여러 시간 프레임에 기반한 비트코인 양적 대역 거래 전략

저자:차오장, 날짜: 2023-12-01 13:50:02태그:

전반적인 설명

이 전략은 다양한 시간 프레임에 걸쳐 양적 지표를 결합하여 비트코인의 가격 대역을 식별하고 트렌드 추적 거래를 수행합니다. 5 분 시간 프레임을 채택하고 이익을 위해 대역을 장기적으로 보유하는 것을 목표로합니다.

전략 논리

- 일일 시간 프레임에 기초하여 계산된 RSI 지표는 가짜 브레이크를 필터하기 위해 거래량에 기초하여 무게를 가집니다.

- 일일 RSI 인디케이터는 양적 밴드 인디케이터를 만들기 위해 EMA에 의해 평평화됩니다.

- 5분 시간 프레임은 거래 신호를 생성하기 위해 선형 회귀와 HMA 지표의 조합을 사용합니다.

- 양적 범위 지표와 시간 프레임에 걸쳐 거래 신호를 결합함으로써 전략은 중장기 가격 범위를 식별합니다.

이점 분석

- 부피 가중된 RSI 지표는 실제 범위를 효과적으로 식별하고 잘못된 파장을 필터링할 수 있습니다.

- HMA 지표는 가격 변화에 더 민감하며, 급격한 전환을 파악할 수 있습니다.

- 여러 시간 프레임을 결합하면 중장기 범위를 더 정확하게 식별 할 수 있습니다.

- 5분 시간 프레임에서 거래하면 더 높은 거래 빈도가 가능합니다.

- 밴드 추적 전략으로서, 정확한 지점 선택이 필요하지 않으며 더 긴 기간 동안 유지될 수 있습니다.

위험 분석

- 양적 지표는 잘못된 신호를 생성 할 수 있으므로 근본 분석이 권장됩니다.

- 간격은 중간 반전을 볼 수 있습니다. 스톱 로스 메커니즘이 있어야 합니다.

- 신호 지연은 가장 좋은 입구점을 놓치는 결과를 초래할 수 있습니다.

- 수익성 있는 밴드는 더 긴 보유 기간을 필요로 하고 자본 압력 견딜 수 있어야 합니다.

최적화 방향

- 다른 매개 변수와 함께 RSI 지표의 테스트 효과

- 다른 보조 밴드 표시기를 도입해보세요.

- HMA 지표 길이 파라미터 최적화

- 스톱 로즈와 수익 전략을 추가합니다.

- 밴드 트레이드를 위해 대기 주기를 조정합니다.

결론

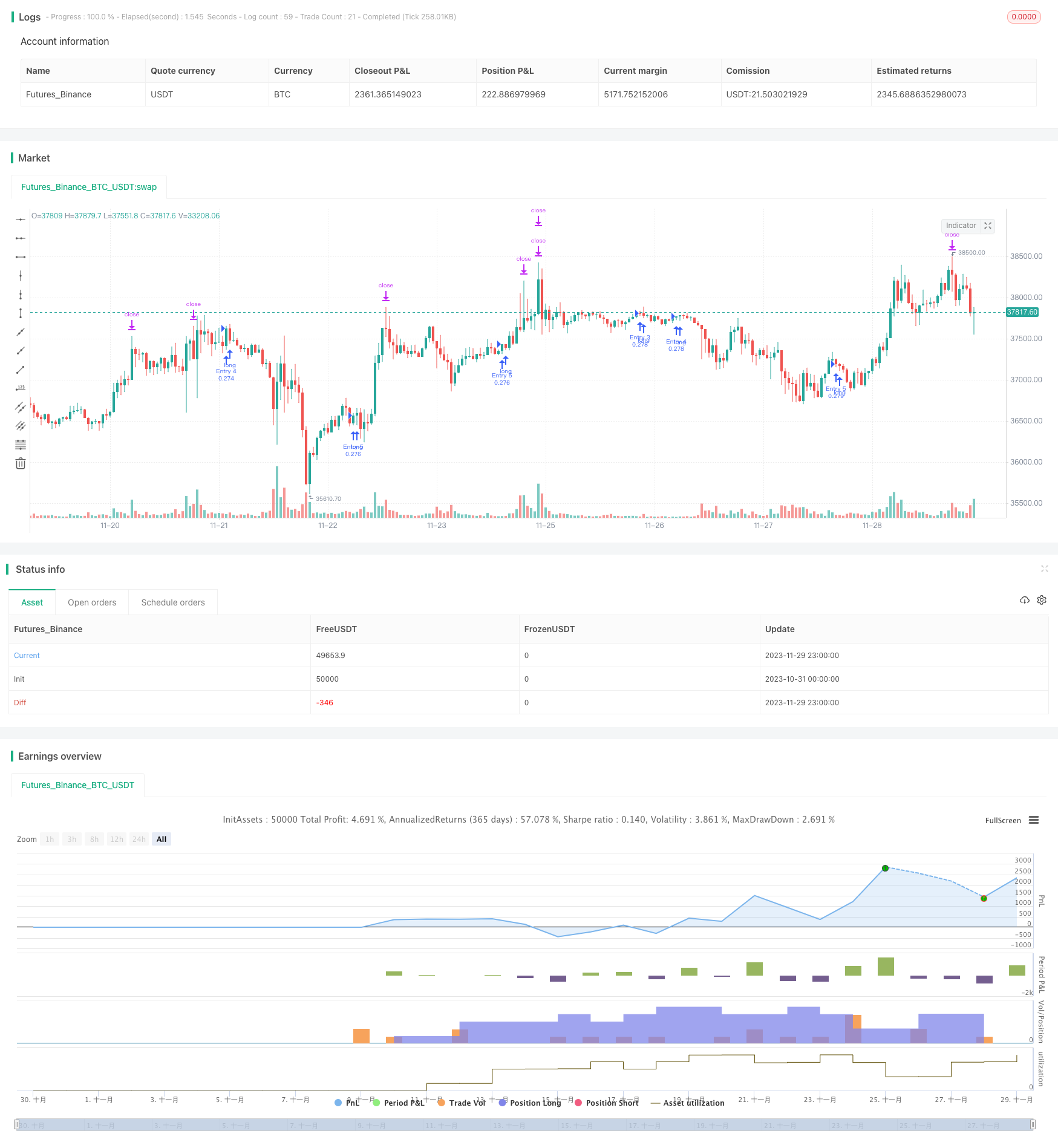

이 전략은 시간 프레임과 밴드 추적을 결합하여 비트코인의 중장기 트렌드를 효과적으로 포착합니다. 단기 거래와 비교하면 중장기 밴드 거래는 더 작은 드라우다운과 더 큰 수익 잠재력을 보입니다. 다음 단계는 매개 변수 조정 및 리스크 관리 추가로 수익성과 안정성을 더욱 향상시키는 것입니다.

/*backtest

start: 2023-10-31 00:00:00

end: 2023-11-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title='Pyramiding BTC 5 min', overlay=true, pyramiding=5, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=20, commission_type=strategy.commission.percent, commission_value=0.075)

//the pyramide based on this script https://www.tradingview.com/script/7NNJ0sXB-Pyramiding-Entries-On-Early-Trends-by-Coinrule/

//

fastLength = input(250, title="Fast filter length ", minval=1)

slowLength = input(500,title="Slow filter length", minval=1)

source=close

v1=ema(source,fastLength)

v2=ema(source,slowLength)

//

//Backtest dates

fromMonth = input(defval=1, title="From Month")

fromDay = input(defval=10, title="From Day")

fromYear = input(defval=2020, title="From Year")

thruMonth = input(defval=1, title="Thru Month")

thruDay = input(defval=1, title="Thru Day")

thruYear = input(defval=2112, title="Thru Year")

showDate = input(defval=true, title="Show Date Range")

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => // create function "within window of time"

time >= start and time <= finish ? true : false

leng=1

p1=close[1]

len55 = 10

//taken from https://www.tradingview.com/script/Ql1FjjfX-security-free-MTF-example-JD/

HTF = input("1D", type=input.resolution)

ti = change( time(HTF) ) != 0

T_c = fixnan( ti ? close : na )

vrsi = rsi(cum(change(T_c) * volume), leng)

pp=wma(vrsi,len55)

d=(vrsi[1]-pp[1])

len100 = 10

x=ema(d,len100)

//

zx=x/-1

col=zx > 0? color.lime : color.orange

//

tf10 = input("1", title = "Timeframe", type = input.resolution, options = ["1", "5", "15", "30", "60","120", "240","360","720", "D", "W"])

length = input(50, title = "Period", type = input.integer)

shift = input(1, title = "Shift", type = input.integer)

hma(_src, _length)=>

wma((2 * wma(_src, _length / 2)) - wma(_src, _length), round(sqrt(_length)))

hma3(_src, _length)=>

p = length/2

wma(wma(close,p/3)*3 - wma(close,p/2) - wma(close,p),p)

b =security(syminfo.tickerid, tf10, hma3(close[1], length)[shift])

//plot(a,color=color.gray)

//plot(b,color=color.yellow)

close_price = close[0]

len = input(25)

linear_reg = linreg(close_price, len, 0)

filter=input(true)

buy=crossover(linear_reg, b)

longsignal = (v1 > v2 or filter == false ) and buy and window()

//set take profit

ProfitTarget_Percent = input(3)

Profit_Ticks = close * (ProfitTarget_Percent / 100) / syminfo.mintick

//set take profit

LossTarget_Percent = input(10)

Loss_Ticks = close * (LossTarget_Percent / 100) / syminfo.mintick

//Order Placing

strategy.entry("Entry 1", strategy.long, when=strategy.opentrades == 0 and longsignal)

strategy.entry("Entry 2", strategy.long, when=strategy.opentrades == 1 and longsignal)

strategy.entry("Entry 3", strategy.long, when=strategy.opentrades == 2 and longsignal)

strategy.entry("Entry 4", strategy.long, when=strategy.opentrades == 3 and longsignal)

strategy.entry("Entry 5", strategy.long, when=strategy.opentrades == 4 and longsignal)

if strategy.position_size > 0

strategy.exit(id="Exit 1", from_entry="Entry 1", profit=Profit_Ticks, loss=Loss_Ticks)

strategy.exit(id="Exit 2", from_entry="Entry 2", profit=Profit_Ticks, loss=Loss_Ticks)

strategy.exit(id="Exit 3", from_entry="Entry 3", profit=Profit_Ticks, loss=Loss_Ticks)

strategy.exit(id="Exit 4", from_entry="Entry 4", profit=Profit_Ticks, loss=Loss_Ticks)

strategy.exit(id="Exit 5", from_entry="Entry 5", profit=Profit_Ticks, loss=Loss_Ticks)

더 많은

- 듀얼 인디케이터 콤보 미친 내일 스칼핑 전략

- 동적 그리드 거래 전략

- 이중 이동 평균 거래 전략

- 초기 수익 취득 이동 평균 개막 벨 출구 전략

- 월간 패러볼릭 브레이크업 전략

- 트렌드 필터 이동 평균 크로스오버 양적 전략

- RSI 및 이동 평균에 기반한 양적 거래 전략

- 변동성 포착 RSI-볼링거 밴드 전략

- 역삼체 양적 전략

- 볼링거 밴드 브레이크에 기반한 FiboBuLL 웨브 전략

- 기하급수적 이동평균 전략을 따르는 경향

- 트래일링 스톱 손실 역전 전략

- 급속한 RSI 역전 전략

- 이중 진입 포지션 평균화 후속 스톱 손실 전략

- RSI 이동 평균 크로스오버 트렌드 전략

- 역사적인 데이터에 기초한 동적 지원 및 저항 전략

- 노로의 볼링거 추적 전략

- EMA 반전 구매-판매 전략

- 하라미 폐쇄 가격 전략

- CMO와 WMA를 기반으로 한 모멘텀 거래 전략