Estratégia de negociação quantitativa baseada em filtro de tendência dupla

Visão geral

É uma estratégia que utiliza um filtro de tendência dupla para quantificar a negociação. Esta estratégia combina simultaneamente um filtro de tendência global e um filtro de tendência local, garantindo que as posições sejam abertas apenas quando a direção da tendência é correta. Além disso, a estratégia configura várias outras condições de filtragem, como filtros RSI, filtros de preço e filtros de inclinação, para aumentar ainda mais a confiabilidade do sinal de negociação.

Princípio da estratégia

A lógica central da estratégia é baseada em um filtro de tendência dupla. O filtro de tendência global baseia-se no movimento geral do mercado baseado no EMA de alto período, e o filtro de tendência local baseia-se no movimento local baseado no EMA de baixo período.

Especificamente, a estratégia calcula a linha EMA do BTCUSDT para determinar se o mercado global está em uma tendência ascendente ou descendente, o filtro de tendência global. Ao mesmo tempo, a estratégia calcula a linha EMA do contrato e determina o movimento do mercado local, o filtro de tendência local. Quando os dois julgam a tendência coincidente, em combinação com vários outros filtros auxiliares, a estratégia gera um sinal de negociação e prevê a abertura de posição no preço de parada de perda.

Depois de determinar o sinal de negociação, a estratégia abre a posição imediatamente. Ao mesmo tempo, a estratégia define previamente o preço de parada e o preço de parada. Quando o preço aciona a parada ou a perda, a estratégia automaticamente pára ou pára.

Análise de vantagens

É uma estratégia de negociação quantitativa estável e confiável, com as principais vantagens:

O mecanismo de filtragem de tendência dupla permite a filtragem da maioria dos sinais falsos, tornando os sinais de negociação mais confiáveis e precisos.

A combinação de vários filtros auxiliares, como filtros RSI, filtros de preço, etc., aumenta ainda mais a qualidade do sinal.

A operação automática do Stop Loss, sem a necessidade de monitorização manual, reduz o risco de negociação.

Os parâmetros da estratégia podem ser customizados para mais variedades de negociação, com maior adaptabilidade.

A ideia estratégica é clara e fácil de entender, facilitando a otimização e melhoria, com grande espaço para expansão.

Análise de Riscos

Apesar de ter muitos benefícios, a estratégia ainda apresenta alguns riscos de transação, que se concentram em:

Os filtros de tendência dupla determinam pontos de entrada com pouca precisão. Pode ser otimizado ajustando os parâmetros do filtro.

O preço de stop loss pode ser impreciso e pode ser prematuro. Pode-se testar diferentes combinações de parâmetros para encontrar a melhor solução.

A escolha inadequada da variedade e do período de negociação pode levar à invalidez da estratégia. Recomenda-se ajuste e teste de parâmetros para diferentes variedades de negociação.

Existe um certo risco de sobre-ajuste. É necessário fazer um retrospecto em mais ambientes de mercado para garantir a estabilidade da estratégia.

Direção de otimização

A estratégia pode ser melhorada principalmente nas seguintes direções:

Ajustar os parâmetros do duplo filtro para encontrar a melhor combinação;

Testar e selecionar os filtros auxiliares mais adequados;

Otimizar os algoritmos de stop loss para torná-los mais inteligentes;

A tentativa de introduzir ferramentas como a aprendizagem de máquina para a dinâmica de implementação da estratégia;

A estabilidade da estratégia pode ser melhorada através da retrospectiva de mais variedades de negociação e de períodos mais longos.

Resumir

A estratégia em geral é uma estratégia de negociação quantitativa estável, precisa e fácil de otimizar. Ela usa um filtro de tendência dupla em combinação com vários filtros auxiliares para gerar um sinal de negociação, que pode filtrar a maior parte do ruído, tornando o sinal mais preciso e confiável.

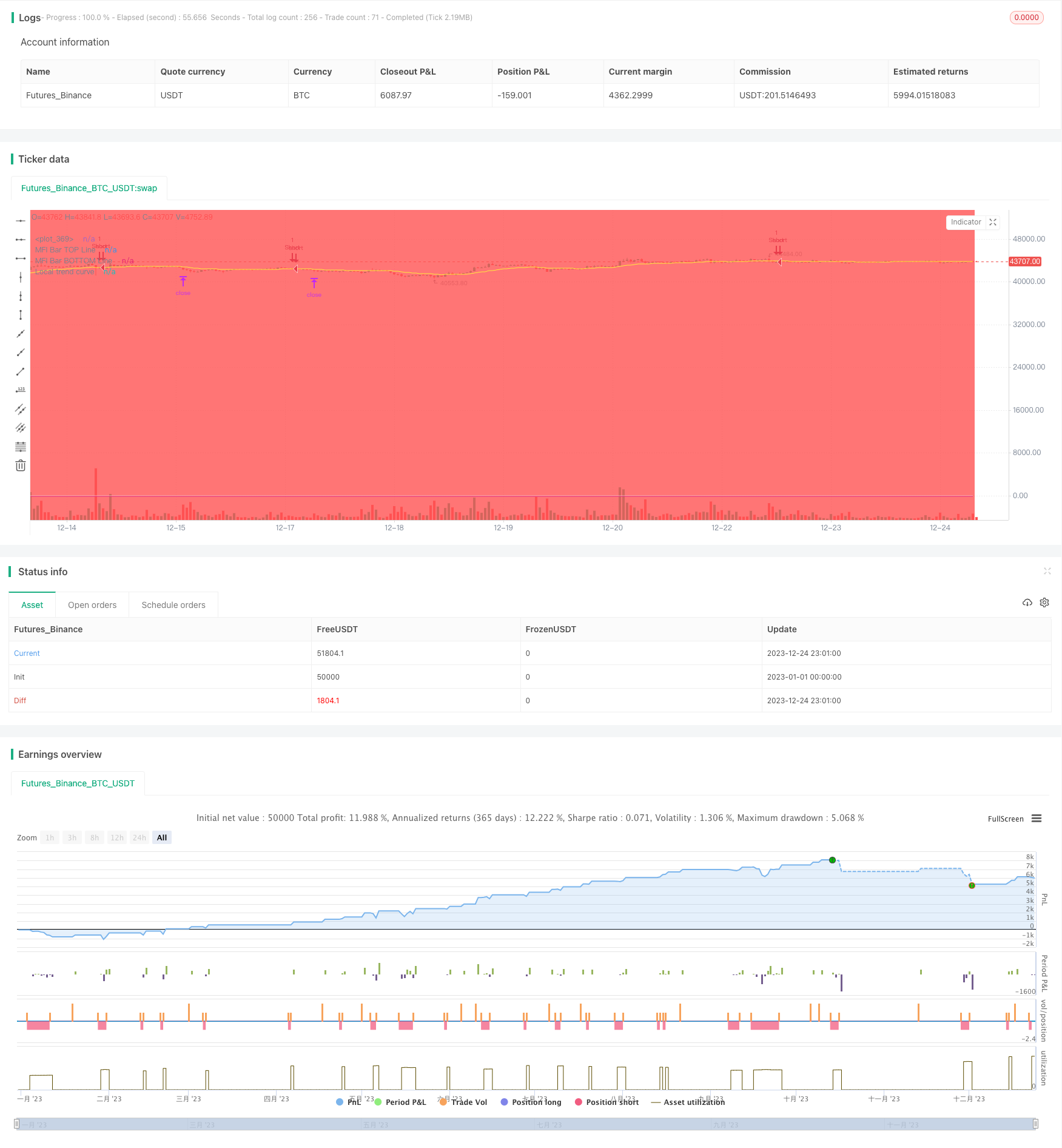

/*backtest

start: 2023-01-01 00:00:00

end: 2023-12-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title = 'Cipher_B', overlay=true )

// PARAMETERS {

// WaveTrend

wtShow = input(true, title = 'Show WaveTrend', type = input.bool)

wtBuyShow = input(true, title = 'Show Buy dots', type = input.bool)

wtGoldShow = input(true, title = 'Show Gold dots', type = input.bool)

wtSellShow = input(true, title = 'Show Sell dots', type = input.bool)

wtDivShow = input(true, title = 'Show Div. dots', type = input.bool)

vwapShow = input(true, title = 'Show Fast WT', type = input.bool)

wtChannelLen = input(9, title = 'WT Channel Length', type = input.integer)

wtAverageLen = input(12, title = 'WT Average Length', type = input.integer)

wtMASource = input(hlc3, title = 'WT MA Source', type = input.source)

wtMALen = input(3, title = 'WT MA Length', type = input.integer)

// WaveTrend Overbought & Oversold lines

obLevel = input(53, title = 'WT Overbought Level 1', type = input.integer)

obLevel2 = input(60, title = 'WT Overbought Level 2', type = input.integer)

obLevel3 = input(100, title = 'WT Overbought Level 3', type = input.integer)

osLevel = input(-53, title = 'WT Oversold Level 1', type = input.integer)

osLevel2 = input(-60, title = 'WT Oversold Level 2', type = input.integer)

osLevel3 = input(-75, title = 'WT Oversold Level 3', type = input.integer)

// Divergence WT

wtShowDiv = input(true, title = 'Show WT Regular Divergences', type = input.bool)

wtShowHiddenDiv = input(false, title = 'Show WT Hidden Divergences', type = input.bool)

showHiddenDiv_nl = input(true, title = 'Not apply OB/OS Limits on Hidden Divergences', type = input.bool)

wtDivOBLevel = input(45, title = 'WT Bearish Divergence min', type = input.integer)

wtDivOSLevel = input(-65, title = 'WT Bullish Divergence min', type = input.integer)

// Divergence extra range

wtDivOBLevel_addshow = input(false, title = 'Show 2nd WT Regular Divergences', type = input.bool)

wtDivOBLevel_add = input(15, title = 'WT 2nd Bearish Divergence', type = input.integer)

wtDivOSLevel_add = input(-40, title = 'WT 2nd Bullish Divergence 15 min', type = input.integer)

// RSI+MFI

rsiMFIShow = input(true, title = 'Show MFI', type = input.bool)

rsiMFIperiod = input(60,title = 'MFI Period', type = input.integer)

rsiMFIMultiplier = input(150, title = 'MFI Area multiplier', type = input.float)

rsiMFIPosY = input(2.5, title = 'MFI Area Y Pos', type = input.float)

// RSI

rsiShow = input(false, title = 'Show RSI', type = input.bool)

rsiSRC = input(close, title = 'RSI Source', type = input.source)

rsiLen = input(14, title = 'RSI Length', type = input.integer)

rsiOversold = input(30, title = 'RSI Oversold', minval = 50, maxval = 100, type = input.integer)

rsiOverbought = input(60, title = 'RSI Overbought', minval = 0, maxval = 50, type = input.integer)

// Divergence RSI

rsiShowDiv = input(false, title = 'Show RSI Regular Divergences', type = input.bool)

rsiShowHiddenDiv = input(false, title = 'Show RSI Hidden Divergences', type = input.bool)

rsiDivOBLevel = input(60, title = 'RSI Bearish Divergence min', type = input.integer)

rsiDivOSLevel = input(30, title = 'RSI Bullish Divergence min', type = input.integer)

// RSI Stochastic

stochShow = input(true, title = 'Show Stochastic RSI', type = input.bool)

stochUseLog = input(true, title=' Use Log?', type = input.bool)

stochAvg = input(false, title='Use Average of both K & D', type = input.bool)

stochSRC = input(close, title = 'Stochastic RSI Source', type = input.source)

stochLen = input(14, title = 'Stochastic RSI Length', type = input.integer)

stochRsiLen = input(14, title = 'RSI Length ', type = input.integer)

stochKSmooth = input(3, title = 'Stochastic RSI K Smooth', type = input.integer)

stochDSmooth = input(3, title = 'Stochastic RSI D Smooth', type = input.integer)

// Divergence stoch

stochShowDiv = input(false, title = 'Show Stoch Regular Divergences', type = input.bool)

stochShowHiddenDiv = input(false, title = 'Show Stoch Hidden Divergences', type = input.bool)

// Schaff Trend Cycle

tcLine = input(false, title="Show Schaff TC line", type=input.bool)

tcSRC = input(close, title = 'Schaff TC Source', type = input.source)

tclength = input(10, title="Schaff TC", type=input.integer)

tcfastLength = input(23, title="Schaff TC Fast Lenght", type=input.integer)

tcslowLength = input(50, title="Schaff TC Slow Length", type=input.integer)

tcfactor = input(0.5, title="Schaff TC Factor", type=input.float)

// Sommi Flag

sommiFlagShow = input(false, title = 'Show Sommi flag', type = input.bool)

sommiShowVwap = input(false, title = 'Show Sommi F. Wave', type = input.bool)

sommiVwapTF = input('720', title = 'Sommi F. Wave timeframe', type = input.string)

sommiVwapBearLevel = input(0, title = 'F. Wave Bear Level (less than)', type = input.integer)

sommiVwapBullLevel = input(0, title = 'F. Wave Bull Level (more than)', type = input.integer)

soomiFlagWTBearLevel = input(0, title = 'WT Bear Level (more than)', type = input.integer)

soomiFlagWTBullLevel = input(0, title = 'WT Bull Level (less than)', type = input.integer)

soomiRSIMFIBearLevel = input(0, title = 'Money flow Bear Level (less than)', type = input.integer)

soomiRSIMFIBullLevel = input(0, title = 'Money flow Bull Level (more than)', type = input.integer)

// Sommi Diamond

sommiDiamondShow = input(false, title = 'Show Sommi diamond', type = input.bool)

sommiHTCRes = input('60', title = 'HTF Candle Res. 1', type = input.string)

sommiHTCRes2 = input('240', title = 'HTF Candle Res. 2', type = input.string)

soomiDiamondWTBearLevel = input(0, title = 'WT Bear Level (More than)', type = input.integer)

soomiDiamondWTBullLevel = input(0, title = 'WT Bull Level (Less than)', type = input.integer)

// macd Colors

macdWTColorsShow = input(false, title = 'Show MACD Colors', type = input.bool)

macdWTColorsTF = input('240', title = 'MACD Colors MACD TF', type = input.string)

darkMode = input(false, title = 'Dark mode', type = input.bool)

// Colors

colorRed = #ff0000

colorPurple = #e600e6

colorGreen = #3fff00

colorOrange = #e2a400

colorYellow = #ffe500

colorWhite = #ffffff

colorPink = #ff00f0

colorBluelight = #31c0ff

colorWT1 = #90caf9

colorWT2 = #0d47a1

colorWT2_ = #131722

colormacdWT1a = #4caf58

colormacdWT1b = #af4c4c

colormacdWT1c = #7ee57e

colormacdWT1d = #ff3535

colormacdWT2a = #305630

colormacdWT2b = #310101

colormacdWT2c = #132213

colormacdWT2d = #770000

// } PARAMETERS

// FUNCTIONS {

// Divergences

f_top_fractal(src) => src[4] < src[2] and src[3] < src[2] and src[2] > src[1] and src[2] > src[0]

f_bot_fractal(src) => src[4] > src[2] and src[3] > src[2] and src[2] < src[1] and src[2] < src[0]

f_fractalize(src) => f_top_fractal(src) ? 1 : f_bot_fractal(src) ? -1 : 0

f_findDivs(src, topLimit, botLimit, useLimits) =>

fractalTop = f_fractalize(src) > 0 and (useLimits ? src[2] >= topLimit : true) ? src[2] : na

fractalBot = f_fractalize(src) < 0 and (useLimits ? src[2] <= botLimit : true) ? src[2] : na

highPrev = valuewhen(fractalTop, src[2], 0)[2]

highPrice = valuewhen(fractalTop, high[2], 0)[2]

lowPrev = valuewhen(fractalBot, src[2], 0)[2]

lowPrice = valuewhen(fractalBot, low[2], 0)[2]

bearSignal = fractalTop and high[2] > highPrice and src[2] < highPrev

bullSignal = fractalBot and low[2] < lowPrice and src[2] > lowPrev

bearDivHidden = fractalTop and high[2] < highPrice and src[2] > highPrev

bullDivHidden = fractalBot and low[2] > lowPrice and src[2] < lowPrev

[fractalTop, fractalBot, lowPrev, bearSignal, bullSignal, bearDivHidden, bullDivHidden]

// RSI+MFI

f_rsimfi(_period, _multiplier, _tf) => security(syminfo.tickerid, _tf, sma(((close - open) / (high - low)) * _multiplier, _period) - rsiMFIPosY)

// WaveTrend

f_wavetrend(src, chlen, avg, malen, tf) =>

tfsrc = security(syminfo.tickerid, tf, src)

esa = ema(tfsrc, chlen)

de = ema(abs(tfsrc - esa), chlen)

ci = (tfsrc - esa) / (0.015 * de)

wt1 = security(syminfo.tickerid, tf, ema(ci, avg))

wt2 = security(syminfo.tickerid, tf, sma(wt1, malen))

wtVwap = wt1 - wt2

wtOversold = wt2 <= osLevel

wtOverbought = wt2 >= obLevel

wtCross = cross(wt1, wt2)

wtCrossUp = wt2 - wt1 <= 0

wtCrossDown = wt2 - wt1 >= 0

wtCrosslast = cross(wt1[2], wt2[2])

wtCrossUplast = wt2[2] - wt1[2] <= 0

wtCrossDownlast = wt2[2] - wt1[2] >= 0

[wt1, wt2, wtOversold, wtOverbought, wtCross, wtCrossUp, wtCrossDown, wtCrosslast, wtCrossUplast, wtCrossDownlast, wtVwap]

// Schaff Trend Cycle

f_tc(src, length, fastLength, slowLength) =>

ema1 = ema(src, fastLength)

ema2 = ema(src, slowLength)

macdVal = ema1 - ema2

alpha = lowest(macdVal, length)

beta = highest(macdVal, length) - alpha

gamma = (macdVal - alpha) / beta * 100

gamma := beta > 0 ? gamma : nz(gamma[1])

delta = gamma

delta := na(delta[1]) ? delta : delta[1] + tcfactor * (gamma - delta[1])

epsilon = lowest(delta, length)

zeta = highest(delta, length) - epsilon

eta = (delta - epsilon) / zeta * 100

eta := zeta > 0 ? eta : nz(eta[1])

stcReturn = eta

stcReturn := na(stcReturn[1]) ? stcReturn : stcReturn[1] + tcfactor * (eta - stcReturn[1])

stcReturn

// Stochastic RSI

f_stochrsi(_src, _stochlen, _rsilen, _smoothk, _smoothd, _log, _avg) =>

src = _log ? log(_src) : _src

rsi = rsi(src, _rsilen)

kk = sma(stoch(rsi, rsi, rsi, _stochlen), _smoothk)

d1 = sma(kk, _smoothd)

avg_1 = avg(kk, d1)

k = _avg ? avg_1 : kk

[k, d1]

// MACD

f_macd(src, fastlen, slowlen, sigsmooth, tf) =>

fast_ma = security(syminfo.tickerid, tf, ema(src, fastlen))

slow_ma = security(syminfo.tickerid, tf, ema(src, slowlen))

macd = fast_ma - slow_ma,

signal = security(syminfo.tickerid, tf, sma(macd, sigsmooth))

hist = macd - signal

[macd, signal, hist]

// MACD Colors on WT

f_macdWTColors(tf) =>

hrsimfi = f_rsimfi(rsiMFIperiod, rsiMFIMultiplier, tf)

[macd, signal, hist] = f_macd(close, 28, 42, 9, macdWTColorsTF)

macdup = macd >= signal

macddown = macd <= signal

macdWT1Color = macdup ? hrsimfi > 0 ? colormacdWT1c : colormacdWT1a : macddown ? hrsimfi < 0 ? colormacdWT1d : colormacdWT1b : na

macdWT2Color = macdup ? hrsimfi < 0 ? colormacdWT2c : colormacdWT2a : macddown ? hrsimfi < 0 ? colormacdWT2d : colormacdWT2b : na

[macdWT1Color, macdWT2Color]

// Get higher timeframe candle

f_getTFCandle(_tf) =>

_open = security(heikinashi(syminfo.tickerid), _tf, open, barmerge.gaps_off, barmerge.lookahead_off)

_close = security(heikinashi(syminfo.tickerid), _tf, close, barmerge.gaps_off, barmerge.lookahead_off)

_high = security(heikinashi(syminfo.tickerid), _tf, high, barmerge.gaps_off, barmerge.lookahead_off)

_low = security(heikinashi(syminfo.tickerid), _tf, low, barmerge.gaps_off, barmerge.lookahead_off)

hl2 = (_high + _low) / 2.0

newBar = change(_open)

candleBodyDir = _close > _open

[candleBodyDir, newBar]

// Sommi flag

f_findSommiFlag(tf, wt1, wt2, rsimfi, wtCross, wtCrossUp, wtCrossDown) =>

[hwt1, hwt2, hwtOversold, hwtOverbought, hwtCross, hwtCrossUp, hwtCrossDown, hwtCrosslast, hwtCrossUplast, hwtCrossDownlast, hwtVwap] = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, tf)

bearPattern = rsimfi < soomiRSIMFIBearLevel and

wt2 > soomiFlagWTBearLevel and

wtCross and

wtCrossDown and

hwtVwap < sommiVwapBearLevel

bullPattern = rsimfi > soomiRSIMFIBullLevel and

wt2 < soomiFlagWTBullLevel and

wtCross and

wtCrossUp and

hwtVwap > sommiVwapBullLevel

[bearPattern, bullPattern, hwtVwap]

f_findSommiDiamond(tf, tf2, wt1, wt2, wtCross, wtCrossUp, wtCrossDown) =>

[candleBodyDir, newBar] = f_getTFCandle(tf)

[candleBodyDir2, newBar2] = f_getTFCandle(tf2)

bearPattern = wt2 >= soomiDiamondWTBearLevel and

wtCross and

wtCrossDown and

not candleBodyDir and

not candleBodyDir2

bullPattern = wt2 <= soomiDiamondWTBullLevel and

wtCross and

wtCrossUp and

candleBodyDir and

candleBodyDir2

[bearPattern, bullPattern]

// } FUNCTIONS

// CALCULATE INDICATORS {

// RSI

rsi = rsi(rsiSRC, rsiLen)

rsiColor = rsi <= rsiOversold ? colorGreen : rsi >= rsiOverbought ? colorRed : colorPurple

// RSI + MFI Area

rsiMFI = f_rsimfi(rsiMFIperiod, rsiMFIMultiplier, timeframe.period)

rsiMFIColor = rsiMFI > 0 ? #3ee145 : #ff3d2e

// Calculates WaveTrend

[wt1, wt2, wtOversold, wtOverbought, wtCross, wtCrossUp, wtCrossDown, wtCross_last, wtCrossUp_last, wtCrossDown_last, wtVwap] = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, timeframe.period)

// Stochastic RSI

[stochK, stochD] = f_stochrsi(stochSRC, stochLen, stochRsiLen, stochKSmooth, stochDSmooth, stochUseLog, stochAvg)

// Schaff Trend Cycle

tcVal = f_tc(tcSRC, tclength, tcfastLength, tcslowLength)

// Sommi flag

[sommiBearish, sommiBullish, hvwap] = f_findSommiFlag(sommiVwapTF, wt1, wt2, rsiMFI, wtCross, wtCrossUp, wtCrossDown)

//Sommi diamond

[sommiBearishDiamond, sommiBullishDiamond] = f_findSommiDiamond(sommiHTCRes, sommiHTCRes2, wt1, wt2, wtCross, wtCrossUp, wtCrossDown)

// macd colors

[macdWT1Color, macdWT2Color] = f_macdWTColors(macdWTColorsTF)

// WT Divergences

[wtFractalTop, wtFractalBot, wtLow_prev, wtBearDiv, wtBullDiv, wtBearDivHidden, wtBullDivHidden] = f_findDivs(wt2, wtDivOBLevel, wtDivOSLevel, true)

[wtFractalTop_add, wtFractalBot_add, wtLow_prev_add, wtBearDiv_add, wtBullDiv_add, wtBearDivHidden_add, wtBullDivHidden_add] = f_findDivs(wt2, wtDivOBLevel_add, wtDivOSLevel_add, true)

[wtFractalTop_nl, wtFractalBot_nl, wtLow_prev_nl, wtBearDiv_nl, wtBullDiv_nl, wtBearDivHidden_nl, wtBullDivHidden_nl] = f_findDivs(wt2, 0, 0, false)

wtBearDivHidden_ = showHiddenDiv_nl ? wtBearDivHidden_nl : wtBearDivHidden

wtBullDivHidden_ = showHiddenDiv_nl ? wtBullDivHidden_nl : wtBullDivHidden

wtBearDivColor = (wtShowDiv and wtBearDiv) or (wtShowHiddenDiv and wtBearDivHidden_) ? colorRed : na

wtBullDivColor = (wtShowDiv and wtBullDiv) or (wtShowHiddenDiv and wtBullDivHidden_) ? colorGreen : na

wtBearDivColor_add = (wtShowDiv and (wtDivOBLevel_addshow and wtBearDiv_add)) or (wtShowHiddenDiv and (wtDivOBLevel_addshow and wtBearDivHidden_add)) ? #9a0202 : na

wtBullDivColor_add = (wtShowDiv and (wtDivOBLevel_addshow and wtBullDiv_add)) or (wtShowHiddenDiv and (wtDivOBLevel_addshow and wtBullDivHidden_add)) ? #1b5e20 : na

// RSI Divergences

[rsiFractalTop, rsiFractalBot, rsiLow_prev, rsiBearDiv, rsiBullDiv, rsiBearDivHidden, rsiBullDivHidden] = f_findDivs(rsi, rsiDivOBLevel, rsiDivOSLevel, true)

[rsiFractalTop_nl, rsiFractalBot_nl, rsiLow_prev_nl, rsiBearDiv_nl, rsiBullDiv_nl, rsiBearDivHidden_nl, rsiBullDivHidden_nl] = f_findDivs(rsi, 0, 0, false)

rsiBearDivHidden_ = showHiddenDiv_nl ? rsiBearDivHidden_nl : rsiBearDivHidden

rsiBullDivHidden_ = showHiddenDiv_nl ? rsiBullDivHidden_nl : rsiBullDivHidden

rsiBearDivColor = (rsiShowDiv and rsiBearDiv) or (rsiShowHiddenDiv and rsiBearDivHidden_) ? colorRed : na

rsiBullDivColor = (rsiShowDiv and rsiBullDiv) or (rsiShowHiddenDiv and rsiBullDivHidden_) ? colorGreen : na

// Stoch Divergences

[stochFractalTop, stochFractalBot, stochLow_prev, stochBearDiv, stochBullDiv, stochBearDivHidden, stochBullDivHidden] = f_findDivs(stochK, 0, 0, false)

stochBearDivColor = (stochShowDiv and stochBearDiv) or (stochShowHiddenDiv and stochBearDivHidden) ? colorRed : na

stochBullDivColor = (stochShowDiv and stochBullDiv) or (stochShowHiddenDiv and stochBullDivHidden) ? colorGreen : na

// Small Circles WT Cross

signalColor = wt2 - wt1 > 0 ? color.red : color.lime

// Buy signal.

buySignal = wtCross and wtCrossUp and wtOversold

buySignalDiv = (wtShowDiv and wtBullDiv) or

(wtShowDiv and wtBullDiv_add) or

(stochShowDiv and stochBullDiv) or

(rsiShowDiv and rsiBullDiv)

buySignalDiv_color = wtBullDiv ? colorGreen :

wtBullDiv_add ? color.new(colorGreen, 60) :

rsiShowDiv ? colorGreen : na

// Sell signal

sellSignal = wtCross and wtCrossDown and wtOverbought

sellSignalDiv = (wtShowDiv and wtBearDiv) or

(wtShowDiv and wtBearDiv_add) or

(stochShowDiv and stochBearDiv) or

(rsiShowDiv and rsiBearDiv)

sellSignalDiv_color = wtBearDiv ? colorRed :

wtBearDiv_add ? color.new(colorRed, 60) :

rsiBearDiv ? colorRed : na

// Gold Buy

lastRsi = valuewhen(wtFractalBot, rsi[2], 0)[2]

wtGoldBuy = ((wtShowDiv and wtBullDiv) or (rsiShowDiv and rsiBullDiv)) and

wtLow_prev <= osLevel3 and

wt2 > osLevel3 and

wtLow_prev - wt2 <= -5 and

lastRsi < 30

// } CALCULATE INDICATORS

// DRAW {

bgcolor(darkMode ? color.new(#000000, 80) : na)

zLine = plot(0, color = color.new(colorWhite, 50))

// MFI BAR

rsiMfiBarTopLine = plot(rsiMFIShow ? -95 : na, title = 'MFI Bar TOP Line', transp = 100)

rsiMfiBarBottomLine = plot(rsiMFIShow ? -99 : na, title = 'MFI Bar BOTTOM Line', transp = 100)

fill(rsiMfiBarTopLine, rsiMfiBarBottomLine, title = 'MFI Bar Colors', color = rsiMFIColor, transp = 75)

Global=input(title="Use Global trend?", defval=true, type=input.bool, group="Trend Settings")

regimeFilter_frame=input(title="Global trend timeframe", defval="5", options=['D','60','5'], group="Trend Settings")

regimeFilter_length=input(title="Global trend length", defval=1700, type=input.integer, group="Trend Settings")

localFilter_length=input(title="Local trend filter length", defval=20, type=input.integer, group="Trend Settings")

localFilter_frame=input(title="Local trend filter timeframe", defval="60", options=['D','60', '5'], group="Trend Settings")

Div_1=input(title="Only divergencies for long", defval=true, type=input.bool, group="Trend Settings")

Div_2=input(title="Only divergencies for short", defval=true, type=input.bool, group="Trend Settings")

sommi_diamond_on=input(title="Sommi diamond alerts", defval=false, type=input.bool, group="Trend Settings")

Cancel_all=input(title="Cancel all positions if price crosses local sma? (yellow line)", defval=false, type=input.bool, group="Trend Settings")

a_1=input(title="TP long", defval=0.95,step=0.5, type=input.float, group="TP/SL Settings")

a_1_div=input(title="TP long div", defval=0.95,step=0.5, type=input.float, group="TP/SL Settings")

a_2=input(title="TP short", defval=0.95,step=1, type=input.float, group="TP/SL Settings")

b_1=input(title="SL long", defval=5,step=0.1, type=input.float, group="TP/SL Settings")

b_2=input(title="SL short", defval=5,step=0.1, type=input.float, group="TP/SL Settings")

RSI_filter_checkbox = input(title="RSI filter ON", defval=false, type=input.bool, group="Trend Settings")

Price_filter_checkbox=input(title="Price filter ON", defval=false, type=input.bool, group="Trend Settings")

Price_filter_1_long=input(title="Long Price filter from", defval=1000, type=input.integer, group="Trend Settings")

Price_filter_2_long=input(title="Long Price filter to", defval=1200, type=input.integer, group="Trend Settings")

Price_filter_1_short=input(title="Short Price filter from", defval=1000, type=input.integer, group="Trend Settings")

Price_filter_2_short=input(title="Short Price filter to", defval=1200, type=input.integer, group="Trend Settings")

Local_filter_checkbox=input(title="Use Local trend?", defval=true, type=input.bool, group="Trend Settings")

slope_checkbox = input(title="Use Slope filter?", defval=false, type=input.bool, group="Slope Settings")

slope_number_long = input(title="Slope number long", defval=-0.3,step=0.01, type=input.float, group="Slope Settings")

slope_number_short = input(title="Slope number short", defval=0.16,step=0.01, type=input.float, group="Slope Settings")

slope_period = input(title="Slope period", defval=300, type=input.integer, group="Slope Settings")

long_on = input(title="Only long?", defval=true, type=input.bool, group="Position Settings")

short_on = input(title="Only short?", defval=true, type=input.bool, group="Position Settings")

volume_ETH_spot_checkbox = input(title="Volume filter?", defval=false, type=input.bool, group="Volume Settings")

volume_ETH_spot_number_more = input(title="Volume no more than:", defval=3700, type=input.integer, group="Volume Settings")

volume_ETH_spot_number_less = input(title="Volume no less than:", defval=600, type=input.integer, group="Volume Settings")

limit_checkbox = input(title="Shift open position?", defval=false, type=input.bool, group="Shift Settings")

limit_shift = input(title="How many % to shift?", defval=0.5,step=0.01, type=input.float, group="Shift Settings")

cancel_in = input(title="Cancel position in #bars?", defval=false, type=input.bool, group="Cancel Settings")

cancel_in_num = input(title="Number of bars", defval=96, type=input.integer, group="Cancel Settings")

//Name of ticker

_str=tostring(syminfo.ticker)

_chars = str.split(_str, "")

int _len = array.size(_chars)

int _beg = max(0, _len - 4)

string[] _substr = array.new_string(0)

if _beg < _len

_substr := array.slice(_chars, 0, _beg)

string _return = array.join(_substr, "")

//Hour sma

basis = security(syminfo.tickerid, localFilter_frame, ema(close, localFilter_length))

plot(basis, title="Local trend curve", color=color.yellow, style=plot.style_linebr)

//Trend calculation with EMA

f_sec(_market, _res, _exp) => security(_market, _res, _exp[barstate.isconfirmed ? 0 : 1])

ema = sma(close, regimeFilter_length)

emaValue = f_sec("BTC_USDT:swap", regimeFilter_frame, ema)

marketPrice = f_sec("BTC_USDT:swap", regimeFilter_frame, close)

regimeFilter = Global?(marketPrice > emaValue or marketPrice[1] > emaValue[1]):true

reverse_regime=Global?(marketPrice < emaValue or marketPrice[1] < emaValue[1]):true

bgcolor(Global?regimeFilter ? color.green : color.red:color.yellow)

//Local trend

regimeFilter_local = Local_filter_checkbox ? close > basis: true //or close[1] > basis[1]

reverse_regime_local = Local_filter_checkbox ? close < basis: true //or close[1] < basis[1]

//RSI filter

up = rma(max(change(close), 0), 14)

down = rma(-min(change(close), 0), 14)

rsi_ = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsiMA = ema(rsi_,12)

//local incline

sma =security(syminfo.tickerid, '60', ema(close, 15))

slope = (sma - sma[slope_period]) / slope_period

slope_filter_long = slope_checkbox? slope > slope_number_long : true

slope_filter_short = slope_checkbox? slope < slope_number_short : true

var long_check = true

var short_check = true

if RSI_filter_checkbox

long_check:= rsiMA<40

short_check:= rsiMA>60

//

validlow = Div_1 ? buySignalDiv or wtGoldBuy : buySignal or buySignalDiv or wtGoldBuy

validhigh = Div_2 ? sellSignalDiv : sellSignal or sellSignalDiv

//check volume of ETHUSDT

volume_ETH_spot = volume

volume_ETH_spot_filter = volume_ETH_spot_checkbox? volume_ETH_spot < volume_ETH_spot_number_more and volume_ETH_spot > volume_ETH_spot_number_less : true

// Check if we have confirmation for our setup

var Price_long = true

if Price_filter_checkbox

Price_long:=close>Price_filter_1_long and close<Price_filter_2_long

var Price_short = true

if Price_filter_checkbox

Price_short:=close>Price_filter_1_short and close<Price_filter_2_short

validlong = sommi_diamond_on ? sommiBullishDiamond and strategy.position_size == 0 and barstate.isconfirmed and regimeFilter_local and regimeFilter : validlow and strategy.position_size == 0 and barstate.isconfirmed and regimeFilter_local and Price_long and long_check and slope_filter_long and volume_ETH_spot_filter

validshort = sommi_diamond_on ? sommiBearishDiamond and strategy.position_size == 0 and barstate.isconfirmed and reverse_regime_local and reverse_regime : validhigh and strategy.position_size == 0 and barstate.isconfirmed and reverse_regime_local and Price_short and short_check and slope_filter_short and volume_ETH_spot_filter

// Save trade stop & target & position size if a valid setup is detected

var tradeStopPrice = 0.0

var tradeTargetPrice = 0.0

var TP=0.0

var limit_price=0.0

//Detect valid long setups & trigger alert

if validlong

if buySignalDiv or wtGoldBuy

limit_price:=limit_checkbox? close*(1-limit_shift*0.01) : close

tradeStopPrice := limit_price*(1-b_1*0.01)

tradeTargetPrice := limit_price*(1+a_1_div*0.01)

TP:= a_1_div

else

limit_price:=limit_checkbox? close*(1-limit_shift*0.01) : close

tradeStopPrice := limit_price*(1-b_1*0.01)

tradeTargetPrice := limit_price*(1+a_1*0.01)

TP:= a_1

// if validlong

// if buySignalDiv or wtGoldBuy

// limit_price:=close

// tradeStopPrice := limit_price*(1-b_1*0.01)

// tradeTargetPrice := limit_price*(1+a_1_div*0.01)

// TP:= a_1_div

// else

// limit_price:=close

// tradeStopPrice := limit_price*(1-b_1*0.01)

// tradeTargetPrice := limit_price*(1+a_1*0.01)

// TP:= a_1

// Detect valid short setups & trigger alert

if validshort

limit_price:=limit_checkbox? close*(1+limit_shift*0.01) : close

tradeStopPrice := limit_price*(1+b_2*0.01)

tradeTargetPrice := limit_price*(1-a_2*0.01)

TP:= a_2

// if validshort

// limit_price:= close

// tradeStopPrice := limit_price*(1+b_2*0.01)

// tradeTargetPrice := limit_price*(1-a_2*0.01)

// TP:= a_2

if cancel_in and barssince(validlong) == cancel_in_num or barssince(validshort) == cancel_in_num

strategy.cancel_all()

if long_on

strategy.entry (id="Long", long=strategy.long, limit=limit_price, when=validlong, comment='{\n' + ' "name": "",\n' + ' "secret": "",\n' + ' "side": "buy",\n' + ' "symbol": '+'"'+_return+'"'+',\n' + ' "positionSide": "long"\n' + '}')

if short_on

strategy.entry (id="Short", long=strategy.short, limit=limit_price, when=validshort,comment='{\n' + ' "name": "",\n' + ' "secret": "",\n' + ' "side": "sell",\n' + ' "symbol": '+'"'+_return+'"'+',\n' + ' "positionSide": "short",\n' + ' "sl": {\n' + ' "enabled": true\n' + ' }\n' + '}')

// condition:=true

// if Cancel_all and strategy.position_size > 0 and (reverse_regime_local or reverse_regime)

// strategy.close_all(when=strategy.position_size != 0, comment='{\n' + ' "name": "",\n' + ' "secret": "",\n' + ' "side": "sell",\n' + ' "symbol": '+'"'+_return+'"'+',\n' + ' "positionSide": "flat"\n' + '}')

if Cancel_all and strategy.position_size > 0 and reverse_regime_local

strategy.close_all(when=strategy.position_size != 0, comment='{\n'

+ ' "name": "",\n'

+ ' "secret": "",\n'

+ ' "side": "sell",\n'

+ ' "symbol": '+'"'+_return+'"'+',\n'

+ ' "positionSide": "flat"\n'

+ '}')

if Cancel_all and strategy.position_size < 0 and regimeFilter_local

strategy.close_all(when=strategy.position_size != 0, comment='{\n'

+ ' "name": "",\n'

+ ' "secret": "",\n'

+ ' "side": "buy",\n'

+ ' "symbol": '+'"'+_return+'"'+',\n'

+ ' "positionSide": "flat"\n'

+ '}')

if cancel_in and strategy.position_size > 0 and barssince(validlong) > cancel_in_num

strategy.close_all(when=strategy.position_size != 0, comment='{\n'

+ ' "name": "",\n'

+ ' "secret": "",\n'

+ ' "side": "sell",\n'

+ ' "symbol": '+'"'+_return+'"'+',\n'

+ ' "positionSide": "flat"\n'

+ '}')

if cancel_in and strategy.position_size < 0 and barssince(validshort) > cancel_in_num

strategy.close_all(when=strategy.position_size != 0, comment='{\n'

+ ' "name": "",\n'

+ ' "secret": "",\n'

+ ' "side": "buy",\n'

+ ' "symbol": '+'"'+_return+'"'+',\n'

+ ' "positionSide": "flat"\n'

+ '}')

// Exit trades whenever our stop or target is hit

strategy.exit(id="Long Exit", from_entry="Long", limit=tradeTargetPrice, stop=tradeStopPrice, when=strategy.position_size > 0)

strategy.exit(id="Short Exit", from_entry="Short", limit=tradeTargetPrice,stop=tradeStopPrice, when=strategy.position_size < 0)