TMA-Legacy

Autora:ChaoZhang, Data: 2022-05-09 22:38:11Tags:RSI

Este é um script baseado no indicador original de Divergência TMA-RSI da PhoenixBinary.

A comunidade Phoenix Binary e a comunidade TMA construíram esta versão para ser código público para a comunidade para uso e revisão posteriores após a morte de Phoenix Binary (A comunidade estende nossas condolências à família de Phoenix

As utilizações previstas são as mesmas do original, mas alguns cálculos são diferentes e podem não agir ou sinalizar da mesma forma que o original.

Descrição do indicador a partir da publicação original. Este indicador foi inspirado no Arty e na Christy.

█ COMPONENTES

Aqui está uma breve visão geral do indicador da publicação original:

1

2

3

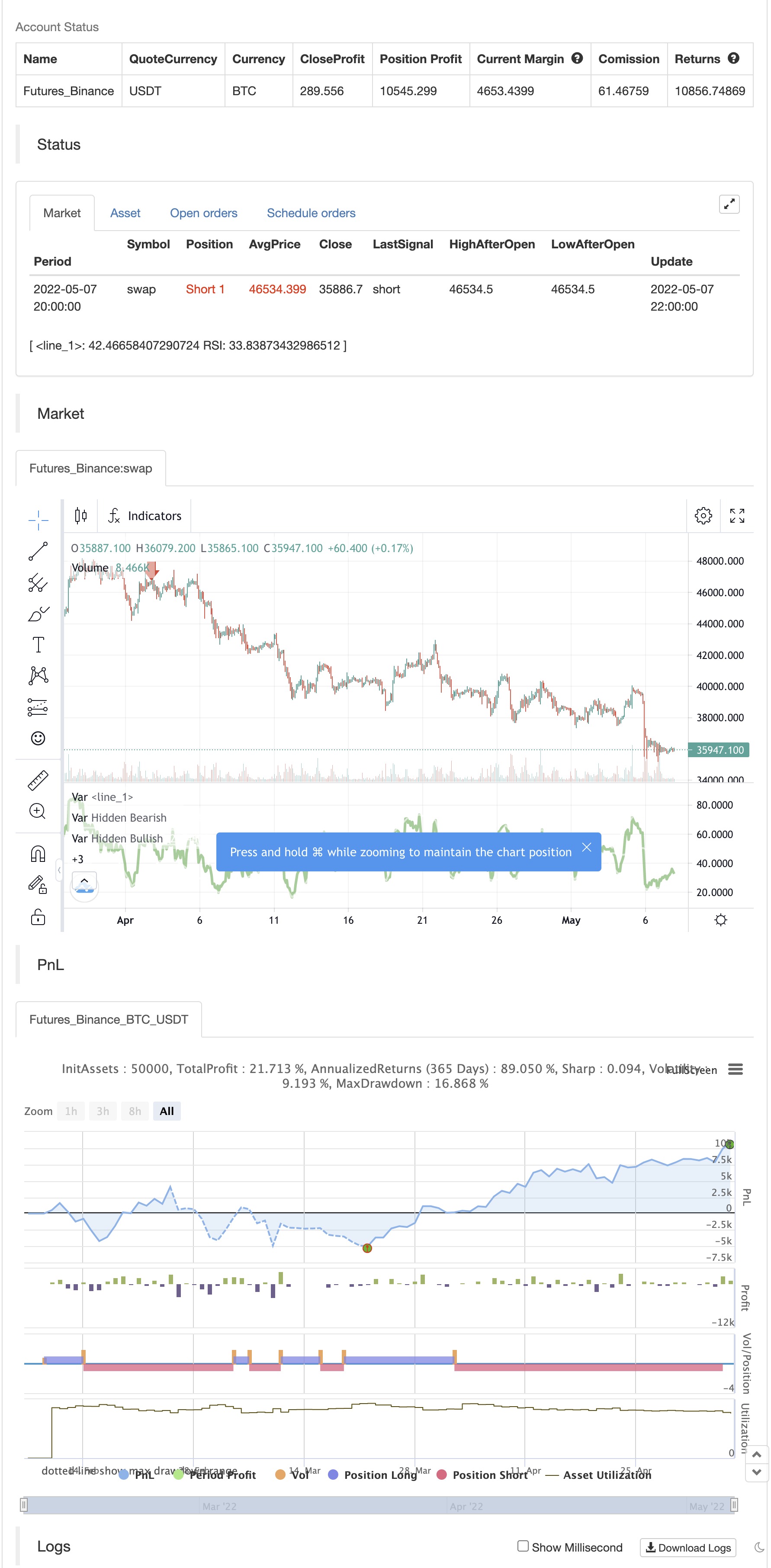

backtest

/*backtest

start: 2022-02-08 00:00:00

end: 2022-05-08 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// ©Hotchachachaa, Rest in Peace Pheonix Algo(aka Doug) your community misses you and we extend our deepest sympathies to your family.

//@version=5

//

//This indicator is based on the TMA-Divergence indicator created by PhoenixBinary for the TMA discord Community. Since Phoenix is no longer part of the community

//we did our best to recreate the indicator for the community's continued use updates and revisions.

indicator("TMA-Legacy", overlay=false)

////////////////////////////////////inputs////////////////////////////////////////////////

displayRSI = input.string(title="RSI Type", defval="RSI Divergence", options=["RSI Divergence","RSI Smoothed","RSI Momentum"],group="Main Settings")

lenrsinordiv = input.int(title="RSI Normal Length", defval=14,minval=1, group= "RSI Normal")

lenrsismodiv = input.int(title="RSI Smoothed Length", defval=40, minval=1,group = "RSI Smoothed" )

lenrsissmoma = input.int(title="RSI Smoothed MA", defval=40,minval=1, group = "RSI Smoothed" )

lenrsimomdiv = input.int(title="RSI Normal Length", defval=5 ,minval=1, group = "RSI Momentum")

rsimommalen = input.int(34, minval=1, title="Smooth RSI MA Length",group="RSI Momentum")

srcrsidiv = input(title="RSI Source", defval=close, group="Main Settings")

lbR = input.int(title="Pivot Lookback Right", defval=5,minval=1,group="Divergence Spotter")

lbL = input.int(title="Pivot Lookback Left", defval=5,minval=1,group="Divergence Spotter")

rangeUpper = input.int(title="Max of Lookback Range", defval=60,minval=1,group="Divergence Spotter")

rangeLower = input.int(title="Min of Lookback Range", defval=5,minval=1,group="Divergence Spotter")

plotBull = input.bool(title="Plot Bullish", defval=true,group="Divergence Spotter")

plotHiddenBull = input.bool(title="Plot Hidden Bullish", defval=true,group="Divergence Spotter")

plotBear = input.bool(title="Plot Bearish", defval=true,group="Divergence Spotter")

plotHiddenBear = input.bool(title="Plot Hidden Bearish", defval=true,group="Divergence Spotter")

bearColorrsidiv = color.red

bullColorrsidiv = color.green

hiddenBullColor = color.new(color.green, 80)

hiddenBearColor = color.new(color.red, 80)

textColor = color.white

noneColor = color.new(color.white, 100)

lenDisplay= displayRSI == "RSI Divergence" ? lenrsinordiv: displayRSI == "RSI Smoothed" ? lenrsismodiv: na

rsiValue1 = ta.rsi(srcrsidiv, lenrsinordiv)

// ### Smoothed MA

averageSource = rsiValue1

typeofMA1 = "SMMA"

length_ma1 = 50

f_smma(averageSource, averageLength) =>

smma = 0.0

smma := na(smma[1]) ? ta.sma(averageSource, averageLength) : (smma[1] * (averageLength - 1) + averageSource) / averageLength

smma

f_smwma(averageSource, averageLength) =>

smwma = 0.0

smwma := na(smwma[1]) ? ta.wma(averageSource, averageLength) : (smwma[1] * (averageLength - 1) + averageSource) / averageLength

smwma

f_tma(averageSource, averageLength) =>

ta.sma(ta.sma(averageSource, averageLength), averageLength)

f_dema(averageSource, averageLength) =>

emaValue = ta.ema(averageSource, averageLength)

2 * emaValue - ta.ema(emaValue, averageLength)

f_tema(averageSource, averageLength) =>

ema1 = ta.ema(averageSource, averageLength)

ema2 = ta.ema(ema1, averageLength)

ema3 = ta.ema(ema2, averageLength)

(3 * ema1) - (3 * ema2) + ema3

f_ma(smoothing, averageSource, averageLength) =>

switch str.upper(smoothing)

"SMA" => ta.sma(averageSource, averageLength)

"EMA" => ta.ema(averageSource, averageLength)

"WMA" => ta.wma(averageSource, averageLength)

"HMA" => ta.hma(averageSource, averageLength)

"RMA" => ta.rma(averageSource, averageLength)

"SWMA" => ta.swma(averageSource)

"ALMA" => ta.alma(averageSource, averageLength, 0.85, 6)

"VWMA" => ta.vwma(averageSource, averageLength)

"VWAP" => ta.vwap(averageSource)

"SMMA" => f_smma(averageSource, averageLength)

"SMWMA" => f_smwma(averageSource, averageLength)

"DEMA" => f_dema(averageSource, averageLength)

"TEMA"=> f_tema(averageSource, averageLength)

=> runtime.error("Moving average type '" + smoothing +

"' not found!"), na

MA1 = f_ma(typeofMA1, averageSource, length_ma1)

showNormal=displayRSI=="RSI Divergence"

showSmoothed=displayRSI=="RSI Smoothed"

showMomentum = displayRSI =="RSI Momentum"

showAll= displayRSI=="All Three"

///////OB/OS lines

hline(showNormal or showSmoothed ? 80 :na, title="OverBought", linestyle=hline.style_dotted, linewidth=2)

hline(showNormal or showSmoothed ? 20 :na, title="OverSold", linestyle=hline.style_dotted, linewidth=2)

////////////////show normal

plot(showNormal? MA1 : na , linewidth=2, color=color.white)

var int colortoken=1

color1= color.green

color2 = color.yellow

color3 = color.orange

color4 = color.red

if rsiValue1>rsiValue1[1] and colortoken!=1

colortoken:= colortoken[1] - 1

if rsiValue1<rsiValue1[1] and colortoken!=4

colortoken:= colortoken[1] + 1

lineColor= colortoken == 1 ? color1: colortoken ==2 ? color2 : colortoken == 3 ? color3 : colortoken == 4 ? color4 :na

plot(showNormal? rsiValue1 : na, title="RSI", linewidth=3, color=lineColor)

////////////show smoothed

lensig = input.int(14, title="ADX Smoothing", minval=1, maxval=50)

len = input.int(14, minval=1, title="DI Length")

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

trur = ta.rma(ta.tr, len)

plus = fixnan(100 * ta.rma(plusDM, len) / trur)

minus = fixnan(100 * ta.rma(minusDM, len) / trur)

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), lensig)

rsisrc = ta.rsi(close,lenrsismodiv)

adxthreshold=input.int(title="adx",defval=15)

smoothColor= adx>adxthreshold and plus>minus? color.green:adx>adxthreshold and plus<minus?color.red : adx<adxthreshold?color.gray:na

rsismma = 0.0

rsismma := na(rsismma[1]) ? ta.sma(rsisrc, lenrsissmoma) : (rsismma[1] * (lenrsissmoma - 1) + rsisrc) / lenrsissmoma

rsiwsmma= ta.wma(rsismma,lenrsissmoma)

plot(showSmoothed ? rsisrc:na, linewidth=2, color=smoothColor)

plot(showSmoothed ? rsiwsmma:na, linewidth=2, color=color.white)

////////////////RSI momentum

///////////////////// normal RSI

rsiValue2 = ta.rsi(ohlc4,lenrsimomdiv)

rsiema = ta.wma(rsiValue2,rsimommalen)

normalizedRSI= (rsiValue2-50)/100

/////////////////// Normal Momentum

lenmom = input.int(5, minval=1, title=" MOM Length",group= "RSI Momentum")

srcmom = ohlc4

mom = srcmom - srcmom[lenmom]

//////////stochRSI K line

smoothK = input.int(5, "K", minval=1)

lengthRSI = input.int(5, "RSI Length", minval=1, group="RSI Momentum")

lengthStoch = input.int(34, "Stochastic Length", minval=1,group= "RSI Momentum")

src = input(ohlc4, title="RSI Source",group= "RSI Momentum")

rsi1 = ta.rsi(src, lengthRSI)

k = ((ta.sma(ta.stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK))-50)/100

WTF=math.avg(mom,normalizedRSI,k)

smmaLen = input.int(25, minval=1, title="SMMA Length", group = "RSI Momentum")

smmaLen1= 2

smmaSrc = WTF

WTFsmma = 0.0

WTFsmma := na(WTFsmma[1]) ? ta.sma(smmaSrc, smmaLen1) : (WTFsmma[1] * (smmaLen1 - 1) + smmaSrc) / smmaLen1

smma = 0.0

smma := na(smma[1]) ? ta.sma(smmaSrc, smmaLen) : (smma[1] * (smmaLen - 1) + smmaSrc) / smmaLen

color1a= #0E3F01

color2a = #31FA2A

color3a = #FA6B6B

color4a = #971643

momentumColor= WTF>WTF[1] and WTF>smma ? color1a : WTF<WTF[1] and WTF>smma ? color2a : WTF>WTF[1] and WTF<smma ? color3a : WTF<WTF[1] and WTF<smma ? color4a : na

plot(showMomentum ? WTF:na, color=momentumColor, linewidth=3)

plot(showMomentum ? smma:na , linewidth=2, color=color.white)

osc= displayRSI =="RSI Divergence" ? rsiValue1 : displayRSI =="RSI Smoothed" ? rsisrc:na

///////////divergence

plFound = na(ta.pivotlow(osc, lbL, lbR)) ? false : true

phFound = na(ta.pivothigh(osc, lbL, lbR)) ? false : true

_inRange(cond) =>

bars = ta.barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

//------------------------------------------------------------------------------

// Regular Bullish

// Osc: Higher Low

oscHL = osc[lbR] > ta.valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Lower Low

priceLL = low[lbR] < ta.valuewhen(plFound, low[lbR], 1)

bullCond = plotBull and priceLL and oscHL and plFound

plot(

displayRSI !="RSI Momentum"and plFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish",

linewidth=2,

color=(bullCond ? bullColorrsidiv : noneColor)

)

//------------------------------------------------------------------------------

// Hidden Bullish

// Osc: Lower Low

oscLL = osc[lbR] < ta.valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Higher Low

priceHL = low[lbR] > ta.valuewhen(plFound, low[lbR], 1)

hiddenBullCond = plotHiddenBull and priceHL and oscLL and plFound

plot(

displayRSI !="RSI Momentum" and plFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish",

linewidth=2,

color=(hiddenBullCond ? hiddenBullColor : noneColor)

)

//------------------------------------------------------------------------------

// Regular Bearish

// Osc: Lower High

oscLH = osc[lbR] < ta.valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Higher High

priceHH = high[lbR] > ta.valuewhen(phFound, high[lbR], 1)

bearCond = plotBear and priceHH and oscLH and phFound

plot(

displayRSI !="RSI Momentum" and phFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish",

linewidth=2,

color=(bearCond ? bearColorrsidiv : noneColor)

)

//------------------------------------------------------------------------------

// Hidden Bearish

// Osc: Higher High

oscHH = osc[lbR] > ta.valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Lower High

priceLH = high[lbR] < ta.valuewhen(phFound, high[lbR], 1)

hiddenBearCond = plotHiddenBear and priceLH and oscHH and phFound

plot(

displayRSI !="RSI Momentum" and phFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish",

linewidth=2,

color=(hiddenBearCond ? hiddenBearColor : noneColor)

)

// ### Alerts

if bearCond

alert("Bearish Divergence")

else if hiddenBearCond

alert("Hidden Bearish Divergence")

else if bullCond

alert("Bullish Divergence")

else if hiddenBullCond

alert("Hidden Bullish Divergence")

if hiddenBullCond

strategy.entry("Enter Long", strategy.long)

else if hiddenBearCond

strategy.entry("Enter Short", strategy.short)

// END ###

- Sistema de estratégia de quantificação de tendências de potência de dois indicadores

- Estratégia de negociação de tendências de sinais múltiplos binários equilíbrios-RSI

- Estratégias de otimização de negociação diurna combinadas com o indicador de momentum RSI do sistema dinâmico equilíbrio

- Múltiplos indicadores tecnológicos estratégias de rastreamento de tendências de movimento

- Dinâmica de ajuste de estratégias de rastreamento de tendências de coluna de elefante

- Estratégia de intensidade de tendência do RSI de dois ciclos combinada com um sistema de gestão de posições de pirâmide

- Estratégias de negociação quantitativas de parâmetros dinâmicos RSI auxiliados por cruzamento multilinear

- Tendências dinâmicas determinam a estratégia de cruzamento do RSI

- Algoritmos multidimensionais K de vizinhança e estratégias de negociação de análise quantitativa de preços na forma de um deslizamento

- Sistema de comutação dinâmica multiestratégica adaptativa: estratégias de negociação quantitativas para acompanhar tendências de convergência e oscilações de faixa

- Múlti-indicadores, tendências multidimensionais e estratégias de quantificação avançadas

- MA HYBRID BY RAJ

- Tendência do diamante

- Nik Stoch

- Stoch supertrd atr 200ma

- MTF RSI & Estratégia STOCH

- EMA + AROON + ASH

- Impulso 2.0

- Estratégia de gama da EHMA

- Média móvel de compra-venda

- Midas Mk. II - Ultimate Crypto Swing

- TV estratégia alta e baixa

- Melhor Estratégia de TradingView

- Alertas R3.0 + Condição de Volatilidade Chaiking + TP RSI

- Chande Kroll Parar

- CCI + EMA com estratégia cruzada RSI

- Estratégia de captura de tendências de bandas EMA + leledc + bandas Bollinger

- RSI MTF Ob+Os

- Estratégia MACD Willy

- RSI - Sinais de compra e venda

- Tendência Heikin-Ashi