estratégia de reversão do perfil do escillador baseada no cruzamento zero do MACD de vários prazos

Autora:ChaoZhang, Data: 2024-02-18 15:27:21Tags:

Resumo

A estratégia 3 10.0 Oscillator Profile Reversal identifica potenciais inversões de preços através do cálculo dos indicadores MACD em diferentes prazos.

Estratégia lógica

A estratégia calcula as médias móveis SMA de 3 e 10 períodos para construir linhas rápidas e lentas e o indicador MACD e a linha de sinal. Quando a linha rápida e a linha de sinal cruzam a linha zero para cima ou para baixo, ele indica que o preço atingiu um ponto crítico e uma reversão pode ocorrer. Além disso, também incorpora julgamento de pressão de volume, índice RSI etc. para identificar a confiabilidade dos sinais de reversão.

Especificamente, a estratégia julga as inversões de preços através de:

- O cruzamento de zero do MACD indica que o preço atinge um ponto crítico

- A pressão do volume determina o sentimento de alta ou baixa

- O índice RSI com mudança de inclinação do MACD determina a força dos sinais de reversão

- A linha rápida e a linha de sinalização que se cruzam em sentido inverso formam um sinal de inversão

Quando a confiabilidade do sinal de reversão é elevada, a estratégia adota uma parada de perda de tendência para obter lucros mais elevados.

Análise das vantagens

A estratégia apresenta as seguintes vantagens:

- Indicadores múltiplos tornam os sinais de reversão mais confiáveis

- O MACD zero-crossing localiza com precisão os pontos de reversão

- O RSI e o volume auxiliam o julgamento para melhorar a confiabilidade

- A suspensão de perdas de tendência melhora a eficiência do capital

Análise de riscos

Há também alguns riscos:

- Alta probabilidade de sinais falsos do MACD e de ficarem presos

- O risco de que o stop loss seja atingido durante tendências alternativas é elevado

- A definição inadequada dos parâmetros pode aumentar a frequência e o custo das negociações

Os riscos podem ser reduzidos através de:

- Permitir uma perda de parada mais ampla para evitar ficar preso

- Otimizar os parâmetros para reduzir a frequência de negociação

- Considerar apenas a entrada perto dos níveis principais de suporte/resistência

Orientações de otimização

A estratégia pode ser melhorada através de:

- Adicionar algoritmos de aprendizagem de máquina para auxiliar a confiabilidade do sinal de reversão

- Adicionar índices de sentimento para determinar a mentalidade touro/urso

- Combinar os principais níveis de apoio/resistência para melhorar a precisão de entrada

- Otimizar o stop loss para uma maior eficiência de capital

- Teste combinações óptimas de parâmetros para reduzir a frequência de negociação

Conclusão

A estratégia de reversão de cruzamento zero do MACD de vários prazos considera de forma abrangente os indicadores de preço, volume e volatilidade para determinar o tempo de entrada através da avaliação de múltiplos indicadores. Ele define stop loss oportuno com lucratividade suficiente. Pode alcançar bons retornos durante os mercados de reversão.

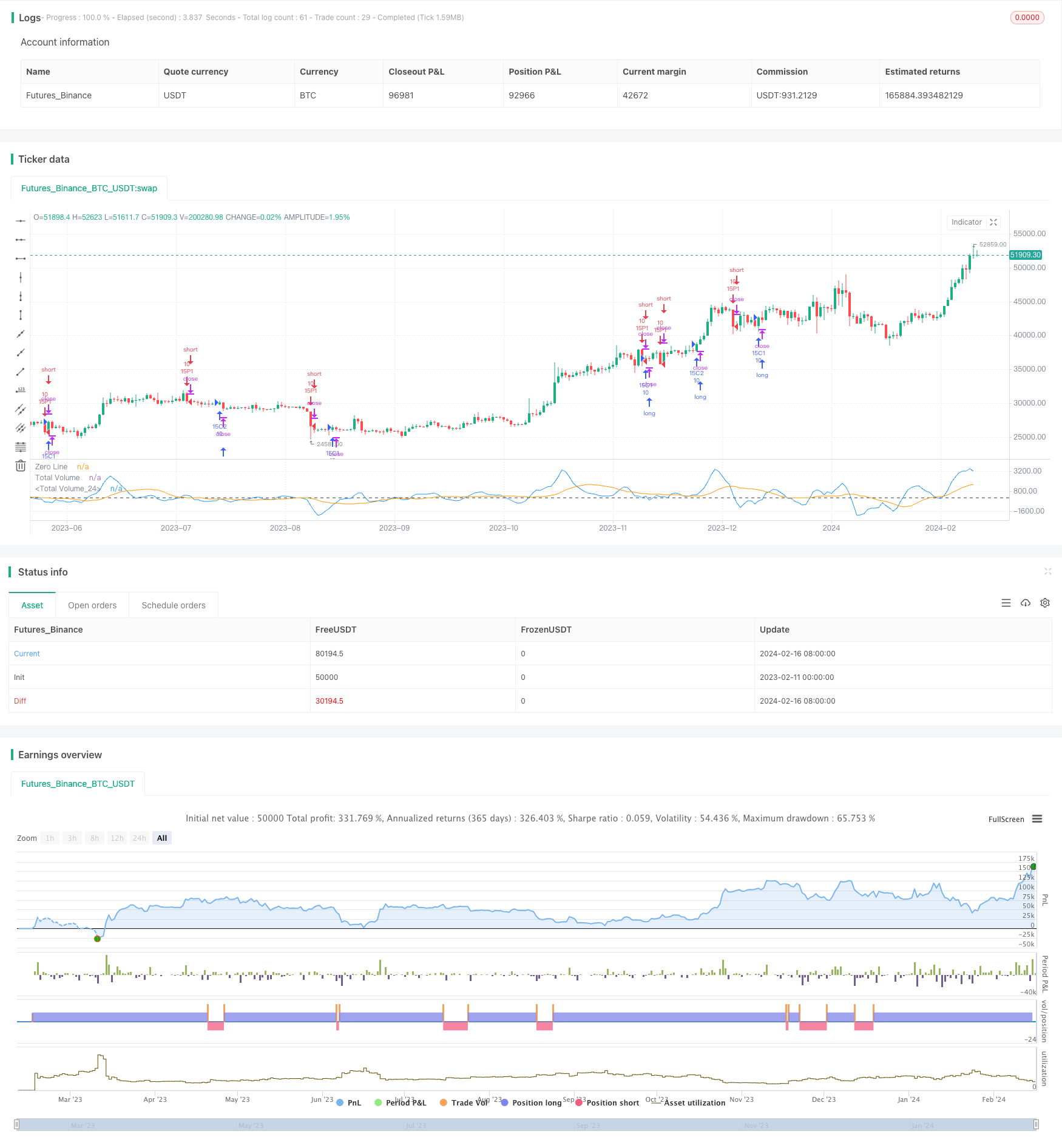

/*backtest

start: 2023-02-11 00:00:00

end: 2024-02-17 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("3 10.0 Oscillator Profile Flagging", shorttitle="3 10.0 Oscillator Profile Flagging", overlay=false)

signalBiasValue = input(title="Signal Bias", defval=0.26)

macdBiasValue = input(title="MACD Bias", defval=0.8)

shortLookBack = input( title="Short LookBack", defval=3)

longLookBack = input( title="Long LookBack", defval=10.0)

takeProfit = input( title="Take Profit", defval=0.8)

stopLoss = input( title="Stop Loss", defval=0.75)

fast_ma = ta.sma(close, 3)

slow_ma = ta.sma(close, 10)

macd = fast_ma - slow_ma

signal = ta.sma(macd, 16)

hline(0, "Zero Line", color = color.black)

buyVolume = volume*((close-low)/(high-low))

sellVolume = volume*((high-close)/(high-low))

buyVolSlope = buyVolume - buyVolume[1]

sellVolSlope = sellVolume - sellVolume[1]

signalSlope = ( signal - signal[1] )

macdSlope = ( macd - macd[1] )

plot(macd, color=color.blue, title="Total Volume")

plot(signal, color=color.orange, title="Total Volume")

intrabarRange = high - low

rsi = ta.rsi(close, 14)

rsiSlope = rsi - rsi[1]

getRSISlopeChange(lookBack) =>

j = 0

for i = 0 to lookBack

if ( rsi[i] - rsi[ i + 1 ] ) > -5

j += 1

j

getBuyerVolBias(lookBack) =>

j = 0

for i = 1 to lookBack

if buyVolume[i] > sellVolume[i]

j += 1

j

getSellerVolBias(lookBack) =>

j = 0

for i = 1 to lookBack

if sellVolume[i] > buyVolume[i]

j += 1

j

getVolBias(lookBack) =>

float b = 0.0

float s = 0.0

for i = 1 to lookBack

b += buyVolume[i]

s += sellVolume[i]

b > s

getSignalBuyerBias(lookBack) =>

j = 0

for i = 1 to lookBack

if signal[i] > signalBiasValue

j += 1

j

getSignalSellerBias(lookBack) =>

j = 0

for i = 1 to lookBack

if signal[i] < ( 0.0 - signalBiasValue )

j += 1

j

getSignalNoBias(lookBack) =>

j = 0

for i = 1 to lookBack

if signal[i] < signalBiasValue and signal[i] > ( 0.0 - signalBiasValue )

j += 1

j

getPriceRising(lookBack) =>

j = 0

for i = 1 to lookBack

if close[i] > close[i + 1]

j += 1

j

getPriceFalling(lookBack) =>

j = 0

for i = 1 to lookBack

if close[i] < close[i + 1]

j += 1

j

getRangeNarrowing(lookBack) =>

j = 0

for i = 1 to lookBack

if intrabarRange[i] < intrabarRange[i + 1]

j+= 1

j

getRangeBroadening(lookBack) =>

j = 0

for i = 1 to lookBack

if intrabarRange[i] > intrabarRange[i + 1]

j+= 1

j

bool isNegativeSignalReversal = signalSlope < 0.0 and signalSlope[1] > 0.0

bool isNegativeMacdReversal = macdSlope < 0.0 and macdSlope[1] > 0.0

bool isPositiveSignalReversal = signalSlope > 0.0 and signalSlope[1] < 0.0

bool isPositiveMacdReversal = macdSlope > 0.0 and macdSlope[1] < 0.0

bool hasBearInversion = signalSlope > 0.0 and macdSlope < 0.0

bool hasBullInversion = signalSlope < 0.0 and macdSlope > 0.0

bool hasSignalBias = math.abs(signal) >= signalBiasValue

bool hasNoSignalBias = signal < signalBiasValue and signal > ( 0.0 - signalBiasValue )

bool hasSignalBuyerBias = hasSignalBias and signal > 0.0

bool hasSignalSellerBias = hasSignalBias and signal < 0.0

bool hasPositiveMACDBias = macd > macdBiasValue

bool hasNegativeMACDBias = macd < ( 0.0 - macdBiasValue )

bool hasBullAntiPattern = ta.crossunder(macd, signal)

bool hasBearAntiPattern = ta.crossover(macd, signal)

bool hasSignificantBuyerVolBias = buyVolume > ( sellVolume * 1.5 )

bool hasSignificantSellerVolBias = sellVolume > ( buyVolume * 1.5 )

// 393.60 Profit 52.26% 15m

if ( hasBullInversion and rsiSlope > 1.5 and volume > 300000.0 )

strategy.entry("15C1", strategy.long, qty=10.0)

strategy.exit("TPS", "15C1", limit=strategy.position_avg_price + takeProfit, stop=strategy.position_avg_price - stopLoss)

// 356.10 Profit 51,45% 15m

if ( getVolBias(shortLookBack) == false and rsiSlope > 3.0 and signalSlope > 0)

strategy.entry("15C2", strategy.long, qty=10.0)

strategy.exit("TPS", "15C2", limit=strategy.position_avg_price + takeProfit, stop=strategy.position_avg_price - stopLoss)

// 124 Profit 52% 15m

if ( rsiSlope < -11.25 and macdSlope < 0.0 and signalSlope < 0.0)

strategy.entry("15P1", strategy.short, qty=10.0)

strategy.exit("TPS", "15P1", limit=strategy.position_avg_price - takeProfit, stop=strategy.position_avg_price + stopLoss)

// 455.40 Profit 49% 15m

if ( math.abs(math.abs(macd) - math.abs(signal)) < .1 and buyVolume > sellVolume and hasBullInversion)

strategy.entry("15P2", strategy.short, qty=10.0)

strategy.exit("TPS", "15P2", limit=strategy.position_avg_price - takeProfit, stop=strategy.position_avg_price + stopLoss)

- A média móvel exponencial dupla de Williams e a estratégia Ichimoku Kinkou Hyo

- 3 10 Estratégia de sinalização do perfil do oscilador

- Estratégia de negociação RSI-SRSI multi-tempo

- Uma estratégia combinada com MACD e RSI

- Estratégia de tendência longa baseada em ATR, EOM e VORTEX

- Estratégia de negociação de média móvel dupla de rastreamento inteligente

- Estratégia de dimensionamento de posições com volume elevado e baixa ruptura

- A média do custo do dólar do Bitcoin baseada em bandas BEAM

- Byron Serpent Cloud Quant Estratégia

- Estratégia de negociação de variações de volatilidade de duplo prazo

- Estratégia de acompanhamento da tendência cruzada da MACD EMA

- Estratégia de negociação de média móvel dupla

- Estratégia de negociação de tendência de média móvel dupla Golden Cross

- Estratégia V-Reversão da SMA

- Estratégia de negociação de ruptura do canal de regressão linear

- Tendência baseada em indicadores de dupla EMA seguindo a estratégia

- Tartaruga-real

Estratégia firme como uma tartaruga-das-rochas - Estratégia de rastreamento de perdas de parada aberta-alta-baixa

- Estratégia de negociação automática de futuros abrangente para longo e curto prazo

- Estratégia de negociação de ruptura da Supertrend