쉬운

- 명칭 사양, 전체 의견

- 2차 개발 및 최적화에 쉬운

위험 분석

- 매개 변수 최적화 어려움이 높습니다

- 최적의 매개 변수를 찾기 위해 많은 역사적 데이터 백테스팅이 필요합니다.

- 거래 빈도는 너무 높을 수 있습니다.

- 여러 요인 조합 판단은 너무 많은 거래로 이어질 수 있습니다.

- 시장과 높은 상관관계

- 트렌드 판단 전략은 비합리적인 행동으로 향한다

최적화 방향

- 스톱 손실 논리를 추가합니다.

- 비합리적 인 행동 으로 인한 큰 손실 을 피 하라

- 매개 변수 설정을 최적화

- 전략 안정성을 향상시키기 위해 최적의 매개 변수 조합을 찾아

- 기계 학습 요소를 증가

- 현재 시장 상태를 판단하고 전략 결정을 돕기 위해 딥 러닝을 사용하십시오.

요약

이 전략은 동력 지표와 트렌드 지표의 다중 요인 조합을 통해 시장 상태를 판단하고 설정된 임계치를 기반으로 거래 신호를 발행합니다. 전략의 장점은 강력한 구성성, 다른 시장 환경에 적응성 및 쉬운 이해입니다; 단점은 매개 변수 최적화, 아마도 너무 높은 거래 빈도 및 시장과의 높은 상관관계입니다. 향후 최적화는 스톱 로스, 매개 변수 최적화 및 머신 러닝을 추가하여 수행 할 수 있습니다.

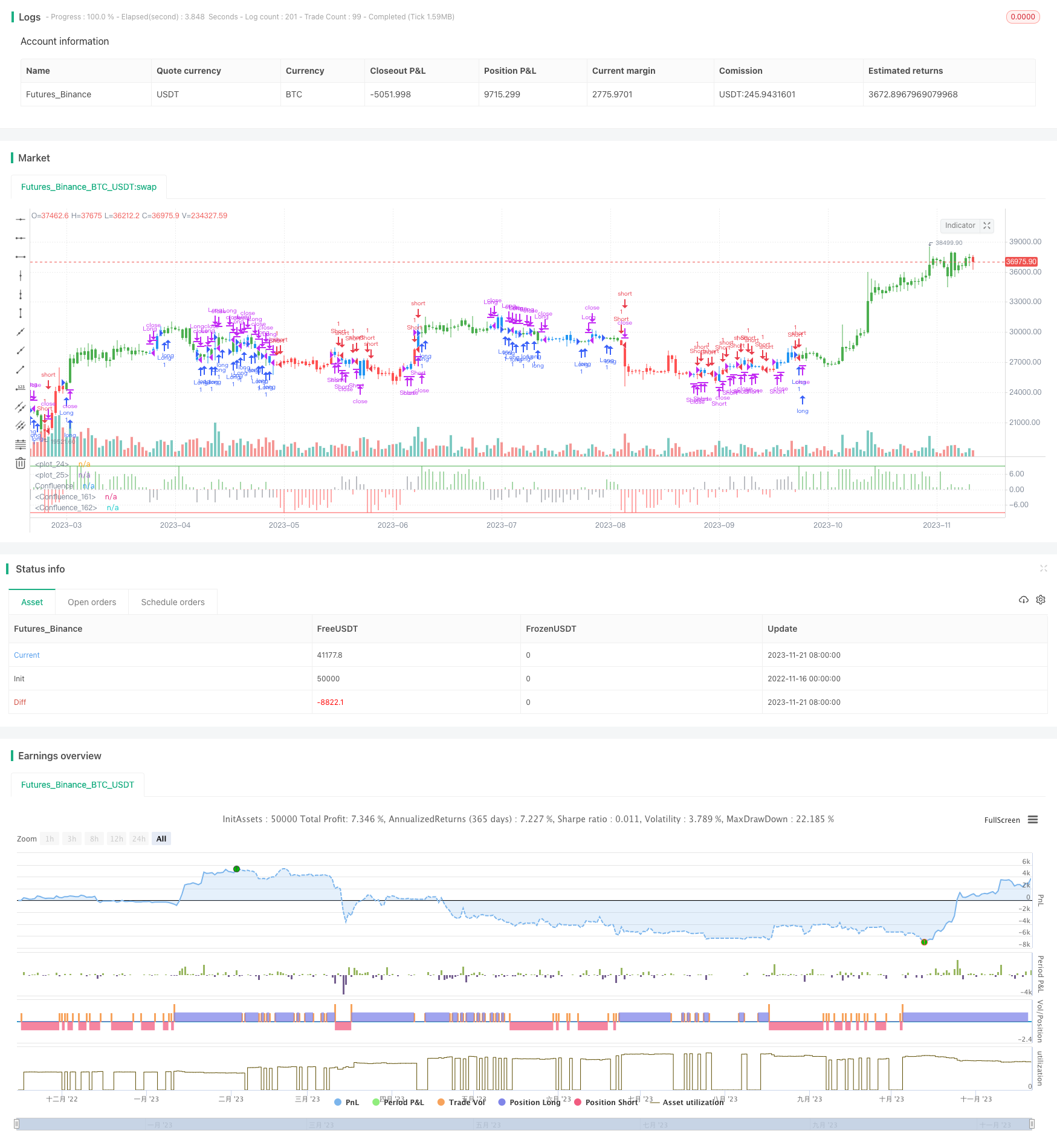

/*backtest

start: 2022-11-16 00:00:00

end: 2023-11-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 14/03/2017

// This is modified version of Dale Legan's "Confluence" indicator written by Gary Fritz.

// ================================================================

// Here is Gary`s commentary:

// Since the Confluence indicator returned several "states" (bull, bear, grey, and zero),

// he modified the return value a bit:

// -9 to -1 = Bearish

// -0.9 to 0.9 = "grey" (and zero)

// 1 to 9 = Bullish

// The "grey" range corresponds to the "grey" values plotted by Dale's indicator, but

// they're divided by 10.

//

// You can change long to short in the Input Settings

// Please, use it only for learning or paper trading. Do not for real trading.

////////////////////////////////////////////////////////////

strategy(title="Confluence", shorttitle="Confluence")

Harmonic = input(10, minval=1)

BuyBand = input(9)

SellBand = input(-9)

reverse = input(false, title="Trade reverse")

hline(SellBand, color=red, linestyle=line)

hline(BuyBand, color=green, linestyle=line)

Price = close

STL = round((Harmonic * 2) - 1 - 0.5)

ITL = round((STL * 2) - 1 - 0.5)

LTL = round((ITL * 2) - 1 - 0.5)

HOFF = round(Harmonic / 2 - 0.5)

SOFF = round(STL / 2 - 0.5)

IOFF = round(ITL / 2 - 0.5)

xHavg = sma(Price, Harmonic)

xSavg = sma(Price, STL)

xIavg = sma(Price, ITL)

xLavg = sma(Price, LTL)

xvalue2 = xSavg - xHavg[HOFF]

xvalue3 = xIavg - xSavg[SOFF]

xvalue12 = xLavg - xIavg[IOFF]

xmomsig = xvalue2 + xvalue3 + xvalue12

xLavgOHLC = sma(ohlc4, LTL - 1)

xH2 = sma(Price, Harmonic - 1)

xS2 = sma(Price, STL - 1)

xI2 = sma(Price, ITL - 1)

xL2 = sma(Price, LTL - 1)

DerivH = (xHavg * 2) - xHavg[1]

DerivS = (xSavg * 2) - xSavg[1]

DerivI = (xIavg * 2) - xIavg[1]

DerivL = (xLavg * 2) - xLavg[1]

SumDH = Harmonic * DerivH

SumDS = STL * DerivS

SumDI = ITL * DerivI

SumDL = LTL * DerivL

LengH = Harmonic - 1

LengS = STL - 1

LengI = ITL - 1

LengL = LTL - 1

N1H = xH2 * LengH

N1S = xS2 * LengS

N1I = xI2 * LengI

N1L = xL2 * LengL

DRH = SumDH - N1H

DRS = SumDS - N1S

DRI = SumDI - N1I

DRL = SumDL - N1L

SumH = xH2 * (Harmonic - 1)

SumS = xS2 * (STL - 1)

SumI = xI2 * (ITL - 1)

SumL = xLavgOHLC * (LTL - 1)

xvalue5 = (SumH + DRH) / Harmonic

xvalue6 = (SumS + DRS) / STL

xvalue7 = (SumI + DRI) / ITL

xvalue13 = (SumL + DRL) / LTL

value9 = xvalue6 - xvalue5[HOFF]

value10 = xvalue7 - xvalue6[SOFF]

value14 = xvalue13 - xvalue7[IOFF]

xmom = value9 + value10 + value14

HT = sin(xvalue5 * 2 * 3.14 / 360) + cos(xvalue5 * 2 * 3.14 / 360)

HTA = sin(xHavg * 2 * 3.14 / 360) + cos(xHavg * 2 * 3.14 / 360)

ST = sin(xvalue6 * 2 * 3.14 / 360) + cos(xvalue6 * 2 * 3.14 / 360)

STA = sin(xSavg * 2 * 3.14 / 360) + cos(xSavg * 2 * 3.14 / 360)

IT = sin(xvalue7 * 2 * 3.14 / 360) + cos(xvalue7 * 2 * 3.14 / 360)

ITA = sin(xIavg * 2 * 3.14 / 360) + cos(xIavg * 2 * 3.14 / 360)

xSum = HT + ST + IT

xErr = HTA + STA + ITA

Condition2 = (((xSum > xSum[SOFF]) and (xHavg < xHavg[SOFF])) or ((xSum < xSum[SOFF]) and (xHavg > xHavg[SOFF])))

Phase = iff(Condition2 , -1 , 1)

xErrSum = (xSum - xErr) * Phase

xErrSig = sma(xErrSum, SOFF)

xvalue70 = xvalue5 - xvalue13

xvalue71 = sma(xvalue70, Harmonic)

ErrNum = iff (xErrSum > 0 and xErrSum < xErrSum[1] and xErrSum < xErrSig, 1,

iff (xErrSum > 0 and xErrSum < xErrSum[1] and xErrSum > xErrSig, 2,

iff (xErrSum > 0 and xErrSum > xErrSum[1] and xErrSum < xErrSig, 2,

iff (xErrSum > 0 and xErrSum > xErrSum[1] and xErrSum > xErrSig, 3,

iff (xErrSum < 0 and xErrSum > xErrSum[1] and xErrSum > xErrSig, -1,

iff (xErrSum < 0 and xErrSum < xErrSum[1] and xErrSum > xErrSig, -2,

iff (xErrSum < 0 and xErrSum > xErrSum[1] and xErrSum < xErrSig, -2,

iff (xErrSum < 0 and xErrSum < xErrSum[1] and xErrSum < xErrSig, -3, 0))))))))

momNum = iff (xmom > 0 and xmom < xmom[1] and xmom < xmomsig , 1,

iff (xmom > 0 and xmom < xmom[1] and xmom > xmomsig, 2,

iff (xmom > 0 and xmom > xmom[1] and xmom < xmomsig, 2,

iff (xmom > 0 and xmom > xmom[1] and xmom > xmomsig, 3,

iff (xmom < 0 and xmom > xmom[1] and xmom > xmomsig, -1,

iff (xmom < 0 and xmom < xmom[1] and xmom > xmomsig, -2,

iff (xmom < 0 and xmom > xmom[1] and xmom < xmomsig, -2,

iff (xmom < 0 and xmom < xmom[1] and xmom < xmomsig, -3, 0))))))))

TCNum = iff (xvalue70 > 0 and xvalue70 < xvalue70[1] and xvalue70 < xvalue71, 1,

iff (xvalue70 > 0 and xvalue70 < xvalue70[1] and xvalue70 > xvalue71, 2,

iff (xvalue70 > 0 and xvalue70 > xvalue70[1] and xvalue70 < xvalue71, 2,

iff (xvalue70 > 0 and xvalue70 > xvalue70[1] and xvalue70 > xvalue71, 3,

iff (xvalue70 < 0 and xvalue70 > xvalue70[1] and xvalue70 > xvalue71, -1,

iff (xvalue70 < 0 and xvalue70 < xvalue70[1] and xvalue70 > xvalue71, -2,

iff (xvalue70 < 0 and xvalue70 > xvalue70[1] and xvalue70 < xvalue71, -2,

iff (xvalue70 < 0 and xvalue70 < xvalue70[1] and xvalue70 < xvalue71, -3,0))))))))

value42 = ErrNum + momNum + TCNum

Confluence = iff (value42 > 0 and xvalue70 > 0, value42,

iff (value42 < 0 and xvalue70 < 0, value42,

iff ((value42 > 0 and xvalue70 < 0) or (value42 < 0 and xvalue70 > 0), value42 / 10, 0)))

Res1 = iff (Confluence >= 1, Confluence, 0)

Res2 = iff (Confluence <= -1, Confluence, 0)

Res3 = iff (Confluence == 0, 0, iff (Confluence > -1 and Confluence < 1, 10 * Confluence, 0))

pos = iff(Res2 >= SellBand and Res2 != 0, -1,

iff(Res1 <= BuyBand and Res1 != 0, 1,

iff(Res3 != 0, 0, nz(pos[1], 0))))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close("Long", when = possig == 0)

strategy.close("Short", when = possig == 0)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(Res1, color=green, title="Confluence", linewidth=3, style = histogram)

plot(Res2, color=red, title="Confluence", linewidth=3, style = histogram)

plot(Res3, color=gray, title="Confluence", linewidth=3, style = histogram)

더 많은

- 투기 걸프: 트렌드 추적 전략 SAR에 기반

- 원래의 원시적 트렌드 추적 전략 이동 평균에 기초한

- 볼링거 밴드 스톱 로스 전략

- 다중 지표에 기반한 트렌드 추적 전략

- 다중 이동 평균 동적 트렌드 전략

- 가격 기반 스톱 로스 및 영업 전략

- 시간 프레임 전력 거래 전략

- 양방향 트렌드 추적 이동 평균 크로스오버 전략

- 개인화 된 모멘텀 거래 전략

- 전략에 따라 이동 평균 봉투 채널 트렌드

- 내부 진폭 중지 손실을 기반으로 하는 모멘텀 브레이크업 전략

- 골든 크로스 기반의 트렌드 트레이딩 전략

- 채널 브레이크에 기반한 트렌드 추적 전략

- Bollinger 피라미딩으로 브레이크 아웃 전략

- 모멘텀 추적 전략

- CCTBBO 회전 추적 전략

- 이동 평균 크로스오버 전략

- 모멘텀 거북이 트렌드 추적 전략

- 하라미 역전 역 테스트 전략

- 동적 이동 평균 전략