동적 구매 판매 부피 파업 전략

저자:차오장, 날짜: 2023-12-26 11:15:31태그:

전반적인 설명

이 전략은 높은 확률 트렌드 추적을 실현하기 위해 매주 VWAP 및 필터링을 위한 볼링거 밴드와 결합하여 사용자 정의 시간 프레임 구매 및 판매 부피를 통해 장기 및 단기를 결정합니다. 또한 일방적인 위험을 효과적으로 제어하기 위해 동적 인 수익 및 손실을 중지하는 메커니즘을 도입합니다.

전략 원칙

- 맞춤형 시간 프레임 내에서 구매 및 판매량 지표를 계산

- BV: 낮은 가격으로 구매한 결과 구매량이 증가합니다.

- SV: 판매량, 최고 판매점으로 인해

- 공정 구매 및 판매량

- 20주기 EMA로 평탄하다

- 양과 음으로 처리된 매수 및 판매량을 분리합니다.

- 판사 지표 방향

- 0보다 크면 상승, 0보다 작으면 하락

- 주간 VWAP 및 볼링거 밴드와 결합한 오차를 결정합니다

- VWAP 이상 가격과 지표 상승은 긴 신호입니다

- VWAP 아래의 가격과 지표 하향은 짧은 신호입니다.

- 동적 취득 및 스톱 손실

- 일일 ATR에 기초한 취득 및 스톱 로스 비율 설정

장점

- 구매 및 판매 부피는 실제 시장 추진력을 반영하고 잠재적인 동향의 에너지를 포착합니다.

- 주간 VWAP는 더 긴 시간 프레임 트렌드 방향을 판단합니다. 볼링거 밴드는 브레이크 신호를 결정합니다.

- 동적 ATR 세트는 수익을 취하고 손실을 멈추고, 수익 잠금을 극대화하고 오버 튜닝을 피합니다.

위험성

- 구매 및 판매량 데이터는 특정 오류가 있습니다, 잘못된 판단을 일으킬 수 있습니다

- 단일 지표의 결합 판단은 잘못된 신호를 생성하는 경향이 있습니다.

- 부적절한 볼링거 밴드 매개 변수 설정으로 유효한 브레이크오웃이 좁아집니다

최적화 방향

- 여러 시간 프레임 구매 및 판매량 지표로 최적화

- 필터링을 위한 거래량 및 다른 보조 지표를 추가합니다.

- 브레이크오웃 효율을 높이기 위해 볼링거 밴드 매개 변수를 동적으로 조정합니다.

결론

이 전략은 구매 및 판매 부피의 예측성을 최대한 활용하여 VWAP 및 볼링거 밴드 (Bollinger Bands) 로 보완된 높은 확률 신호를 생성하며, 동적 인 취득 및 스톱 로스를 통해 위험을 효과적으로 제어합니다. 매개 변수 및 규칙이 계속 최적화됨에 따라 성능이 더욱 중요해질 것으로 예상됩니다.

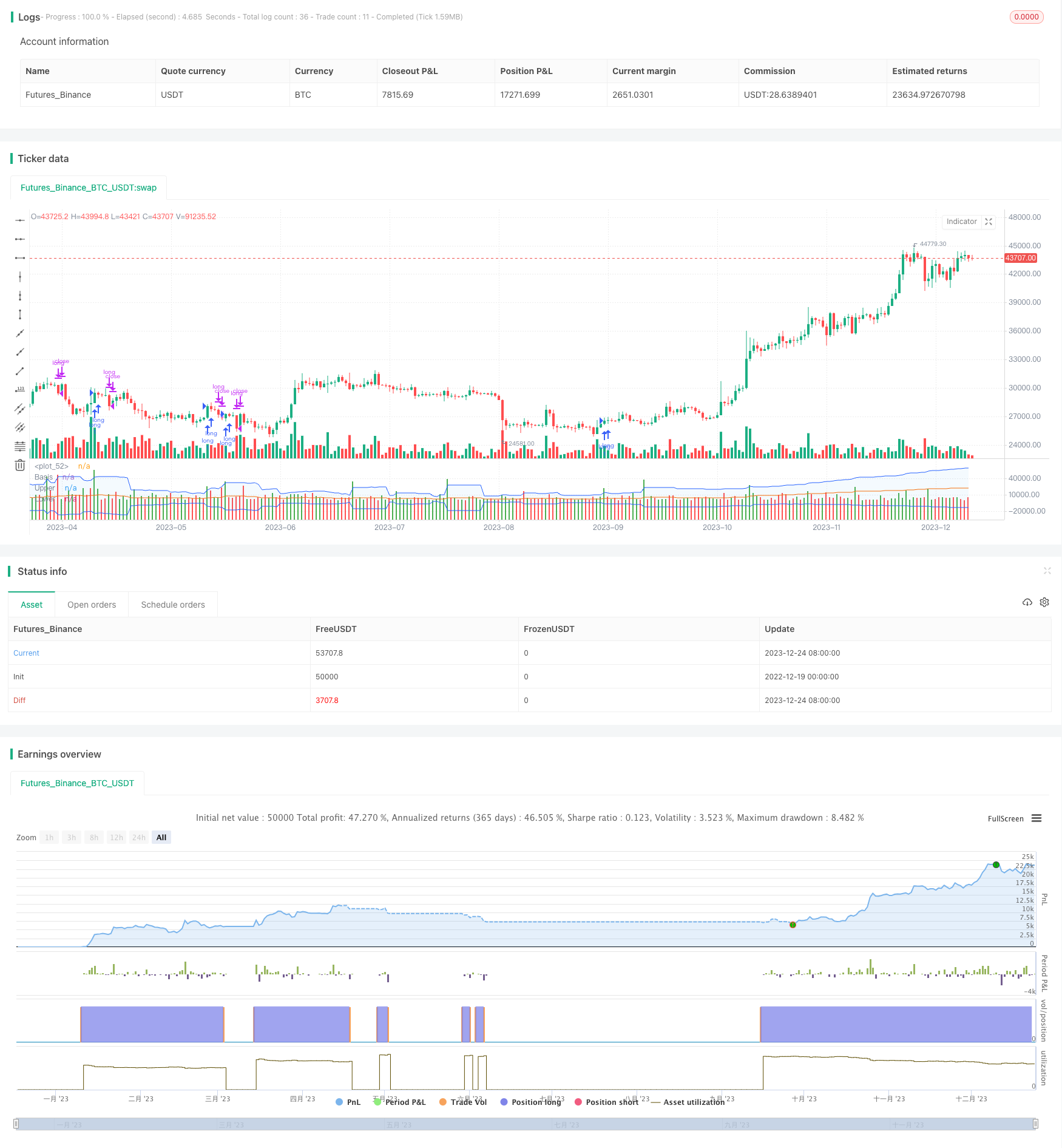

/*backtest

start: 2022-12-19 00:00:00

end: 2023-12-25 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © original author ceyhun

//@ exlux99 update

//@version=5

strategy('Buying Selling Volume Strategy', format=format.volume, precision=0, overlay=false)

weekly_vwap = request.security(syminfo.tickerid, "W", ta.vwap(hlc3))

vi = false

customTimeframe = input.timeframe("60", group="Entry Settings")

allow_long = input.bool(true, group="Entry Settings")

allow_short = input.bool(false, group="Entry Settings")

xVolume = request.security(syminfo.tickerid, customTimeframe, volume)

xHigh = request.security(syminfo.tickerid, customTimeframe, high)

xLow = request.security(syminfo.tickerid, customTimeframe, low)

xClose = request.security(syminfo.tickerid, customTimeframe, close)

BV = xHigh == xLow ? 0 : xVolume * (xClose - xLow) / (xHigh - xLow)

SV = xHigh == xLow ? 0 : xVolume * (xHigh - xClose) / (xHigh - xLow)

vol = xVolume > 0 ? xVolume : 1

TP = BV + SV

BPV = BV / TP * vol

SPV = SV / TP * vol

TPV = BPV + SPV

tavol20 = request.security(syminfo.tickerid, customTimeframe, ta.ema(vol, 20))

tabv20= request.security(syminfo.tickerid, customTimeframe, ta.ema(BV, 20))

tasv20= request.security(syminfo.tickerid, customTimeframe, ta.ema(SV, 20))

VN = vol / tavol20

BPN = BV / tabv20 * VN * 100

SPN = SV / tasv20 * VN * 100

TPN = BPN + SPN

xbvp = request.security(syminfo.tickerid, customTimeframe,-math.abs(BPV))

xbpn = request.security(syminfo.tickerid, customTimeframe,-math.abs(BPN))

xspv = request.security(syminfo.tickerid, customTimeframe,-math.abs(SPV))

xspn = request.security(syminfo.tickerid, customTimeframe,-math.abs(SPN))

BPc1 = BPV > SPV ? BPV : xbvp

BPc2 = BPN > SPN ? BPN : xbpn

SPc1 = SPV > BPV ? SPV : xspv

SPc2 = SPN > BPN ? SPN : xspn

BPcon = vi ? BPc2 : BPc1

SPcon = vi ? SPc2 : SPc1

minus = BPcon + SPcon

plot(minus, color = BPcon > SPcon ? color.green : color.red , style=plot.style_columns)

length = input.int(20, minval=1, group="Volatility Settings")

src = minus//input(close, title="Source")

mult = input.float(2.0, minval=0.001, maxval=50, title="StdDev", group="Volatility Settings")

xtasma = request.security(syminfo.tickerid, customTimeframe, ta.sma(src, length))

xstdev = request.security(syminfo.tickerid, customTimeframe, ta.stdev(src, length))

basis = xtasma

dev = mult * xstdev

upper = basis + dev

lower = basis - dev

plot(basis, "Basis", color=#FF6D00, offset = 0)

p1 = plot(upper, "Upper", color=#2962FF, offset = 0)

p2 = plot(lower, "Lower", color=#2962FF, offset = 0)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

// Original a

longOriginal = minus > upper and BPcon > SPcon and close > weekly_vwap

shortOriginal = minus > upper and BPcon < SPcon and close< weekly_vwap

high_daily = request.security(syminfo.tickerid, "D", high)

low_daily = request.security(syminfo.tickerid, "D", low)

close_daily = request.security(syminfo.tickerid, "D", close)

true_range = math.max(high_daily - low_daily, math.abs(high_daily - close_daily[1]), math.abs(low_daily - close_daily[1]))

atr_range = ta.sma(true_range*100/request.security(syminfo.tickerid, "D", close), 14)

ProfitTarget_Percent_long = input.float(100.0, title='TP Multiplier for Long entries ', step=0.5, step=0.5, group='Dynamic Risk Management')

Profit_Ticks_long = close + (close * (atr_range * ProfitTarget_Percent_long))/100

LossTarget_Percent_long = input.float(1.0, title='SL Multiplier for Long entries', step=0.5, group='Dynamic Risk Management')

Loss_Ticks_long = close - (close * (atr_range * LossTarget_Percent_long ))/100

ProfitTarget_Percent_short = input.float(100.0, title='TP Multiplier for Short entries ', step=0.5, step=0.5, group='Dynamic Risk Management')

Profit_Ticks_short = close - (close * (atr_range*ProfitTarget_Percent_short))/100

LossTarget_Percent_short = input.float(5.0, title='SL Multiplier for Short entries', step=0.5, group='Dynamic Risk Management')

Loss_Ticks_short = close + (close * (atr_range*LossTarget_Percent_short))/100

var longOpened_original = false

var int timeOfBuyLong = na

var float tpLong_long_original = na

var float slLong_long_original = na

long_entryx = longOriginal

longEntry_original = long_entryx and not longOpened_original

if longEntry_original

longOpened_original := true

tpLong_long_original := Profit_Ticks_long

slLong_long_original := Loss_Ticks_long

timeOfBuyLong := time

//lowest_low_var_sl := lowest_low

tpLong_trigger = longOpened_original[1] and ((close > tpLong_long_original) or (high > tpLong_long_original)) //or high > lowest_low_var_tp

slLong_Trigger = longOpened_original[1] and ((close < slLong_long_original) or (low < slLong_long_original)) //or low < lowest_low_var_sl

longExitSignal_original = shortOriginal or tpLong_trigger or slLong_Trigger

if(longExitSignal_original)

longOpened_original := false

tpLong_long_original := na

slLong_long_original := na

if(allow_long)

strategy.entry("long", strategy.long, when=longOriginal)

strategy.close("long", when= longExitSignal_original) //or shortNew

if(allow_short)

strategy.entry("short", strategy.short, when=shortOriginal )

strategy.close("short", when= longOriginal) //or shortNew

더 많은

- 래리 윌리엄스의 이동평균 크로스오버 전략

- 오시레이터 미세 이동 평균 시점 전략

- 동적 스톱 로스로 DMI 및 스토카스틱 거래 전략

- 이중 요인 복합 역전 및 질량 지수 전략

- 이중 트렌드 필터 기반의 양적 거래 전략

- 스토카스틱 RSI 모멘텀 오스실레이션 거래 전략

- RSI 콜백으로 볼링거스 대역이 가격 이하로 넘어가면 단축 판매의 거래 전략

- 이동 평균 크로스오버 전략

- 동적 회전 대역에 기반한 트렌드 추적 전략

- 볼링거 밴드 추진 동향 전략

- 슈퍼트렌드 MACD 양적 전략

- 4 EMA 트렌드 전략

- 양적 지표에 기초한 비트코인 거래 전략

- 마지막 N 촛불 역 논리 전략

- 트렌드 추적 브레이크업 전략

- 단순 하락 구매 하락 판매 높은 전략

- N 바 클로즈 아래 오픈 쇼트 전략

- 극한 값 방법 기반의 통계 변동성 백테스트 전략

- 상대적 강도 지수 중지 손실 전략

치안의 이중 채널 탈출 전략