متحرک خرید و فروخت حجم بریک آؤٹ حکمت عملی

مصنف:چاؤ ژانگ، تاریخ: 2023-12-26 11:15:31ٹیگز:

جائزہ

یہ حکمت عملی اعلی امکان کے رجحان سے باخبر رہنے کے ل weekly ہفتہ وار وی ڈبلیو اے پی اور فلٹرنگ کے لئے بولنگر بینڈ کے ساتھ مل کر ، اپنی مرضی کے مطابق ٹائم فریم خرید و فروخت کے حجم کے ذریعے طویل اور مختصر طے کرتی ہے۔ یہ یکطرفہ خطرے کو مؤثر طریقے سے کنٹرول کرنے کے لئے متحرک منافع لینے اور نقصان کو روکنے کا طریقہ کار بھی متعارف کراتی ہے۔

حکمت عملی کا اصول

- اپنی مرضی کے مطابق ٹائم فریم کے اندر خرید و فروخت کے حجم کے اشارے کا حساب لگائیں

- BV: کم قیمت پر خریدنے کی وجہ سے خریدنے کا حجم

- ایس وی: فروخت کا حجم، اعلی نقطہ پر فروخت کی وجہ سے

- پروسیسنگ خرید و فروخت کا حجم

- 20 پیریڈ ای ایم اے کی طرف سے ہموار

- پروسیس شدہ خرید و فروخت کے حجم کو مثبت اور منفی میں الگ کریں

- جج اشارے کی سمت

- 0 سے زیادہ تیزی ہے، 0 سے کم کمی ہے

- ہفتہ وار VWAP اور بولنگر بینڈ کے ساتھ مل کر اختلاف کا تعین کریں

- قیمت VWAP اور اشارے سے اوپر تیزی سے طویل سگنل ہے

- VWAP اور اشارے کے نیچے قیمت کم سگنل ہے

- متحرک منافع اور سٹاپ نقصان

- روزانہ اے ٹی آر کی بنیاد پر منافع لینے اور نقصان روکنے کا مقررہ فیصد

فوائد

- خرید و فروخت کا حجم مارکیٹ کی حقیقی رفتار کی عکاسی کرتا ہے، رجحانات کی ممکنہ توانائی کو پکڑتا ہے

- ہفتہ وار وی ڈبلیو اے پی طویل مدتی ٹرینڈ سمت کا فیصلہ کرتا ہے، بولنگر بینڈ بریک آؤٹ سگنل کا تعین کرتے ہیں

- متحرک اے ٹی آر سیٹ منافع اور سٹاپ نقصان لیتے ہیں، منافع کو زیادہ سے زیادہ مقفل کرتے ہیں اور اوور ٹوننگ سے بچتے ہیں

خطرات

- خریدنے اور فروخت کے حجم کے اعداد و شمار میں کچھ غلطیاں ہیں، غلط فیصلے کا سبب بن سکتی ہیں

- ایک اشارے کے ساتھ مل کر فیصلہ کرنے سے غلط سگنل پیدا ہوتے ہیں

- غلط بولنگر بینڈز پیرامیٹر کی ترتیبات درست بریکآؤٹس کو محدود کرتی ہیں

اصلاح کی ہدایات

- متعدد ٹائم فریم خریدنے اور فروخت کے حجم کے اشارے کے ساتھ بہتر بنائیں

- فلٹرنگ کے لئے تجارتی حجم اور دیگر معاون اشارے شامل کریں

- بریک آؤٹ کی کارکردگی کو بہتر بنانے کے لئے بولنگر بینڈ پیرامیٹرز کو متحرک طور پر ایڈجسٹ کریں

نتیجہ

یہ حکمت عملی خرید و فروخت کے حجم کی پیش گوئی کا مکمل استعمال کرتی ہے ، جس سے VWAP اور بولنگر بینڈ کے ذریعہ اعلی احتمال کے سگنل پیدا ہوتے ہیں ، جبکہ متحرک منافع اور اسٹاپ نقصان کے ذریعہ خطرہ کو مؤثر طریقے سے کنٹرول کیا جاتا ہے۔ جیسا کہ پیرامیٹرز اور قوانین کو بہتر بنایا جاتا رہتا ہے ، کارکردگی میں مزید نمایاں ہونے کی توقع ہے۔

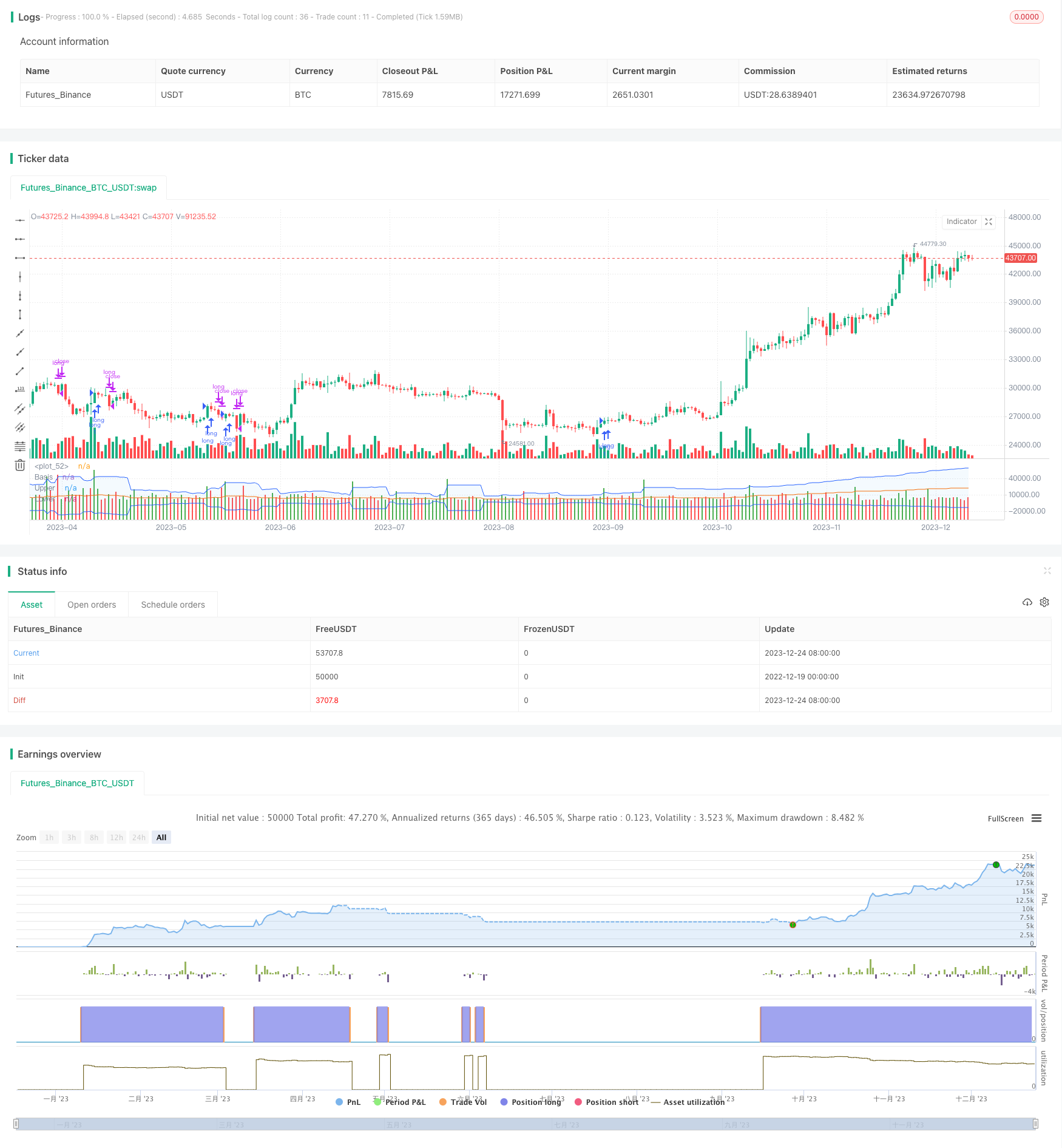

/*backtest

start: 2022-12-19 00:00:00

end: 2023-12-25 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © original author ceyhun

//@ exlux99 update

//@version=5

strategy('Buying Selling Volume Strategy', format=format.volume, precision=0, overlay=false)

weekly_vwap = request.security(syminfo.tickerid, "W", ta.vwap(hlc3))

vi = false

customTimeframe = input.timeframe("60", group="Entry Settings")

allow_long = input.bool(true, group="Entry Settings")

allow_short = input.bool(false, group="Entry Settings")

xVolume = request.security(syminfo.tickerid, customTimeframe, volume)

xHigh = request.security(syminfo.tickerid, customTimeframe, high)

xLow = request.security(syminfo.tickerid, customTimeframe, low)

xClose = request.security(syminfo.tickerid, customTimeframe, close)

BV = xHigh == xLow ? 0 : xVolume * (xClose - xLow) / (xHigh - xLow)

SV = xHigh == xLow ? 0 : xVolume * (xHigh - xClose) / (xHigh - xLow)

vol = xVolume > 0 ? xVolume : 1

TP = BV + SV

BPV = BV / TP * vol

SPV = SV / TP * vol

TPV = BPV + SPV

tavol20 = request.security(syminfo.tickerid, customTimeframe, ta.ema(vol, 20))

tabv20= request.security(syminfo.tickerid, customTimeframe, ta.ema(BV, 20))

tasv20= request.security(syminfo.tickerid, customTimeframe, ta.ema(SV, 20))

VN = vol / tavol20

BPN = BV / tabv20 * VN * 100

SPN = SV / tasv20 * VN * 100

TPN = BPN + SPN

xbvp = request.security(syminfo.tickerid, customTimeframe,-math.abs(BPV))

xbpn = request.security(syminfo.tickerid, customTimeframe,-math.abs(BPN))

xspv = request.security(syminfo.tickerid, customTimeframe,-math.abs(SPV))

xspn = request.security(syminfo.tickerid, customTimeframe,-math.abs(SPN))

BPc1 = BPV > SPV ? BPV : xbvp

BPc2 = BPN > SPN ? BPN : xbpn

SPc1 = SPV > BPV ? SPV : xspv

SPc2 = SPN > BPN ? SPN : xspn

BPcon = vi ? BPc2 : BPc1

SPcon = vi ? SPc2 : SPc1

minus = BPcon + SPcon

plot(minus, color = BPcon > SPcon ? color.green : color.red , style=plot.style_columns)

length = input.int(20, minval=1, group="Volatility Settings")

src = minus//input(close, title="Source")

mult = input.float(2.0, minval=0.001, maxval=50, title="StdDev", group="Volatility Settings")

xtasma = request.security(syminfo.tickerid, customTimeframe, ta.sma(src, length))

xstdev = request.security(syminfo.tickerid, customTimeframe, ta.stdev(src, length))

basis = xtasma

dev = mult * xstdev

upper = basis + dev

lower = basis - dev

plot(basis, "Basis", color=#FF6D00, offset = 0)

p1 = plot(upper, "Upper", color=#2962FF, offset = 0)

p2 = plot(lower, "Lower", color=#2962FF, offset = 0)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

// Original a

longOriginal = minus > upper and BPcon > SPcon and close > weekly_vwap

shortOriginal = minus > upper and BPcon < SPcon and close< weekly_vwap

high_daily = request.security(syminfo.tickerid, "D", high)

low_daily = request.security(syminfo.tickerid, "D", low)

close_daily = request.security(syminfo.tickerid, "D", close)

true_range = math.max(high_daily - low_daily, math.abs(high_daily - close_daily[1]), math.abs(low_daily - close_daily[1]))

atr_range = ta.sma(true_range*100/request.security(syminfo.tickerid, "D", close), 14)

ProfitTarget_Percent_long = input.float(100.0, title='TP Multiplier for Long entries ', step=0.5, step=0.5, group='Dynamic Risk Management')

Profit_Ticks_long = close + (close * (atr_range * ProfitTarget_Percent_long))/100

LossTarget_Percent_long = input.float(1.0, title='SL Multiplier for Long entries', step=0.5, group='Dynamic Risk Management')

Loss_Ticks_long = close - (close * (atr_range * LossTarget_Percent_long ))/100

ProfitTarget_Percent_short = input.float(100.0, title='TP Multiplier for Short entries ', step=0.5, step=0.5, group='Dynamic Risk Management')

Profit_Ticks_short = close - (close * (atr_range*ProfitTarget_Percent_short))/100

LossTarget_Percent_short = input.float(5.0, title='SL Multiplier for Short entries', step=0.5, group='Dynamic Risk Management')

Loss_Ticks_short = close + (close * (atr_range*LossTarget_Percent_short))/100

var longOpened_original = false

var int timeOfBuyLong = na

var float tpLong_long_original = na

var float slLong_long_original = na

long_entryx = longOriginal

longEntry_original = long_entryx and not longOpened_original

if longEntry_original

longOpened_original := true

tpLong_long_original := Profit_Ticks_long

slLong_long_original := Loss_Ticks_long

timeOfBuyLong := time

//lowest_low_var_sl := lowest_low

tpLong_trigger = longOpened_original[1] and ((close > tpLong_long_original) or (high > tpLong_long_original)) //or high > lowest_low_var_tp

slLong_Trigger = longOpened_original[1] and ((close < slLong_long_original) or (low < slLong_long_original)) //or low < lowest_low_var_sl

longExitSignal_original = shortOriginal or tpLong_trigger or slLong_Trigger

if(longExitSignal_original)

longOpened_original := false

tpLong_long_original := na

slLong_long_original := na

if(allow_long)

strategy.entry("long", strategy.long, when=longOriginal)

strategy.close("long", when= longExitSignal_original) //or shortNew

if(allow_short)

strategy.entry("short", strategy.short, when=shortOriginal )

strategy.close("short", when= longOriginal) //or shortNew

مزید

- لیری ولیمز کی حرکت پذیر اوسط کراس اوور حکمت عملی

- اوسیلیٹر ڈفریینشل چلتی اوسط ٹائمنگ حکمت عملی

- متحرک سٹاپ نقصان کے ساتھ ڈی ایم آئی اور اسٹوکاسٹک ٹریڈنگ کی حکمت عملی

- دو فیکٹر کمبو رورس اور ماس انڈیکس کی حکمت عملی

- ڈبل ٹرینڈ فلٹر پر مبنی مقداری تجارتی حکمت عملی

- اسٹوکاسٹک آر ایس آئی مومنٹم آسسیلیشن ٹریڈنگ حکمت عملی

- مختصر فروخت کی ٹریڈنگ حکمت عملی جب بولنگر بینڈ آر ایس آئی کال بیک کے ساتھ قیمت سے نیچے کراس کرتا ہے

- چلتی اوسط کراس اوور حکمت عملی

- متحرک محور بینڈ پر مبنی رجحان ٹریکنگ کی حکمت عملی

- بولنگر بینڈز مومنٹم ٹرینڈ اسٹریٹجی کے بعد

- سپر ٹرینڈ MACD مقداری حکمت عملی

- 4 ای ایم اے ٹرینڈ اسٹریٹیجی

- کوانٹیٹیو اشارے پر مبنی بٹ کوائن ٹریڈنگ حکمت عملی

- آخری N موم بتی ریورس منطق کی حکمت عملی

- ٹرینڈ ٹریکنگ بریک آؤٹ حکمت عملی

- سادہ خرید کم فروخت اعلی حکمت عملی

- N بار بند ذیل کھولیں مختصر حکمت عملی

- انتہائی قدر کے طریقہ کار پر مبنی شماریاتی اتار چڑھاؤ بیک ٹیسٹ کی حکمت عملی

- رشتہ دار طاقت انڈیکس سٹاپ نقصان کی حکمت عملی

- ڈبل چینل ڈونچیان بریک آؤٹ حکمت عملی