Strategi pemecahan momentum berdasarkan blok pesanan

Gambaran keseluruhan

Strategi ini mencari julat harga yang mempunyai momentum terobosan dengan mengenal pasti blok pesanan dalam harga, dan memasuki pasaran apabila isyarat membeli dan menjual muncul. Blok pesanan menandakan kawasan di mana institusi terlibat, yang merupakan perwujudan kekuatan pasaran yang lebih besar. Oleh itu, apabila isyarat blok pesanan muncul, terdapat kemungkinan yang lebih tinggi untuk perubahan harga yang cenderung.

Prinsip Strategi

Pengenalan blok pesanan

Blok pesanan dibahagikan kepada dua jenis: Blok pesanan bermulut dan Blok pesanan kosong. Blok pesanan bermulut ditakrifkan sebagai satu baris ke bawah K ((garis K merah) diikuti oleh baris ke atas K ((garis K hijau). Blok pesanan kosong ditakrifkan sebagai satu baris ke atas K ((garis K hijau) diikuti oleh baris ke bawah K (garis K merah).

Untuk mengenal pasti blok pesanan, beberapa syarat perlu dipenuhi:

Warna K-Line Berubah: Warna K-Line Berubah dari K-Line terdahulu ke K-Line semasa (contohnya, dari merah menjadi hijau, atau dari hijau menjadi merah). Ini menunjukkan bahawa mungkin ada trend sebelum institusi berakhir, bersedia untuk memulakan trend baru.

Baris K berturut-turut mempunyai arah warna yang sama: selepas mencapai akar yang ditentukan oleh parameter period, baris K berturut-turut mengekalkan arah warna yang sama ((contohnya, semua baris K hijau di belakang blok pesanan berbilang kepala)). Ini menunjukkan bahawa trend baru diperkukuhkan dan disahkan.

Penurunan melebihi had: Penurunan daripada harga pembukaan blok pesanan ke harga penutupan K baris seterusnya melebihi parameter yang ditetapkan sebagai threshold (default 0). Ini memastikan bahawa trend baru mempunyai kekuatan dan pengaruh yang mencukupi.

Apabila ketiga-tiga syarat di atas dipenuhi secara serentak, isyarat blok pesanan dapat diiktiraf.

Penciptaan isyarat dagangan

Apabila mengenal pasti blok pesanan berbilang, menghasilkan isyarat beli; apabila mengenal pasti blok pesanan kosong, menghasilkan isyarat jual.

Memandangkan ketidakpastian isyarat blok pesanan dan kemungkinan ujian semula, strategi tidak masuk ke pasaran secara langsung apabila isyarat blok pesanan muncul, tetapi mengingatkan peniaga dengan cara melukis garis, memberi amaran dan sebagainya. Pedagang boleh memilih untuk mengerahkan harga had dengan betul di sekitar kawasan harga blok pesanan dan menunggu harga untuk memasuki trend setelah ia mencetuskan.

Kelebihan Strategik

Menggunakan maklumat aliran pesanan untuk mengenal pasti jumlah

Blok pesanan menandakan penyertaan dana institusi dan jumlah transaksi yang besar, yang mewakili peralihan kekuatan pasaran. Oleh itu, isyarat blok pesanan mempunyai jangkaan dan ketepatan tertentu, yang dapat menangkap arah terobosan yang berpotensi terlebih dahulu. Ini memberikan kedudukan dan masa yang baik untuk menaiki trend.

Parameter dasar boleh disesuaikan

Parameter strategi termasuk jumlah garis K sejarah, amplitud pergerakan terobosan dan lain-lain boleh disesuaikan melalui parameter, sehingga dapat dioptimumkan untuk persekitaran pasaran dan gaya peniaga yang berbeza, meningkatkan kemampuan strategi.

Risiko yang boleh dikawal

Strategi ini tidak akan memasuki pasaran apabila isyarat blok pesanan muncul, tetapi akan memberi amaran dan membina kedudukan dengan cara mengeluarkan harga terhad. Dengan cara ini, peniaga dapat mengawal titik masuk dan risiko tertentu. Walaupun isyarat blok pesanan membuat kesalahan, ia hanya akan menyebabkan harga terhad tidak tercetus, risiko dapat dikawal.

Risiko Strategik

Sinyal blok pesanan lebih berkemungkinan diuji semula

Oleh kerana blok pesanan menandakan satu kawasan, kemungkinan harga seterusnya akan kembali ke kawasan itu. Oleh itu, isyarat blok pesanan tidak boleh dianggap sebagai isyarat masuk standard, tetapi digunakan sebagai maklumat peringatan, yang memerlukan peniaga sendiri untuk menilai masa masuknya.

Tetapan parameter yang tidak betul mudah menyebabkan isyarat yang salah

Tetapan parameter blok pesanan (bilangan garisan K sejarah, nilai terhad amplitudo, dan lain-lain) jika tidak betul, mudah menghasilkan isyarat palsu dalam julat Sideways yang normal. Ini memerlukan pedagang mempunyai sensitiviti dan kehakiman tertentu terhadap pasaran, untuk mengelakkan optimasi parameter secara buta.

Ia perlu diukur secara manual untuk menilai kualiti setiap isyarat.

Oleh kerana isyarat blok pesanan tidak 100 peratus boleh dipercayai, peniaga perlu menganalisis lebih lanjut untuk menilai kebolehpercayaan isyarat semasa ketika mendapatkan isyarat, yang meningkatkan jumlah kerja tangan tertentu. Keputusan yang berbeza mengenai kualiti isyarat juga boleh menyebabkan perbezaan dalam prestasi perdagangan.

Arah pengoptimuman strategi

Menapis isyarat palsu dalam kombinasi dengan petunjuk lain

Apabila isyarat blok pesanan muncul, arah dan kekuatan trend boleh dinilai dengan gabungan indikator lain, seperti gabungan MACD, RSI, dan lain-lain, menapis isyarat salah yang disebabkan oleh tetapan parameter, meningkatkan ketepatan isyarat.

Tetapan parameter optimum

Pelbagai pasaran dan pelbagai jenis perdagangan boleh menguji dan mengoptimumkan parameter, seperti bilangan K-line, nilai penurunan dan penurunan, dan sebagainya, agar lebih sesuai dengan keadaan pasaran semasa. Anda juga boleh menetapkan fungsi penyesuaian sendiri parameter, menyesuaikan secara automatik mengikut turun naik pasaran dan pilihan risiko.

Membangunkan mekanisme kemasukan dan keluar automatik

Strategi ini hanya sebagai alat isyarat isyarat, pedagang perlu menentukan sendiri masa masuk. Kita boleh membangunkan mekanisme pesanan automatik untuk julat harga blok pesanan, masuk secara automatik apabila syarat tertentu dipenuhi; dan menggabungkan kaedah seperti berhenti kehilangan untuk menetapkan logik keluar, mengurangkan keperluan untuk penilaian buatan manusia, meningkatkan tahap automasi strategi.

ringkaskan

Strategi ini memberikan kedudukan yang baik dan peluang untuk mengambil peluang untuk menaiki harga yang sedang tren. Strategi blok pesanan mempunyai keupayaan pengenalan kepala dan inisiatif berbanding dengan kaedah yang hanya mengikuti trend. Apabila digunakan dengan pengoptimuman parameter dan kaedah kawalan angin, ia boleh menjadi strategi trend yang berkesan. Tetapi peniaga perlu berjaga-jaga terhadap penjanaan isyarat yang salah dan membuat penilaian setiap kali mengenai kualiti isyarat.

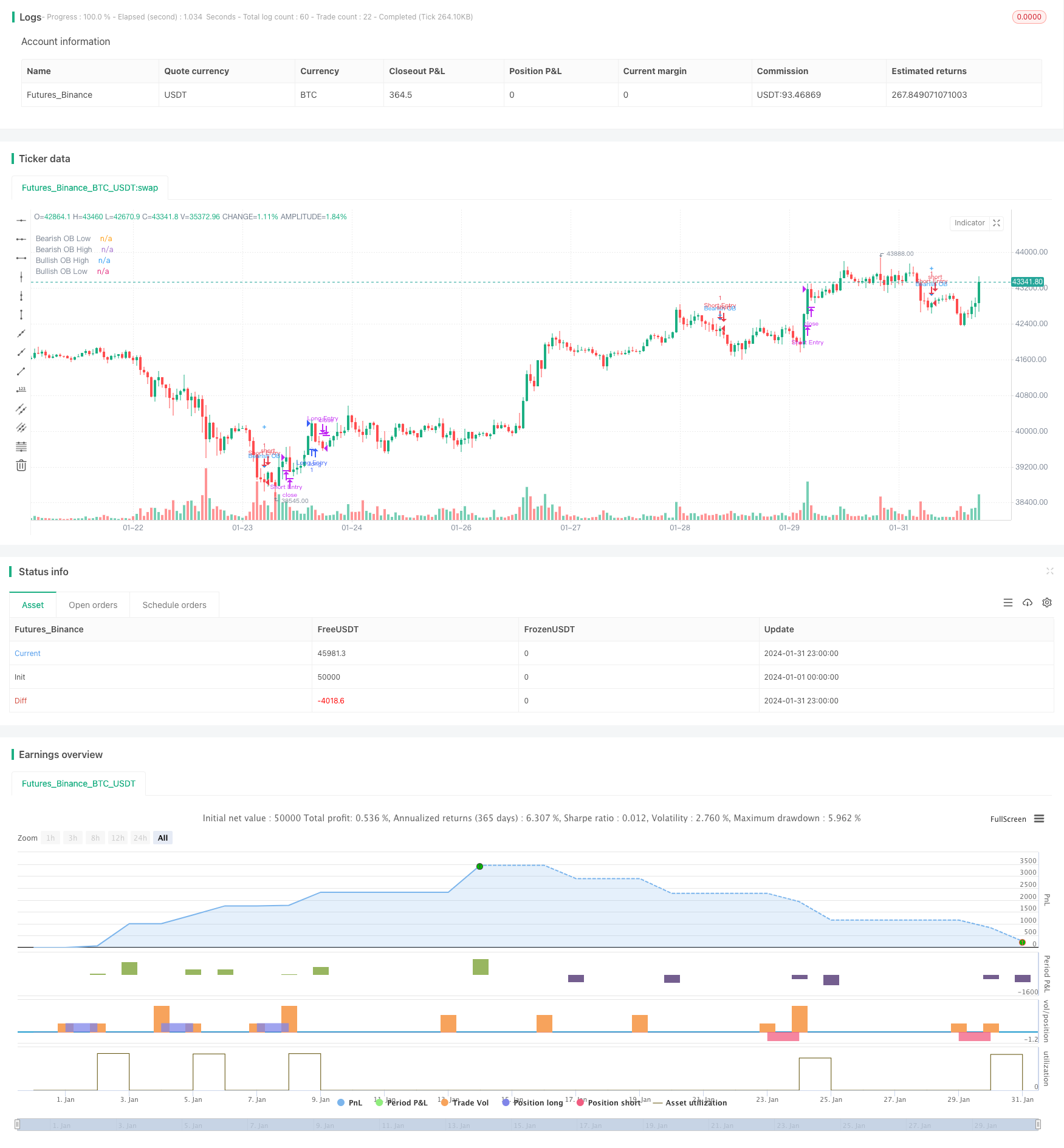

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © TradingSecrets and wugamlo

// This experimental Indicator helps identifying instituational Order Blocks.

// Often these blocks signal the beginning of a strong move, but there is a significant probability that these price levels will be revisited at a later point in time again.

// Therefore these are interesting levels to place limit orders (Buy Orders for Bullish OB / Sell Orders for Bearish OB).

//

// A Bullish Order block is defined as the last down candle before a sequence of up candles. (Relevant price range "Open" to "Low" is marked) / Optionally full range "High" to "Low"

// A Bearish Order Block is defined as the last up candle before a sequence of down candles. (Relevant price range "Open" to "High" is marked) / Optionally full range "High" to "Low"

//

// In the settings the number of required sequential candles can be adjusted.

// Furthermore a %-threshold can be entered. It defines which %-change the sequential move needs to achieve in order to identify a relevant Order Block.

// Channels for the last Bullish/Bearish Block can be shown/hidden.

//

// In addition to the upper/lower limits of each Order Block, also the equlibrium (average value) is marked as this is an interesting area for price interaction.

//

// Alerts added: Alerts fire when an Order Block is detected. The delay is based on the "Relevant Periods" input. Means with the default setting "5" the alert will trigger after the

// number of consecutive candles is reached.

//@version=4

strategy("[Backtest] Order Block Finder", overlay = true)

colors = input(title = "Color Scheme", defval="DARK", options=["DARK", "BRIGHT"])

periods = input(5, "Relevant Periods to identify OB") // Required number of subsequent candles in the same direction to identify Order Block

threshold = input(0.0, "Min. Percent move to identify OB", step = 0.1) // Required minimum % move (from potential OB close to last subsequent candle to identify Order Block)

usewicks = input(false, "Use whole range [High/Low] for OB marking?" ) // Display High/Low range for each OB instead of Open/Low for Bullish / Open/High for Bearish

showbull = input(false, "Show latest Bullish Channel?") // Show Channel for latest Bullish OB?

showbear = input(false, "Show latest Bearish Channel?") // Show Channel for latest Bearish OB?

showdocu = input(false, "Show Label for documentation tooltip?") // Show Label which shows documentation as tooltip?

info_pan = input(false, "Show Latest OB Panel?") // Show Info Panel with latest OB Stats

//strategy inputs

plot_offset = input( type=input.bool,defval = false, title = 'Plot Offset?')

stoploss_percent = input(type=input.float, defval = 1, title = 'Stop Loss [%]')

takeprofit_percent = input(type=input.float, defval = 2, title = 'Take Profit [%]')

pyramiding = input( type=input.bool,defval = true, title = 'Pyramiding')

ob_period = periods + 1 // Identify location of relevant Order Block candle

absmove = ((abs(close[ob_period] - close[1]))/close[ob_period]) * 100 // Calculate absolute percent move from potential OB to last candle of subsequent candles

relmove = absmove >= threshold // Identify "Relevant move" by comparing the absolute move to the threshold

// Color Scheme

bullcolor = colors == "DARK"? color.white : color.green

bearcolor = colors == "DARK"? color.blue : color.red

// Bullish Order Block Identification

bullishOB = close[ob_period] < open[ob_period] // Determine potential Bullish OB candle (red candle)

int upcandles = 0

for i = 1 to periods

upcandles := upcandles + (close[i] > open[i]? 1 : 0) // Determine color of subsequent candles (must all be green to identify a valid Bearish OB)

OB_bull = bullishOB and (upcandles == (periods)) and relmove // Identification logic (red OB candle & subsequent green candles)

OB_bull_high = OB_bull? usewicks? high[ob_period] : open[ob_period] : na // Determine OB upper limit (Open or High depending on input)

OB_bull_low = OB_bull? low[ob_period] : na // Determine OB lower limit (Low)

OB_bull_avg = (OB_bull_high + OB_bull_low)/2 // Determine OB middle line

// Bearish Order Block Identification

bearishOB = close[ob_period] > open[ob_period] // Determine potential Bearish OB candle (green candle)

int downcandles = 0

for i = 1 to periods

downcandles := downcandles + (close[i] < open[i]? 1 : 0) // Determine color of subsequent candles (must all be red to identify a valid Bearish OB)

OB_bear = bearishOB and (downcandles == (periods)) and relmove // Identification logic (green OB candle & subsequent green candles)

OB_bear_high = OB_bear? high[ob_period] : na // Determine OB upper limit (High)

OB_bear_low = OB_bear? usewicks? low[ob_period] : open[ob_period] : na // Determine OB lower limit (Open or Low depending on input)

OB_bear_avg = (OB_bear_low + OB_bear_high)/2 // Determine OB middle line

//@TradingSecrets: Option to disable the offset in order to allign signals with Backtest

if not plot_offset

ob_period := 0

// Plotting

plotshape(OB_bull, title="Bullish OB", style = shape.triangleup, color = bullcolor, textcolor = bullcolor, size = size.tiny, location = location.belowbar, offset = -ob_period, text = "Bullish OB") // Bullish OB Indicator

bull1 = plot(OB_bull_high, title="Bullish OB High", style = plot.style_linebr, color = bullcolor, offset = -ob_period, linewidth = 3) // Bullish OB Upper Limit

bull2 = plot(OB_bull_low, title="Bullish OB Low", style = plot.style_linebr, color = bullcolor, offset = -ob_period, linewidth = 3) // Bullish OB Lower Limit

fill(bull1, bull2, color=bullcolor, transp = 0, title = "Bullish OB fill") // Fill Bullish OB

plotshape(OB_bull_avg, title="Bullish OB Average", style = shape.cross, color = bullcolor, size = size.normal, location = location.absolute, offset = -ob_period) // Bullish OB Average

plotshape(OB_bear, title="Bearish OB", style = shape.triangledown, color = bearcolor, textcolor = bearcolor, size = size.tiny, location = location.abovebar, offset = -ob_period, text = "Bearish OB") // Bearish OB Indicator

bear1 = plot(OB_bear_low, title="Bearish OB Low", style = plot.style_linebr, color = bearcolor, offset = -ob_period, linewidth = 3) // Bearish OB Lower Limit

bear2 = plot(OB_bear_high, title="Bearish OB High", style = plot.style_linebr, color = bearcolor, offset = -ob_period, linewidth = 3) // Bearish OB Upper Limit

fill(bear1, bear2, color=bearcolor, transp = 0, title = "Bearish OB fill") // Fill Bearish OB

plotshape(OB_bear_avg, title="Bearish OB Average", style = shape.cross, color = bearcolor, size = size.normal, location = location.absolute, offset = -ob_period) // Bullish OB Average

var line linebull1 = na // Bullish OB average

var line linebull2 = na // Bullish OB open

var line linebull3 = na // Bullish OB low

var line linebear1 = na // Bearish OB average

var line linebear2 = na // Bearish OB high

var line linebear3 = na // Bearish OB open

if OB_bull and showbull

line.delete(linebull1)

linebull1 := line.new(x1 = bar_index, y1 = OB_bull_avg, x2 = bar_index - 1, y2 = OB_bull_avg, extend = extend.left, color = bullcolor, style = line.style_solid, width = 1)

line.delete(linebull2)

linebull2 := line.new(x1 = bar_index, y1 = OB_bull_high, x2 = bar_index - 1, y2 = OB_bull_high, extend = extend.left, color = bullcolor, style = line.style_dashed, width = 1)

line.delete(linebull3)

linebull3 := line.new(x1 = bar_index, y1 = OB_bull_low, x2 = bar_index - 1, y2 = OB_bull_low, extend = extend.left, color = bullcolor, style = line.style_dashed, width = 1)

if OB_bear and showbear

line.delete(linebear1)

linebear1 := line.new(x1 = bar_index, y1 = OB_bear_avg, x2 = bar_index - 1, y2 = OB_bear_avg, extend = extend.left, color = bearcolor, style = line.style_solid, width = 1)

line.delete(linebear2)

linebear2 := line.new(x1 = bar_index, y1 = OB_bear_high, x2 = bar_index - 1, y2 = OB_bear_high, extend = extend.left, color = bearcolor, style = line.style_dashed, width = 1)

line.delete(linebear3)

linebear3 := line.new(x1 = bar_index, y1 = OB_bear_low, x2 = bar_index - 1, y2 = OB_bear_low, extend = extend.left, color = bearcolor, style = line.style_dashed, width = 1)

// Alerts for Order Blocks Detection

alertcondition(OB_bull, title='New Bullish OB detected', message='New Bullish OB detected - This is NOT a BUY signal!')

alertcondition(OB_bear, title='New Bearish OB detected', message='New Bearish OB detected - This is NOT a SELL signal!')

// Print latest Order Blocks in Data Window

var latest_bull_high = 0.0 // Variable to keep latest Bull OB high

var latest_bull_avg = 0.0 // Variable to keep latest Bull OB average

var latest_bull_low = 0.0 // Variable to keep latest Bull OB low

var latest_bear_high = 0.0 // Variable to keep latest Bear OB high

var latest_bear_avg = 0.0 // Variable to keep latest Bear OB average

var latest_bear_low = 0.0 // Variable to keep latest Bear OB low

// Assign latest values to variables

if OB_bull_high > 0

latest_bull_high := OB_bull_high

if OB_bull_avg > 0

latest_bull_avg := OB_bull_avg

if OB_bull_low > 0

latest_bull_low := OB_bull_low

if OB_bear_high > 0

latest_bear_high := OB_bear_high

if OB_bear_avg > 0

latest_bear_avg := OB_bear_avg

if OB_bear_low > 0

latest_bear_low := OB_bear_low

// Plot invisible characters to be able to show the values in the Data Window

plotchar(latest_bull_high, char = ' ', location = location.abovebar, color = #777777, transp = 100, size = size.tiny, title = "Latest Bull High")

plotchar(latest_bull_avg, char = ' ', location = location.abovebar, color = #777777, transp = 100, size = size.tiny, title = "Latest Bull Avg")

plotchar(latest_bull_low, char = ' ', location = location.abovebar, color = #777777, transp = 100, size = size.tiny, title = "Latest Bull Low")

plotchar(latest_bear_high, char = ' ', location = location.abovebar, color = #777777, transp = 100, size = size.tiny, title = "Latest Bear High")

plotchar(latest_bear_avg, char = ' ', location = location.abovebar, color = #777777, transp = 100, size = size.tiny, title = "Latest Bear Avg")

plotchar(latest_bear_low, char = ' ', location = location.abovebar, color = #777777, transp = 100, size = size.tiny, title = "Latest Bear Low")

//InfoPanel for latest Order Blocks

draw_InfoPanel(_text, _x, _y, font_size)=>

var label la_panel = na

label.delete(la_panel)

la_panel := label.new(

x=_x, y=_y,

text=_text, xloc=xloc.bar_time, yloc=yloc.price,

color=color.new(#383838, 5), style=label.style_label_left, textcolor=color.white, size=font_size)

info_panel_x = time_close + round(change(time) * 100)

info_panel_y = close

title = "LATEST ORDER BLOCKS"

row0 = "-----------------------------------------------------"

row1 = ' Bullish - High: ' + tostring(latest_bull_high, '#.##')

row2 = ' Bullish - Avg: ' + tostring(latest_bull_avg, '#.##')

row3 = ' Bullish - Low: ' + tostring(latest_bull_low, '#.##')

row4 = "-----------------------------------------------------"

row5 = ' Bearish - High: ' + tostring(latest_bear_high, '#.##')

row6 = ' Bearish - Avg: ' + tostring(latest_bear_avg, '#.##')

row7 = ' Bearish - Low: ' + tostring(latest_bear_low, '#.##')

panel_text = '\n' + title + '\n' + row0 + '\n' + row1 + '\n' + row2 + '\n' + row3 + '\n' + row4 + '\n\n' + row5 + '\n' + row6 + '\n' + row7 + '\n'

if info_pan

draw_InfoPanel(panel_text, info_panel_x, info_panel_y, size.normal)

// === Label for Documentation/Tooltip ===

chper = time - time[1]

chper := change(chper) > 0 ? chper[1] : chper

// === Tooltip text ===

var vartooltip = "Indicator to help identifying instituational Order Blocks. Often these blocks signal the beginning of a strong move, but there is a high probability, that these prices will be revisited at a later point in time again and therefore are interesting levels to place limit orders. \nBullish Order block is the last down candle before a sequence of up candles. \nBearish Order Block is the last up candle before a sequence of down candles. \nIn the settings the number of required sequential candles can be adjusted. \nFurthermore a %-threshold can be entered which the sequential move needs to achieve in order to validate a relevant Order Block. \nChannels for the last Bullish/Bearish Block can be shown/hidden."

// === Print Label ===

var label l_docu = na

label.delete(l_docu)

if showdocu

l_docu := label.new(x = time + chper * 35, y = close, text = "DOCU OB", color=color.gray, textcolor=color.white, style=label.style_label_center, xloc = xloc.bar_time, yloc=yloc.price, size=size.tiny, textalign = text.align_left, tooltip = vartooltip)

// @TradingSecrets: Generate entry and exit orders based on the signals

entryLongSignal = OB_bull

entryShortSignal = OB_bear

if not pyramiding

entryLongSignal := entryLongSignal and not strategy.position_size

entryShortSignal := entryShortSignal and not strategy.position_size

if entryLongSignal

strategy.entry("Long Entry", strategy.long)

//strategy.exit("Long Exit Loss", "Long Entry", stop = close * (1 - stoploss_percent*0.01))

if entryShortSignal

strategy.entry("Short Entry", strategy.short)

//strategy.exit("Short Exit Loss", "Short Entry", stop = close * (1 + stoploss_percent*0.01))

strategy.initial_capital = 50000

//Close Position by market order

if strategy.position_size > 0 and strategy.openprofit/nz(strategy.initial_capital + strategy.netprofit) >= takeprofit_percent*0.01

//If I m in a long position and my take profit got hit close it by market order

strategy.close("Long Entry", comment = "Long Exit Profit")

if strategy.position_size < 0 and strategy.openprofit/nz(strategy.initial_capital + strategy.netprofit) >= takeprofit_percent*0.01

strategy.close("Short Entry", comment = "Short Exit Profit")

if strategy.position_size > 0 and strategy.openprofit/nz(strategy.initial_capital + strategy.netprofit) <= -stoploss_percent*0.01

//If I m in a long position and my take profit got hit close it by market order

strategy.close("Long Entry", comment = "Long Exit Loss")

if strategy.position_size < 0 and strategy.openprofit/nz(strategy.initial_capital + strategy.netprofit) <= -stoploss_percent*0.01

strategy.close("Short Entry", comment = "Short Exit Loss")