Titik Pivot dan Fibonacci Retracement Berasaskan Trend Automatik Mengikut Strategi

Penulis:ChaoZhang, Tarikh: 2024-01-05 11:34:17Tag:

Ringkasan

Strategi ini secara automatik mengenal pasti corak ABC dalam harga saham berdasarkan titik pivot dan nisbah retracement Fibonacci, dan menghasilkan isyarat panjang / pendek. Ia menggunakan titik pivot untuk menentukan gelombang harga dan mengira nisbah retracement Fibonacci antara gelombang ABC. Jika nisbah memenuhi kriteria tertentu, isyarat perdagangan dihasilkan.

Logika Strategi

- Mengira titik tertinggi dan terendah saham

- Menghakimi jika harga telah jatuh dari titik tinggi sebelumnya atau meningkat dari titik rendah sebelumnya

- Mengira nisbah retracement Fibonacci antara gelombang semasa dan gelombang sebelumnya

- Jika nisbah retracement kedua-dua gelombang ke atas dan ke bawah adalah dalam julat yang betul, menentukan corak ABC yang berpotensi

- Selepas pengesahan corak ABC, tetapkan stop loss di Titik C untuk panjang, dan Titik A untuk pendek.

Analisis Kelebihan

- Titik pusingan mengenal pasti tahap sokongan / rintangan utama untuk meningkatkan ketepatan isyarat

- Fibonacci retracements menangkap titik perubahan trend dengan mengenal pasti corak ABC

- Peraturan keuntungan / kerugian yang jelas mengelakkan kerugian besar

Analisis Risiko

- Titik pusingan dan retracement Fibonacci tidak dapat memastikan pengenalan sempurna setiap titik perubahan trend. Penilaian yang salah mungkin berlaku.

- Titik C dan Titik A berhenti boleh ditembusi, membawa kepada kerugian yang lebih besar

- Parameter seperti julat nisbah retracement Fibonacci memerlukan pengoptimuman lanjut

Arahan pengoptimuman

- Menggabungkan lebih banyak penunjuk teknikal untuk membantu pengesahan corak ABC, meningkatkan ketepatan isyarat

- Mengoptimumkan julat nisbah retracement Fibonacci untuk memenuhi keadaan pasaran yang lebih banyak

- Menggunakan kaedah pembelajaran mesin untuk melatih model pengenalan corak ABC

Kesimpulan

Strategi ini mengenal pasti corak ABC untuk menjana isyarat panjang / pendek pada titik perubahan trend, berdasarkan pengesahan titik pusingan tahap sokongan / rintangan utama, dan pengiraan nisbah retracement Fibonacci. Logiknya mudah dan bersih, dengan peraturan keuntungan / kerugian yang munasabah yang mengawal risiko dengan berkesan. Walau bagaimanapun, beberapa risiko penilaian yang salah tetap ada, yang memerlukan pengoptimuman dan penambahbaikan lanjut untuk memenuhi keadaan pasaran yang lebih banyak.

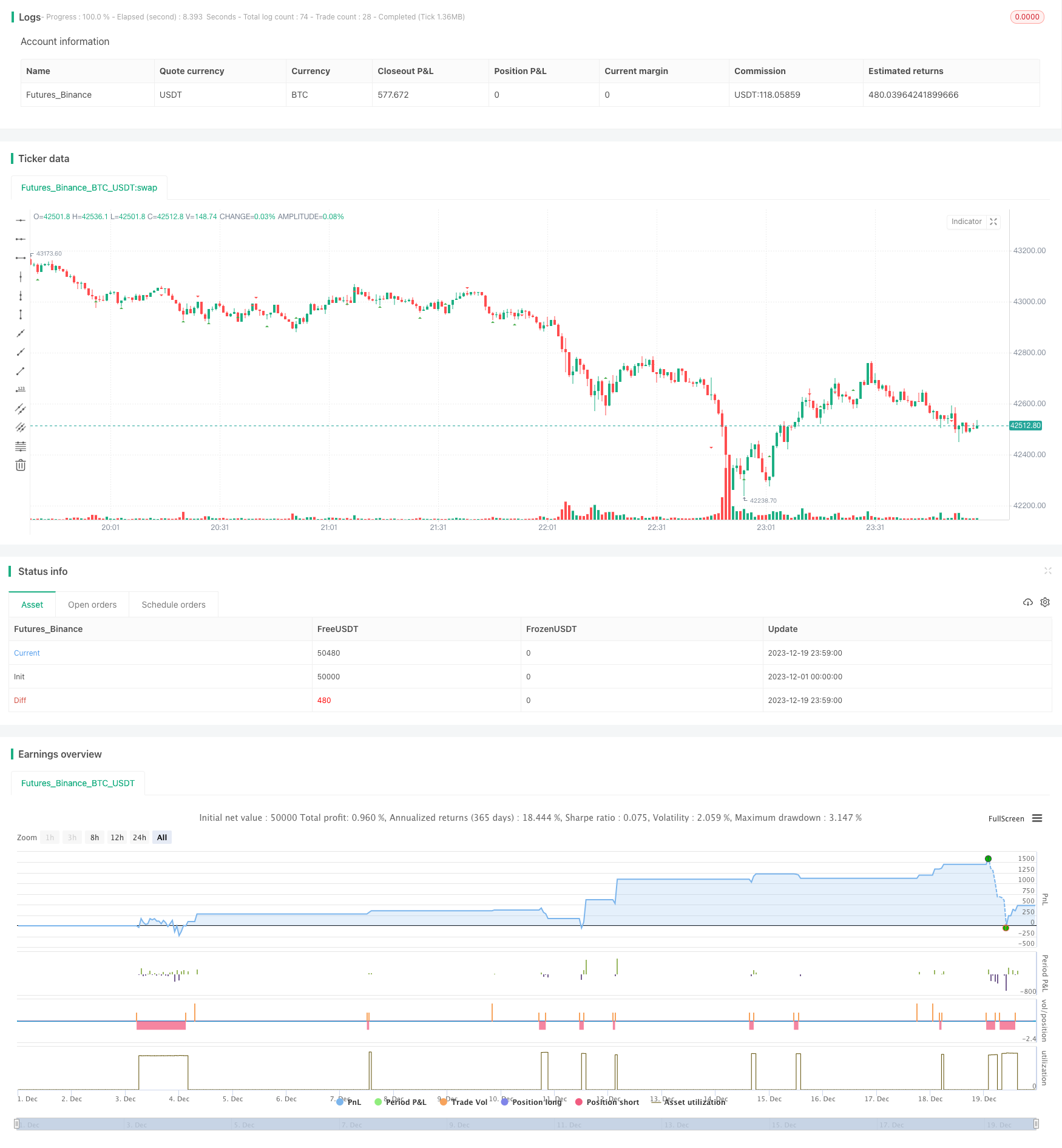

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-19 23:59:59

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © kerok3g

//@version=5

strategy("ABCD Strategy", shorttitle="ABCDS", overlay=true, commission_value=0.04)

calcdev(fprice, lprice, fbars, lbars) =>

rise = lprice - fprice

run = lbars - fbars

avg = rise/run

((bar_index - lbars) * avg) + lprice

len = input(5)

ph = ta.pivothigh(len, len)

pl = ta.pivotlow(len, len)

var bool ishigh = false

ishigh := ishigh[1]

var float currph = 0.0

var int currphb = 0

currph := nz(currph)

currphb := nz(currphb)

var float oldph = 0.0

var int oldphb = 0

oldph := nz(oldph)

oldphb := nz(oldphb)

var float currpl = 0.0

var int currplb = 0

currpl := nz(currpl)

currplb := nz(currplb)

var float oldpl = 0.0

var int oldplb = 0

oldpl := nz(oldpl)

oldplb := nz(oldplb)

if (not na(ph))

ishigh := true

oldph := currph

oldphb := currphb

currph := ph

currphb := bar_index[len]

else

if (not na(pl))

ishigh := false

oldpl := currpl

oldplb := currplb

currpl := pl

currplb := bar_index[len]

endHighPoint = calcdev(oldph, currph, oldphb, currphb)

endLowPoint = calcdev(oldpl, currpl, oldplb, currplb)

plotshape(ph, style=shape.triangledown, color=color.red, location=location.abovebar, offset=-len)

plotshape(pl, style=shape.triangleup, color=color.green, location=location.belowbar, offset=-len)

// var line lnhigher = na

// var line lnlower = na

// lnhigher := line.new(oldphb, oldph, bar_index, endHighPoint)

// lnlower := line.new(oldplb, oldpl, bar_index, endLowPoint)

// line.delete(lnhigher[1])

// line.delete(lnlower[1])

formlong = oldphb < oldplb and oldpl < currphb and currphb < currplb

longratio1 = (currph - oldpl) / (oldph - oldpl)

longratio2 = (currph - currpl) / (currph - oldpl)

formshort = oldplb < oldphb and oldphb < currplb and currplb < currphb

shortratio1 = (oldph - currpl) / (oldph - oldpl)

shortratio2 = (currph - currpl) / (oldph - currpl)

// prevent multiple entry for one pattern

var int signalid = 0

signalid := nz(signalid[1])

longCond = formlong and

longratio1 < 0.7 and

longratio1 > 0.5 and

longratio2 > 1.1 and

longratio2 < 1.35 and

close < oldph and

close > currpl and

signalid != oldplb

if (longCond)

signalid := oldplb

longsl = currpl - ta.tr

longtp = ((close - longsl) * 1.5) + close

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", "Long", limit=math.min(longtp, oldph), stop=longsl)

shortCond = formshort and

shortratio1 < 0.7 and

shortratio1 > 0.5 and

shortratio2 > 1.1 and

shortratio2 < 1.35 and

close > oldpl and

close < currph and

signalid != oldphb

if (shortCond)

signalid := oldphb

shortsl = currph + ta.tr

shorttp = close - ((shortsl - close) * 1.5)

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", "Short", limit=math.max(shorttp, oldpl), stop=shortsl)

- Trend Berikutan Strategi Perdagangan Purata Bergerak

- Trend Berikutan Strategi Pemutusan Momentum

- Strategi Saluran Harga Breakout dan Bollinger Bands Pintar

- Trend Sederhana Mengikuti Strategi

- Strategi Terobosan Panjang Berdasarkan Pembinaan K-Line

- Strategi dagangan purata bergerak berdasarkan Bollinger Bands yang dipaparkan

- Strategi Pilihan Julat Tarikh Backtest Berkualiti Berdasarkan MA Berganda

- Strategi pengoptimuman crossover purata bergerak pelbagai jangka masa

- Strategi Pengesanan Terobosan

- Strategi Dagangan Sesuai Berdasarkan Penunjuk Momentum

- Trend Mengikuti Strategi Berdasarkan EMA dan MACD merentasi Tempoh

- Strategi pembalikan perlanggaran pelbagai penunjuk

- Strategi Pembalikan Trend Berdasarkan EMA dan SMA Crossover

- Strategi Pengawal DPO DMI

- Strategi Dagangan Jangka Pendek Pengesanan Trend

- Trend RSI Berikutan Strategi Bull

- Strategi Gabungan RSIndex dan Purata Bergerak

- Trend MA pelbagai jangka masa Mengikut Strategi

- Dual Indikator Strategi Beli Bawah

- Strategi Peralihan Menelan Buruh