PPO Sensitiviti Harga Momentum Strategi Dagangan Arah Double Bottom

Penulis:ChaoZhang, Tarikh: 2024-01-29 11:38:42Tag:

Ringkasan

PPO Sensitivity Momentum Price Double Bottom Directional Trading Strategy adalah strategi perdagangan trend berikut yang menggunakan pengenalan pembentukan harga double bottom oleh penunjuk PPO (Peratusan Osilator Harga) untuk menjana isyarat perdagangan.

Prinsip Strategi

Strategi ini menggunakan penunjuk PPO untuk menentukan ciri-ciri harga bawah berganda, sementara menggabungkan penilaian titik minimum harga untuk memantau pembentukan dasar penunjuk PPO dalam masa nyata.

Sebaliknya, strategi ini bekerjasama dengan penentuan nilai minimum harga untuk memastikan sama ada harga berada pada tahap yang agak rendah.

Melalui pengesahan ciri pembalikan PPO dan mekanisme pengesahan tahap harga berganda, kemungkinan pembalikan harga yang berpotensi dapat dikenal pasti dengan berkesan, menapis isyarat palsu dan meningkatkan kualiti isyarat.

Analisis Kelebihan

-

PPO corak bahagian bawah berganda membolehkan masa yang tepat di titik masuk.

-

Menggabungkan pengesahan tahap harga menapis isyarat palsu yang berlaku pada tahap yang agak tinggi, meningkatkan kualiti isyarat.

-

PPO sensitif dan dengan cepat menangkap perubahan trend harga, sesuai untuk penjejakan trend.

-

Mekanisme pengesahan berganda berkesan mengurangkan risiko perdagangan.

Risiko dan Penyelesaian

-

PPO cenderung menghasilkan isyarat palsu, yang memerlukan pengesahan dari penunjuk lain.

-

Pembalikan bawah berganda mungkin tidak dapat bertahan, menghadapi risiko penurunan lebih lanjut. Stop loss boleh ditetapkan bersama-sama dengan pengoptimuman saiz kedudukan.

-

Konfigurasi parameter yang tidak sesuai membawa kepada keuntungan yang hilang atau entri yang salah. Ujian balik berulang dan pengoptimuman pada kombinasi parameter diperlukan.

-

Terdapat jumlah kod yang besar dengan replikasi. Modularisasi lebih lanjut membantu mengurangkan kod duplikat.

Arahan pengoptimuman

-

Menggabungkan modul stop loss dan mengoptimumkan strategi saiz kedudukan.

-

Memperkenalkan purata bergerak atau penunjuk turun naik sebagai alat pengesahan.

-

Modularisasi kod untuk mengelakkan pertimbangan logik yang berlebihan.

-

Lanjutkan penyesuaian parameter untuk meningkatkan kestabilan.

-

Uji aplikasi perdagangan penyebaran di lebih banyak produk.

Kesimpulan

PPO Price Sensitivity Momentum Double Bottom Directional Trading Strategy merangkumi ciri-ciri PPO indikator

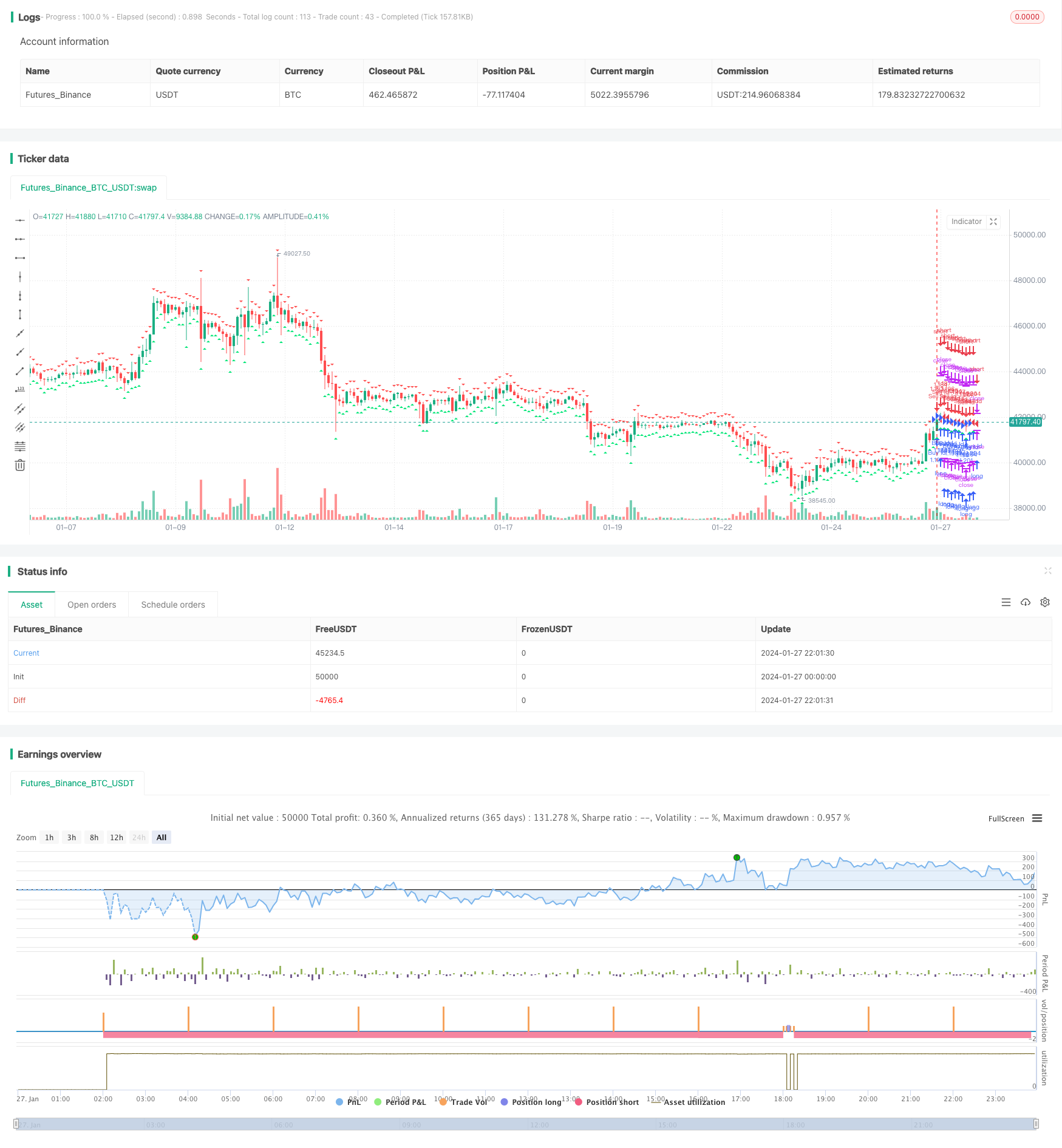

/*backtest

start: 2024-01-27 00:00:00

end: 2024-01-28 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © luciancapdefier

//@version=4

strategy("PPO Divergence ST", overlay=true, initial_capital=30000, calc_on_order_fills=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// time

FromYear = input(2019, "Backtest Start Year")

FromMonth = input(1, "Backtest Start Month")

FromDay = input(1, "Backtest Start Day")

ToYear = input(2999, "Backtest End Year")

ToMonth = input(1, "Backtest End Month")

ToDay = input(1, "Backtest End Day")

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => time >= start and time <= finish ? true : false

source = close

topbots = input(true, title="Show PPO high/low triangles?")

long_term_div = input(true, title="Use long term divergences?")

div_lookback_period = input(55, minval=1, title="Lookback Period")

fastLength = input(12, minval=1, title="PPO Fast")

slowLength=input(26, minval=1, title="PPO Slow")

signalLength=input(9,minval=1, title="PPO Signal")

smoother = input(2,minval=1, title="PPO Smooth")

fastMA = ema(source, fastLength)

slowMA = ema(source, slowLength)

macd = fastMA - slowMA

macd2=(macd/slowMA)*100

d = sma(macd2, smoother) // smoothing PPO

bullishPrice = low

priceMins = bullishPrice > bullishPrice[1] and bullishPrice[1] < bullishPrice[2] or low[1] == low[2] and low[1] < low and low[1] < low[3] or low[1] == low[2] and low[1] == low[3] and low[1] < low and low[1] < low[4] or low[1] == low[2] and low[1] == low[3] and low[1] and low[1] == low[4] and low[1] < low and low[1] < low[5] // this line identifies bottoms and plateaus in the price

oscMins= d > d[1] and d[1] < d[2] // this line identifies bottoms in the PPO

BottomPointsInPPO = oscMins

bearishPrice = high

priceMax = bearishPrice < bearishPrice[1] and bearishPrice[1] > bearishPrice[2] or high[1] == high[2] and high[1] > high and high[1] > high[3] or high[1] == high[2] and high[1] == high[3] and high[1] > high and high[1] > high[4] or high[1] == high[2] and high[1] == high[3] and high[1] and high[1] == high[4] and high[1] > high and high[1] > high[5] // this line identifies tops in the price

oscMax = d < d[1] and d[1] > d[2] // this line identifies tops in the PPO

TopPointsInPPO = oscMax

currenttrough4=valuewhen (oscMins, d[1], 0) // identifies the value of PPO at the most recent BOTTOM in the PPO

lasttrough4=valuewhen (oscMins, d[1], 1) // NOT USED identifies the value of PPO at the second most recent BOTTOM in the PPO

currenttrough5=valuewhen (oscMax, d[1], 0) // identifies the value of PPO at the most recent TOP in the PPO

lasttrough5=valuewhen (oscMax, d[1], 1) // NOT USED identifies the value of PPO at the second most recent TOP in the PPO

currenttrough6=valuewhen (priceMins, low[1], 0) // this line identifies the low (price) at the most recent bottom in the Price

lasttrough6=valuewhen (priceMins, low[1], 1) // NOT USED this line identifies the low (price) at the second most recent bottom in the Price

currenttrough7=valuewhen (priceMax, high[1], 0) // this line identifies the high (price) at the most recent top in the Price

lasttrough7=valuewhen (priceMax, high[1], 1) // NOT USED this line identifies the high (price) at the second most recent top in the Price

delayedlow = priceMins and barssince(oscMins) < 3 ? low[1] : na

delayedhigh = priceMax and barssince(oscMax) < 3 ? high[1] : na

// only take tops/bottoms in price when tops/bottoms are less than 5 bars away

filter = barssince(priceMins) < 5 ? lowest(currenttrough6, 4) : na

filter2 = barssince(priceMax) < 5 ? highest(currenttrough7, 4) : na

//delayedbottom/top when oscillator bottom/top is earlier than price bottom/top

y11 = valuewhen(oscMins, delayedlow, 0)

y12 = valuewhen(oscMax, delayedhigh, 0)

// only take tops/bottoms in price when tops/bottoms are less than 5 bars away, since 2nd most recent top/bottom in osc

y2=valuewhen(oscMax, filter2, 1) // identifies the highest high in the tops of price with 5 bar lookback period SINCE the SECOND most recent top in PPO

y6=valuewhen(oscMins, filter, 1) // identifies the lowest low in the bottoms of price with 5 bar lookback period SINCE the SECOND most recent bottom in PPO

long_term_bull_filt = valuewhen(priceMins, lowest(div_lookback_period), 1)

long_term_bear_filt = valuewhen(priceMax, highest(div_lookback_period), 1)

y3=valuewhen(oscMax, currenttrough5, 0) // identifies the value of PPO in the most recent top of PPO

y4=valuewhen(oscMax, currenttrough5, 1) // identifies the value of PPO in the second most recent top of PPO

y7=valuewhen(oscMins, currenttrough4, 0) // identifies the value of PPO in the most recent bottom of PPO

y8=valuewhen(oscMins, currenttrough4, 1) // identifies the value of PPO in the SECOND most recent bottom of PPO

y9=valuewhen(oscMins, currenttrough6, 0)

y10=valuewhen(oscMax, currenttrough7, 0)

bulldiv= BottomPointsInPPO ? d[1] : na // plots dots at bottoms in the PPO

beardiv= TopPointsInPPO ? d[1]: na // plots dots at tops in the PPO

i = currenttrough5 < highest(d, div_lookback_period) // long term bearish oscilator divergence

i2 = y10 > long_term_bear_filt // long term bearish top divergence

i3 = delayedhigh > long_term_bear_filt // long term bearish delayedhigh divergence

i4 = currenttrough4 > lowest(d, div_lookback_period) // long term bullish osc divergence

i5 = y9 < long_term_bull_filt // long term bullish bottom div

i6 = delayedlow < long_term_bull_filt // long term bullish delayedbottom div

//plot(0, color=gray)

//plot(d, color=black)

//plot(bulldiv, title = "Bottoms", color=maroon, style=circles, linewidth=3, offset= -1)

//plot(beardiv, title = "Tops", color=green, style=circles, linewidth=3, offset= -1)

bearishdiv1 = (y10 > y2 and oscMax and y3 < y4) ? true : false

bearishdiv2 = (delayedhigh > y2 and y3 < y4) ? true : false

bearishdiv3 = (long_term_div and oscMax and i and i2) ? true : false

bearishdiv4 = (long_term_div and i and i3) ? true : false

bullishdiv1 = (y9 < y6 and oscMins and y7 > y8) ? true : false

bullishdiv2 = (delayedlow < y6 and y7 > y8) ? true : false

bullishdiv3 = (long_term_div and oscMins and i4 and i5) ? true : false

bullishdiv4 = (long_term_div and i4 and i6) ? true : false

bearish = bearishdiv1 or bearishdiv2 or bearishdiv3 or bearishdiv4

bullish = bullishdiv1 or bullishdiv2 or bullishdiv3 or bullishdiv4

greendot = beardiv != 0 ? true : false

reddot = bulldiv != 0 ? true : false

if (reddot and window())

strategy.entry("Buy Id", strategy.long, comment="BUY")

if (greendot and window())

strategy.entry("Sell Id", strategy.short, comment="SELL")

alertcondition( bearish, title="Bearish Signal (Orange)", message="Orange & Bearish: Short " )

alertcondition( bullish, title="Bullish Signal (Purple)", message="Purple & Bullish: Long " )

alertcondition( greendot, title="PPO High (Green)", message="Green High Point: Short " )

alertcondition( reddot, title="PPO Low (Red)", message="Red Low Point: Long " )

// plotshape(bearish ? d : na, text='▼\nP', style=shape.labeldown, location=location.abovebar, color=color(orange,0), textcolor=color(white,0), offset=0)

// plotshape(bullish ? d : na, text='P\n▲', style=shape.labelup, location=location.belowbar, color=color(#C752FF,0), textcolor=color(white,0), offset=0)

plotshape(topbots and greendot ? d : na, text='', style=shape.triangledown, location=location.abovebar, color=color.red, offset=0, size=size.tiny)

plotshape(topbots and reddot ? d : na, text='', style=shape.triangleup, location=location.belowbar, color=color.lime, offset=0, size=size.tiny)

//barcolor(bearishdiv1 or bearishdiv2 or bearishdiv3 or bearishdiv4 ? orange : na)

//barcolor(bullishdiv1 or bullishdiv2 or bullishdiv3 or bullishdiv4 ? fuchsia : na)

//barcolor(#dedcdc)

- Strategi Perdagangan Kuantitatif FNGU Berdasarkan Bollinger Bands dan RSI

- Bollinger Bands RSI OBV Strategi

- Strategi P-Signal Reversal

- RSI Alligator Trend Strategi

- Strategi FX harian berdasarkan Purata Bergerak dan Penunjuk Williams

- Strategi Perdagangan Penembusan Saluran Purata Bergerak

- Strategi Stochastic Purata Bergerak Berganda

- Strategi Penembusan Saluran Donchian

- Strategi Pengesanan Trend Purata Bergerak

- Strategi Perdagangan Grid Indikator RSI

- Strategi Scalping dengan Pengesahan Volume dan VWAP

- ADX, MA dan EMA Long Only Trend Tracking Strategy

- Momentum Terobosan Strategi Salib Emas

- Strategi Perlanggaran Tiga Indikator

- Out-of-the-box Strategi Perdagangan Pembelajaran Mesin

- Strategi Perdagangan Crossover Titik Peralihan Purata Bergerak

- Strategi Arbitraj Cross-Cycle Berdasarkan Pelbagai Penunjuk

- Bollinger Band breakout strategi adalah jangka panjang hanya strategi mengejar momentum

- Strategi Perdagangan Kuantitatif Kemenangan yang sempurna berdasarkan Penunjuk BB Berganda dan RSI

- Strategi Stop Loss dan Take Profit berasaskan RSI