Pengoptimuman trend purata bergerak berganda mengikut strategi berdasarkan gabungan penunjuk

Penulis:ChaoZhang, Tarikh: 2024-02-01 15:13:13Tag:

Ringkasan

Strategi ini menghasilkan isyarat perdagangan dengan mengira garis purata bergerak pantas dan perlahan dan menggabungkan penunjuk Parabolic SAR. Ia tergolong dalam strategi berikut trend. Apabila MA pantas melintasi MA perlahan, kedudukan panjang akan dibuka. Apabila MA pantas melintasi di bawah MA perlahan, kedudukan pendek akan dibuka. SAR Parabolic digunakan untuk menapis pecah palsu.

Prinsip Strategi

- Mengira garis purata bergerak pantas dan perlahan. Parameter boleh disesuaikan.

- Bandingkan dua garis MA untuk menentukan trend pasaran. Apabila MA pantas melintasi MA perlahan, ia menunjukkan trend menaik. Apabila MA pantas melintasi di bawah MA perlahan, ia menunjukkan trend menurun.

- Pengesahan lanjut dibuat dengan memeriksa sama ada harga penutupan di atas / di bawah MA pantas. Hanya apabila MA pantas melintasi MA perlahan dan harga penutupan di atas MA pantas, isyarat panjang dihasilkan. Hanya apabila MA pantas melintasi MA perlahan dan harga penutupan di bawah MA pantas, isyarat pendek dihasilkan.

- Parabolik SAR digunakan untuk menapis isyarat palsu. Hanya apabila ketiga-tiga kriteria dipenuhi, isyarat akhir dihasilkan.

- Indikator ATR digunakan untuk mengira harga stop loss dinamik.

Kelebihan

- Garis MA menentukan trend pasaran dan mengelakkan perdagangan berlebihan di pasaran terhad julat.

- Penapis berganda mengurangkan risiko pelarian palsu dengan ketara.

- Strategi Stop Loss secara berkesan mengehadkan kerugian setiap perdagangan.

Risiko

- Strategi penunjuk cenderung menghasilkan isyarat palsu

- Tiada pertimbangan risiko pendedahan mata wang

- Kemungkinan terlepas trend awal ke arah yang bertentangan

Strategi ini boleh dioptimumkan dalam aspek berikut:

- Mengoptimumkan parameter MA untuk menyesuaikan produk tertentu

- Tambah penunjuk atau model lain untuk penapisan isyarat

- Pertimbangkan lindung nilai masa nyata atau penukaran mata wang automatik

Arahan untuk Pengoptimuman

- Mengoptimumkan parameter MA untuk menangkap trend yang lebih baik

- Meningkatkan kepelbagaian model untuk meningkatkan ketepatan isyarat

- Pengesahan pelbagai jangka masa untuk mengelakkan terperangkap

- Meningkatkan strategi stop loss untuk meningkatkan kestabilan

Kesimpulan

Ini adalah trend gabungan purata bergerak silang dan penunjuk dua tipikal yang mengikuti strategi. Dengan membandingkan arah MA yang cepat dan perlahan, trend pasaran ditentukan. Pelbagai penunjuk penapis digunakan untuk mengelakkan isyarat palsu. Pada masa yang sama, fungsi stop loss dilaksanakan untuk mengawal kerugian setiap perdagangan. Kelebihannya adalah bahawa logik strategi adalah mudah dan mudah difahami dan dioptimumkan. Kelemahannya adalah sebagai alat trend kasar, masih ada ruang untuk meningkatkan ketepatan isyarat, dengan memperkenalkan model pembelajaran mesin sebagai contoh.

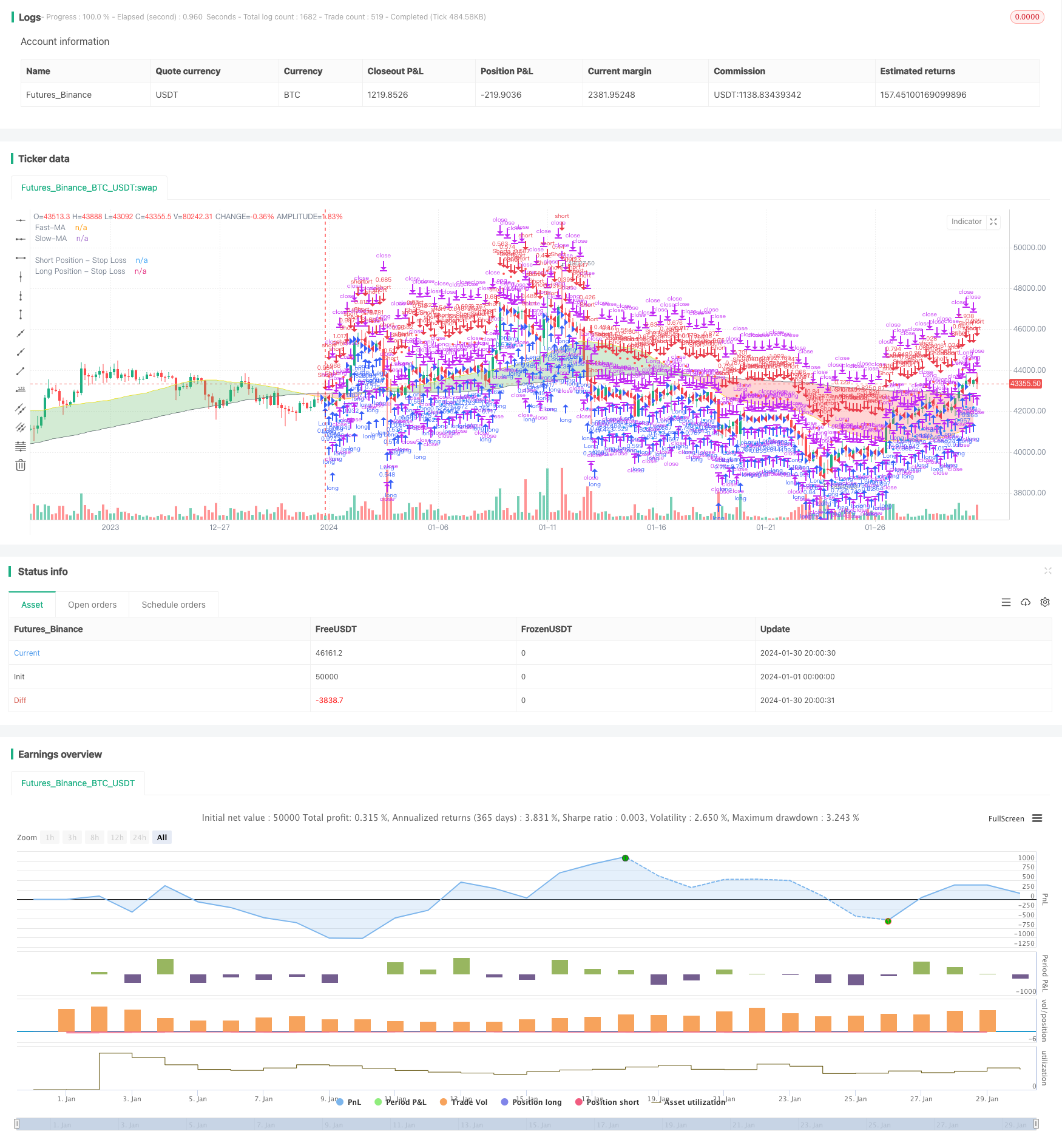

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © sosacur01

//@version=5

strategy(title="2 MA | Trend Following", overlay=true, pyramiding=1, commission_type=strategy.commission.percent, commission_value=0.2, initial_capital=10000)

//==========================================

//BACKTEST RANGE

useDateFilter = input.bool(true, title="Filter Date Range of Backtest",

group="Backtest Time Period")

backtestStartDate = input(timestamp("1 jan 2000"),

title="Start Date", group="Backtest Time Period",

tooltip="This start date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

backtestEndDate = input(timestamp("1 Jul 2100"),

title="End Date", group="Backtest Time Period",

tooltip="This end date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

inTradeWindow = true

if not inTradeWindow and inTradeWindow[1]

strategy.cancel_all()

strategy.close_all(comment="Date Range Exit")

//--------------------------------------

//LONG/SHORT POSITION ON/OFF INPUT

LongPositions = input.bool(title='On/Off Long Postion', defval=true, group="Long & Short Position")

ShortPositions = input.bool(title='On/Off Short Postion', defval=true, group="Long & Short Position")

//---------------------------------------

//SLOW MA INPUTS

averageType1 = input.string(defval="SMA", group="Slow MA Inputs", title="Slow MA Type", options=["SMA", "EMA", "WMA", "HMA", "RMA", "SWMA", "ALMA", "VWMA", "VWAP"])

averageLength1 = input.int(defval=160, group="Slow MA Inputs", title="Slow MA Length", minval=50)

averageSource1 = input(close, title="Slow MA Source", group="Slow MA Inputs")

//SLOW MA TYPE

MovAvgType1(averageType1, averageSource1, averageLength1) =>

switch str.upper(averageType1)

"SMA" => ta.sma(averageSource1, averageLength1)

"EMA" => ta.ema(averageSource1, averageLength1)

"WMA" => ta.wma(averageSource1, averageLength1)

"HMA" => ta.hma(averageSource1, averageLength1)

"RMA" => ta.rma(averageSource1, averageLength1)

"SWMA" => ta.swma(averageSource1)

"ALMA" => ta.alma(averageSource1, averageLength1, 0.85, 6)

"VWMA" => ta.vwma(averageSource1, averageLength1)

"VWAP" => ta.vwap(averageSource1)

=> runtime.error("Moving average type '" + averageType1 +

"' not found!"), na

//----------------------------------

//FAST MA INPUTS

averageType2 = input.string(defval="SMA", group="Fast MA Inputs", title="Fast MA Type", options=["SMA","EMA","WMA","HMA","RMA","SWMA","ALMA","VWMA","VWAP"])

averageLength2 = input.int(defval=40, group="Fast MA Inputs", title="Fast MA Length", maxval=40)

averageSource2 = input(close, title="Fast MA Source", group="Fast MA Inputs")

//FAST MA TYPE

MovAvgType2(averageType2, averageSource2, averageLength2) =>

switch str.upper(averageType2)

"SMA" => ta.sma(averageSource2, averageLength2)

"EMA" => ta.ema(averageSource2, averageLength2)

"WMA" => ta.wma(averageSource2, averageLength2)

"HMA" => ta.hma(averageSource2, averageLength2)

"RMA" => ta.rma(averageSource2, averageLength2)

"SWMA" => ta.swma(averageSource2)

"ALMA" => ta.alma(averageSource2, averageLength2, 0.85, 6)

"VWMA" => ta.vwma(averageSource2, averageLength2)

"VWAP" => ta.vwap(averageSource2)

=> runtime.error("Moving average type '" + averageType2 +

"' not found!"), na

//---------------------------------------------------

//MA VALUES

FASTMA = MovAvgType2(averageType2, averageSource2, averageLength2)

SLOWMA = MovAvgType1(averageType1, averageSource1, averageLength1)

//BUY/SELL TRIGGERS

bullish_trend = FASTMA > SLOWMA and close > FASTMA

bearish_trend = FASTMA < SLOWMA and close < FASTMA

//MAs PLOT

plot1 = plot(SLOWMA,color=color.gray, linewidth=1, title="Slow-MA")

plot2 = plot(FASTMA,color=color.yellow, linewidth=1, title="Fast-MA")

fill(plot1, plot2, color=SLOWMA>FASTMA ? color.new(color.red, 70) : color.new(color.green, 70), title="EMA Clouds")

//-----------------------------------------------------

//PARABOLIC SAR USER INPUT

usepsarFilter = input.bool(title='Use Parabolic Sar?', defval=true, group = "Parabolic SAR Inputs")

psar_display = input.bool(title="Display Parabolic Sar?", defval=false, group="Parabolic SAR Inputs")

start = input.float(title="Start", defval=0.02, group="Parabolic SAR Inputs", step=0.001)

increment = input.float(title="Increment", defval=0.02, group="Parabolic SAR Inputs", step=0.001)

maximum = input.float(title="Maximum", defval=0.2, group="Parabolic SAR Inputs", step=0.001)

//SAR VALUES

psar = request.security(syminfo.tickerid, "D", ta.sar(start, increment, maximum))

//BULLISH & BEARISH PSAR CONDITIONS

bullish_psar = (usepsarFilter ? low > psar : bullish_trend )

bearsish_psar = (usepsarFilter ? high < psar : bearish_trend)

//SAR PLOT

psar_plot = if low > psar

color.rgb(198, 234, 199, 13)

else

color.rgb(219, 134, 134, 48)

plot(psar_display ? psar : na, color=psar_plot, title="Par SAR")

//-------------------------------------

//ENTRIES AND EXITS

long_entry = if inTradeWindow and bullish_trend and bullish_psar and LongPositions

true

long_exit = if inTradeWindow and bearish_trend

true

short_entry = if inTradeWindow and bearish_trend and bearsish_psar and ShortPositions

true

short_exit = if inTradeWindow and bullish_trend

true

//--------------------------------------

//RISK MANAGEMENT - SL, MONEY AT RISK, POSITION SIZING

atrPeriod = input.int(14, "ATR Length", group="Risk Management Inputs")

sl_atr_multiplier = input.float(title="Long Position - Stop Loss - ATR Multiplier", defval=2, group="Risk Management Inputs", step=0.5)

sl_atr_multiplier_short = input.float(title="Short Position - Stop Loss - ATR Multiplier", defval=2, group="Risk Management Inputs", step=0.5)

i_pctStop = input.float(2, title="% of Equity at Risk", step=.5, group="Risk Management Inputs")/100

//ATR VALUE

_atr = ta.atr(atrPeriod)

//CALCULATE LAST ENTRY PRICE

lastEntryPrice = strategy.opentrades.entry_price(strategy.opentrades - 1)

//STOP LOSS - LONG POSITIONS

var float sl = na

//CALCULTE SL WITH ATR AT ENTRY PRICE - LONG POSITION

if (strategy.position_size[1] != strategy.position_size)

sl := lastEntryPrice - (_atr * sl_atr_multiplier)

//IN TRADE - LONG POSITIONS

inTrade = strategy.position_size > 0

//PLOT SL - LONG POSITIONS

plot(inTrade ? sl : na, color=color.blue, style=plot.style_circles, title="Long Position - Stop Loss")

//CALCULATE ORDER SIZE - LONG POSITIONS

positionSize = (strategy.equity * i_pctStop) / (_atr * sl_atr_multiplier)

//============================================================================================

//STOP LOSS - SHORT POSITIONS

var float sl_short = na

//CALCULTE SL WITH ATR AT ENTRY PRICE - SHORT POSITIONS

if (strategy.position_size[1] != strategy.position_size)

sl_short := lastEntryPrice + (_atr * sl_atr_multiplier_short)

//IN TRADE SHORT POSITIONS

inTrade_short = strategy.position_size < 0

//PLOT SL - SHORT POSITIONS

plot(inTrade_short ? sl_short : na, color=color.red, style=plot.style_circles, title="Short Position - Stop Loss")

//CALCULATE ORDER - SHORT POSITIONS

positionSize_short = (strategy.equity * i_pctStop) / (_atr * sl_atr_multiplier_short)

//===============================================

//LONG STRATEGY

strategy.entry("Long", strategy.long, comment="Long", when = long_entry, qty=positionSize)

if (strategy.position_size > 0)

strategy.close("Long", when = (long_exit), comment="Close Long")

strategy.exit("Long", stop = sl, comment="Exit Long")

//SHORT STRATEGY

strategy.entry("Short", strategy.short, comment="Short", when = short_entry, qty=positionSize_short)

if (strategy.position_size < 0)

strategy.close("Short", when = (short_exit), comment="Close Short")

strategy.exit("Short", stop = sl_short, comment="Exit Short")

//ONE DIRECTION TRADING COMMAND (BELLOW ONLY ACTIVATE TO CORRECT BUGS)

- Strategi Dagangan Trend Berdasarkan Indikator MACD

- Strategi Stochastic & Moving Average dengan Penapis Ganda

- Strategi Berasaskan Trend Berasaskan RSI

- Strategi Penembusan Purata Bergerak Satu Titik

- Strategi Crossover Purata Bergerak

- Strategi SuperTrend

- Strategi Stop Loss Bergerak Bersama Tempoh Parabolik dan Bollinger Band

- Strategi Dagangan Berasaskan Harga Purata Bergerak

- Strategi Perdagangan Convergence Arah Momentum Ergotik

- Strategi Perdagangan Purata Bergerak dan Stochastic

- Strategi Perdagangan Kuantiti yang cekap menggabungkan

- Strategy Combinasi Rata-rata Bergerak Berganda dan Penunjuk Williams

- Strategi Garis Perak Terobosan Momentum

- RWI Volatility Contrarian Strategy

- Parabolik SAR Trend Tracking Stop Loss Reversal Strategi

- Strategy Crossover Indikator Momentum

- Strategi Stop Profit dan Stop Loss Ganda Penembusan Osilasi yang cekap

- Strategi Penembusan Saluran Dua

- Strategi Perdagangan Grid Berdasarkan Pengesanan Garis K Masa Nyata

- Strategi Pullback Breakout