Pembunuh Sma BTC

Penulis:ChaoZhang, Tarikh: 2022-05-17 11:23:58Tag:SMAATRADX

Halo!!

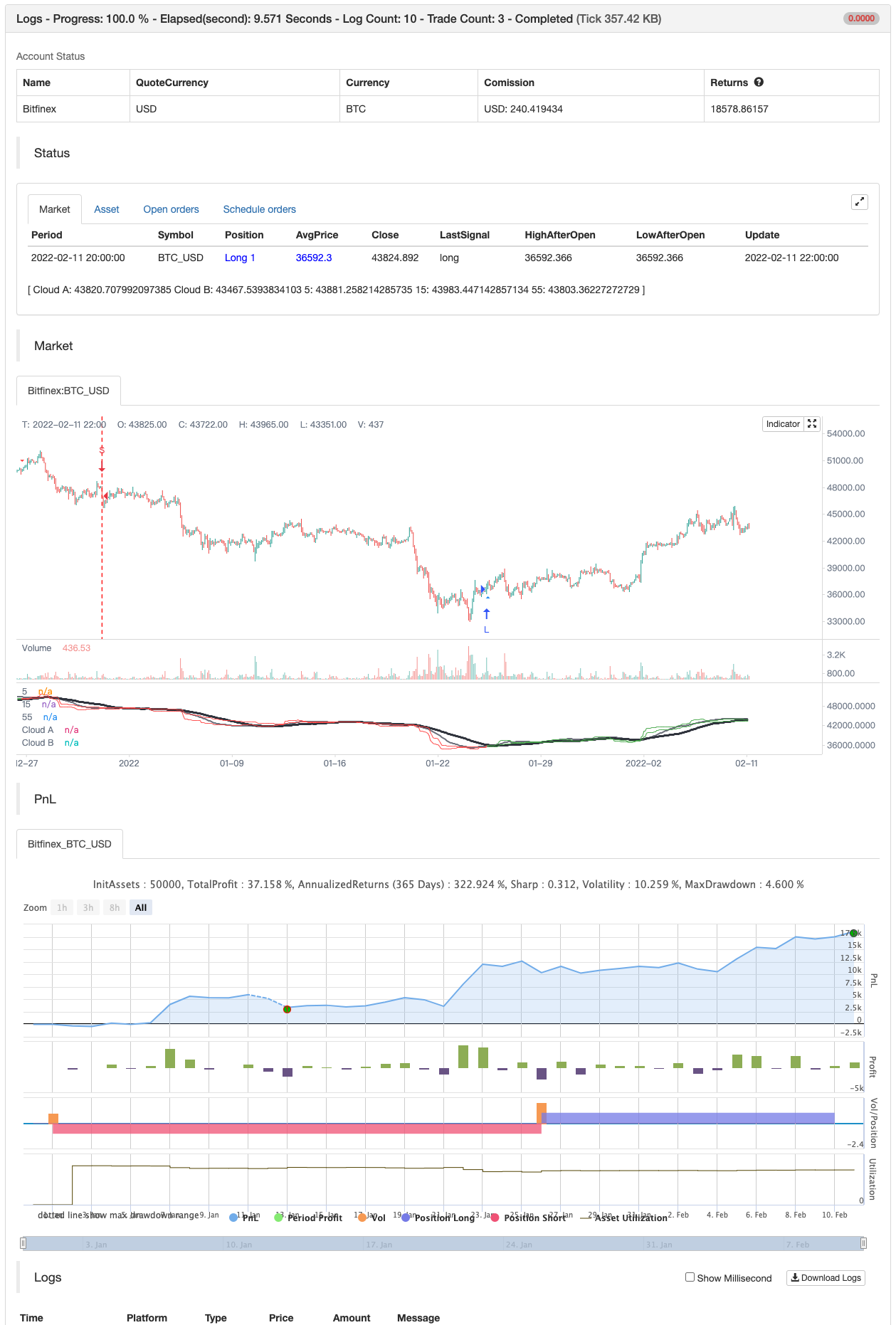

Saya membuat strategi yang baik dengan keuntungan gila dengan hanya pesanan LONG dan SHORT Nah, strategi ini untuk ------->>> BINANCE:BTCUSDT

Logik strategi agak mudah.

Strategi menggunakan 3 SMA yang berbeza (7,21,55) untuk mencari trend yang betul Untuk mengelakkan banyak isyarat yang salah saya menambah dua petunjuk seperti:

ADX - Adalah salah satu penunjuk trend yang paling kuat dan tepat. ADX mengukur betapa kuatnya trend, dan boleh memberikan maklumat berharga mengenai sama ada terdapat peluang perdagangan yang berpotensi. CLOUD - Ini adalah salah satu penunjuk newset yang saya gunakan. Penunjuk ini membantu strategi, penunjuk ini direka untuk menunjukkan trend pasaran yang betul. Dengan menggunakan panjang besar penunjuk ini, saya dapat melihat perubahan trend sedikit kemudian, tetapi lebih tepat.

Tambahan pula saya menambah stop-loss trailing untuk keselamatan maksimum

Untuk jujur strategi ini kelihatan sangat baik, banyak perdagangan, keuntungan yang tinggi dan sejumlah kecil penunjuk, keuntungan masa depan boleh menjadi serupa

Menggunakan kombinasi SMA ini memberi saya perubahan cepat yang menakjubkan manakala trend juga berubah dengan cepat seperti di sini:

gambar ringkas

Malangnya, saya tidak dapat menghapuskan 100% isyarat yang salah pada carta rata seperti ini:

gambar ringkas

Saya harap strategi ini berguna untuk sesiapa sahaja ;)

Kaki sentiasa

Menikmati!!

Ujian belakang

/*backtest

start: 2022-01-01 00:00:00

end: 2022-02-11 23:59:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Bitfinex","currency":"BTC_USD"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © wielkieef

//@version=4

src = close

//strategy("Sma BTC killer [60MIN]", overlay = true, pyramiding=1,initial_capital = 10000, default_qty_type= strategy.percent_of_equity, default_qty_value = 100, calc_on_order_fills=false, slippage=0,commission_type=strategy.commission.percent,commission_value=0.04)

//SMAs -----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Length1 = input(14, title=" 1-SMA Lenght", minval=1)

Length2 = input(28, title=" 2-SMA Lenght", minval=1)

Length3 = input(55, title=" 3-SMA Lenght", minval=1)

xPrice = close

SMA1 = sma(xPrice, Length1)

SMA2 = sma(xPrice, Length2)

SMA3 = sma(xPrice, Length3)

//Indicators Inputs -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

ADX_options = input("MASANAKAMURA", title=" Adx Type", options = ["CLASSIC", "MASANAKAMURA"], group="Average Directional Index")

ADX_len = input(29, title=" Adx Lenght", type=input.integer, minval = 1, group="Average Directional Index")

th = input(21, title=" Adx Treshold", type=input.integer, minval = 0, group="Average Directional Index")

len = input(11, title="Cloud Length", group="Cloud")

// ATR Inputs -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

prd = input(18, title=" PP period", group="Average True Range")

Factor = input(5, title=" ATR Factor", group="Average True Range")

Pd = input(6, title=" ATR Period", group="Average True Range")

//Indicators -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

calcADX(_len) =>

up = change(high)

down = -change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = rma(tr, _len)

_plus = fixnan(100 * rma(plusDM, _len) / truerange)

_minus = fixnan(100 * rma(minusDM, _len) / truerange)

sum = _plus + _minus

_adx = 100 * rma(abs(_plus - _minus) / (sum == 0 ? 1 : sum), _len)

[_plus,_minus,_adx]

calcADX_Masanakamura(_len) =>

SmoothedTrueRange = 0.0

SmoothedDirectionalMovementPlus = 0.0

SmoothedDirectionalMovementMinus = 0.0

TrueRange = max(max(high - low, abs(high - nz(close[1]))), abs(low - nz(close[1])))

DirectionalMovementPlus = high - nz(high[1]) > nz(low[1]) - low ? max(high - nz(high[1]), 0) : 0

DirectionalMovementMinus = nz(low[1]) - low > high - nz(high[1]) ? max(nz(low[1]) - low, 0) : 0

SmoothedTrueRange := nz(SmoothedTrueRange[1]) - (nz(SmoothedTrueRange[1]) /_len) + TrueRange

SmoothedDirectionalMovementPlus := nz(SmoothedDirectionalMovementPlus[1]) - (nz(SmoothedDirectionalMovementPlus[1]) / _len) + DirectionalMovementPlus

SmoothedDirectionalMovementMinus := nz(SmoothedDirectionalMovementMinus[1]) - (nz(SmoothedDirectionalMovementMinus[1]) / _len) + DirectionalMovementMinus

DIP = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIM = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DX = abs(DIP-DIM) / (DIP+DIM)*100

adx = sma(DX, _len)

[DIP,DIM,adx]

[DIPlusC,DIMinusC,ADXC] = calcADX(ADX_len)

[DIPlusM,DIMinusM,ADXM] = calcADX_Masanakamura(ADX_len)

DIPlus = ADX_options == "CLASSIC" ? DIPlusC : DIPlusM

DIMinus = ADX_options == "CLASSIC" ? DIMinusC : DIMinusM

ADX = ADX_options == "CLASSIC" ? ADXC : ADXM

L_adx = DIPlus > DIMinus and ADX > th

S_adx = DIPlus < DIMinus and ADX > th

ADX_COLOR = L_adx ? color.lime : S_adx ? color.red : color.orange

PI = 2 * asin(1)

hilbertTransform(src) =>

0.0962 * src + 0.5769 * nz(src[2]) - 0.5769 * nz(src[4]) - 0.0962 * nz(src[6])

computeComponent(src, mesaPeriodMult) =>

hilbertTransform(src) * mesaPeriodMult

computeAlpha(src, fastLimit, slowLimit) =>

mesaPeriod = 0.0

mesaPeriodMult = 0.075 * nz(mesaPeriod[1]) + 0.54

smooth = 0.0

smooth := (4 * src + 3 * nz(src[1]) + 2 * nz(src[2]) + nz(src[3])) / 10

detrender = 0.0

detrender := computeComponent(smooth, mesaPeriodMult)

I1 = nz(detrender[3])

Q1 = computeComponent(detrender, mesaPeriodMult)

jI = computeComponent(I1, mesaPeriodMult)

jQ = computeComponent(Q1, mesaPeriodMult)

I2 = 0.0

Q2 = 0.0

I2 := I1 - jQ

Q2 := Q1 + jI

I2 := 0.2 * I2 + 0.8 * nz(I2[1])

Q2 := 0.2 * Q2 + 0.8 * nz(Q2[1])

Re = I2 * nz(I2[1]) + Q2 * nz(Q2[1])

Im = I2 * nz(Q2[1]) - Q2 * nz(I2[1])

Re := 0.2 * Re + 0.8 * nz(Re[1])

Im := 0.2 * Im + 0.8 * nz(Im[1])

if Re != 0 and Im != 0

mesaPeriod := 2 * PI / atan(Im / Re)

if mesaPeriod > 1.5 * nz(mesaPeriod[1])

mesaPeriod := 1.5 * nz(mesaPeriod[1])

if mesaPeriod < 0.67 * nz(mesaPeriod[1])

mesaPeriod := 0.67 * nz(mesaPeriod[1])

if mesaPeriod < 6

mesaPeriod := 6

if mesaPeriod > 50

mesaPeriod := 50

mesaPeriod := 0.2 * mesaPeriod + 0.8 * nz(mesaPeriod[1])

phase = 0.0

if I1 != 0

phase := (180 / PI) * atan(Q1 / I1)

deltaPhase = nz(phase[1]) - phase

if deltaPhase < 1

deltaPhase := 1

alpha = fastLimit / deltaPhase

if alpha < slowLimit

alpha := slowLimit

[alpha,alpha/2.0]

er = abs(change(src,len)) / sum(abs(change(src)),len)

[a,b] = computeAlpha(src, er, er*0.1)

mama = 0.0

mama := a * src + (1 - a) * nz(mama[1])

fama = 0.0

fama := b * mama + (1 - b) * nz(fama[1])

alpha = pow((er * (b - a)) + a, 2)

kama = 0.0

kama := alpha * src + (1 - alpha) * nz(kama[1])

L_cloud = kama > kama[1]

S_cloud = kama < kama[1]

float ph = pivothigh(prd, prd)

float pl = pivotlow(prd, prd)

var float center = na

float lastpp = ph ? ph : pl ? pl : na

if lastpp

if na(center)

center := lastpp

else

center := (center * 2 + lastpp) / 3

Up = center - (Factor * atr(Pd))

Dn = center + (Factor * atr(Pd))

float TUp = na

float TDown = na

Trend = 0

TUp := close[1] > TUp[1] ? max(Up, TUp[1]) : Up

TDown := close[1] < TDown[1] ? min(Dn, TDown[1]) : Dn

Trend := close > TDown[1] ? 1: close < TUp[1]? -1: nz(Trend[1], 1)

Trailingsl = Trend == 1 ? TUp : TDown

bsignal = Trend == 1 and Trend[1] == -1

ssignal = Trend == -1 and Trend[1] == 1

L_ATR = Trend == 1

S_ATR = Trend == -1

// Strategy logic ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

var bool longCond = na, var bool shortCond = na

var int CondIni_long = 0, var int CondIni_short = 0

var bool _Final_longCondition = na, var bool _Final_shortCondition = na

var float last_open_longCondition = na, var float last_open_shortCondition = na

var int last_longCondition = na, var int last_shortCondition = na

var int last_Final_longCondition = na, var int last_Final_shortCondition = na

var int nLongs = na, var int nShorts = na

Long_MA =L_adx and L_cloud and (SMA1 < close and SMA2 < close and SMA3 < close )

Short_MA =S_adx and S_cloud and (SMA1 > close and SMA2 > close and SMA3 > close )

longCond := Long_MA

shortCond := Short_MA

CondIni_long := longCond[1] ? 1 : shortCond[1] ? -1 : nz(CondIni_long[1] )

CondIni_short := longCond[1] ? 1 : shortCond[1] ? -1 : nz(CondIni_short[1] )

longCondition = (longCond[1] and nz(CondIni_long[1]) == -1 )

shortCondition = (shortCond[1] and nz(CondIni_short[1]) == 1 )

var float sum_long = 0.0, var float sum_short = 0.0

var float Position_Price = 0.0

var bool Final_long_BB = na, var bool Final_short_BB = na

var int last_long_BB = na, var int last_short_BB = na

last_open_longCondition := longCondition or Final_long_BB[1] ? close[1] : nz(last_open_longCondition[1] )

last_open_shortCondition := shortCondition or Final_short_BB[1] ? close[1] : nz(last_open_shortCondition[1] )

last_longCondition := longCondition or Final_long_BB[1] ? time : nz(last_longCondition[1] )

last_shortCondition := shortCondition or Final_short_BB[1] ? time : nz(last_shortCondition[1] )

in_longCondition = last_longCondition > last_shortCondition

in_shortCondition = last_shortCondition > last_longCondition

last_Final_longCondition := longCondition ? time : nz(last_Final_longCondition[1] )

last_Final_shortCondition := shortCondition ? time : nz(last_Final_shortCondition[1] )

nLongs := nz(nLongs[1] )

nShorts := nz(nShorts[1] )

if longCondition or Final_long_BB

nLongs := nLongs + 1

nShorts := 0

sum_long := nz(last_open_longCondition) + nz(sum_long[1])

sum_short := 0.0

if shortCondition or Final_short_BB

nLongs := 0

nShorts := nShorts + 1

sum_short := nz(last_open_shortCondition)+ nz(sum_short[1])

sum_long := 0.0

Position_Price := nz(Position_Price[1])

Position_Price := longCondition or Final_long_BB ? sum_long/nLongs : shortCondition or Final_short_BB ? sum_short/nShorts : na

ATR_L_STOP = ssignal and in_longCondition

ATR_S_STOP = bsignal and in_shortCondition

// Plots and colors 010101010101010010101010101010101010101001010101010101001010101001010100101100111100101010010100110110010011100101010101010010101010101001011110011010101010101001010100101100110101010001001010101001010101001110110010101010100101010101010100111110101010101010101010100101010101100

colors = (in_longCondition ? color.green : in_shortCondition ? color.red : color.orange)

bgcolor(color=colors)

//barcolor (color = colors)

plotshape(longCondition, title="Long", style=shape.triangleup, location=location.belowbar, color=color.blue, size=size.small , transp = 0 )

plotshape(shortCondition, title="Short", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small , transp = 0 )

mama_p = plot(mama, title="Cloud A", style= plot.style_stepline, color=colors )

fama_p = plot(fama, title="Cloud B", style= plot.style_stepline, color=colors )

fill (mama_p,fama_p, color=colors )

plot(SMA1, color=color.white,style= plot.style_stepline, title="5", linewidth=1)

plot(SMA2, color=color.gray,style= plot.style_stepline, title="15", linewidth=2)

plot(SMA3, color=color.black,style= plot.style_stepline, title="55", linewidth=3)

plotshape(ATR_L_STOP, title = "ATR LONG CLOSE", style=shape.arrowdown, location=location.abovebar, color=color.red, size=size.small , text="ATR LONG CLOSE", textcolor=color.red, transp = 0 )

plotshape(ATR_S_STOP, title = "ATR SHORT CLOSE", style=shape.arrowup, location=location.belowbar, color=color.blue, size=size.small, text="ATR SHORT CLOSE", textcolor=color.blue, transp = 0 )

// Strategy -----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

if Long_MA

strategy.entry ("L", strategy.long)

if Short_MA

strategy.entry ("S", strategy.short)

strategy.close_all( when = ATR_L_STOP or ATR_S_STOP)

// By wielkieef

- Dapatkan trend anda

- Trend Multi-Indikator Mengikuti Strategi dengan Pengoptimuman Keuntungan

- Strategi Dagangan Trend Trend Stop-Loss Dinamik Berbilang Penunjuk

- Strategi Dagangan Purata Bergerak Pintar Penembusan Trend Multi-Filter

- Strategi DCA dinamik berasaskan jumlah

- Teori Gelombang Elliott 4-9 Impulse Wave Automatic Detection Strategi Dagangan

- Strategi pembalikan purata bergerak berganda dengan kawalan risiko

- Selamat datang di BEARMARKET [30 MIN]

- Supertrend+4 bergerak

- Multi-SMA Support Level False Breakout Strategy dengan Sistem Stop-Loss ATR

- Risotto

- EMA Cloud Intraday Strategi

- Titik Pivot Supertrend

- Supertrend+4 bergerak

- ZigZag berasaskan momentum

- VuManChu Cipher B + Strategi Perbezaan

- Konsep Dual SuperTrend

- Super Scalper

- Ujian belakang- Penunjuk

- Trendycious

- Templat amaran ML

- Perkembangan Fibonacci Dengan Jurang

- RSI MTF Ob+Os

- Fukuiz Octa-EMA + Ichimoku

- CCI MTF Ob+Os

- MACD yang lebih bijak

- Strategi OCC R5.1

- Selamat datang di BEARMARKET [30 MIN]

- Sidboss

- Titik Pivot Tinggi Rangka Masa Multi Rendah