اشارے کے امتزاج پر مبنی حکمت عملی کے بعد دوہری چلتی اوسط رجحان کی اصلاح

مصنف:چاؤ ژانگ، تاریخ: 2024-02-01 15:13:13ٹیگز:

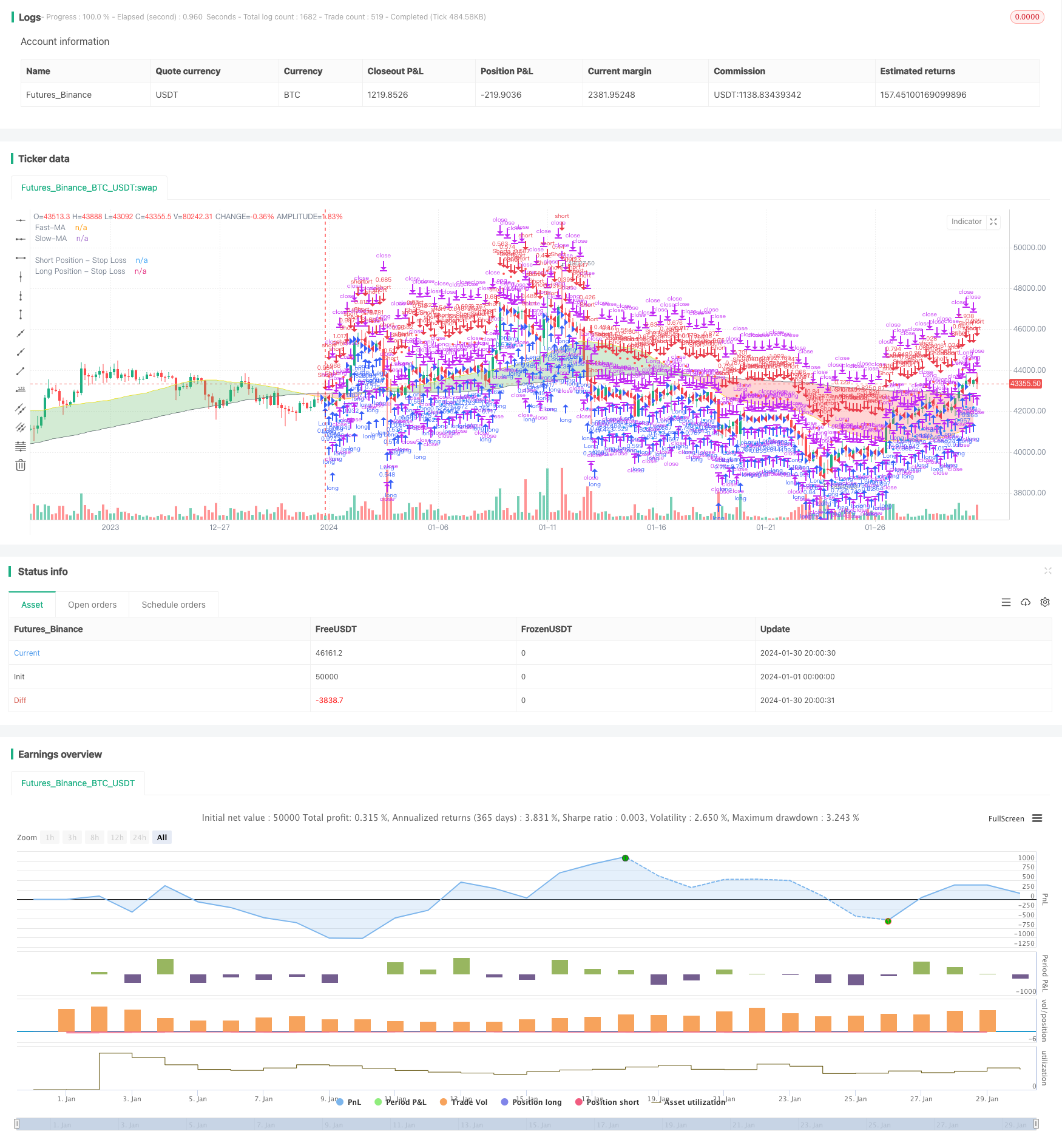

جائزہ

یہ حکمت عملی تیز اور سست حرکت پذیر اوسط لائنوں کا حساب لگاتے ہوئے اور پیرابولک ایس اے آر اشارے کو جوڑ کر تجارتی سگنل تیار کرتی ہے۔ یہ رجحان کی پیروی کرنے والی حکمت عملی سے تعلق رکھتی ہے۔ جب تیز ایم اے سست ایم اے کو عبور کرتا ہے تو ، لمبی پوزیشن کھولی جائے گی۔ جب تیز ایم اے سست ایم اے سے نیچے عبور کرتا ہے تو ، مختصر پوزیشن کھولی جائے گی۔ پیرابولک ایس اے آر کا استعمال جعلی بریکآؤٹس کو فلٹر کرنے کے لئے کیا جاتا ہے۔

حکمت عملی کا اصول

- تیز رفتار اور سست حرکت پذیر اوسط لائنوں کا حساب لگائیں۔ پیرامیٹرز کو اپنی مرضی کے مطابق کیا جا سکتا ہے.

- مارکیٹ کے رجحان کا تعین کرنے کے لئے دو ایم اے لائنوں کا موازنہ کریں۔ جب تیز ایم اے سست ایم اے پر عبور کرتا ہے تو ، اس سے تیزی کا رجحان ظاہر ہوتا ہے۔ جب تیز ایم اے سست ایم اے سے نیچے عبور کرتا ہے تو ، اس سے bearish رجحان ظاہر ہوتا ہے۔

- مزید تصدیق اس بات کی جانچ پڑتال کرکے کی جاتی ہے کہ آیا قریبی قیمت تیز ایم اے سے اوپر / نیچے ہے۔ صرف اس وقت جب تیز ایم اے سست ایم اے سے عبور کرتی ہے اور قریبی قیمت تیز ایم اے سے اوپر ہوتی ہے تو ، لانگ سگنل تیار ہوتا ہے۔ صرف اس وقت جب تیز ایم اے سست ایم اے سے نیچے عبور کرتی ہے اور قریبی قیمت تیز ایم اے سے نیچے ہوتی ہے تو ، شارٹ سگنل تیار ہوتا ہے۔

- پیرابولک SAR کا استعمال جعلی سگنل کو فلٹر کرنے کے لئے کیا جاتا ہے۔ صرف اس وقت جب تینوں معیار پورے ہوجاتے ہیں ، تو حتمی سگنل تیار ہوتا ہے۔

- اسٹاپ نقصان زیادہ سے زیادہ قابل برداشت نقصان کی بنیاد پر مقرر کیا جاتا ہے۔ متحرک اسٹاپ نقصان کی قیمت کا حساب کرنے کے لئے اے ٹی آر اشارے کا استعمال کیا جاتا ہے۔

فوائد

- ایم اے لائنز مارکیٹ کے رجحان کا تعین کرتی ہیں اور رینج سے منسلک مارکیٹ میں زیادہ سے زیادہ تجارت سے بچتی ہیں۔

- ڈبل فلٹرز جعلی فرار کے خطرے کو نمایاں طور پر کم کرتے ہیں.

- سٹاپ نقصان کی حکمت عملی مؤثر طریقے سے ہر تجارت کے نقصان کی حد.

خطرات

- اشارے کی حکمت عملی غلط سگنل پیدا کرتی ہے

- غیر ملکی کرنسی کے خطرے کے بارے میں کوئی غور نہیں

- ممکنہ طور پر مخالف سمت میں ابتدائی رجحان کو یاد کرنا

حکمت عملی کو مندرجہ ذیل پہلوؤں میں بہتر بنایا جاسکتا ہے:

- مخصوص مصنوعات کے مطابق ایم اے پیرامیٹرز کو بہتر بنائیں

- سگنل فلٹرنگ کے لئے دیگر اشارے یا ماڈل شامل کریں

- ریئل ٹائم ہیجنگ یا آٹو کرنسی تبادلوں پر غور کریں

اصلاح کے لیے ہدایات

- رجحانات کو بہتر طور پر پکڑنے کے لئے ایم اے پیرامیٹرز کو بہتر بنائیں

- سگنل کی درستگی کو بہتر بنانے کے لئے ماڈل کی تنوع میں اضافہ

- پھنسنے سے بچنے کے لئے کثیر ٹائم فریم کی توثیق

- استحکام بڑھانے کے لئے سٹاپ نقصان کی حکمت عملی کو بہتر بنائیں

نتیجہ

یہ ایک عام دوہری حرکت پذیر اوسط کراس اور اشارے کے امتزاج کا رجحان ہے۔ تیز اور سست ایم اے سمتوں کا موازنہ کرکے ، مارکیٹ کے رجحان کا تعین کیا جاتا ہے۔ غلط سگنلز سے بچنے کے لئے مختلف فلٹر اشارے استعمال کیے جاتے ہیں۔ اسی وقت ، اسٹاپ نقصان کا فنکشن ہر تجارت کے نقصان کو کنٹرول کرنے کے لئے نافذ کیا جاتا ہے۔ فائدہ یہ ہے کہ حکمت عملی کا منطق آسان اور سمجھنے اور بہتر بنانے میں آسان ہے۔ نقصان یہ ہے کہ ایک موٹے رجحان کے آلے کے طور پر ، مشین لرننگ ماڈل متعارف کرانے کے ذریعہ سگنل کی درستگی کو بہتر بنانے کی ابھی بھی گنجائش ہے۔

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © sosacur01

//@version=5

strategy(title="2 MA | Trend Following", overlay=true, pyramiding=1, commission_type=strategy.commission.percent, commission_value=0.2, initial_capital=10000)

//==========================================

//BACKTEST RANGE

useDateFilter = input.bool(true, title="Filter Date Range of Backtest",

group="Backtest Time Period")

backtestStartDate = input(timestamp("1 jan 2000"),

title="Start Date", group="Backtest Time Period",

tooltip="This start date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

backtestEndDate = input(timestamp("1 Jul 2100"),

title="End Date", group="Backtest Time Period",

tooltip="This end date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

inTradeWindow = true

if not inTradeWindow and inTradeWindow[1]

strategy.cancel_all()

strategy.close_all(comment="Date Range Exit")

//--------------------------------------

//LONG/SHORT POSITION ON/OFF INPUT

LongPositions = input.bool(title='On/Off Long Postion', defval=true, group="Long & Short Position")

ShortPositions = input.bool(title='On/Off Short Postion', defval=true, group="Long & Short Position")

//---------------------------------------

//SLOW MA INPUTS

averageType1 = input.string(defval="SMA", group="Slow MA Inputs", title="Slow MA Type", options=["SMA", "EMA", "WMA", "HMA", "RMA", "SWMA", "ALMA", "VWMA", "VWAP"])

averageLength1 = input.int(defval=160, group="Slow MA Inputs", title="Slow MA Length", minval=50)

averageSource1 = input(close, title="Slow MA Source", group="Slow MA Inputs")

//SLOW MA TYPE

MovAvgType1(averageType1, averageSource1, averageLength1) =>

switch str.upper(averageType1)

"SMA" => ta.sma(averageSource1, averageLength1)

"EMA" => ta.ema(averageSource1, averageLength1)

"WMA" => ta.wma(averageSource1, averageLength1)

"HMA" => ta.hma(averageSource1, averageLength1)

"RMA" => ta.rma(averageSource1, averageLength1)

"SWMA" => ta.swma(averageSource1)

"ALMA" => ta.alma(averageSource1, averageLength1, 0.85, 6)

"VWMA" => ta.vwma(averageSource1, averageLength1)

"VWAP" => ta.vwap(averageSource1)

=> runtime.error("Moving average type '" + averageType1 +

"' not found!"), na

//----------------------------------

//FAST MA INPUTS

averageType2 = input.string(defval="SMA", group="Fast MA Inputs", title="Fast MA Type", options=["SMA","EMA","WMA","HMA","RMA","SWMA","ALMA","VWMA","VWAP"])

averageLength2 = input.int(defval=40, group="Fast MA Inputs", title="Fast MA Length", maxval=40)

averageSource2 = input(close, title="Fast MA Source", group="Fast MA Inputs")

//FAST MA TYPE

MovAvgType2(averageType2, averageSource2, averageLength2) =>

switch str.upper(averageType2)

"SMA" => ta.sma(averageSource2, averageLength2)

"EMA" => ta.ema(averageSource2, averageLength2)

"WMA" => ta.wma(averageSource2, averageLength2)

"HMA" => ta.hma(averageSource2, averageLength2)

"RMA" => ta.rma(averageSource2, averageLength2)

"SWMA" => ta.swma(averageSource2)

"ALMA" => ta.alma(averageSource2, averageLength2, 0.85, 6)

"VWMA" => ta.vwma(averageSource2, averageLength2)

"VWAP" => ta.vwap(averageSource2)

=> runtime.error("Moving average type '" + averageType2 +

"' not found!"), na

//---------------------------------------------------

//MA VALUES

FASTMA = MovAvgType2(averageType2, averageSource2, averageLength2)

SLOWMA = MovAvgType1(averageType1, averageSource1, averageLength1)

//BUY/SELL TRIGGERS

bullish_trend = FASTMA > SLOWMA and close > FASTMA

bearish_trend = FASTMA < SLOWMA and close < FASTMA

//MAs PLOT

plot1 = plot(SLOWMA,color=color.gray, linewidth=1, title="Slow-MA")

plot2 = plot(FASTMA,color=color.yellow, linewidth=1, title="Fast-MA")

fill(plot1, plot2, color=SLOWMA>FASTMA ? color.new(color.red, 70) : color.new(color.green, 70), title="EMA Clouds")

//-----------------------------------------------------

//PARABOLIC SAR USER INPUT

usepsarFilter = input.bool(title='Use Parabolic Sar?', defval=true, group = "Parabolic SAR Inputs")

psar_display = input.bool(title="Display Parabolic Sar?", defval=false, group="Parabolic SAR Inputs")

start = input.float(title="Start", defval=0.02, group="Parabolic SAR Inputs", step=0.001)

increment = input.float(title="Increment", defval=0.02, group="Parabolic SAR Inputs", step=0.001)

maximum = input.float(title="Maximum", defval=0.2, group="Parabolic SAR Inputs", step=0.001)

//SAR VALUES

psar = request.security(syminfo.tickerid, "D", ta.sar(start, increment, maximum))

//BULLISH & BEARISH PSAR CONDITIONS

bullish_psar = (usepsarFilter ? low > psar : bullish_trend )

bearsish_psar = (usepsarFilter ? high < psar : bearish_trend)

//SAR PLOT

psar_plot = if low > psar

color.rgb(198, 234, 199, 13)

else

color.rgb(219, 134, 134, 48)

plot(psar_display ? psar : na, color=psar_plot, title="Par SAR")

//-------------------------------------

//ENTRIES AND EXITS

long_entry = if inTradeWindow and bullish_trend and bullish_psar and LongPositions

true

long_exit = if inTradeWindow and bearish_trend

true

short_entry = if inTradeWindow and bearish_trend and bearsish_psar and ShortPositions

true

short_exit = if inTradeWindow and bullish_trend

true

//--------------------------------------

//RISK MANAGEMENT - SL, MONEY AT RISK, POSITION SIZING

atrPeriod = input.int(14, "ATR Length", group="Risk Management Inputs")

sl_atr_multiplier = input.float(title="Long Position - Stop Loss - ATR Multiplier", defval=2, group="Risk Management Inputs", step=0.5)

sl_atr_multiplier_short = input.float(title="Short Position - Stop Loss - ATR Multiplier", defval=2, group="Risk Management Inputs", step=0.5)

i_pctStop = input.float(2, title="% of Equity at Risk", step=.5, group="Risk Management Inputs")/100

//ATR VALUE

_atr = ta.atr(atrPeriod)

//CALCULATE LAST ENTRY PRICE

lastEntryPrice = strategy.opentrades.entry_price(strategy.opentrades - 1)

//STOP LOSS - LONG POSITIONS

var float sl = na

//CALCULTE SL WITH ATR AT ENTRY PRICE - LONG POSITION

if (strategy.position_size[1] != strategy.position_size)

sl := lastEntryPrice - (_atr * sl_atr_multiplier)

//IN TRADE - LONG POSITIONS

inTrade = strategy.position_size > 0

//PLOT SL - LONG POSITIONS

plot(inTrade ? sl : na, color=color.blue, style=plot.style_circles, title="Long Position - Stop Loss")

//CALCULATE ORDER SIZE - LONG POSITIONS

positionSize = (strategy.equity * i_pctStop) / (_atr * sl_atr_multiplier)

//============================================================================================

//STOP LOSS - SHORT POSITIONS

var float sl_short = na

//CALCULTE SL WITH ATR AT ENTRY PRICE - SHORT POSITIONS

if (strategy.position_size[1] != strategy.position_size)

sl_short := lastEntryPrice + (_atr * sl_atr_multiplier_short)

//IN TRADE SHORT POSITIONS

inTrade_short = strategy.position_size < 0

//PLOT SL - SHORT POSITIONS

plot(inTrade_short ? sl_short : na, color=color.red, style=plot.style_circles, title="Short Position - Stop Loss")

//CALCULATE ORDER - SHORT POSITIONS

positionSize_short = (strategy.equity * i_pctStop) / (_atr * sl_atr_multiplier_short)

//===============================================

//LONG STRATEGY

strategy.entry("Long", strategy.long, comment="Long", when = long_entry, qty=positionSize)

if (strategy.position_size > 0)

strategy.close("Long", when = (long_exit), comment="Close Long")

strategy.exit("Long", stop = sl, comment="Exit Long")

//SHORT STRATEGY

strategy.entry("Short", strategy.short, comment="Short", when = short_entry, qty=positionSize_short)

if (strategy.position_size < 0)

strategy.close("Short", when = (short_exit), comment="Close Short")

strategy.exit("Short", stop = sl_short, comment="Exit Short")

//ONE DIRECTION TRADING COMMAND (BELLOW ONLY ACTIVATE TO CORRECT BUGS)

- MACD اشارے پر مبنی رجحان ٹریڈنگ کی حکمت عملی

- ڈبل فلٹرز کے ساتھ اسٹوکاسٹک اور چلتی اوسط حکمت عملی

- اسٹاک آر ایس آئی پر مبنی رجحان کی پیروی کی حکمت عملی

- سنگل پوائنٹ چلتی اوسط بریک آؤٹ حکمت عملی

- چلتی اوسط کراس اوور حکمت عملی

- سپر ٹرینڈ حکمت عملی

- پیرابولک مدت اور بولنگر بینڈ مشترکہ چلتی سٹاپ نقصان کی حکمت عملی

- چلتی اوسط قیمت پر مبنی تجارتی حکمت عملی

- ایروٹک مومنٹم ڈائریکشن کنورجنسی ٹریڈنگ حکمت عملی

- چلتی اوسط اور اسٹوکاسٹک ٹریڈنگ کی حکمت عملی

- کوانٹم ٹریڈنگ کی موثر حکمت عملی

- دوہری حرکت پذیر اوسط کراس اوور اور ولیمز اشارے کی کمبو حکمت عملی

- رفتار کی پیشرفت سلور لائن حکمت عملی

- RWI Volatility Contrarian حکمت عملی

- پیرابولک SAR ٹرینڈ ٹریکنگ سٹاپ نقصان الٹ حکمت عملی

- رفتار اشارے کراس اوور حکمت عملی

- موثر آسکیلیشن توڑ دوہری سٹاپ منافع اور سٹاپ نقصان کی حکمت عملی

- ڈبل چینل بریک آؤٹ حکمت عملی

- ریئل ٹائم کے لائن ٹریکنگ پر مبنی گرڈ ٹریڈنگ کی حکمت عملی

- بریک آؤٹ پل بیک حکمت عملی