Strategi Dagangan Grid Beradaptasi Berdasarkan Platform Dagangan Kuantitatif

Penulis:ChaoZhang, Tarikh: 2024-02-21 10:55:21Tag:

Ringkasan

Strategi ini adalah strategi dagangan grid adaptif berdasarkan platform dagangan kuantitatif. Ia menetapkan julat dagangan grid automatik atau manual dan meletakkan pesanan beli dan jual pada selang masa yang sama dalam julat untuk melaksanakan perdagangan grid. Apabila harga memecahkan had atas atau bawah grid, strategi itu menyesuaikan julat grid secara automatik.

Prinsip Strategi

-

Tetapkan harga had atas dan bawah untuk grid. Mengira harga secara automatik dalam selang tertentu daripada harga sejarah tertinggi dan terendah sebagai had atas dan bawah, atau menetapkan harga had atas dan bawah secara manual.

-

Mengira selang harga untuk setiap grid berdasarkan harga had atas dan bawah dan bilangan grid.

-

Susun beberapa titik beli dan jual pada selang masa yang sama antara harga had atas dan bawah sebagai grid.

-

Apabila harga pasaran menembusi had bawah grid, letakkan pesanan beli di grid seterusnya di bawah grid di mana pesanan yang tidak ditutup terakhir terletak; apabila harga pasaran menembusi had atas grid, letakkan pesanan jual di grid di atas grid di mana pesanan yang tidak ditutup terakhir terletak.

-

Oleh itu, teruskan membeli dan menjual operasi dalam had atas dan bawah grid. Apabila trend harga berbalik, pesanan sebelumnya secara beransur-ansur akan mengambil keuntungan atau menghentikan kerugian.

Analisis Kelebihan

-

Perdagangan grid boleh mendapat keuntungan dalam pasaran terhad dan berayun.

-

Penyesuaian adaptif julat grid boleh menyesuaikan secara automatik berdasarkan turun naik pasaran tanpa campur tangan manual.

-

Jumlah pelaburan modal boleh ditetapkan terlebih dahulu untuk mengalokasikan risiko di seluruh rangkaian.

-

Logiknya mudah dan mudah difahami, dan parameternya fleksibel untuk disesuaikan.

Analisis Risiko

-

Melalui batas atas dan bawah boleh menyebabkan kerugian

- Penyelesaian: Tetapkan kedudukan stop loss dengan munasabah.

-

Tren pasaran boleh membawa kepada kerugian berulang

- Penyelesaian: Mengenal pasti trend dan menghentikan perdagangan tepat pada masanya.

-

Tetapan parameter yang tidak betul

- Penyelesaian: Sesuaikan kuantiti grid dan parameter selang harga.

Arahan pengoptimuman

-

Menggunakan pembelajaran mesin untuk meramalkan julat turun naik harga dan trend untuk menyesuaikan parameter grid secara dinamik.

-

Bertukar ke perdagangan trend di pasaran trend untuk mengelakkan kerugian perdagangan grid.

-

Menggabungkan langkah kawalan risiko berdasarkan kadar penggunaan modal, kadar pulangan dan lain-lain.

-

Memanjangkan pelbagai jenis aset untuk meningkatkan penggunaan modal.

Kesimpulan

Strategi ini adalah strategi grid adaptif dengan parameter yang boleh diselaraskan secara automatik, sesuai untuk saham, mata wang kripto dan produk pertukaran asing dengan pergerakan berfluktuasi dan terikat julat.

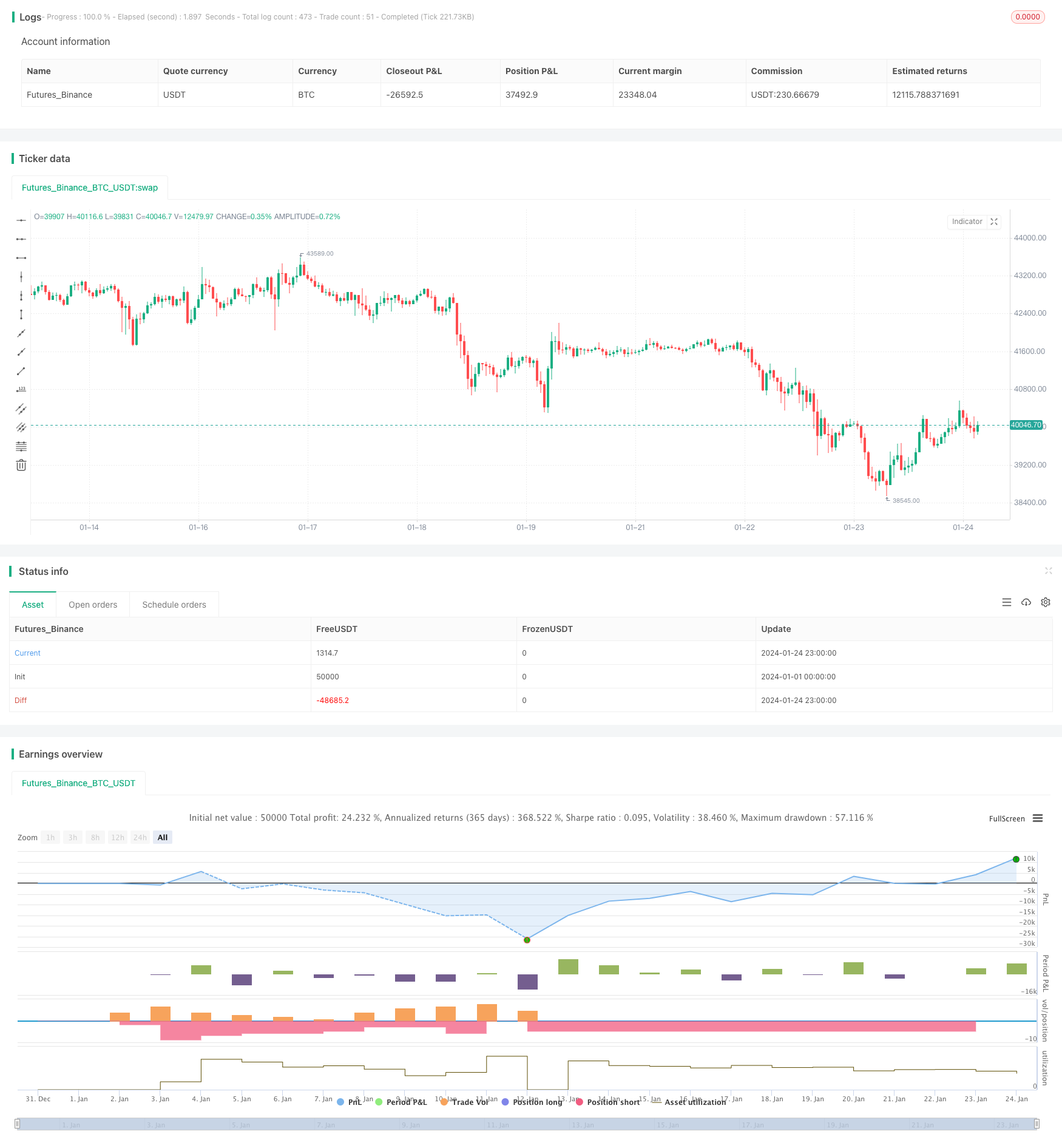

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-24 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//hk4jerry

strategy("Grid Bot Backtesting", overlay=false, pyramiding=3000, close_entries_rule="ANY", default_qty_type=strategy.cash, initial_capital=100.0, currency="USD", commission_type=strategy.commission.percent, commission_value=0.025)

i_autoBounds = input(group="Grid Bounds", title="Use Auto Bounds?", defval=true, type=input.bool) // calculate upper and lower bound of the grid automatically? This will theorhetically be less profitable, but will certainly require less attention

i_boundSrc = input(group="Grid Bounds", title="(Auto) Bound Source", defval="Hi & Low", options=["Hi & Low", "Average"]) // should bounds of the auto grid be calculated from recent High & Low, or from a Simple Moving Average

i_boundLookback = input(group="Grid Bounds", title="(Auto) Bound Lookback", defval=250, type=input.integer, maxval=500, minval=0) // when calculating auto grid bounds, how far back should we look for a High & Low, or what should the length be of our sma

i_boundDev = input(group="Grid Bounds", title="(Auto) Bound Deviation", defval=0.10, type=input.float, maxval=1, minval=-1) // if sourcing auto bounds from High & Low, this percentage will (positive) widen or (negative) narrow the bound limits. If sourcing from Average, this is the deviation (up and down) from the sma, and CANNOT be negative.

i_upperBound = input(group="Grid Bounds", title="(Manual) Upper Boundry(상단 가격)", defval=0.285, type=input.float) // for manual grid bounds only. The upperbound price of your grid

i_lowerBound = input(group="Grid Bounds", title="(Manual) Lower Boundry(하단 가격)", defval=0.225, type=input.float) // for manual grid bounds only. The lowerbound price of your grid.

i_gridQty = input(group="Grid Lines", title="Grid Line Quantity(그리드 수)", defval=30, maxval=999, minval=1, type=input.integer) // how many grid lines are in your grid

initial_balance = input(group="Trading option", title="Initial balance(투자금액)", defval=100, step=0.01)

start_time = input(group="Trading option",defval=timestamp('15 March 2023 06:00'), title='Start Time', type = input.time)

end_time = input(group="Trading option",defval=timestamp('31 Dec 2035 20:00'), title='End Time', type = input.time)

isAfterStartDate = true

tradingtime= (timenow - start_time)/(86400000*30)

yeartime=tradingtime/12

f_getGridBounds(_bs, _bl, _bd, _up) =>

if _bs == "Hi & Low"

_up ? highest(close, _bl) * (1 + _bd) : lowest(close, _bl) * (1 - _bd)

else

avg = sma(close, _bl)

_up ? avg * (1 + _bd) : avg * (1 - _bd)

f_buildGrid(_lb, _gw, _gq) =>

gridArr = array.new_float(0)

for i=0 to _gq-1

array.push(gridArr, _lb+(_gw*i))

gridArr

f_getNearGridLines(_gridArr, _price) =>

arr = array.new_int(3)

for i = 0 to array.size(_gridArr)-1

if array.get(_gridArr, i) > _price

array.set(arr, 0, i == array.size(_gridArr)-1 ? i : i+1)

array.set(arr, 1, i == 0 ? i : i-1)

break

arr

var upperBound = i_autoBounds ? f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, true) : i_upperBound // upperbound of our grid

var lowerBound = i_autoBounds ? f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, false) : i_lowerBound // lowerbound of our grid

var gridWidth = (upperBound - lowerBound)/(i_gridQty-1) // space between lines in our grid

var gridLineArr = f_buildGrid(lowerBound, gridWidth, i_gridQty) // an array of prices that correspond to our grid lines

var orderArr = array.new_bool(i_gridQty, false) // a boolean array that indicates if there is an open order corresponding to each grid line

var closeLineArr = f_getNearGridLines(gridLineArr, close) // for plotting purposes - an array of 2 indices that correspond to grid lines near price

var nearTopGridLine = array.get(closeLineArr, 0) // for plotting purposes - the index (in our grid line array) of the closest grid line above current price

var nearBotGridLine = array.get(closeLineArr, 1) // for plotting purposes - the index (in our grid line array) of the closest grid line below current price

if isAfterStartDate

for i = 0 to (array.size(gridLineArr) - 1)

if close < array.get(gridLineArr, i) and not array.get(orderArr, i) and i < (array.size(gridLineArr) - 1)

buyId = i

array.set(orderArr, buyId, true)

strategy.entry(id=tostring(buyId), long=true, qty=(initial_balance/(i_gridQty-1))/close, comment="#"+tostring(buyId))

if close > array.get(gridLineArr, i) and i != 0

if array.get(orderArr, i-1)

sellId = i-1

array.set(orderArr, sellId, false)

strategy.close(id=tostring(sellId), comment="#"+tostring(sellId))

if i_autoBounds

upperBound := f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, true)

lowerBound := f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, false)

gridWidth := (upperBound - lowerBound)/(i_gridQty-1)

gridLineArr := f_buildGrid(lowerBound, gridWidth, i_gridQty)

closeLineArr := f_getNearGridLines(gridLineArr, close)

nearTopGridLine := array.get(closeLineArr, 0)

nearBotGridLine := array.get(closeLineArr, 1)

var table table = table.new(position.top_right,6,8, frame_color = color.rgb(255, 255, 255),frame_width = 2,border_width = 2, border_color=color.rgb(255, 255, 255))

//제목

table.cell(table,0,0,"상단 라인 :", bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,0,1,"하단 라인 :",bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,0,2,"그리드 수 :",bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,0,3,"투자금액 :",text_color =color.white,bgcolor=color.new(color.black,0))

table.cell(table,0,4,"그리드당 투자금액 :",text_color =color.white,bgcolor=color.new(color.black,0))

//수치

table.cell(table,1,0, tostring(upperBound, '###.#####')+ " USDT", bgcolor=color.new(#5a637e, 0),text_color =color.white)

table.cell(table,1,1, tostring(lowerBound, '###.#####')+ " USDT", bgcolor=color.new(#5a637e, 0),text_color =color.white)

table.cell(table,1,2, tostring(i_gridQty, '###'), bgcolor=color.new(#5a637e, 0),text_color =color.white)

table.cell(table,1,3, tostring(initial_balance,'###.##')+ " USDT", bgcolor=color.new(#5a637e, 0),text_color =color.white)

table.cell(table,1,4, tostring(initial_balance/i_gridQty,'###.##')+ " USDT", bgcolor=color.new(#5a637e, 0),text_color =color.white)

//제목

table.cell(table,2,0,"현재 포지션 :",text_color =color.white,bgcolor=color.new(color.black,0))

table.cell(table,2,1,"현재 포지션 평단가 :",text_color =color.white,bgcolor=color.new(color.black,0))

table.cell(table,2,2,"현재 포지션 수익 :",bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,2,3,"현재 포지션 수익 % :",bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,2,4,"현재 포지션 수수료 :",text_color =color.white,bgcolor=color.new(color.black,0))

//수치

table.cell(table,3,0, tostring(strategy.position_size) + syminfo.basecurrency + "\n" + tostring(strategy.position_size*strategy.position_avg_price/1, '###.##') + "USDT" ,text_color =color.white,bgcolor=color.new(#5a637e, 0))

table.cell(table,3,1, text=strategy.position_size>0 ? tostring(strategy.position_avg_price,'###.####')+ " USDT" : "NOT TRADING",text_color =color.white,bgcolor=color.new(#5a637e, 0))

table.cell(table,3,2, tostring(strategy.openprofit, '###.##')+ " USDT",text_color =color.white,bgcolor=strategy.openprofit > 0 ? color.teal : color.maroon)

table.cell(table,3,3, tostring(strategy.openprofit/initial_balance*100, '###.##')+ "%",text_color =color.white,bgcolor=strategy.openprofit > 0 ? color.teal : color.maroon)

table.cell(table,3,4, "-" + tostring(strategy.position_avg_price*strategy.position_size*0.025/100,'###.##')+ " USDT",text_color =color.white,bgcolor=color.new(#5a637e, 0))

//제목

table.cell(table,4,0,"그리드 수익 :",text_color =color.white,bgcolor=color.new(color.black,0))

table.cell(table,4,1,"그리드 수익률 :",text_color =color.white,bgcolor=color.new(color.black,0))

table.cell(table,4,2,"총 수익 :", bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,4,3,"총 수익률 :",bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,4,4,"현재 자산 :",bgcolor=color.new(color.black,0),text_color =color.white)

//수치

table.cell(table,5,0, tostring(strategy.netprofit, '###.#####')+ "USDT", text_color =color.white,bgcolor=strategy.netprofit > 0 ? color.teal : color.maroon)

table.cell(table,5,1, tostring((strategy.netprofit)/initial_balance*100/tradingtime, '####.##') + "%",text_color =color.white,bgcolor=strategy.netprofit > 0 ? color.teal : color.maroon)

table.cell(table,5,2, tostring(strategy.netprofit+strategy.openprofit, '###.##') + " USDT",text_color =color.white,bgcolor=strategy.netprofit+strategy.openprofit > 0 ? color.teal : color.maroon)

table.cell(table,5,3, tostring((strategy.netprofit+strategy.openprofit)/initial_balance*100, '####.##') + "%",text_color =color.white,bgcolor=strategy.netprofit+strategy.openprofit > 0 ? color.teal : color.maroon)

table.cell(table,5,4, tostring(initial_balance+strategy.netprofit+strategy.openprofit, '###.##')+ " USDT", text_color =color.white,bgcolor=color.new(#3d4d7c, 0))

// plot(strategy.initial_capital+ strategy.netprofit+strategy.openprofit, "총 수익 USDT",color=color.rgb(81, 137, 128))

// plot(initial_balance, "투자금액",color=color.rgb(81, 137, 128))

- Strategi Perdagangan Kuantum Berbilang Penunjuk

- TradingVMA

Strategi Dagangan Purata Bergerak Berubah - Strategi Perbezaan RSI

- Dual Donchian Channel Breakout Strategy

- Strategi Perdagangan Breakout Bollinger Bands

- Strategi perangkap terobosan EMA

- Strategi Perdagangan Golden Cross Dead Cross

- Strategi Pengesanan Trend Multitimeframe Berasaskan Supertrend

- Manual Beli & Jual Isyarat Strategi

- Strategi Rujukan Rujukan Kuantitatif

- Strategi Dagangan Kuantitatif Berdasarkan Awan Ichimoku dan Purata Bergerak

- Strategi Pengesanan Pembalikan Purata Bergerak Berganda

- Strategi pembalikan Bollinger Bands

- Ichimoku Kinko Hyo Cloud + QQE Strategi Kuantitatif

- Semua Tentang Strategi Dagangan Momentum dengan Stop Loss untuk Emas

- Parabola Oscillator Mencari Strategi Tinggi dan Rendah

- Strategi Penembusan Bollinger Bands

- Strategy Gap Nilai Adil Terobosan

- Adaptive Moving Average Crossover System dengan Penembusan Momentum

- Strategi Dagangan Berdasarkan Corak Puncak ke Puncak