Импульс в сочетании с оценкой тренда Многофакторная количественная стратегия торговли

Автор:Чао Чжан, Дата: 2023-11-23 14:58:57Тэги:

Обзор

Эта стратегия представляет собой многофакторную количественную торговую стратегию, которая сочетает в себе индикаторы импульса и индикаторы тренда. Стратегия оценивает общую тенденцию и направление импульса рынка путем расчета математических комбинаций нескольких скользящих средних и генерирует торговые сигналы на основе пороговых условий.

Принцип стратегии

- Вычислить множественные скользящие средние и индикаторы импульса

- Расчет гармонической скользящей средней, краткосрочной скользящей средней, среднесрочной скользящей средней, долгосрочной скользящей средней и других многократных скользящих средних

- Вычислить разницу между каждой скользящей средней, чтобы отразить тенденцию изменения цен

- Вычислить производную первого порядка каждой скользящей средней, чтобы отразить динамику изменений цен

- Вычислить синус и косинус индикаторы для определения направления тренда

- Всесторонне оценивать торговые сигналы

- Взвешенный расчет показателей импульса, показателей тренда и других многофакторных показателей

- Судить о текущем состоянии рынка в соответствии с расстоянием между результатом и порогом

- Выпускать длинные и короткие торговые сигналы

Анализ преимуществ

- Многофакторная оценка повышает точность сигнала

- Всесторонне рассмотреть цену, тенденцию, импульс и другие факторы

- Различные факторы могут быть настроены с различными весами

- Настраиваемые параметры, адаптируемые к различным рынкам

- Параметры скользящих средних, границы диапазона торговли могут быть настроены

- Способность адаптироваться к различным циклам и рыночным условиям

- Ясная структура кода, легкая для понимания

- Спецификации наименования, полные замечания

- Легко для вторичной разработки и оптимизации

Анализ рисков

- Трудность в оптимизации параметров высока

- Требует много исторических данных обратного тестирования, чтобы найти оптимальные параметры

- Частота торговли может быть слишком высокой

- Судебное решение по комбинации нескольких факторов может привести к слишком большому количеству сделок

- Высокая корреляция с рынком

- Стратегии оценки трендов склонны к иррациональному поведению

Руководство по оптимизации

- Добавить логику остановки потери

- Избегайте больших потерь, вызванных иррациональным поведением

- Оптимизировать параметры

- Найти оптимальные комбинации параметров для улучшения стабильности стратегии

- Увеличить элементы машинного обучения

- Использование глубокого обучения для оценки текущего состояния рынка и поддержки стратегических решений

Резюме

Эта стратегия оценивает состояние рынка с помощью многофакторной комбинации индикаторов импульса и индикаторов тренда и выдает торговые сигналы на основе установленных порогов. Преимущества стратегии - сильная конфигуративность, адаптивность к различным рыночным средам и легкое понимание; недостатками являются трудности в оптимизации параметров, возможно слишком высокая частота торговли и высокая корреляция с рынком. Будущие оптимизации могут быть сделаны путем добавления стоп-лосса, оптимизации параметров и машинного обучения.

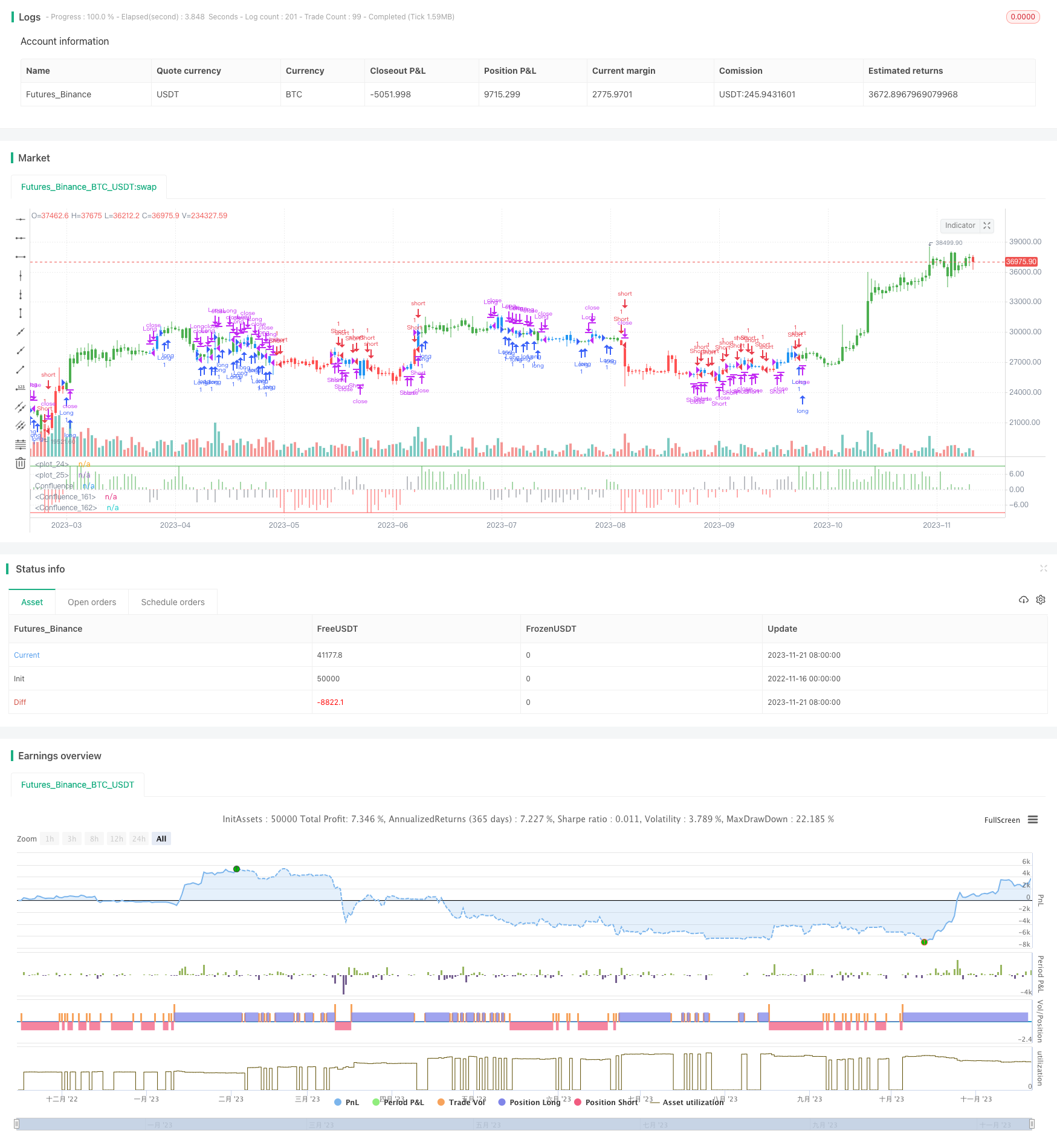

/*backtest

start: 2022-11-16 00:00:00

end: 2023-11-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 14/03/2017

// This is modified version of Dale Legan's "Confluence" indicator written by Gary Fritz.

// ================================================================

// Here is Gary`s commentary:

// Since the Confluence indicator returned several "states" (bull, bear, grey, and zero),

// he modified the return value a bit:

// -9 to -1 = Bearish

// -0.9 to 0.9 = "grey" (and zero)

// 1 to 9 = Bullish

// The "grey" range corresponds to the "grey" values plotted by Dale's indicator, but

// they're divided by 10.

//

// You can change long to short in the Input Settings

// Please, use it only for learning or paper trading. Do not for real trading.

////////////////////////////////////////////////////////////

strategy(title="Confluence", shorttitle="Confluence")

Harmonic = input(10, minval=1)

BuyBand = input(9)

SellBand = input(-9)

reverse = input(false, title="Trade reverse")

hline(SellBand, color=red, linestyle=line)

hline(BuyBand, color=green, linestyle=line)

Price = close

STL = round((Harmonic * 2) - 1 - 0.5)

ITL = round((STL * 2) - 1 - 0.5)

LTL = round((ITL * 2) - 1 - 0.5)

HOFF = round(Harmonic / 2 - 0.5)

SOFF = round(STL / 2 - 0.5)

IOFF = round(ITL / 2 - 0.5)

xHavg = sma(Price, Harmonic)

xSavg = sma(Price, STL)

xIavg = sma(Price, ITL)

xLavg = sma(Price, LTL)

xvalue2 = xSavg - xHavg[HOFF]

xvalue3 = xIavg - xSavg[SOFF]

xvalue12 = xLavg - xIavg[IOFF]

xmomsig = xvalue2 + xvalue3 + xvalue12

xLavgOHLC = sma(ohlc4, LTL - 1)

xH2 = sma(Price, Harmonic - 1)

xS2 = sma(Price, STL - 1)

xI2 = sma(Price, ITL - 1)

xL2 = sma(Price, LTL - 1)

DerivH = (xHavg * 2) - xHavg[1]

DerivS = (xSavg * 2) - xSavg[1]

DerivI = (xIavg * 2) - xIavg[1]

DerivL = (xLavg * 2) - xLavg[1]

SumDH = Harmonic * DerivH

SumDS = STL * DerivS

SumDI = ITL * DerivI

SumDL = LTL * DerivL

LengH = Harmonic - 1

LengS = STL - 1

LengI = ITL - 1

LengL = LTL - 1

N1H = xH2 * LengH

N1S = xS2 * LengS

N1I = xI2 * LengI

N1L = xL2 * LengL

DRH = SumDH - N1H

DRS = SumDS - N1S

DRI = SumDI - N1I

DRL = SumDL - N1L

SumH = xH2 * (Harmonic - 1)

SumS = xS2 * (STL - 1)

SumI = xI2 * (ITL - 1)

SumL = xLavgOHLC * (LTL - 1)

xvalue5 = (SumH + DRH) / Harmonic

xvalue6 = (SumS + DRS) / STL

xvalue7 = (SumI + DRI) / ITL

xvalue13 = (SumL + DRL) / LTL

value9 = xvalue6 - xvalue5[HOFF]

value10 = xvalue7 - xvalue6[SOFF]

value14 = xvalue13 - xvalue7[IOFF]

xmom = value9 + value10 + value14

HT = sin(xvalue5 * 2 * 3.14 / 360) + cos(xvalue5 * 2 * 3.14 / 360)

HTA = sin(xHavg * 2 * 3.14 / 360) + cos(xHavg * 2 * 3.14 / 360)

ST = sin(xvalue6 * 2 * 3.14 / 360) + cos(xvalue6 * 2 * 3.14 / 360)

STA = sin(xSavg * 2 * 3.14 / 360) + cos(xSavg * 2 * 3.14 / 360)

IT = sin(xvalue7 * 2 * 3.14 / 360) + cos(xvalue7 * 2 * 3.14 / 360)

ITA = sin(xIavg * 2 * 3.14 / 360) + cos(xIavg * 2 * 3.14 / 360)

xSum = HT + ST + IT

xErr = HTA + STA + ITA

Condition2 = (((xSum > xSum[SOFF]) and (xHavg < xHavg[SOFF])) or ((xSum < xSum[SOFF]) and (xHavg > xHavg[SOFF])))

Phase = iff(Condition2 , -1 , 1)

xErrSum = (xSum - xErr) * Phase

xErrSig = sma(xErrSum, SOFF)

xvalue70 = xvalue5 - xvalue13

xvalue71 = sma(xvalue70, Harmonic)

ErrNum = iff (xErrSum > 0 and xErrSum < xErrSum[1] and xErrSum < xErrSig, 1,

iff (xErrSum > 0 and xErrSum < xErrSum[1] and xErrSum > xErrSig, 2,

iff (xErrSum > 0 and xErrSum > xErrSum[1] and xErrSum < xErrSig, 2,

iff (xErrSum > 0 and xErrSum > xErrSum[1] and xErrSum > xErrSig, 3,

iff (xErrSum < 0 and xErrSum > xErrSum[1] and xErrSum > xErrSig, -1,

iff (xErrSum < 0 and xErrSum < xErrSum[1] and xErrSum > xErrSig, -2,

iff (xErrSum < 0 and xErrSum > xErrSum[1] and xErrSum < xErrSig, -2,

iff (xErrSum < 0 and xErrSum < xErrSum[1] and xErrSum < xErrSig, -3, 0))))))))

momNum = iff (xmom > 0 and xmom < xmom[1] and xmom < xmomsig , 1,

iff (xmom > 0 and xmom < xmom[1] and xmom > xmomsig, 2,

iff (xmom > 0 and xmom > xmom[1] and xmom < xmomsig, 2,

iff (xmom > 0 and xmom > xmom[1] and xmom > xmomsig, 3,

iff (xmom < 0 and xmom > xmom[1] and xmom > xmomsig, -1,

iff (xmom < 0 and xmom < xmom[1] and xmom > xmomsig, -2,

iff (xmom < 0 and xmom > xmom[1] and xmom < xmomsig, -2,

iff (xmom < 0 and xmom < xmom[1] and xmom < xmomsig, -3, 0))))))))

TCNum = iff (xvalue70 > 0 and xvalue70 < xvalue70[1] and xvalue70 < xvalue71, 1,

iff (xvalue70 > 0 and xvalue70 < xvalue70[1] and xvalue70 > xvalue71, 2,

iff (xvalue70 > 0 and xvalue70 > xvalue70[1] and xvalue70 < xvalue71, 2,

iff (xvalue70 > 0 and xvalue70 > xvalue70[1] and xvalue70 > xvalue71, 3,

iff (xvalue70 < 0 and xvalue70 > xvalue70[1] and xvalue70 > xvalue71, -1,

iff (xvalue70 < 0 and xvalue70 < xvalue70[1] and xvalue70 > xvalue71, -2,

iff (xvalue70 < 0 and xvalue70 > xvalue70[1] and xvalue70 < xvalue71, -2,

iff (xvalue70 < 0 and xvalue70 < xvalue70[1] and xvalue70 < xvalue71, -3,0))))))))

value42 = ErrNum + momNum + TCNum

Confluence = iff (value42 > 0 and xvalue70 > 0, value42,

iff (value42 < 0 and xvalue70 < 0, value42,

iff ((value42 > 0 and xvalue70 < 0) or (value42 < 0 and xvalue70 > 0), value42 / 10, 0)))

Res1 = iff (Confluence >= 1, Confluence, 0)

Res2 = iff (Confluence <= -1, Confluence, 0)

Res3 = iff (Confluence == 0, 0, iff (Confluence > -1 and Confluence < 1, 10 * Confluence, 0))

pos = iff(Res2 >= SellBand and Res2 != 0, -1,

iff(Res1 <= BuyBand and Res1 != 0, 1,

iff(Res3 != 0, 0, nz(pos[1], 0))))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close("Long", when = possig == 0)

strategy.close("Short", when = possig == 0)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(Res1, color=green, title="Confluence", linewidth=3, style = histogram)

plot(Res2, color=red, title="Confluence", linewidth=3, style = histogram)

plot(Res3, color=gray, title="Confluence", linewidth=3, style = histogram)

- Спекуляции Gulf: Trend Follow Strategy Based on SAR (Спекуляции Персидского залива):

- ОРИГИНАЛЬНАЯ ПРИМИТИВНАЯ СТРАТЕГИЯ ПРЕДСЛЕДЕНИЯ ТРЕНДОВ, основанная на скользящей средней

- Стратегия сдерживания потерь по полосам Боллинджера

- Стратегия отслеживания тенденций на основе многопоказателей

- Стратегия динамического тренда с несколькими скользящими средними

- Стоп-лосс и стратегия получения прибыли на основе цены

- Стратегия торговли электроэнергией по срокам

- Двунаправленная стратегия отслеживания тренда перемещающейся средней перекрестности

- Персонализированная стратегия торговли импульсом

- Движущаяся средняя тенденция каналов конвертации в соответствии со стратегией

- Стратегия прорыва импульса, основанная на внутренней амплитуде стоп-потери

- Тенденционная стратегия торговли, основанная на Золотом кресте

- Стратегия отслеживания трендов на основе перерывов каналов

- Стратегия выхода с помощью пирамиды

- Стратегия отслеживания импульса

- Стратегия отслеживания изменения CCTBBO

- Стратегия перекрестного использования скользящей средней

- Стратегия отслеживания трендов Momentum Turtle

- Береговая стратегия перехода на "харами"

- Стратегия динамической скользящей средней