Estratégia adaptativa de tomada de lucro e stop loss baseada em quadros de tempo duplos e indicadores de impulso

Autora:ChaoZhang, Data: 2023-11-23 17:57:52Tags:

Resumo

Esta estratégia combina quadros de tempo duplos e indicadores de momentum para alcançar o aproveitamento adaptativo e o stop loss. O quadro de tempo principal monitora a direção da tendência, enquanto o quadro de tempo secundário é usado para confirmar sinais. Os sinais de negociação são gerados quando as direções de ambos se alinham. Após entrar no mercado, os níveis de aproveitamento e stop loss são atualizados progressivamente.

Estratégia lógica

-

O quadro de tempo principal usa o indicador de regressão linear Squeeze Momentum (SQM) para determinar a tendência. O quadro de tempo secundário usa uma combinação EMA no indicador SQM para filtrar sinais falsos.

-

Quando o gráfico principal SQM rompe para cima e o gráfico secundário SQM também sobe, uma posição longa é tomada.

-

Após a entrada no mercado, os níveis iniciais de take profit e stop loss são definidos com base nos parâmetros de entrada. Quando o preço atinge o nível de take profit, os níveis de take profit e stop loss são atualizados. Especificamente, o nível de take profit é aumentado progressivamente e o nível de stop loss é apertado, alcançando uma gradual take profit.

Vantagens

-

Duas marcas de tempo filtram os falsos sinais e garantem a precisão.

-

O indicador SQM determina a direcção da tendência, evitando o ruído do mercado.

-

O mecanismo adaptativo de captação de lucros e stop loss bloqueia os lucros na medida máxima e controla efetivamente o risco.

Análise de riscos

-

As configurações incorretas dos parâmetros SQM podem deixar de lado pontos de virada da tendência, levando a perdas.

-

Um quadro temporal secundário inadequado pode não filtrar o ruído de forma eficaz, causando trocas errôneas.

-

Se a amplitude de stop loss for demasiado larga, a perda por transacção pode ser substancial.

Oportunidades de melhoria

-

Os parâmetros do MQQ devem ser ajustados para diferentes mercados para garantir a sensibilidade.

-

Devem ser testados diferentes períodos de tempo secundários para determinar o melhor efeito de filtragem do ruído.

-

Em vez de um valor fixo, a amplitude de stop loss pode ter um intervalo definido dinamicamente com base na volatilidade do mercado.

Resumo

No geral, esta é uma estratégia muito prática. A combinação de quadros de tempo duplos com um indicador de impulso para determinar tendências, juntamente com o método adaptativo de lucro e stop loss, pode gerar lucros estáveis. Ao otimizar os parâmetros do SQM, o período de período de tempo secundário e a amplitude de stop loss, os resultados da estratégia podem ser melhorados para aplicação e aprimoramento produtivos ao vivo.

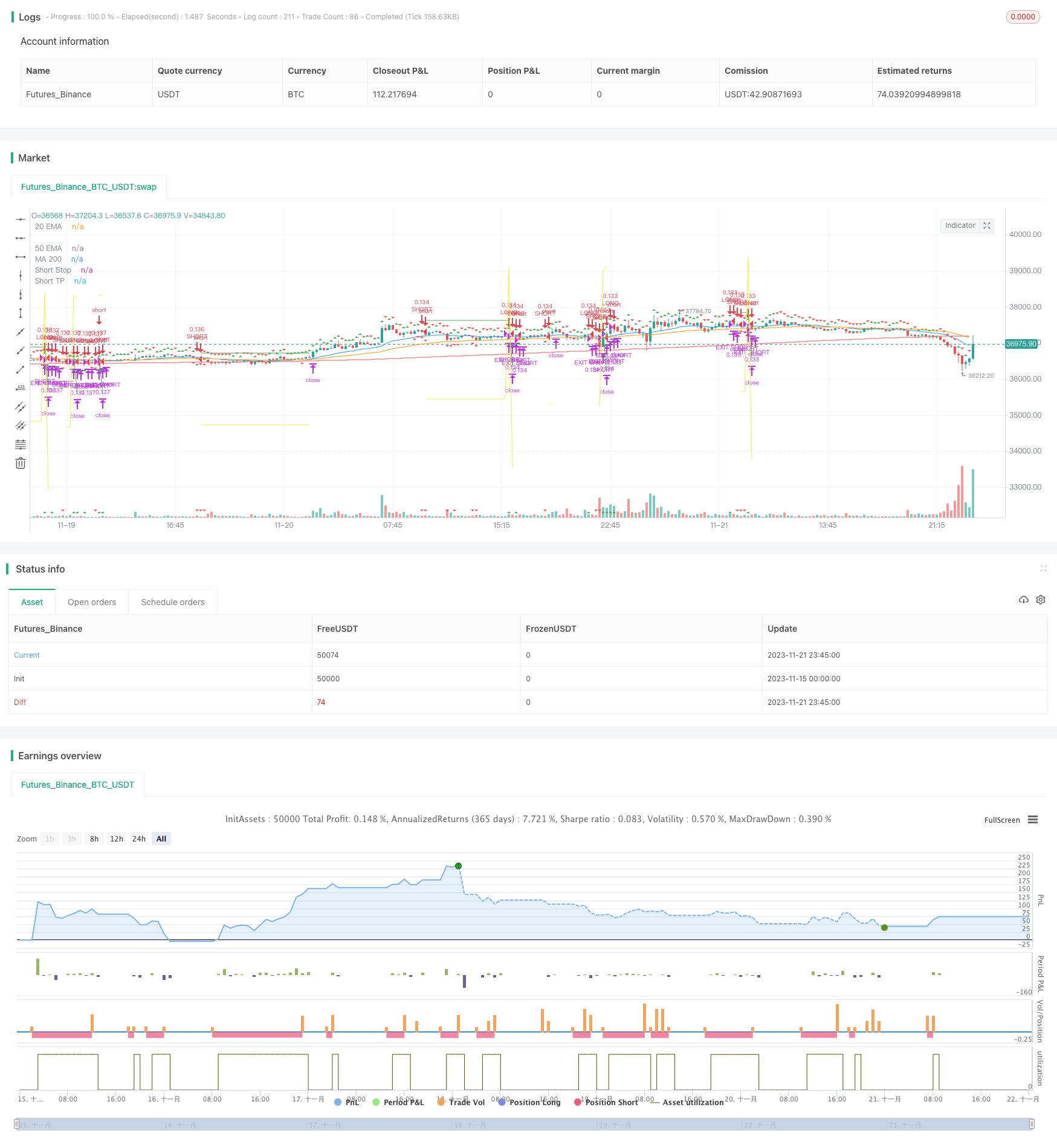

/*backtest

start: 2023-11-15 00:00:00

end: 2023-11-22 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("SQZ Multiframe Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

fast_ema_len = input(11, minval=5, title="Fast EMA")

slow_ema_len = input(34, minval=20, title="Slow EMA")

sqm_lengthKC = input(20, title="SQM KC Length")

kauf_period = input(20, title="Kauf Period")

kauf_mult = input(2,title="Kauf Mult factor")

min_profit_sl = input(5.0, minval=1, maxval=100, title="Min profit to start moving SL [%]")

longest_sl = input(10, minval=1, maxval=100, title="Maximum possible of SL [%]")

sl_step = input(0.5, minval=0.0, maxval=1.0, title="Take profit factor")

// ADMF

CMF_length = input(11, minval=1, title="CMF length") // EMA27 = SMMA/RMA14 ~ lunar month

show_plots = input(true, title="Show plots")

lower_resolution = timeframe.period=='1'?'5':timeframe.period=='5'?'15':timeframe.period=='15'?'30':timeframe.period=='30'?'60':timeframe.period=='60'?'240':timeframe.period=='240'?'D':timeframe.period=='D'?'W':'M'

higher_resolution = timeframe.period=='5'?'1':timeframe.period=='15'?'5':timeframe.period=='30'?'15':timeframe.period=='60'?'30':timeframe.period=='240'?'60':timeframe.period=='D'?'240':timeframe.period=='W'?'D':'W'

// Calculate Squeeze Momentum

sqm_val = linreg(close - avg(avg(highest(high, sqm_lengthKC), lowest(low, sqm_lengthKC)),sma(close,sqm_lengthKC)), sqm_lengthKC,0)

sqm_val_high = security(syminfo.tickerid, higher_resolution, linreg(close - avg(avg(highest(high, sqm_lengthKC), lowest(low, sqm_lengthKC)),sma(close,sqm_lengthKC)), sqm_lengthKC,0), lookahead=barmerge.lookahead_on)

sqm_val_low = security(syminfo.tickerid, lower_resolution, linreg(close - avg(avg(highest(high, sqm_lengthKC), lowest(low, sqm_lengthKC)),sma(close,sqm_lengthKC)), sqm_lengthKC,0), gaps=barmerge.gaps_off, lookahead=barmerge.lookahead_on)

// Emas

high_close = security(syminfo.tickerid, higher_resolution, close, lookahead=barmerge.lookahead_on)

high_fast_ema = security(syminfo.tickerid, higher_resolution, ema(close, fast_ema_len), lookahead=barmerge.lookahead_on)

high_slow_ema = security(syminfo.tickerid, higher_resolution, ema(close, slow_ema_len), lookahead=barmerge.lookahead_on)

//low_fast_ema = security(syminfo.tickerid, lower_resolution, ema(close, fast_ema_len), lookahead=barmerge.lookahead_on)

//low_slow_ema = security(syminfo.tickerid, lower_resolution, ema(close, slow_ema_len), lookahead=barmerge.lookahead_on)

// CMF

ad = close==high and close==low or high==low ? 0 : ((2*close-low-high)/(high-low))*volume

money_flow = sum(ad, CMF_length) / sum(volume, CMF_length)

// Entry conditions

low_condition_long = (sqm_val_low > sqm_val_low[1])

low_condition_short = (sqm_val_low < sqm_val_low[1])

money_flow_min = (money_flow[4] > money_flow[3]) and (money_flow[3] > money_flow[2]) and (money_flow[2] < money_flow[1]) and (money_flow[1] < money_flow)

money_flow_max = (money_flow[4] < money_flow[3]) and (money_flow[3] < money_flow[2]) and (money_flow[2] > money_flow[1]) and (money_flow[1] > money_flow)

condition_long = ((sqm_val > sqm_val[1])) and (money_flow_min or money_flow_min[1] or money_flow_min[2] or money_flow_min[3]) and lowest(sqm_val, 5) < 0

condition_short = ((sqm_val < sqm_val[1])) and (money_flow_max or money_flow_max[1] or money_flow_max[2] or money_flow_max[3]) and highest(sqm_val, 5) > 0

high_condition_long = true//high_close > high_fast_ema and high_close > high_slow_ema //(high_fast_ema > high_slow_ema) //and (sqm_val_low > sqm_val_low[1])

high_condition_short = true//high_close < high_fast_ema and high_close < high_slow_ema//(high_fast_ema < high_slow_ema) //and (sqm_val_low < sqm_val_low[1])

enter_long = low_condition_long and condition_long and high_condition_long

enter_short = low_condition_short and condition_short and high_condition_short

// Stop conditions

var current_target_price = 0.0

var current_sl_price = 0.0 // Price limit to take profit

var current_target_per = 0.0

var current_profit_per = 0.0

set_targets(isLong, min_profit, current_target_per, current_profit_per) =>

target = 0.0

sl = 0.0

if isLong

target := close * (1.0 + current_target_per)

sl := close * (1.0 - (longest_sl/100.0)) // Longest SL

else

target := close * (1.0 - current_target_per)

sl := close * (1.0 + (longest_sl/100.0)) // Longest SL

[target, sl]

target_reached(isLong, min_profit, current_target_per, current_profit_per) =>

target = 0.0

sl = 0.0

profit_per = 0.0

target_per = 0.0

if current_profit_per == 0

profit_per := (min_profit*sl_step) / 100.0

else

profit_per := current_profit_per + ((min_profit*sl_step) / 100.0)

target_per := current_target_per + (min_profit / 100.0)

if isLong

target := strategy.position_avg_price * (1.0 + target_per)

sl := strategy.position_avg_price * (1.0 + profit_per)

else

target := strategy.position_avg_price * (1.0 - target_per)

sl := strategy.position_avg_price * (1.0 - profit_per)

[target, sl, profit_per, target_per]

hl_diff = sma(high - low, kauf_period)

stop_condition_long = 0.0

new_stop_condition_long = low - (hl_diff * kauf_mult)

if (strategy.position_size > 0)

if (close > current_target_price)

[target, sl, profit_per, target_per] = target_reached(true, min_profit_sl, current_target_per, current_profit_per)

current_target_price := target

current_sl_price := sl

current_profit_per := profit_per

current_target_per := target_per

stop_condition_long := max(stop_condition_long[1], current_sl_price)

else

stop_condition_long := new_stop_condition_long

stop_condition_short = 99999999.9

new_stop_condition_short = high + (hl_diff * kauf_mult)

if (strategy.position_size < 0)

if (close < current_target_price)

[target, sl, profit_per, target_per] = target_reached(false, min_profit_sl, current_target_per, current_profit_per)

current_target_price := target

current_sl_price := sl

current_profit_per := profit_per

current_target_per := target_per

stop_condition_short := min(stop_condition_short[1], current_sl_price)

else

stop_condition_short := new_stop_condition_short

// Submit entry orders

if (enter_long and (strategy.position_size <= 0))

if (strategy.position_size < 0)

strategy.close(id="SHORT")

current_target_per := (min_profit_sl / 100.0)

current_profit_per := 0.0

[target, sl] = set_targets(true, min_profit_sl, current_target_per, current_profit_per)

current_target_price := target

current_sl_price := sl

strategy.entry(id="LONG", long=true)

// if show_plots

// label.new(bar_index, high, text=tostring("LONG\nSL: ") + tostring(stop_condition_long), style=label.style_labeldown, color=color.green)

if (enter_short and (strategy.position_size >= 0))

if (strategy.position_size > 0)

strategy.close(id="LONG")

current_target_per := (min_profit_sl / 100.0)

current_profit_per := 0.0

[target, sl] = set_targets(false, min_profit_sl, current_target_per, current_profit_per)

current_target_price := target

current_sl_price := sl

strategy.entry(id="SHORT", long=false)

// if show_plots

// label.new(bar_index, high, text=tostring("SHORT\nSL: ") + tostring(stop_condition_short), style=label.style_labeldown, color=color.red)

if (strategy.position_size > 0)

strategy.exit(id="EXIT LONG", stop=stop_condition_long)

if (strategy.position_size < 0)

strategy.exit(id="EXIT SHORT", stop=stop_condition_short)

// Plot anchor trend

plotshape(low_condition_long, style=shape.triangleup,

location=location.abovebar, color=color.green)

plotshape(low_condition_short, style=shape.triangledown,

location=location.abovebar, color=color.red)

plotshape(condition_long, style=shape.triangleup,

location=location.belowbar, color=color.green)

plotshape(condition_short, style=shape.triangledown,

location=location.belowbar, color=color.red)

//plotshape((close < profit_target_short) ? profit_target_short : na, style=shape.triangledown,

// location=location.belowbar, color=color.yellow)

plotshape(enter_long, style=shape.triangleup,

location=location.bottom, color=color.green)

plotshape(enter_short, style=shape.triangledown,

location=location.bottom, color=color.red)

// Plot emas

plot(ema(close, 20), color=color.blue, title="20 EMA")

plot(ema(close, 50), color=color.orange, title="50 EMA")

plot(sma(close, 200), color=color.red, title="MA 200")

// Plot stop loss values for confirmation

plot(series=(strategy.position_size > 0) and show_plots ? stop_condition_long : na,

color=color.green, style=plot.style_linebr,

title="Long Stop")

plot(series=(strategy.position_size < 0) and show_plots ? stop_condition_short : na,

color=color.green, style=plot.style_linebr,

title="Short Stop")

plot(series=(strategy.position_size < 0) and show_plots ? current_target_price : na,

color=color.yellow, style=plot.style_linebr,

title="Short TP")

plot(series=(strategy.position_size > 0) and show_plots ? current_target_price : na,

color=color.yellow, style=plot.style_linebr,

title="Long TP")

//plot(series=(strategy.position_size < 0) ? profit_sl_short : na,

// color=color.gray, style=plot.style_linebr,

// title="Short Stop")

- Tendência de seguir uma estratégia baseada na decomposição de séries temporais e em bandas de Bollinger ponderadas por volume

- Oscilador de preços derivado Estratégia quantitativa de negociação

- Tendência de múltiplos indicadores Seguindo a estratégia

- CCI Dual Timeframe Trend Seguindo a Estratégia

- Estratégia de acompanhamento das tendências do T3-CCI

- Estratégia de ruptura da SuperTendência de Intervalo de Tempo

- Estratégia de combinação de média móvel de inversão de impulso

- Retração da média móvel dinâmica Estratégia Martin

- Combo Momentum Reversal Dual-Rail Matching Estratégia

- Estratégia Quant da Nuvem Ichimoku

- Estratégia de negociação de RSI de rede multiperíodo

- Estratégia de cruzamento de média móvel exponencial dupla

- Estratégia de RSI de média móvel de rastreamento de tendências

- Preço de fechamento mensal e estratégia de cruzamento da média móvel

- Bollinger Bands Breakout tendência a curto prazo após a Estratégia

- Compra de descidas com take profit e stop loss

- Estratégia de cruzamento da média móvel axial do RSI

- Estratégia de cruzamento de SMA dupla

- Estratégia de combinação dupla de EMA e RSI

- Especulação do Golfo: Segue a tendência da estratégia baseada na SAR