EMA/ADX/VOL - Assassino de Criptomoedas

Uma estratégia de negociação quantitativa para entrar em ação, combinada com filtragem de volume de transação, usando o EMA para determinar a direção da tendência, o indicador ADX para determinar a força da tendência

Princípios

A estratégia usa os cinco EMAs de diferentes períodos para determinar a direção da tendência de preços. Quando os cinco EMAs subiram, a tendência de alta foi formada. Quando os cinco EMAs caíram, a tendência de baixa foi formada.

O indicador ADX é então usado para avaliar a força e a fraqueza da tendência, sendo considerado um movimento forte quando a linha DI+ é maior que a linha DI e o ADX é superior ao limite estabelecido, e um movimento vazio quando a linha DI é maior que a linha DI+ e o ADX é superior ao limite estabelecido.

Ao mesmo tempo, o uso de volume de transação de ruptura para a confirmação adicional, exigindo que o volume de transação atual da linha K seja maior do que o múltiplo da média de um determinado período, evitando assim a entrada errada em posições de baixo volume.

A combinação da direção da tendência, a força da tendência e o volume de negociação, formam a lógica de abertura de posições de múltiplos e vazios da estratégia.

Vantagens

O uso de um sistema de EMA para determinar a direção da tendência é mais confiável do que um único EMA.

O indicador ADX é usado para avaliar a força e a fraqueza de uma tendência, evitando a entrada errada quando não há uma tendência clara.

Mecanismos de filtragem de volume de transações para garantir o suporte de volume de transações e aumentar a confiabilidade da estratégia.

A análise de múltiplos fatores torna os sinais de abertura mais precisos e confiáveis.

A estratégia tem mais parâmetros e pode ser melhorada através da otimização dos parâmetros.

Riscos e soluções

Em situações de turbulência, a mediana EMA, o ADX e outros julgamentos podem emitir sinais errados, gerando perdas desnecessárias. Os parâmetros podem ser adequadamente ajustados ou adicionados outros indicadores para julgamento auxiliar.

As condições de filtragem de volume de transação são muito rigorosas e podem perder oportunidades de mercado, podendo os parâmetros de filtragem de volume de transação ser adequadamente reduzidos.

A frequência de negociação resultante da estratégia pode ser elevada, sendo necessário prestar atenção à gestão de fundos e controlar adequadamente o tamanho da posição individual.

Direção de otimização

Teste diferentes combinações de parâmetros para encontrar o melhor parâmetro e melhorar a eficácia da estratégia.

Adicionar outros indicadores, como MACD, KDJ e outros, em combinação com EMA e ADX, formando um julgamento de abertura de posição mais robusto.

Adicionar estratégias de stop loss para controlar ainda mais os riscos.

Otimizar as estratégias de gestão de posições para uma gestão de fundos mais científica.

Resumir

A estratégia integra a direção da tendência de preços, a intensidade da tendência e a informação sobre o volume de transações, formando regras de abertura de posições, evitando, até certo ponto, as armadilhas comuns de erro, com uma maior confiabilidade. No entanto, ainda é necessário aperfeiçoar o sistema de estratégia através da otimização de parâmetros, seleção de indicadores e controle de risco, para melhorar ainda mais a eficácia.

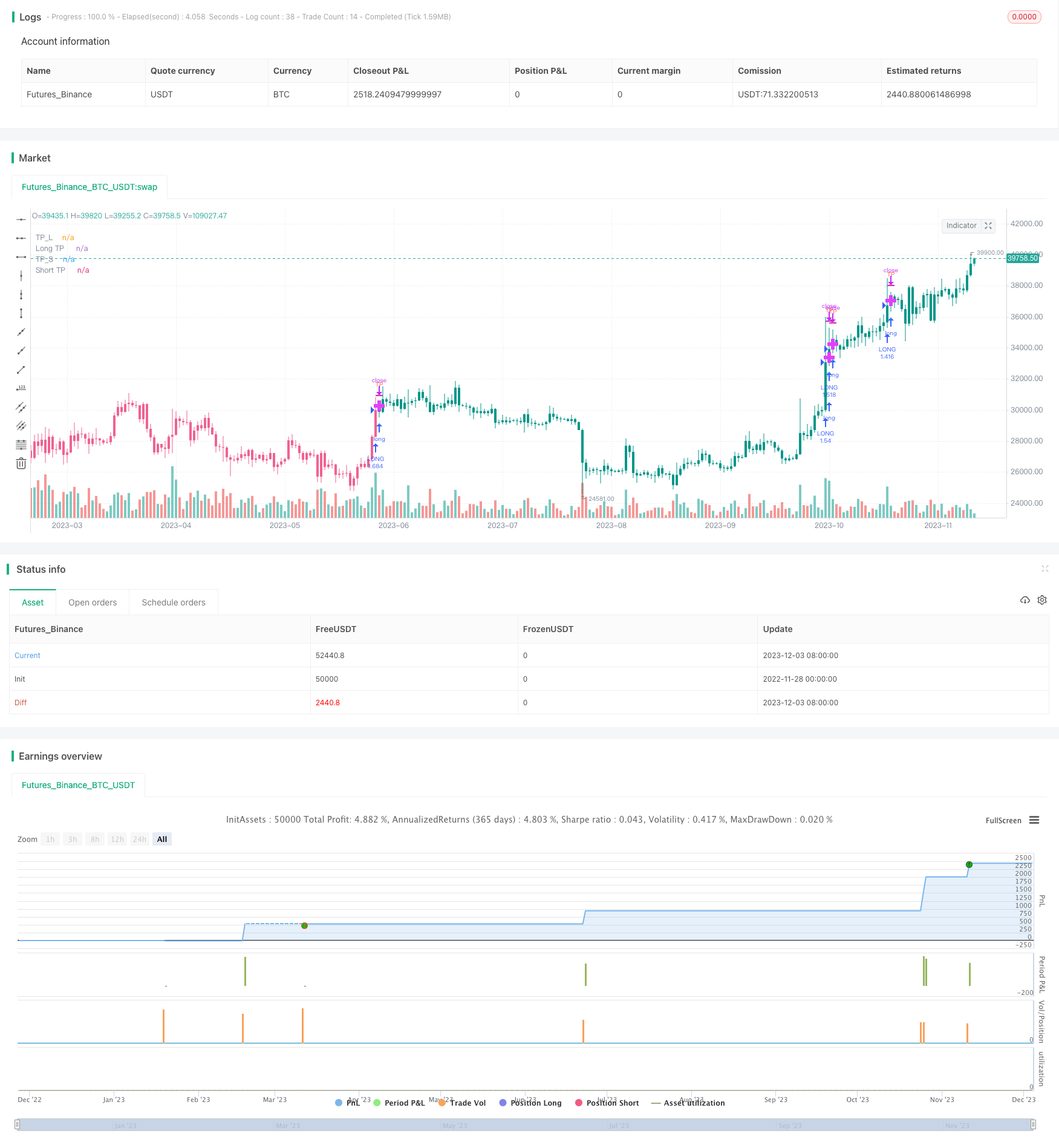

/*backtest

start: 2022-11-28 00:00:00

end: 2023-12-04 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © BabehDyo

//@version=4

strategy("EMA/ADX/VOL-CRYPTO KILLER [15M]", overlay = true, pyramiding=1,initial_capital = 10000, default_qty_type= strategy.percent_of_equity, default_qty_value = 100, calc_on_order_fills=false, slippage=0,commission_type=strategy.commission.percent,commission_value=0.03)

//SOURCE =============================================================================================================================================================================================================================================================================================================

src = input(open, title=" Source")

// Inputs ========================================================================================================================================================================================================================================================================================================

//ADX --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

ADX_options = input("MASANAKAMURA", title=" Adx Type", options = ["CLASSIC", "MASANAKAMURA"], group="ADX")

ADX_len = input(21, title=" Adx Length", type=input.integer, minval = 1, group="ADX")

th = input(20, title=" Adx Treshold", type=input.float, minval = 0, step = 0.5, group="ADX")

//EMA--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Length_ema1 = input(8, title=" 1-EMA Length", minval=1)

Length_ema2 = input(13, title=" 2-EMA Length", minval=1)

Length_ema3 = input(21, title=" 3-EMA Length", minval=1)

Length_ema4 = input(34, title=" 4-EMA Length", minval=1)

Length_ema5 = input(55, title=" 5-EMA Length", minval=1)

// Range Filter ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

per_ = input(15, title=" Period", minval=1, group = "Range Filter")

mult = input(2.6, title=" mult.", minval=0.1, step = 0.1, group = "Range Filter")

// Volume ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

volume_f = input(3.2, title=" Volume mult.", minval = 0, step = 0.1, group="Volume")

sma_length = input(20, title=" Volume lenght", minval = 1, group="Volume")

volume_f1 = input(1.9, title=" Volume mult. 1", minval = 0, step = 0.1, group="Volume")

sma_length1 = input(22, title=" Volume lenght 1", minval = 1, group="Volume")

//TP PLOTSHAPE -----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

tp_long0 = input(0.9, title=" % TP Long", type = input.float, minval = 0, step = 0.1, group="Target Point")

tp_short0 = input(0.9, title=" % TP Short", type = input.float, minval = 0, step = 0.1, group="Target Point")

// SL PLOTSHAPE ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

sl0 = input(4.2, title=" % Stop loss", type = input.float, minval = 0, step = 0.1, group="Stop Loss")

//INDICATORS =======================================================================================================================================================================================================================================================================================================

//ADX-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

calcADX(_len) =>

up = change(high)

down = -change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = rma(tr, _len)

_plus = fixnan(100 * rma(plusDM, _len) / truerange)

_minus = fixnan(100 * rma(minusDM, _len) / truerange)

sum = _plus + _minus

_adx = 100 * rma(abs(_plus - _minus) / (sum == 0 ? 1 : sum), _len)

[_plus,_minus,_adx]

calcADX_Masanakamura(_len) =>

SmoothedTrueRange = 0.0

SmoothedDirectionalMovementPlus = 0.0

SmoothedDirectionalMovementMinus = 0.0

TrueRange = max(max(high - low, abs(high - nz(close[1]))), abs(low - nz(close[1])))

DirectionalMovementPlus = high - nz(high[1]) > nz(low[1]) - low ? max(high - nz(high[1]), 0) : 0

DirectionalMovementMinus = nz(low[1]) - low > high - nz(high[1]) ? max(nz(low[1]) - low, 0) : 0

SmoothedTrueRange := nz(SmoothedTrueRange[1]) - (nz(SmoothedTrueRange[1]) /_len) + TrueRange

SmoothedDirectionalMovementPlus := nz(SmoothedDirectionalMovementPlus[1]) - (nz(SmoothedDirectionalMovementPlus[1]) / _len) + DirectionalMovementPlus

SmoothedDirectionalMovementMinus := nz(SmoothedDirectionalMovementMinus[1]) - (nz(SmoothedDirectionalMovementMinus[1]) / _len) + DirectionalMovementMinus

DIP = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIM = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DX = abs(DIP-DIM) / (DIP+DIM)*100

adx = sma(DX, _len)

[DIP,DIM,adx]

[DIPlusC,DIMinusC,ADXC] = calcADX(ADX_len)

[DIPlusM,DIMinusM,ADXM] = calcADX_Masanakamura(ADX_len)

DIPlus = ADX_options == "CLASSIC" ? DIPlusC : DIPlusM

DIMinus = ADX_options == "CLASSIC" ? DIMinusC : DIMinusM

ADX = ADX_options == "CLASSIC" ? ADXC : ADXM

L_adx = DIPlus > DIMinus and ADX > th

S_adx = DIPlus < DIMinus and ADX > th

//EMA-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

xPrice = close

EMA1 = ema(xPrice, Length_ema1)

EMA2 = ema(xPrice, Length_ema2)

EMA3 = ema(xPrice, Length_ema3)

EMA4 = ema(xPrice, Length_ema4)

EMA5 = ema(xPrice, Length_ema5)

L_ema = EMA1 < close and EMA2 < close and EMA3 < close and EMA4 < close and EMA5 < close

S_ema = EMA1 > close and EMA2 > close and EMA3 > close and EMA4 > close and EMA5 > close

// Range Filter ----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

var bool L_RF = na, var bool S_RF = na

Range_filter(_src, _per_, _mult)=>

var float _upward = 0.0

var float _downward = 0.0

wper = (_per_*2) - 1

avrng = ema(abs(_src - _src[1]), _per_)

_smoothrng = ema(avrng, wper)*_mult

_filt = _src

_filt := _src > nz(_filt[1]) ? ((_src-_smoothrng) < nz(_filt[1]) ? nz(_filt[1]) : (_src-_smoothrng)) : ((_src+_smoothrng) > nz(_filt[1]) ? nz(_filt[1]) : (_src+_smoothrng))

_upward := _filt > _filt[1] ? nz(_upward[1]) + 1 : _filt < _filt[1] ? 0 : nz(_upward[1])

_downward := _filt < _filt[1] ? nz(_downward[1]) + 1 : _filt > _filt[1] ? 0 : nz(_downward[1])

[_smoothrng,_filt,_upward,_downward]

[smoothrng, filt, upward, downward] = Range_filter(src, per_, mult)

hband = filt + smoothrng

lband = filt - smoothrng

L_RF := high > hband and upward > 0

S_RF := low < lband and downward > 0

// Volume -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Volume_condt = volume > sma(volume,sma_length)*volume_f

Volume_condt1 = volume > sma(volume,sma_length1)*volume_f1

//STRATEGY ==========================================================================================================================================================================================================================================================================================================

var bool longCond = na, var bool shortCond = na

var int CondIni_long = 0, var int CondIni_short = 0

var bool _Final_longCondition = na, var bool _Final_shortCondition = na

var float last_open_longCondition = na, var float last_open_shortCondition = na

var int last_longCondition = na, var int last_shortCondition = na

var int last_Final_longCondition = na, var int last_Final_shortCondition = na

var int nLongs = na, var int nShorts = na

L_1 = L_adx and Volume_condt and L_RF and L_ema

S_1 = S_adx and Volume_condt and S_RF and S_ema

L_2 = L_adx and L_RF and L_ema and Volume_condt1

S_2 = S_adx and S_RF and S_ema and Volume_condt1

L_basic_condt = L_1 or L_2

S_basic_condt = S_1 or S_2

longCond := L_basic_condt

shortCond := S_basic_condt

CondIni_long := longCond[1] ? 1 : shortCond[1] ? -1 : nz(CondIni_long[1] )

CondIni_short := longCond[1] ? 1 : shortCond[1] ? -1 : nz(CondIni_short[1] )

longCondition = (longCond[1] and nz(CondIni_long[1]) == -1 )

shortCondition = (shortCond[1] and nz(CondIni_short[1]) == 1 )

//POSITION PRICE-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

var float sum_long = 0.0, var float sum_short = 0.0

var float Position_Price = 0.0

last_open_longCondition := longCondition ? close[1] : nz(last_open_longCondition[1] )

last_open_shortCondition := shortCondition ? close[1] : nz(last_open_shortCondition[1] )

last_longCondition := longCondition ? time : nz(last_longCondition[1] )

last_shortCondition := shortCondition ? time : nz(last_shortCondition[1] )

in_longCondition = last_longCondition > last_shortCondition

in_shortCondition = last_shortCondition > last_longCondition

last_Final_longCondition := longCondition ? time : nz(last_Final_longCondition[1] )

last_Final_shortCondition := shortCondition ? time : nz(last_Final_shortCondition[1] )

nLongs := nz(nLongs[1] )

nShorts := nz(nShorts[1] )

if longCondition

nLongs := nLongs + 1

nShorts := 0

sum_long := nz(last_open_longCondition) + nz(sum_long[1])

sum_short := 0.0

if shortCondition

nLongs := 0

nShorts := nShorts + 1

sum_short := nz(last_open_shortCondition)+ nz(sum_short[1])

sum_long := 0.0

Position_Price := nz(Position_Price[1])

Position_Price := longCondition ? sum_long/nLongs : shortCondition ? sum_short/nShorts : na

//TP---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

var bool long_tp = na, var bool short_tp = na

var int last_long_tp = na, var int last_short_tp = na

var bool Final_Long_tp = na, var bool Final_Short_tp = na

var bool Final_Long_sl0 = na, var bool Final_Short_sl0 = na

var bool Final_Long_sl = na, var bool Final_Short_sl = na

var int last_long_sl = na, var int last_short_sl = na

tp_long = ((nLongs > 1) ? tp_long0 / nLongs : tp_long0) / 100

tp_short = ((nShorts > 1) ? tp_short0 / nShorts : tp_short0) / 100

long_tp := high > (fixnan(Position_Price) * (1 + tp_long)) and in_longCondition

short_tp := low < (fixnan(Position_Price) * (1 - tp_short)) and in_shortCondition

last_long_tp := long_tp ? time : nz(last_long_tp[1])

last_short_tp := short_tp ? time : nz(last_short_tp[1])

Final_Long_tp := (long_tp and last_longCondition > nz(last_long_tp[1]) and last_longCondition > nz(last_long_sl[1]))

Final_Short_tp := (short_tp and last_shortCondition > nz(last_short_tp[1]) and last_shortCondition > nz(last_short_sl[1]))

L_tp = iff(Final_Long_tp, fixnan(Position_Price) * (1 + tp_long) , na)

S_tp = iff(Final_Short_tp, fixnan(Position_Price) * (1 - tp_short) , na)

//TP SIGNALS--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

tplLevel = (in_longCondition and

(last_longCondition > nz(last_long_tp[1])) and

(last_longCondition > nz(last_long_sl[1])) and not Final_Long_sl[1]) ?

(nLongs > 1) ?

(fixnan(Position_Price) * (1 + tp_long)) : (last_open_longCondition * (1 + tp_long)) : na

tpsLevel = (in_shortCondition and

(last_shortCondition > nz(last_short_tp[1])) and

(last_shortCondition > nz(last_short_sl[1])) and not Final_Short_sl[1]) ?

(nShorts > 1) ?

(fixnan(Position_Price) * (1 - tp_short)) : (last_open_shortCondition * (1 - tp_short)) : na

//SL ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Risk = sl0

Percent_Capital = 99

sl = in_longCondition ? min(sl0,(((Risk) * 100) / (Percent_Capital * max(1, nLongs)))) :

in_shortCondition ? min(sl0,(((Risk) * 100) / (Percent_Capital * max(1, nShorts)))) : sl0

Normal_long_sl = ((in_longCondition and low <= ((1 - (sl / 100)) * (fixnan(Position_Price)))))

Normal_short_sl = ((in_shortCondition and high >= ((1 + (sl / 100)) * (fixnan(Position_Price)))))

last_long_sl := Normal_long_sl ? time : nz(last_long_sl[1])

last_short_sl := Normal_short_sl ? time : nz(last_short_sl[1])

Final_Long_sl := Normal_long_sl and last_longCondition > nz(last_long_sl[1]) and last_longCondition > nz(last_long_tp[1]) and not Final_Long_tp

Final_Short_sl := Normal_short_sl and last_shortCondition > nz(last_short_sl[1]) and last_shortCondition > nz(last_short_tp[1]) and not Final_Short_tp

//RE-ENTRY ON TP-HIT-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

if Final_Long_tp or Final_Long_sl

CondIni_long := -1

sum_long := 0.0

nLongs := na

if Final_Short_tp or Final_Short_sl

CondIni_short := 1

sum_short := 0.0

nShorts := na

// Colors ----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Bar_color = in_longCondition ? #009688 : in_shortCondition ? #f06292 : color.orange

barcolor (color = Bar_color)

//PLOTS==============================================================================================================================================================================================================================================================================================================

plot(L_tp, title = "TP_L", style = plot.style_cross, color = color.fuchsia, linewidth = 7 )

plot(S_tp, title = "TP_S", style = plot.style_cross, color = color.fuchsia, linewidth = 7 )

//Price plots ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

plot((nLongs > 1) or (nShorts > 1) ? Position_Price : na, title = "Price", color = in_longCondition ? color.aqua : color.orange, linewidth = 2, style = plot.style_cross)

plot(tplLevel, title="Long TP ", style = plot.style_cross, color=color.fuchsia, linewidth = 1 )

plot(tpsLevel, title="Short TP ", style = plot.style_cross, color=color.fuchsia, linewidth = 1 )

//PLOTSHAPES----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

plotshape(Final_Long_tp, title="TP Long Signal", style = shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny , text="TP", textcolor=color.red, transp = 0 )

plotshape(Final_Short_tp, title="TP Short Signal", style = shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny , text="TP", textcolor=color.green, transp = 0 )

plotshape(longCondition, title="Long", style=shape.triangleup, location=location.belowbar, color=color.blue, size=size.tiny , transp = 0 )

plotshape(shortCondition, title="Short", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny , transp = 0 )

// Backtest ==================================================================================================================================================================================================================================================================================================================================

if L_basic_condt

strategy.entry ("LONG", strategy.long )

if S_basic_condt

strategy.entry ("SHORT", strategy.short )

strategy.exit("TP_L", "LONG", profit = (abs((last_open_longCondition * (1 + tp_long)) - last_open_longCondition) / syminfo.mintick), limit = nLongs >= 1 ? strategy.position_avg_price * (1 + tp_long) : na, loss = (abs((last_open_longCondition*(1-(sl/100)))-last_open_longCondition)/syminfo.mintick))

strategy.exit("TP_S", "SHORT", profit = (abs((last_open_shortCondition * (1 - tp_short)) - last_open_shortCondition) / syminfo.mintick), limit = nShorts >= 1 ? strategy.position_avg_price*(1-(tp_short)) : na, loss = (abs((last_open_shortCondition*(1+(sl/100)))-last_open_shortCondition)/syminfo.mintick))

//By BabehDyo