Análise da estratégia da dupla EMA

Autora:ChaoZhang, Data: 2024-02-28 18:07:59Tags:

Resumo

A estratégia de dupla EMA é uma estratégia de tendência que identifica a direção da tendência dos preços, calculando EMAs de diferentes ciclos e usa isso para determinar entradas e saídas.

Estratégia lógica

A estratégia baseia-se principalmente em dois indicadores EMA, um EMA de 9 dias de curto prazo e um EMA de 21 dias de longo prazo.

Quando a EMA curta cruza acima da EMA longa, ela é vista como preços entrando em uma tendência de alta. A estratégia irá longo para seguir a tendência ascendente. Quando a EMA curta cruza abaixo da EMA longa, ela é vista como preços entrando em uma tendência de queda. A estratégia irá curto para seguir a tendência de queda.

Os indicadores EMA podem efetivamente filtrar o ruído dos dados de preços e identificar a principal direção da tendência.

Vantagens

A estratégia apresenta as seguintes vantagens:

- A ideia estratégica é simples e fácil de entender e implementar.

- Pode identificar eficazmente as tendências de preços e entrar em posições oportunas para seguir as tendências.

- A utilização de EMAs filtra o ruído e evita interferências de flutuações de preços a curto prazo.

- Os parâmetros da EMA podem ser configurados para ajustar a sensibilidade da estratégia.

Riscos

Há também alguns riscos com esta estratégia:

- A característica de atraso das EMAs pode aumentar as perdas quando as tendências se revertem.

- Ajustes incorretos dos parâmetros da EMA aumentam as taxas de sinal falso.

- A estratégia é mais adequada para mercados com tendências fortes e vulneráveis em períodos de variação.

Reforço

A estratégia pode ser otimizada nos seguintes aspectos:

- Incorporar outros indicadores para identificar inversões de tendência e reduzir perdas, por exemplo, MACD, KDJ, etc.

- Adicione a lógica de stop loss. boas estratégias de stop loss podem reduzir muito o drawdown máximo.

- Otimizar os parâmetros da EMA para melhor adaptá-los às características de preços dos diferentes produtos.

- Usar algoritmos de aprendizagem de máquina para automatizar a otimização de parâmetros EMA.

Resumo

Em resumo, a estratégia de dupla EMA é uma estratégia muito útil de tendência. É fácil de operar, entender e tem um excelente desempenho em mercados de forte tendência. A estratégia também tem alguns riscos que podem ser mitigados através de vários aprimoramentos para melhorar sua estabilidade.

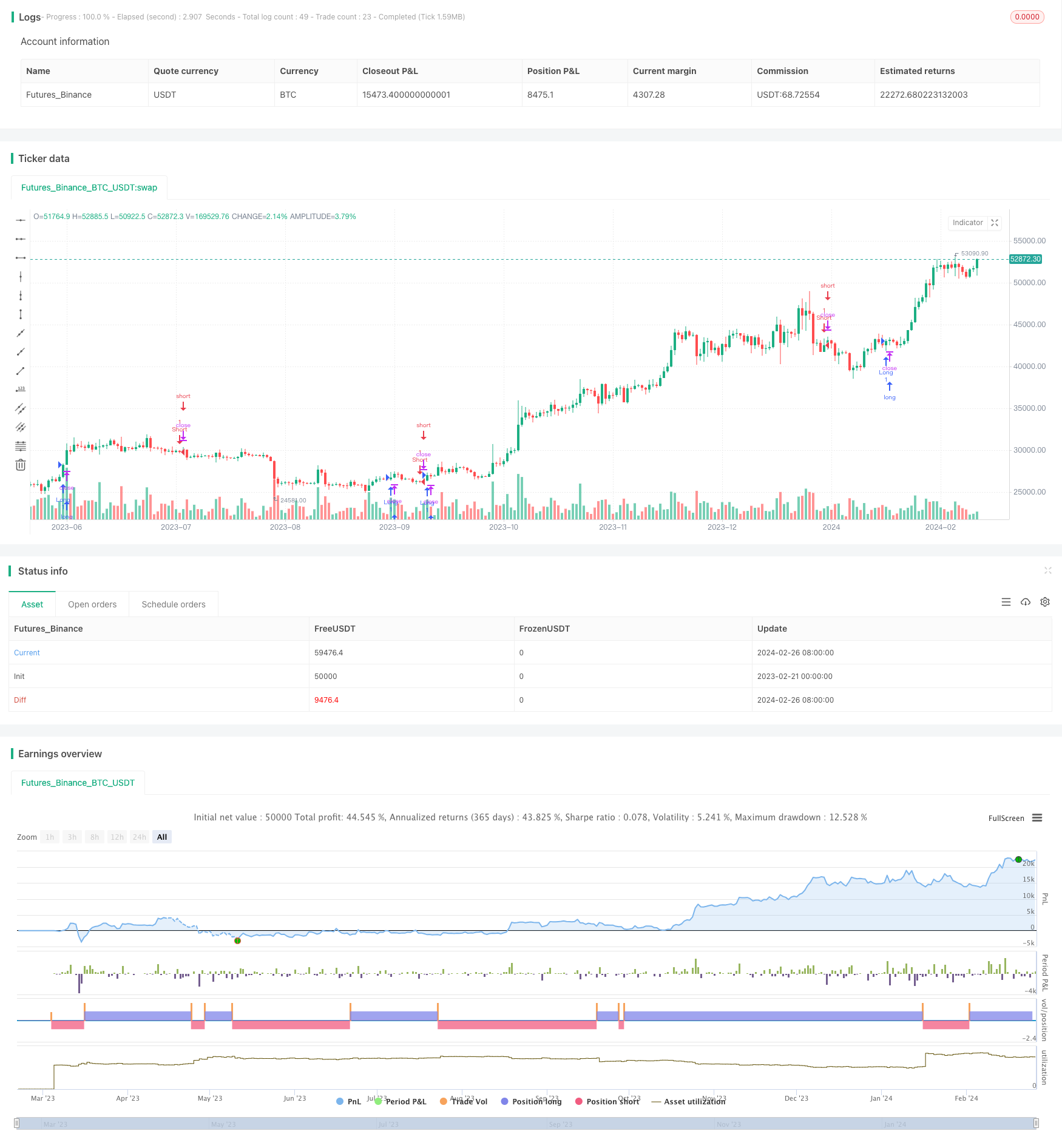

/*backtest

start: 2023-02-21 00:00:00

end: 2024-02-27 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This can only draw so many lines. Use bar replay to go back further

strategy("Strategy Lines", shorttitle="Strategy Lines", overlay=true, max_lines_count=500)

//###########################################################################################################################################

// Replace your strategy here

//###########################################################################################################################################

shortEMA = ta.ema(close, input(9, title="Short EMA Length"))

longEMA = ta.ema(close, input(21, title="Long EMA Length"))

// Entry conditions for long and short positions

longCondition = ta.crossover(shortEMA, longEMA)

shortCondition = ta.crossunder(shortEMA, longEMA)

//###########################################################################################################################################

// Strategy Lines

//###########################################################################################################################################

var timeLow = bar_index

var line li = na

var openLPrice = 0.0000

var openSPrice = 0.0000

LongWColor = input.color(color.rgb(0,255,0,0),"Long Win Color", group="Strategy Lines")

LongLColor = input.color(color.rgb(0,0,255,0),"Long Loss Color", group="Strategy Lines")

ShortWColor = input.color(color.rgb(255,255,0,0),"Short Win Color", group="Strategy Lines")

ShortLColor = input.color(color.rgb(255,0,0,0),"Short Loss Color", group="Strategy Lines")

WinFontColor = input.color(color.rgb(0,0,0,0),"Win Font Color", group="Strategy Lines")

LossFontColor = input.color(color.rgb(255,255,255,0),"Loss Font Color", group="Strategy Lines")

LinesShowLabel = input(false,"Show Labels?",group = "Strategy Lines")

// // Start new line when we go long

// if strategy.position_size >0

// line.delete(li)

// li := line.new(timeLow, close[bar_index-timeLow], bar_index, close, width=2, color=close>openLPrice?LongWColor:LongLColor)

// // Start new line when we go short

// if strategy.position_size <0

// line.delete(li)

// li := line.new(timeLow, close[bar_index-timeLow], bar_index, close, width=2, color=close<openSPrice?ShortWColor:ShortLColor)

// //Delete Lines if we don't have a position open

// if strategy.position_size ==0

// li := line.new(timeLow, close[bar_index-timeLow], bar_index, close, width=2, color=color.rgb(0,0,0,100))

// line.delete(li)

if LinesShowLabel

// Short Label

if strategy.position_size>=0 and strategy.position_size[1] <0

label.new(

timeLow, na,

text=str.tostring((openSPrice-close[1])/(syminfo.mintick*10)),

color=close[1]<openSPrice?ShortWColor:ShortLColor,

textcolor=close[1]<openSPrice?WinFontColor:LossFontColor,

size=size.small,

style=label.style_label_down, yloc=yloc.abovebar)

// Long Label

if strategy.position_size<=0 and strategy.position_size[1] >0

label.new(

timeLow, na,

text=str.tostring((close[1]-openLPrice)/(syminfo.mintick*10)),

color=close[1]>openLPrice?LongWColor:LongLColor,

textcolor=close[1]>openLPrice?WinFontColor:LossFontColor,

size=size.small,

style=label.style_label_down, yloc=yloc.abovebar)

// Open long position and draw line

if (longCondition)

//strategy.entry("Long", strategy.long)

// timeLow := bar_index

// li := line.new(timeLow, close[bar_index-timeLow], bar_index, close, width=2, color=close>openLPrice?LongWColor:LongLColor)

openLPrice := close

// Open short position and draw line

if (shortCondition)

//strategy.entry("Short", strategy.short)

// timeLow := bar_index

// li := line.new(timeLow, close[bar_index-timeLow], bar_index, close, width=2, color=close<openSPrice?ShortWColor:ShortLColor)

openSPrice := close

//###########################################################################################################################################

// Strategy Execution (Replace this as well)

//###########################################################################################################################################

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

- Estratégia de negociação combinada de média móvel dupla e MACD

- Estratégia de tendência dinâmica de absorção

- Estratégia de negociação de recuperação de média móvel de vários prazos

- Estratégia de acompanhamento da volatilidade da média móvel dupla

- Estratégia de negociação a curto prazo baseada em bandas de Bollinger

- Estratégia de tendência baseada no MOST e no KAMA

- Tendência de duplo quadro de tempo Seguindo a estratégia

- Bitlinc MARSI Estratégia de negociação

- Estratégia de acompanhamento das bandas de Bollinger

- SuperTrend Breakout Estratégia

- A estratégia de negociação de retorno de chamada de avanço

- A estratégia de tendência cruzada da média móvel

- Estratégia de caixa branca do canal de preços

- Estratégia quantitativa de tendência de preços de média móvel simples

- Estratégia de compra ATR com parâmetros de perda baseados no tempo

- Estratégia de reversão de ruptura de momento binomial

- Estratégia de abertura de lacunas

- Estratégia ATR de trailing stop com metas de retracementos de Fibonacci

- Bollinger Bands Breakout Trend Trading Strategy (Estratégia de negociação de tendência de ruptura das bandas de Bollinger)

- Baseado na estratégia de reversão da média móvel