Estratégia de combinação de indicadores

Autora:ChaoZhang, Data: 2024-02-20 11:38:22Tags:

Resumo

A estratégia é chamada

- Usando o indicador de tendência de onda para julgar a principal tendência do mercado

- Filtragem de alguns sinais falsos com indicadores RSI e IFM

- Determinação de orientações operacionais específicas com o indicador EMA

- Entrar no mercado com um método de rastreamento inovador para garantir o seguimento da tendência

Princípio da estratégia

A estratégia julga principalmente a direcção e a força da tendência principal e define a negociação bidireccional de longo e curto.

sinal longo:

- O preço está acima da EMA de 200 dias, indicando um mercado de alta

- Preço retira-se para cerca de 50 dias EMA formando suporte

- A tendência de onda se inverte para tendência de alta e um sinal de compra aparece

- Tanto o índice de risco como as IFM mostram sobrecompra

- 3 linhas K consecutivas quebraram a EMA de 50 dias sucessivamente, indicando um avanço para cima

Sinais curtos: O oposto do sinal longo

Titular de uma posição em risco Dois critérios: preço mais baixo/preço mais alto stop loss, ATR stop loss

Análise das vantagens

A estratégia apresenta as seguintes vantagens:

- Integra múltiplos indicadores para determinar a tendência principal e evitar falhas

- Adota a EMA para determinar a direcção operacional, fácil de seguir as tendências

- Método de stop loss de atraso alcança lucros sustentados

- Capaz de ir tanto para longo quanto para curto, seguindo o mercado em qualquer direção

Análise de riscos

A estratégia apresenta também alguns riscos:

- Probabilidade de sinais errados dos indicadores

- Ponto de stop loss demasiado pequeno, aumentando o risco de stop loss

- A alta frequência de negociação leva a perdas ocultas das taxas de negociação

Para reduzir os riscos acima referidos, a otimização pode ser feita nos seguintes aspectos:

- Ajustar os parâmetros do indicador para filtrar sinais errados

- Afrouxar adequadamente o ponto de stop loss

- Otimizar os parâmetros do indicador para reduzir a frequência de negociação

Orientações de otimização

A partir do nível do código, as principais direcções otimizáveis desta estratégia incluem:

- Ajuste dos parâmetros da tendência de onda, do RSI e da IFM para encontrar a melhor combinação de parâmetros

- Teste do desempenho de diferentes parâmetros do ciclo EMA

- Ajuste dos fatores da relação risco/recompensa da obtenção de lucros e da parada de perdas para obter uma configuração ideal

Através do ajuste de parâmetros e dos testes, a estratégia pode maximizar os retornos, reduzindo simultaneamente os riscos e os prejuízos.

Conclusão

A estratégia integra múltiplos indicadores para determinar a direção da tendência principal, usa o indicador EMA como sinal de operação específico e usa stop loss para bloquear os lucros. Através da otimização de parâmetros, podem ser obtidos lucros relativamente bons e constantes.

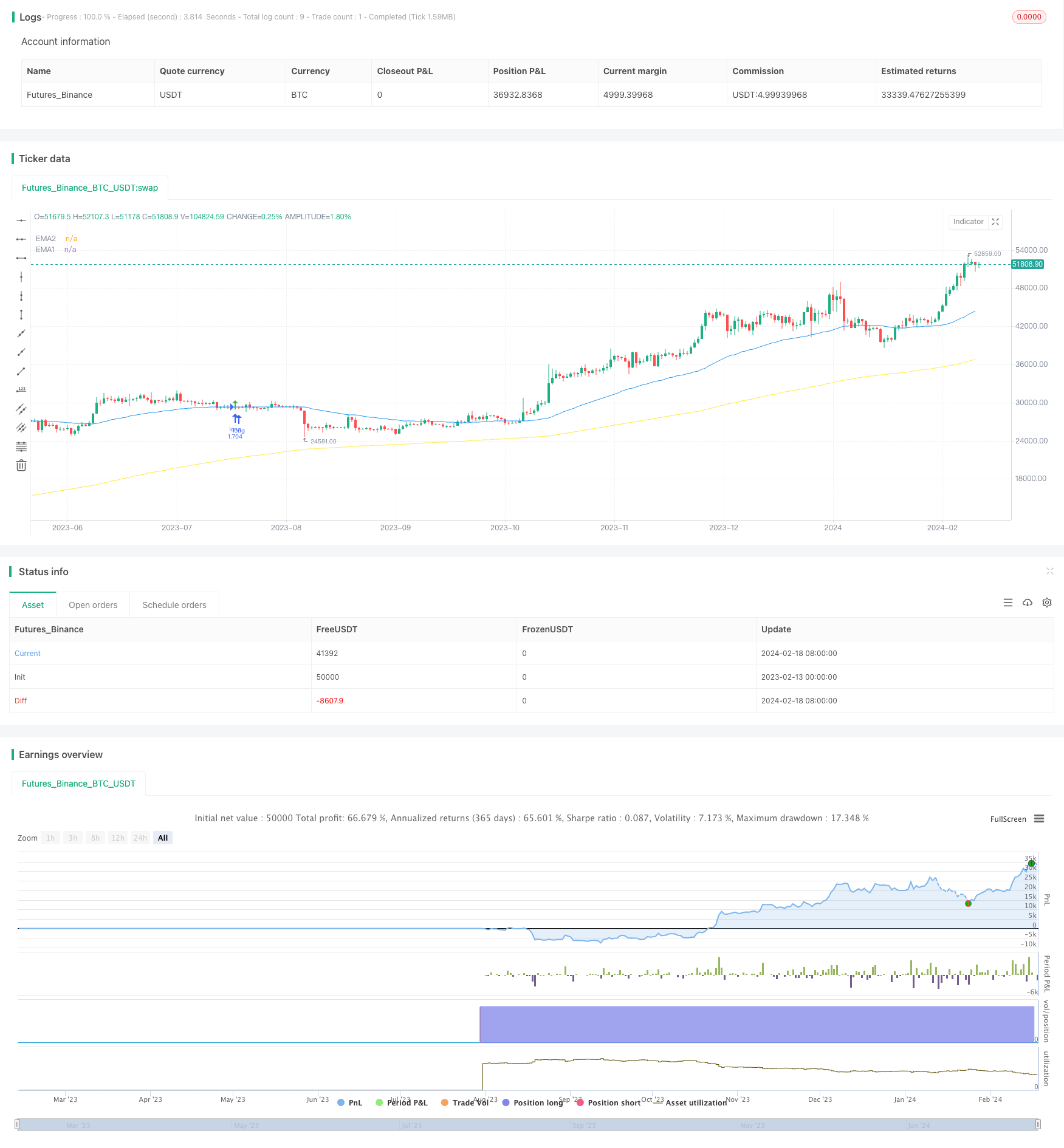

/*backtest

start: 2023-02-13 00:00:00

end: 2024-02-19 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//Lowest Low/ Highest High & ATR Stop Loss/ Take Profit

//Optimized for the 30 minutes chart

strategy(title="TradePro's Trading Idea Cipher B+ Divergence EMA Pullback Strategy", shorttitle="WT MFI RSI EMA PB STRAT", overlay = true, pyramiding = 0, max_bars_back=5000, calc_on_order_fills = false, commission_type = strategy.commission.percent, commission_value = 0, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, initial_capital=5000, currency=currency.USD)

// { Time Range

FromMonth=input(defval=1,title="FromMonth",minval=1,maxval=12)

FromDay=input(defval=1,title="FromDay",minval=1,maxval=31)

FromYear=input(defval=2020,title="FromYear",minval=2016)

ToMonth=input(defval=1,title="ToMonth",minval=1,maxval=12)

ToDay=input(defval=1,title="ToDay",minval=1,maxval=31)

ToYear=input(defval=9999,title="ToYear",minval=2017)

start=timestamp(FromYear,FromMonth,FromDay,00,00)

finish=timestamp(ToYear,ToMonth,ToDay,23,59)

window()=>true

// See if this bar's time happened on/after start date

afterStartDate = time >= start and time<=finish?true:false

zeroline = 0

// } Time Range

// { Wavetrend, RSI, MFI

// WaveTrend

cl = input(12, "Channel Length")

al = input(12, "Average Length")

overbought = input(53, title = 'WT Overbought Level 1', type = input.integer)

oversold = input(-53, title = 'WT Oversold Level 1', type = input.integer)

ap = hlc3

esa = ema(ap, cl)

d = ema(abs(ap - esa), cl)

ci = (ap - esa) / (0.015 * d)

tci = ema(ci, al)

wt1 = tci

wt2 = sma(wt1,4)

wtOs = wt2 <= oversold

wtOb = wt2 >= overbought

wtX = cross(wt1, wt2)

wtUp = wt2 - wt1 <= 0

wtDown = wt2 - wt1 >= 0

buySignal = wtX and wtOs and wtUp

sellSignal = wtX and wtOb and wtDown

// RSI & MFI

rsiMFIPosY = input(2, title = 'MFI Area Y Pos', type = input.float)

rsiMFIperiod = input(80,title = 'MFI Period', type = input.integer)

rsiMFIMultiplier = input(200, title = 'MFI Area multiplier', type = input.float)

f_rsimfi(_period, _multiplier, _tf) => security(syminfo.tickerid, _tf, sma(((close - open) / (high - low)) * _multiplier, _period) - rsiMFIPosY)

rsiMFI = f_rsimfi(rsiMFIperiod, rsiMFIMultiplier, timeframe.period)

// } Wavetrend, RSI, MFI

// { EMA

emasrc = close

res = input(title="EMA Timeframe", type=input.resolution, defval="30")

len1 = input(title="EMA1 Length", type=input.integer, defval=200)

col1 = color.yellow

len2 = input(title="EMA2 Length", type=input.integer, defval=50)

col2 = color.blue

// Calculate EMA

ema1 = ema(emasrc, len1)

emaSmooth1 = security(syminfo.tickerid, res, ema1, barmerge.gaps_off, barmerge.lookahead_off)

ema2 = ema(emasrc, len2)

emaSmooth2 = security(syminfo.tickerid, res, ema2, barmerge.gaps_off, barmerge.lookahead_off)

// Draw EMA

plot(emaSmooth1, title="EMA1", linewidth=1, color=col1)

plot(emaSmooth2, title="EMA2", linewidth=1, color=col2)

// } EMA

// { Long Entry

enablelong = input(true, title="Enable long?")

//Long Signal

upcondition = close > emaSmooth1

wavetrendlong = wt1 and wt2 < zeroline

mfilong = rsiMFI > 0

emapblong1 = (close > emaSmooth2) and (close[1] < emaSmooth2[1])

emapblong2 = ((close[2] > emaSmooth2[2]) and (close[3] > emaSmooth2[3]) and (close[4] > emaSmooth2[4])) or ((close[5] > emaSmooth2[5]) and (close[6] > emaSmooth2[6]) and (close[7] > emaSmooth2[7])) or ((close[8] > emaSmooth2[8]) and (close[9] > emaSmooth2[9]) and (close[10] > emaSmooth2[10]))

longcondition = upcondition and wavetrendlong and buySignal and mfilong and emapblong1 and emapblong2

//strategy buy long

if (longcondition) and (afterStartDate) and strategy.opentrades < 1 and (enablelong == true)

strategy.entry("long", strategy.long)

plotshape(longcondition, style=shape.arrowup,

location=location.abovebar, color=color.green)

// } Long Entry

// { Short Entry

enableshort = input(true, title="Enable short?")

//Short Signal

downcondition = close < emaSmooth1

wavetrendshort = wt1 and wt2 > zeroline

mfishort = rsiMFI < 0

emapbshort1 = (close < emaSmooth2) and (close[1] > emaSmooth2[1])

emapbshort2 = ((close[2] < emaSmooth2[2]) and (close[3] < emaSmooth2[3]) and (close[4] < emaSmooth2[4])) or ((close[5] < emaSmooth2[5]) and (close[6] < emaSmooth2[6]) and (close[7] < emaSmooth2[7])) or ((close[8] < emaSmooth2[8]) and (close[9] < emaSmooth2[9]) and (close[10] < emaSmooth2[10]))

shortcondition = downcondition and wavetrendshort and sellSignal and mfishort and emapbshort1 and emapbshort2

//strategy buy short

if (shortcondition) and (afterStartDate) and strategy.opentrades < 1 and (enableshort == true)

strategy.entry("short", strategy.short)

plotshape(shortcondition, style=shape.arrowdown,

location=location.belowbar, color=color.red)

// } Short Entry

// { Exit Conditions

bought = strategy.position_size[1] < strategy.position_size

sold = strategy.position_size[1] > strategy.position_size

barsbought = barssince(bought)

barssold = barssince(sold)

slbuffer = input(title="SL Buffer", type=input.float, step=0.1, defval=0)

// } Exit Conditions

// { Lowest Low/ Highes High Exit Condition

enablelowhigh = input(false, title="Enable lowest low/ highest high exit?")

//Lowest Low LONG

profitfactorlong = input(title="ProfitfactorLong", type=input.float, step=0.1, defval=2)

loLen = input(title="Lowest Low Lookback", type=input.integer,

defval=50, minval=2)

stop_level_long = lowest(low, loLen)[1]

if enablelowhigh == true and strategy.position_size>0

profit_level_long = strategy.position_avg_price + ((strategy.position_avg_price - stop_level_long[barsbought])*profitfactorlong) + slbuffer

strategy.exit(id="TP/ SL", stop=stop_level_long[barsbought] - slbuffer, limit=profit_level_long)

//Lowest Low SHORT

profitfactorshort = input(title="ProfitfactorShort", type=input.float, step=0.1, defval=2)

highLen = input(title="highest high lookback", type=input.integer,

defval=50, minval=2)

stop_level_short = highest(high, highLen)[1]

if enablelowhigh == true and strategy.position_size<0

profit_level_short = strategy.position_avg_price - ((stop_level_short[barssold] - strategy.position_avg_price)*profitfactorshort) - slbuffer

strategy.exit(id="TP/ SL", stop=stop_level_short[barssold] + slbuffer, limit=profit_level_short)

// } Lowest Low/ Highes High Exit Condition

// { ATR Take Profit/ Stop Loss

enableatr = input(true, title="Enable ATR exit?")

atrprofitfactorlong = input(title="ATR Profitfactor Long", type=input.float, step=0.1, defval=6)

atrstopfactorlong = input(title="ATR Stopfactor Long", type=input.float, step=0.1, defval=5)

atrprofitfactorshort = input(title="ATR Profitfactor Short", type=input.float, step=0.1, defval=3)

atrstopfactorshort = input(title="ATR Stopfactor Short", type=input.float, step=0.1, defval=5)

//ATR

lengthATR = input(title="ATR Length", defval=11, minval=1)

atr = atr(lengthATR)

//LONG EXIT

if (afterStartDate) and ((enableatr == true) and (strategy.opentrades > 0))

barsbought1 = barssince(bought)

profit_level = strategy.position_avg_price + (atr*atrprofitfactorlong)

stop_level = strategy.position_avg_price - (atr*atrstopfactorlong)

strategy.exit("Take Profit/ Stop Loss", "long", stop=stop_level[barsbought1], limit=profit_level[barsbought1])

//SHORT EXIT

if (afterStartDate) and ((enableatr == true) and (strategy.opentrades > 0))

barssold1 = barssince(sold)

profit_level = strategy.position_avg_price - (atr*atrprofitfactorshort)

stop_level = strategy.position_avg_price + (atr*atrstopfactorshort)

strategy.exit("Take Profit/ Stop Loss", "short", stop=stop_level[barssold1], limit=profit_level[barssold1])

// } ATR Take Profit/ Stop Loss

- Estratégia de negociação de vários prazos baseada na EMA, RSI e MACD

- Estratégia quantitativa baseada em pontos pivô

- Estratégia de rastreamento de tendências cruzadas de três cores

- Estratégia de construção de posição dinâmica

- Estratégia de perseguição de média móvel dupla

- Estratégia de negociação a curto prazo baseada na EMA

- Estratégia de negociação inteligente de vários fatores

- Estratégia de inversão da média móvel cruzada

- Estratégia de otimização da taxa de mudança

- Tendência do canal de média móvel de vários períodos

- Identificador do estágio de acumulação e estratégia de negociação

- OBV, OMC e estratégia de negociação baseada na curva de Coppock

- Estratégia da Zona de Ação dos CDC

- Estratégia de negociação quantitativa multifator

- Tendência seguindo uma estratégia baseada num desvio suavizado

- Estratégia de negociação do Oscilador de Nuvem Ichimoku

- Estratégia de rede DCA de reversão média de dupla base

- Assassin's Grid B

A Dynamic Grid Trading Strategy - Estratégia de cruzamento da média móvel de vários prazos

- Estratégia de negociação quantitativa de média móvel exponencial de atraso zero adaptativa