Uma otimização da tendência de média móvel dupla seguindo uma estratégia baseada na combinação de indicadores

Autora:ChaoZhang, Data: 2024-02-01 15:13:13Tags:

Resumo

Esta estratégia gera sinais de negociação através do cálculo de linhas médias móveis rápidas e lentas e combinando o indicador Parabolic SAR. Ela pertence à estratégia de tendência seguinte. Quando o MA rápido cruza o MA lento, a posição longa será aberta. Quando o MA rápido cruza abaixo do MA lento, a posição curta será aberta.

Princípio da estratégia

- Calcule linhas médias móveis rápidas e lentas.

- Compare as duas linhas de MA para determinar a tendência do mercado. Quando a MA rápida atravessa a MA lenta, indica uma tendência de alta. Quando a MA rápida atravessa abaixo da MA lenta, indica uma tendência de baixa.

- A confirmação adicional é feita verificando se o preço de fechamento está acima/abaixo do MA rápido. Somente quando o MA rápido cruza o MA lento e o preço de fechamento está acima do MA rápido, é gerado um sinal longo. Somente quando o MA rápido cruza o MA lento e o preço de fechamento está abaixo do MA rápido, é gerado um sinal curto.

- O SAR parabólico é usado para filtrar sinais falsos. Só quando todos os três critérios são atendidos, o sinal final é gerado.

- O indicador ATR é utilizado para calcular o preço de stop loss dinâmico.

Vantagens

- As linhas de MA determinam a tendência do mercado e evitam a negociação excessiva no mercado de gama.

- Filtros duplos reduzem significativamente o risco de fuga falsa.

- A estratégia de stop loss limita efetivamente a perda por negociação.

Riscos

- As estratégias de indicadores tendem a gerar falsos sinais

- Nenhuma consideração do risco de exposição à moeda

- Potencialmente perder tendência inicial na direção oposta

A estratégia pode ser otimizada nos seguintes aspectos:

- Otimizar os parâmetros de MA para se adequarem a um produto específico

- Adicionar outros indicadores ou modelos para filtragem de sinal

- Considere a cobertura em tempo real ou a conversão automática de moeda

Orientações para a otimização

- Otimizar os parâmetros de MA para melhor captar as tendências

- Aumentar a diversidade de modelos para melhorar a precisão do sinal

- Verificação de quadros de tempo múltiplos para evitar ser preso

- Melhorar a estratégia de stop loss para aumentar a estabilidade

Conclusão

Esta é uma típica combinação de média móvel dupla cruzada e indicadores de tendência após a estratégia. Comparando direções de MA rápidas e lentas, a tendência do mercado é determinada. Vários indicadores de filtro são usados para evitar falsos sinais. Ao mesmo tempo, a função stop loss é implementada para controlar a perda por negócio. A vantagem é que a lógica da estratégia é simples e fácil de entender e otimizar. A desvantagem é que, como uma ferramenta de tendência grosseira, ainda há espaço para melhorar a precisão do sinal, introduzindo modelos de aprendizado de máquina, por exemplo.

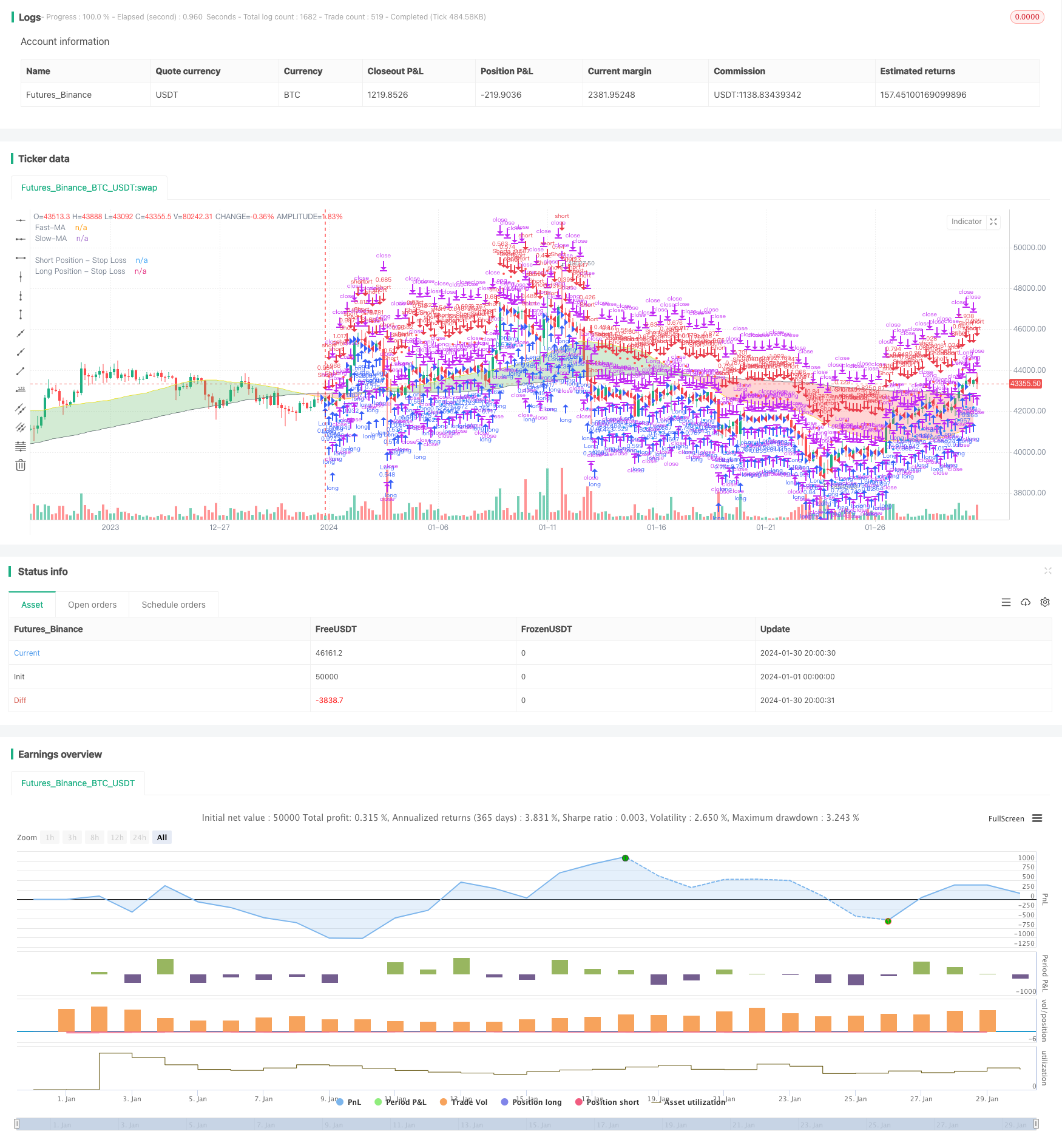

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © sosacur01

//@version=5

strategy(title="2 MA | Trend Following", overlay=true, pyramiding=1, commission_type=strategy.commission.percent, commission_value=0.2, initial_capital=10000)

//==========================================

//BACKTEST RANGE

useDateFilter = input.bool(true, title="Filter Date Range of Backtest",

group="Backtest Time Period")

backtestStartDate = input(timestamp("1 jan 2000"),

title="Start Date", group="Backtest Time Period",

tooltip="This start date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

backtestEndDate = input(timestamp("1 Jul 2100"),

title="End Date", group="Backtest Time Period",

tooltip="This end date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

inTradeWindow = true

if not inTradeWindow and inTradeWindow[1]

strategy.cancel_all()

strategy.close_all(comment="Date Range Exit")

//--------------------------------------

//LONG/SHORT POSITION ON/OFF INPUT

LongPositions = input.bool(title='On/Off Long Postion', defval=true, group="Long & Short Position")

ShortPositions = input.bool(title='On/Off Short Postion', defval=true, group="Long & Short Position")

//---------------------------------------

//SLOW MA INPUTS

averageType1 = input.string(defval="SMA", group="Slow MA Inputs", title="Slow MA Type", options=["SMA", "EMA", "WMA", "HMA", "RMA", "SWMA", "ALMA", "VWMA", "VWAP"])

averageLength1 = input.int(defval=160, group="Slow MA Inputs", title="Slow MA Length", minval=50)

averageSource1 = input(close, title="Slow MA Source", group="Slow MA Inputs")

//SLOW MA TYPE

MovAvgType1(averageType1, averageSource1, averageLength1) =>

switch str.upper(averageType1)

"SMA" => ta.sma(averageSource1, averageLength1)

"EMA" => ta.ema(averageSource1, averageLength1)

"WMA" => ta.wma(averageSource1, averageLength1)

"HMA" => ta.hma(averageSource1, averageLength1)

"RMA" => ta.rma(averageSource1, averageLength1)

"SWMA" => ta.swma(averageSource1)

"ALMA" => ta.alma(averageSource1, averageLength1, 0.85, 6)

"VWMA" => ta.vwma(averageSource1, averageLength1)

"VWAP" => ta.vwap(averageSource1)

=> runtime.error("Moving average type '" + averageType1 +

"' not found!"), na

//----------------------------------

//FAST MA INPUTS

averageType2 = input.string(defval="SMA", group="Fast MA Inputs", title="Fast MA Type", options=["SMA","EMA","WMA","HMA","RMA","SWMA","ALMA","VWMA","VWAP"])

averageLength2 = input.int(defval=40, group="Fast MA Inputs", title="Fast MA Length", maxval=40)

averageSource2 = input(close, title="Fast MA Source", group="Fast MA Inputs")

//FAST MA TYPE

MovAvgType2(averageType2, averageSource2, averageLength2) =>

switch str.upper(averageType2)

"SMA" => ta.sma(averageSource2, averageLength2)

"EMA" => ta.ema(averageSource2, averageLength2)

"WMA" => ta.wma(averageSource2, averageLength2)

"HMA" => ta.hma(averageSource2, averageLength2)

"RMA" => ta.rma(averageSource2, averageLength2)

"SWMA" => ta.swma(averageSource2)

"ALMA" => ta.alma(averageSource2, averageLength2, 0.85, 6)

"VWMA" => ta.vwma(averageSource2, averageLength2)

"VWAP" => ta.vwap(averageSource2)

=> runtime.error("Moving average type '" + averageType2 +

"' not found!"), na

//---------------------------------------------------

//MA VALUES

FASTMA = MovAvgType2(averageType2, averageSource2, averageLength2)

SLOWMA = MovAvgType1(averageType1, averageSource1, averageLength1)

//BUY/SELL TRIGGERS

bullish_trend = FASTMA > SLOWMA and close > FASTMA

bearish_trend = FASTMA < SLOWMA and close < FASTMA

//MAs PLOT

plot1 = plot(SLOWMA,color=color.gray, linewidth=1, title="Slow-MA")

plot2 = plot(FASTMA,color=color.yellow, linewidth=1, title="Fast-MA")

fill(plot1, plot2, color=SLOWMA>FASTMA ? color.new(color.red, 70) : color.new(color.green, 70), title="EMA Clouds")

//-----------------------------------------------------

//PARABOLIC SAR USER INPUT

usepsarFilter = input.bool(title='Use Parabolic Sar?', defval=true, group = "Parabolic SAR Inputs")

psar_display = input.bool(title="Display Parabolic Sar?", defval=false, group="Parabolic SAR Inputs")

start = input.float(title="Start", defval=0.02, group="Parabolic SAR Inputs", step=0.001)

increment = input.float(title="Increment", defval=0.02, group="Parabolic SAR Inputs", step=0.001)

maximum = input.float(title="Maximum", defval=0.2, group="Parabolic SAR Inputs", step=0.001)

//SAR VALUES

psar = request.security(syminfo.tickerid, "D", ta.sar(start, increment, maximum))

//BULLISH & BEARISH PSAR CONDITIONS

bullish_psar = (usepsarFilter ? low > psar : bullish_trend )

bearsish_psar = (usepsarFilter ? high < psar : bearish_trend)

//SAR PLOT

psar_plot = if low > psar

color.rgb(198, 234, 199, 13)

else

color.rgb(219, 134, 134, 48)

plot(psar_display ? psar : na, color=psar_plot, title="Par SAR")

//-------------------------------------

//ENTRIES AND EXITS

long_entry = if inTradeWindow and bullish_trend and bullish_psar and LongPositions

true

long_exit = if inTradeWindow and bearish_trend

true

short_entry = if inTradeWindow and bearish_trend and bearsish_psar and ShortPositions

true

short_exit = if inTradeWindow and bullish_trend

true

//--------------------------------------

//RISK MANAGEMENT - SL, MONEY AT RISK, POSITION SIZING

atrPeriod = input.int(14, "ATR Length", group="Risk Management Inputs")

sl_atr_multiplier = input.float(title="Long Position - Stop Loss - ATR Multiplier", defval=2, group="Risk Management Inputs", step=0.5)

sl_atr_multiplier_short = input.float(title="Short Position - Stop Loss - ATR Multiplier", defval=2, group="Risk Management Inputs", step=0.5)

i_pctStop = input.float(2, title="% of Equity at Risk", step=.5, group="Risk Management Inputs")/100

//ATR VALUE

_atr = ta.atr(atrPeriod)

//CALCULATE LAST ENTRY PRICE

lastEntryPrice = strategy.opentrades.entry_price(strategy.opentrades - 1)

//STOP LOSS - LONG POSITIONS

var float sl = na

//CALCULTE SL WITH ATR AT ENTRY PRICE - LONG POSITION

if (strategy.position_size[1] != strategy.position_size)

sl := lastEntryPrice - (_atr * sl_atr_multiplier)

//IN TRADE - LONG POSITIONS

inTrade = strategy.position_size > 0

//PLOT SL - LONG POSITIONS

plot(inTrade ? sl : na, color=color.blue, style=plot.style_circles, title="Long Position - Stop Loss")

//CALCULATE ORDER SIZE - LONG POSITIONS

positionSize = (strategy.equity * i_pctStop) / (_atr * sl_atr_multiplier)

//============================================================================================

//STOP LOSS - SHORT POSITIONS

var float sl_short = na

//CALCULTE SL WITH ATR AT ENTRY PRICE - SHORT POSITIONS

if (strategy.position_size[1] != strategy.position_size)

sl_short := lastEntryPrice + (_atr * sl_atr_multiplier_short)

//IN TRADE SHORT POSITIONS

inTrade_short = strategy.position_size < 0

//PLOT SL - SHORT POSITIONS

plot(inTrade_short ? sl_short : na, color=color.red, style=plot.style_circles, title="Short Position - Stop Loss")

//CALCULATE ORDER - SHORT POSITIONS

positionSize_short = (strategy.equity * i_pctStop) / (_atr * sl_atr_multiplier_short)

//===============================================

//LONG STRATEGY

strategy.entry("Long", strategy.long, comment="Long", when = long_entry, qty=positionSize)

if (strategy.position_size > 0)

strategy.close("Long", when = (long_exit), comment="Close Long")

strategy.exit("Long", stop = sl, comment="Exit Long")

//SHORT STRATEGY

strategy.entry("Short", strategy.short, comment="Short", when = short_entry, qty=positionSize_short)

if (strategy.position_size < 0)

strategy.close("Short", when = (short_exit), comment="Close Short")

strategy.exit("Short", stop = sl_short, comment="Exit Short")

//ONE DIRECTION TRADING COMMAND (BELLOW ONLY ACTIVATE TO CORRECT BUGS)

- Estratégia de negociação de tendências baseada no indicador MACD

- Estratégia de média estocástica e móvel com filtros duplos

- Estratégia de tendência baseada no RSI

- Estratégia de ruptura da média móvel de ponto único

- Estratégia de cruzamento da média móvel

- Estratégia SuperTrend

- Parabólica período e Bollinger Band combinado Moving Stop Loss estratégia

- Estratégia de negociação baseada no preço médio móvel

- Estratégia de negociação de convergência da direção do ímpeto ergótico

- Estratégia de negociação de média móvel e estocástica

- A estratégia de negociação quantitativa eficiente combinando

- Estratégia combinada de cruzamento de média móvel dupla e indicador Williams

- Estratégia da Linha Prateada de Impulso

- Estratégia contrária à volatilidade do RWI

- Estratégia de reversão de perdas de rastreamento de tendências SAR parabólica

- Estratégia de cruzamento do indicador de impulso

- Estratégia de interrupção de oscilação eficiente com duplo stop profit e stop loss

- Estratégia de ruptura de canal duplo

- Estratégia de negociação em rede baseada no rastreamento de linhas K em tempo real

- Estratégia de recuperação de fuga