Triple Overlapping Strategi Momentum Stochastic

Penulis:ChaoZhang, Tarikh: 2024-01-26 12:15:20Tag:

Ringkasan

Triple Overlapping Stochastic Momentum adalah strategi perdagangan jangka pendek yang tipikal. Ia mengira tiga indikator Stochastic Momentum Index (SMI) dengan tetapan parameter yang berbeza dan menghasilkan isyarat perdagangan apabila ketiga-tiga menunjukkan keadaan overbought atau oversold secara serentak. Dengan menggabungkan analisis pelbagai jangka masa, strategi ini dapat menapis bunyi pasaran dengan berkesan dan meningkatkan kualiti isyarat.

Logika Strategi

Penunjuk teras strategi ini adalah Indeks Momentum Stochastic (SMI).

SMI = 100 * EMA(EMA(Close - Midpoint of High-Low Range, N1), N2) / 0.5 * EMA(EMA(High - Low, N1), N2)

Di mana N1 dan N2 adalah panjang parameter. SMI berayun antara -100 dan 100. Nilai di atas 0 menunjukkan penutupan berada di separuh atas julat harian, sementara nilai di bawah 0 menunjukkan penutupan berada di separuh bawah.

Sama seperti Osilator Stochastic tradisional, tahap overbought (contohnya 40) / oversold (contohnya -40) menunjukkan isyarat pembalikan yang berpotensi. Isyarat bullish dan bearish dihasilkan apabila SMI melintasi di atas / di bawah garis purata bergerak.

Strategi menggunakan tiga penunjuk SMI dengan set parameter yang berbeza, khususnya:

- SMI1: %K Tempoh 10, %K Tempoh Perlahan 3

- SMI2: %K Tempoh 20, %K Tempoh Perlahan 3

- SMI3: %K Tempoh 5, %K Tempoh Perlahan 3

Isyarat perdagangan dihasilkan apabila ketiga-tiga SMI menunjukkan keadaan overbought atau oversold secara serentak.

Kelebihan

- Analisis pelbagai jangka masa untuk isyarat yang kukuh

- SMI meningkatkan kegunaan berbanding Stochastic tradisional

- Penyambungan tiga meningkatkan kebolehpercayaan berbanding penunjuk tunggal

- Parameter fleksibel untuk pengoptimuman

- Sesuai untuk perdagangan jangka pendek/frekuensi tinggi

Risiko

- Pelbagai penunjuk mungkin menunjukkan isyarat kelewatan

- Frekuensi perdagangan yang tinggi meningkatkan kos

- Ujian semula pemasangan semula

- Parameter mungkin gagal dengan perubahan rejim pasaran

Pengurangan Risiko:

- Mengoptimumkan parameter untuk mengurangkan lag

- Sesuaikan tempoh penahan untuk mengurangkan kos dagangan

- Melakukan ujian statistik untuk mengesahkan ketahanan

- Sesuaikan parameter secara dinamik

Peningkatan

- Uji kombinasi parameter SMI yang berbeza

- Tambah metrik statistik untuk menilai kestabilan parameter

- Menggabungkan penunjuk sokongan seperti jumlah, Bollinger Bands dan lain-lain

- Peralihan parameter dinamik berdasarkan persekitaran

- Mengoptimumkan strategi stop loss

Kesimpulan

Strategi Momentum Stochastic berlapis tiga menggabungkan penjanaan isyarat yang kukuh merentasi beberapa bingkai masa dengan melapisi tiga penunjuk SMI dengan parameter yang unik. Berbanding dengan osilator tunggal, pendekatan multi-penunjuk ini menapis lebih banyak bunyi bising dan meningkatkan konsistensi. Penyempurnaan lanjut boleh dibuat ke hadapan melalui pengoptimuman parameter, pengesahan statistik, penunjuk tambahan dan lain-lain untuk meningkatkan ketahanan strategi.

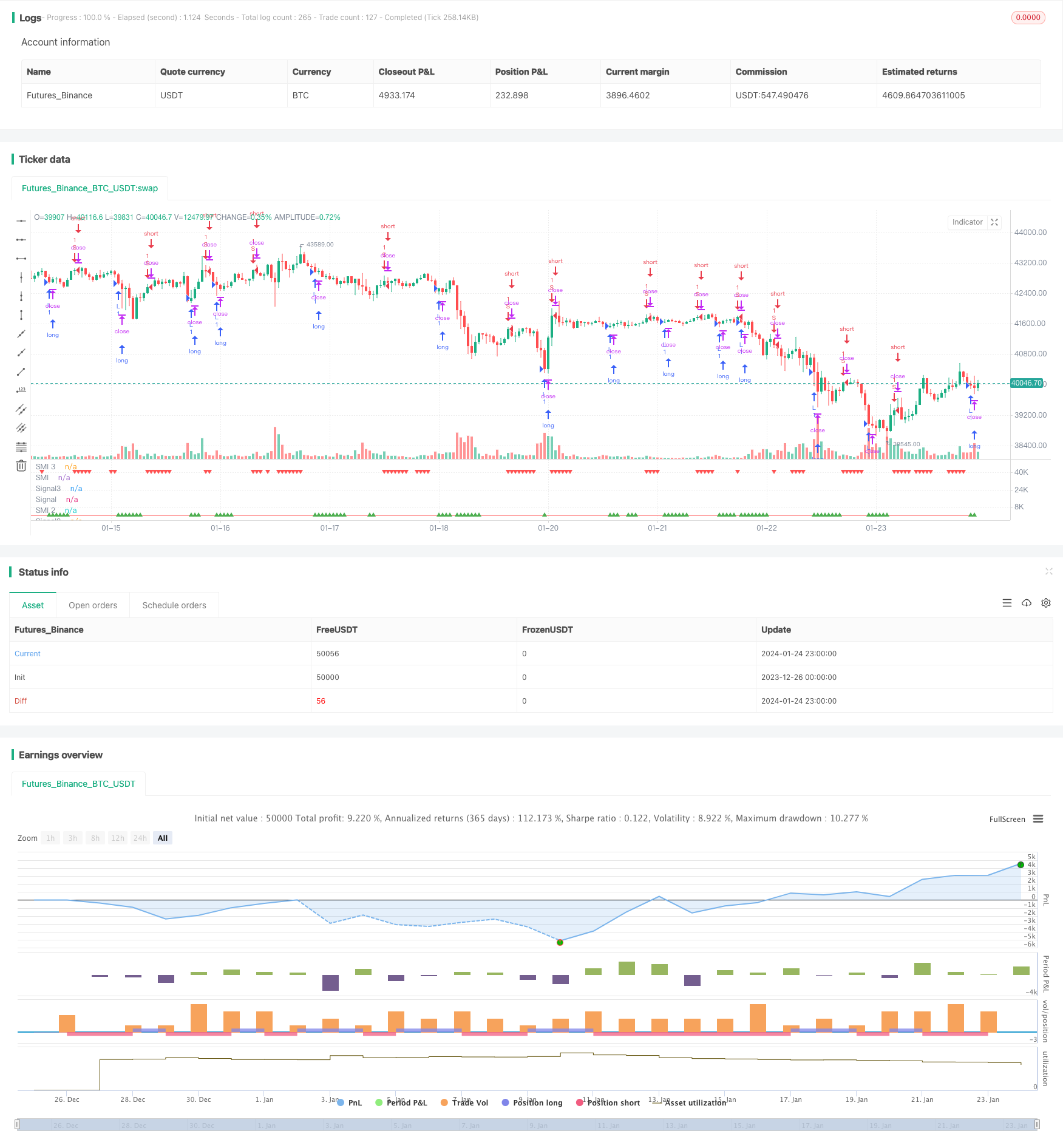

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Stochastic Momentum multi strategy", "Stochastic Momentum Index multi strategy", overlay=false)

q = input(10, title="%K Length")

r = input(3, title="%K Smoothing Length")

s = input(3, title="%K Double Smoothing Length")

nsig = input(10, title="Signal Length")

matype = input("ema", title="Signal MA Type") // possible: ema, sma, wma, trima, hma, dema, tema, zlema

overbought = input(40, title="Overbought Level", type=float)

oversold = input(-40, title="Oversold Level", type=float)

trima(src, length) => sma(sma(src,length),length)

hma(src, length) => wma(2*wma(src, length/2)-wma(src, length), round(sqrt(length)))

dema(src, length) => 2*ema(src,length) - ema(ema(src,length),length)

tema(src, length) => (3*ema(src,length) - 3*ema(ema(src,length),length)) + ema(ema(ema(src,length),length),length)

zlema(src, length) => ema(src,length) + (ema(src,length) - ema(ema(src,length),length))

smi = 100 * ema(ema(close-0.5*(highest(q)+lowest(q)),r),s) / (0.5 * ema(ema(highest(q)-lowest(q),r),s))

sig = matype=="ema" ? ema(smi,nsig) : matype=="sma" ? sma(smi,nsig) : matype=="wma" ? wma(smi,nsig) : matype=="trima" ? trima(smi,nsig) : matype=="hma" ? hma(smi,nsig) : matype=="dema" ? dema(smi,nsig) : matype=="tema" ? tema(smi,nsig) : matype=="zlema" ? zlema(smi,nsig) : ema(smi,nsig)

p_smi = plot(smi, title="SMI", color=aqua)

p_sig = plot(sig, title="Signal", color=red)

// plotchar(crossover(smi, sig), title= "low", location=location.bottom, color=green, char="▲", size= size.tiny)

// plotchar(crossunder(smi, sig), title= "high", location=location.top, color=red, char="▼", size= size.tiny)

/////////////////////////////2

q2 = input(20, title="%K Length 2")

r2 = input(3, title="%K Smoothing Length 2")

s2 = input(3, title="%K Double Smoothing Length 2")

nsig2 = input(10, title="Signal Length 2")

matype2 = input("ema", title="Signal MA Type 2") // possible: ema, sma, wma, trima, hma, dema, tema, zlema

overbought2 = input(40, title="Overbought Level 2", type=float)

oversold2 = input(-40, title="Oversold Level 2", type=float)

trima2(src2, length2) => sma(sma(src2,length2),length2)

hma2(src2, length2) => wma(2*wma(src2, length2/2)-wma(src2, length2), round(sqrt(length2)))

dema2(src2, length2) => 2*ema(src2,length2) - ema(ema(src2,length2),length2)

tema2(src2, length2) => (3*ema(src2,length2) - 3*ema(ema(src2,length2),length2)) + ema(ema(ema(src2,length2),length2),length2)

zlema2(src2, length2) => ema(src2,length2) + (ema(src2,length2) - ema(ema(src2,length2),length2))

smi2 = 100 * ema(ema(close-0.5*(highest(q2)+lowest(q2)),r2),s2) / (0.5 * ema(ema(highest(q2)-lowest(q2),r2),s2))

sig2 = matype2=="ema" ? ema(smi2,nsig2) : matype2=="sma 2" ? sma(smi2,nsig2) : matype2=="wma 2" ? wma(smi2,nsig2) : matype2=="trima 2" ? trima2(smi2,nsig2) : matype2=="hma 2" ? hma2(smi2,nsig2) : matype=="dema 2" ? dema2(smi2,nsig2) : matype2=="tema 2" ? tema2(smi2,nsig2) : matype2=="zlema 2" ? zlema2(smi2,nsig2) : ema(smi2,nsig2)

p_smi2 = plot(smi2, title="SMI 2", color=aqua)

p_sig2 = plot(sig2, title="Signal2", color=red)

// plotchar(crossover(smi2, sig2), title= "low2", location=location.bottom, color=green, char="▲", size= size.tiny)

// plotchar(crossunder(smi2, sig2), title= "high2", location=location.top, color=red, char="▼", size= size.tiny)

/////////////////////////////3

q3 = input(5, title="%K Length 3")

r3 = input(3, title="%K Smoothing Length 3")

s3 = input(3, title="%K Double Smoothing Length 3")

nsig3 = input(10, title="Signal Length 3")

matype3 = input("ema", title="Signal MA Type 3") // possible: ema, sma, wma, trima, hma, dema, tema, zlema

overbought3 = input(40, title="Overbought Level 3", type=float)

oversold3 = input(-40, title="Oversold Level 3", type=float)

trima3(src3, length3) => sma(sma(src3,length3),length3)

hma3(src3, length3) => wma(2*wma(src3, length3/2)-wma(src3, length3), round(sqrt(length3)))

dema3(src3, length3) => 2*ema(src3,length3) - ema(ema(src3,length3),length3)

tema3(src3, length3) => (3*ema(src3,length3) - 3*ema(ema(src3,length3),length3)) + ema(ema(ema(src3,length3),length3),length3)

zlema3(src3, length3) => ema(src3,length3) + (ema(src3,length3) - ema(ema(src3,length3),length3))

smi3 = 100 * ema(ema(close-0.5*(highest(q3)+lowest(q3)),r3),s3) / (0.5 * ema(ema(highest(q3)-lowest(q3),r3),s3))

sig3 = matype3=="ema" ? ema(smi3,nsig3) : matype3=="sma 3" ? sma(smi3,nsig3) : matype3=="wma 3" ? wma(smi3,nsig3) : matype3=="trima 3" ? trima3(smi3,nsig3) : matype3=="hma 3" ? hma3(smi3,nsig3) : matype=="dema 3" ? dema3(smi3,nsig3) : matype3=="tema 3" ? tema3(smi3,nsig3) : matype3=="zlema 3" ? zlema3(smi3,nsig3) : ema(smi3,nsig3)

p_smi3 = plot(smi3, title="SMI 3", color=aqua)

p_sig3 = plot(sig3, title="Signal3", color=red)

// plotchar(crossover(smi3, sig3) and crossover(smi2, sig2) and crossover(smi, sig), title= "low3", location=location.bottom, color=green, char="▲", size= size.tiny)

// plotchar(crossunder(smi3, sig3) and crossunder(smi2, sig2) and crossunder(smi, sig), title= "high3", location=location.top, color=red, char="▼", size= size.tiny)

plotchar (((smi3 < sig3) and (smi2 < sig2) and (smi < sig)), title= "low3", location=location.bottom, color=green, char="▲", size= size.tiny)

plotchar (((smi3 > sig3) and (smi2 > sig2) and (smi > sig)), title= "high3", location=location.top, color=red, char="▼", size= size.tiny)

// === BACKTEST RANGE ===

FromMonth = input(defval = 8, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2014)

ToMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 2018, title = "To Year", minval = 2014)

longCondition = ((smi3 < sig3) and (smi2 < sig2) and (smi < sig))

shortCondition = ((smi3 > sig3) and (smi2 > sig2) and (smi > sig))

// buy = longCondition == 1 and longCondition[1] == 1 ? longCondition : na

buy = longCondition == 1 ? longCondition : na

sell = shortCondition == 1? shortCondition : na

// === ALERTS ===

strategy.entry("L", strategy.long, when=buy)

strategy.entry("S", strategy.short, when=sell)

alertcondition(((smi3 < sig3) and (smi2 < sig2) and (smi < sig)), title='Low Fib.', message='Low Fib. Buy')

alertcondition(((smi3 > sig3) and (smi2 > sig2) and (smi > sig)), title='High Fib.', message='High Fib. Low')

- EMA harga dengan pengoptimuman stokastik berdasarkan pembelajaran mesin

- Strategi Bollinger Breakout Dinamik

- Dua Tahun Baru Tinggi Retracement Moving Average Strategi

- Strategi Dagangan Purata Bergerak Berganda

- Sistem Pengesanan Trend Pengimbangan Kemudahan Dinamik

- Strategi Pembalikan Terbuka Harian

- Golden Cross Strategi Dagangan SMA

- Strategi Purata Bergerak Golden Cross

- Strategi Dagangan Crypto MACD

- Strategi jangka pendek regresi linear dan purata bergerak berganda

- Strategi Trend Momentum

- Strategi kuantum Moving Average Crossover

- Strategi gabungan pembalikan purata bergerak berganda dan ATR Trailing Stop

- Strategi Dagangan Futures Martingale yang dikuasai

- Strategi Pullback Momentum

- Dual Candlestick Prediksi Strategy Penutupan

- Strategi Perdagangan Stop Loss Pengesanan Supertrend Stochastic

- Trend Ganda Peralihan Garis Osilating Mengikuti Strategi

- Trend Mengikut Strategi Berdasarkan DMI dan RSI