Strategi pembalikan gabungan dua faktor dan indeks jisim

Penulis:ChaoZhang, Tarikh: 2023-12-26 12:20:57Tag:

Ringkasan

Strategi ini adalah strategi perdagangan pembalikan gabungan berdasarkan model dua faktor. Ia mengintegrasikan corak pembalikan 123 dan faktor Indeks Massa untuk mencapai kesan kumulatif untuk isyarat strategi. Ia hanya akan panjang atau pendek apabila kedua-dua faktor mengeluarkan isyarat beli atau jual secara serentak.

Logika Strategi

123 Faktor Pembalikan

Faktor ini beroperasi berdasarkan corak harga 123. Apabila hubungan harga penutupan selama dua hari yang lalu adalah

Faktor Indeks Massa

Faktor ini menilai pembalikan trend berdasarkan pengembangan atau pengecutan julat turun naik harga. Apabila julat berkembang, indeks meningkat dan apabila julat menyempit, indeks jatuh. Ia menghasilkan isyarat jual apabila indeks melintasi di atas ambang dan isyarat beli apabila melintasi di bawah ambang.

Strategi ini hanya membuka kedudukan apabila kedua-dua faktor mengeluarkan isyarat ke arah yang sama, mencapai perdagangan yang menguntungkan sambil mengelakkan isyarat palsu dari satu faktor.

Analisis Kelebihan

- Model faktor dua menggabungkan corak harga dan penunjuk turun naik untuk ketepatan isyarat yang lebih baik

- 123 corak menangkap ekstrem tempatan, Indeks Massa menangkap titik pembalikan trend global, kekuatan pelengkap

- Hanya mengambil isyarat apabila dua faktor bersetuju mengelakkan isyarat palsu dan meningkatkan kestabilan

Analisis Risiko

- Kemungkinan wujud untuk kedua-dua faktor untuk mengeluarkan isyarat yang salah pada masa yang sama, menyebabkan kerugian

- Kadar kegagalan pembalikan wujud, perlu menetapkan stop loss untuk mengawal penurunan

- Penyesuaian parameter yang tidak betul boleh membawa kepada pemasangan berlebihan

Risiko boleh dikurangkan dengan memperluaskan set latihan, stop loss yang ketat, penapisan pelbagai faktor dll.

Arahan pengoptimuman

- Uji lebih banyak kombinasi penunjuk harga dan turun naik

- Tambah model ML untuk menilai kualiti isyarat dan kedudukan saiz dinamik

- Masukkan jumlah, Bollinger Bands dan lain-lain untuk menemui lebih banyak alpha

- Menggunakan optimum berjalan ke hadapan untuk ketahanan

Kesimpulan

Strategi ini menggabungkan dua faktor, corak harga dan penunjuk turun naik, untuk hanya mengambil isyarat apabila mereka bersetuju, mengelakkan isyarat palsu dari satu faktor dan meningkatkan kestabilan. Tetapi risiko kekal untuk isyarat yang salah serentak.

/*backtest

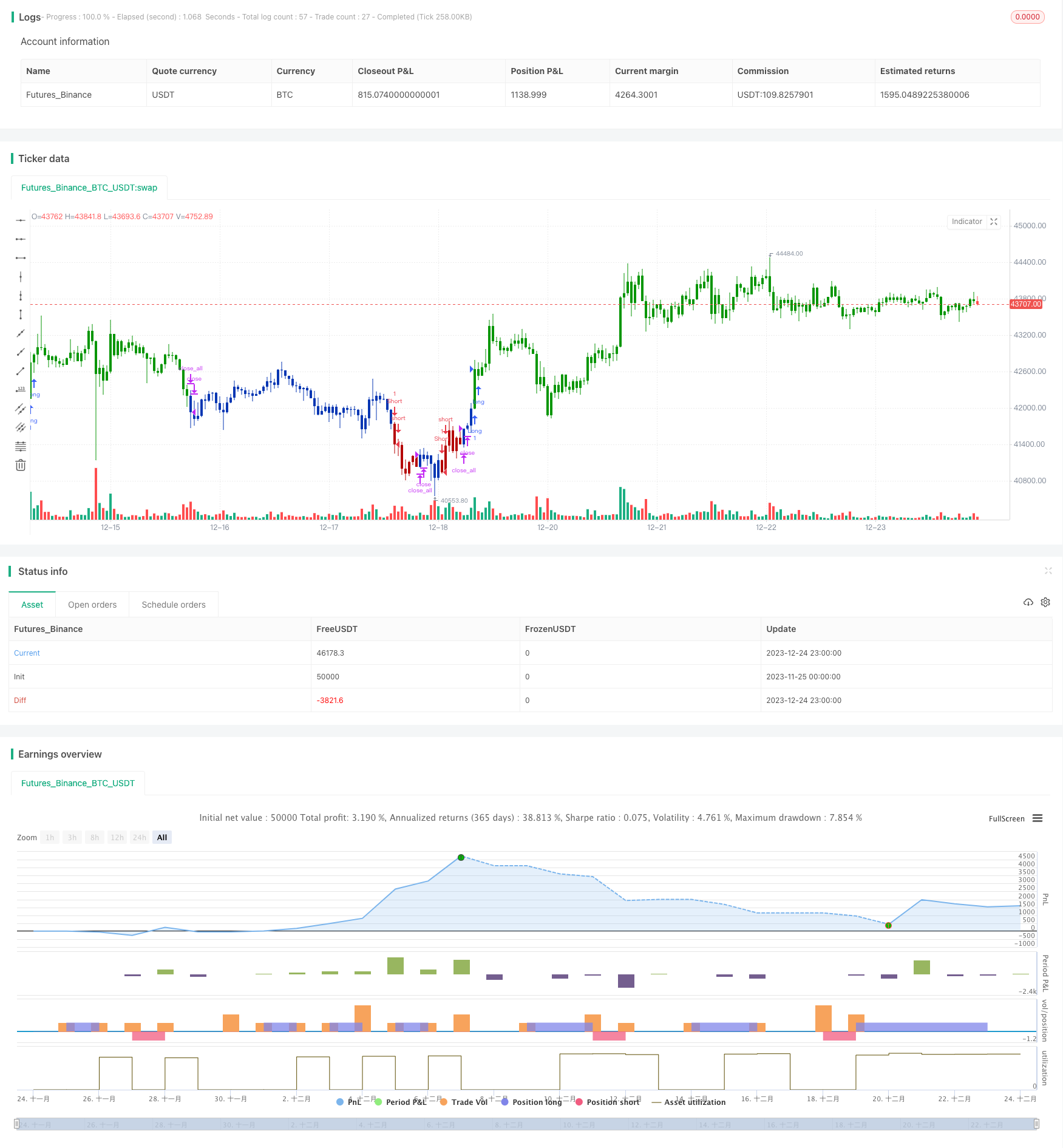

start: 2023-11-25 00:00:00

end: 2023-12-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 22/02/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The Mass Index was designed to identify trend reversals by measuring

// the narrowing and widening of the range between the high and low prices.

// As this range widens, the Mass Index increases; as the range narrows

// the Mass Index decreases.

// The Mass Index was developed by Donald Dorsey.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

MASS(Length1,Length2,Trigger) =>

pos = 0.0

xPrice = high - low

xEMA = ema(xPrice, Length1)

xSmoothXAvg = ema(xEMA, Length1)

nRes = sum(iff(xSmoothXAvg != 0, xEMA / xSmoothXAvg, 0), Length2)

pos := iff(nRes > Trigger, -1,

iff(nRes < Trigger, 1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & MASS Index", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- MASS Index ----")

Length1 = input(9, minval=1)

Length2 = input(25, minval=1)

Trigger = input(26.5, step = 0.01)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posMASS = MASS(Length1,Length2,Trigger)

pos = iff(posReversal123 == 1 and posMASS == 1 , 1,

iff(posReversal123 == -1 and posMASS == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

- Strategi Perdagangan Envelope Purata Bergerak

- Dual Moving Average Golden Cross Strategi Kuantitatif

- Strategi Peralihan Indeks Kuantitatif Mengintegrasikan Isyarat Trend Dual

- Strategi Perdagangan Indikator Inersia

- Bollinger Band RSI Dual Line Strategy

- Strategi Trend Penembusan Rintangan Sokongan Dinamik

- Strategi Ujian Kembali Oscillator Pelangi

- Strategi Crossover Purata Bergerak Larry Williams

- Strategi Masa Rata-rata Bergerak Diferensial Osilator

- Strategi Dagangan DMI & Stochastic dengan Stop-Loss Dinamik

- Strategi Dagangan Kuantitatif Berdasarkan Penapis Trend Berganda

- Strategi Dagangan Skala Skala Skala RSI

- Strategi Dagangan Jualan Singkat Apabila Bollinger Band Melalui Di Bawah Harga Dengan RSI Callback

- Strategi Crossover Purata Bergerak

- Strategi Pengesanan Trend Berdasarkan Garis Pivot Dinamik

- Bollinger Bands Trend Momentum Mengikut Strategi

- Strategi Penjualan Beli Dinamis

- Strategi Kuantitatif Supertrend MACD

- 4 Strategi Trend EMA

- Strategi Perdagangan Bitcoin Berdasarkan Penunjuk Kuantitatif