TMA-Legacy

Tác giả:ChaoZhang, Ngày: 2022-05-09 22:38:11Tags:RSI

Đây là một kịch bản dựa trên chỉ số TMA-RSI Divergence gốc của PhoenixBinary.

Cộng đồng Phoenix Binary và cộng đồng TMA đã xây dựng phiên bản này để làm mã công khai cho cộng đồng để sử dụng và sửa đổi thêm sau khi báo cáo về sự ra đi của Phoenix Binary (Cộng đồng gửi lời chia buồn đến gia đình Phoenix

Các sử dụng dự định giống như bản gốc nhưng một số tính toán khác nhau và có thể không hoạt động hoặc báo hiệu giống như bản gốc.

Mô tả về chỉ số từ lần phát hành ban đầu. Chỉ số này được lấy cảm hứng từ Arty và Christy.

█ CÁCH CÁCH

Dưới đây là một cái nhìn tổng quan ngắn gọn về chỉ số từ bài đăng ban đầu:

1

2

3

backtest

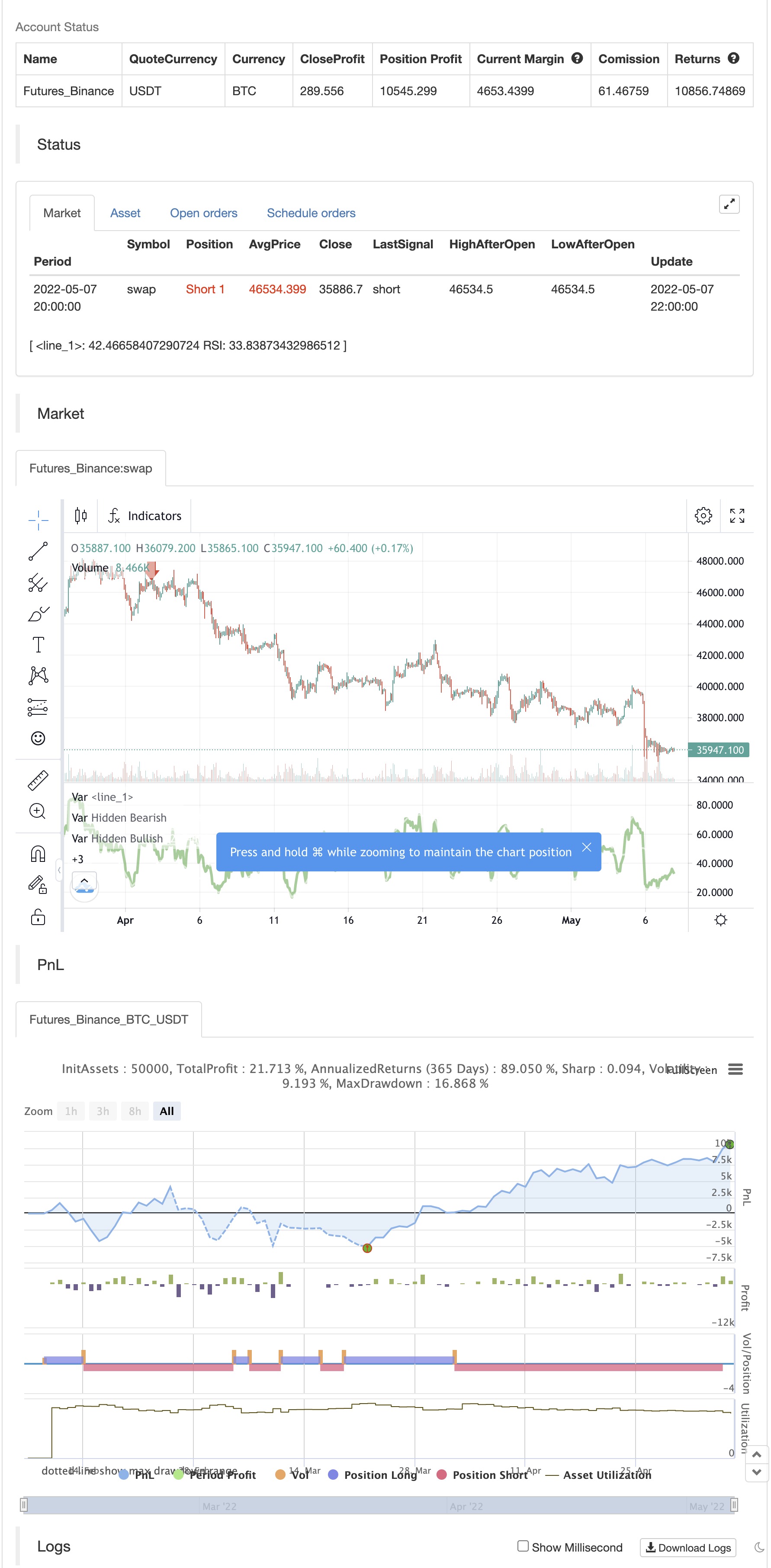

/*backtest

start: 2022-02-08 00:00:00

end: 2022-05-08 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// ©Hotchachachaa, Rest in Peace Pheonix Algo(aka Doug) your community misses you and we extend our deepest sympathies to your family.

//@version=5

//

//This indicator is based on the TMA-Divergence indicator created by PhoenixBinary for the TMA discord Community. Since Phoenix is no longer part of the community

//we did our best to recreate the indicator for the community's continued use updates and revisions.

indicator("TMA-Legacy", overlay=false)

////////////////////////////////////inputs////////////////////////////////////////////////

displayRSI = input.string(title="RSI Type", defval="RSI Divergence", options=["RSI Divergence","RSI Smoothed","RSI Momentum"],group="Main Settings")

lenrsinordiv = input.int(title="RSI Normal Length", defval=14,minval=1, group= "RSI Normal")

lenrsismodiv = input.int(title="RSI Smoothed Length", defval=40, minval=1,group = "RSI Smoothed" )

lenrsissmoma = input.int(title="RSI Smoothed MA", defval=40,minval=1, group = "RSI Smoothed" )

lenrsimomdiv = input.int(title="RSI Normal Length", defval=5 ,minval=1, group = "RSI Momentum")

rsimommalen = input.int(34, minval=1, title="Smooth RSI MA Length",group="RSI Momentum")

srcrsidiv = input(title="RSI Source", defval=close, group="Main Settings")

lbR = input.int(title="Pivot Lookback Right", defval=5,minval=1,group="Divergence Spotter")

lbL = input.int(title="Pivot Lookback Left", defval=5,minval=1,group="Divergence Spotter")

rangeUpper = input.int(title="Max of Lookback Range", defval=60,minval=1,group="Divergence Spotter")

rangeLower = input.int(title="Min of Lookback Range", defval=5,minval=1,group="Divergence Spotter")

plotBull = input.bool(title="Plot Bullish", defval=true,group="Divergence Spotter")

plotHiddenBull = input.bool(title="Plot Hidden Bullish", defval=true,group="Divergence Spotter")

plotBear = input.bool(title="Plot Bearish", defval=true,group="Divergence Spotter")

plotHiddenBear = input.bool(title="Plot Hidden Bearish", defval=true,group="Divergence Spotter")

bearColorrsidiv = color.red

bullColorrsidiv = color.green

hiddenBullColor = color.new(color.green, 80)

hiddenBearColor = color.new(color.red, 80)

textColor = color.white

noneColor = color.new(color.white, 100)

lenDisplay= displayRSI == "RSI Divergence" ? lenrsinordiv: displayRSI == "RSI Smoothed" ? lenrsismodiv: na

rsiValue1 = ta.rsi(srcrsidiv, lenrsinordiv)

// ### Smoothed MA

averageSource = rsiValue1

typeofMA1 = "SMMA"

length_ma1 = 50

f_smma(averageSource, averageLength) =>

smma = 0.0

smma := na(smma[1]) ? ta.sma(averageSource, averageLength) : (smma[1] * (averageLength - 1) + averageSource) / averageLength

smma

f_smwma(averageSource, averageLength) =>

smwma = 0.0

smwma := na(smwma[1]) ? ta.wma(averageSource, averageLength) : (smwma[1] * (averageLength - 1) + averageSource) / averageLength

smwma

f_tma(averageSource, averageLength) =>

ta.sma(ta.sma(averageSource, averageLength), averageLength)

f_dema(averageSource, averageLength) =>

emaValue = ta.ema(averageSource, averageLength)

2 * emaValue - ta.ema(emaValue, averageLength)

f_tema(averageSource, averageLength) =>

ema1 = ta.ema(averageSource, averageLength)

ema2 = ta.ema(ema1, averageLength)

ema3 = ta.ema(ema2, averageLength)

(3 * ema1) - (3 * ema2) + ema3

f_ma(smoothing, averageSource, averageLength) =>

switch str.upper(smoothing)

"SMA" => ta.sma(averageSource, averageLength)

"EMA" => ta.ema(averageSource, averageLength)

"WMA" => ta.wma(averageSource, averageLength)

"HMA" => ta.hma(averageSource, averageLength)

"RMA" => ta.rma(averageSource, averageLength)

"SWMA" => ta.swma(averageSource)

"ALMA" => ta.alma(averageSource, averageLength, 0.85, 6)

"VWMA" => ta.vwma(averageSource, averageLength)

"VWAP" => ta.vwap(averageSource)

"SMMA" => f_smma(averageSource, averageLength)

"SMWMA" => f_smwma(averageSource, averageLength)

"DEMA" => f_dema(averageSource, averageLength)

"TEMA"=> f_tema(averageSource, averageLength)

=> runtime.error("Moving average type '" + smoothing +

"' not found!"), na

MA1 = f_ma(typeofMA1, averageSource, length_ma1)

showNormal=displayRSI=="RSI Divergence"

showSmoothed=displayRSI=="RSI Smoothed"

showMomentum = displayRSI =="RSI Momentum"

showAll= displayRSI=="All Three"

///////OB/OS lines

hline(showNormal or showSmoothed ? 80 :na, title="OverBought", linestyle=hline.style_dotted, linewidth=2)

hline(showNormal or showSmoothed ? 20 :na, title="OverSold", linestyle=hline.style_dotted, linewidth=2)

////////////////show normal

plot(showNormal? MA1 : na , linewidth=2, color=color.white)

var int colortoken=1

color1= color.green

color2 = color.yellow

color3 = color.orange

color4 = color.red

if rsiValue1>rsiValue1[1] and colortoken!=1

colortoken:= colortoken[1] - 1

if rsiValue1<rsiValue1[1] and colortoken!=4

colortoken:= colortoken[1] + 1

lineColor= colortoken == 1 ? color1: colortoken ==2 ? color2 : colortoken == 3 ? color3 : colortoken == 4 ? color4 :na

plot(showNormal? rsiValue1 : na, title="RSI", linewidth=3, color=lineColor)

////////////show smoothed

lensig = input.int(14, title="ADX Smoothing", minval=1, maxval=50)

len = input.int(14, minval=1, title="DI Length")

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

trur = ta.rma(ta.tr, len)

plus = fixnan(100 * ta.rma(plusDM, len) / trur)

minus = fixnan(100 * ta.rma(minusDM, len) / trur)

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), lensig)

rsisrc = ta.rsi(close,lenrsismodiv)

adxthreshold=input.int(title="adx",defval=15)

smoothColor= adx>adxthreshold and plus>minus? color.green:adx>adxthreshold and plus<minus?color.red : adx<adxthreshold?color.gray:na

rsismma = 0.0

rsismma := na(rsismma[1]) ? ta.sma(rsisrc, lenrsissmoma) : (rsismma[1] * (lenrsissmoma - 1) + rsisrc) / lenrsissmoma

rsiwsmma= ta.wma(rsismma,lenrsissmoma)

plot(showSmoothed ? rsisrc:na, linewidth=2, color=smoothColor)

plot(showSmoothed ? rsiwsmma:na, linewidth=2, color=color.white)

////////////////RSI momentum

///////////////////// normal RSI

rsiValue2 = ta.rsi(ohlc4,lenrsimomdiv)

rsiema = ta.wma(rsiValue2,rsimommalen)

normalizedRSI= (rsiValue2-50)/100

/////////////////// Normal Momentum

lenmom = input.int(5, minval=1, title=" MOM Length",group= "RSI Momentum")

srcmom = ohlc4

mom = srcmom - srcmom[lenmom]

//////////stochRSI K line

smoothK = input.int(5, "K", minval=1)

lengthRSI = input.int(5, "RSI Length", minval=1, group="RSI Momentum")

lengthStoch = input.int(34, "Stochastic Length", minval=1,group= "RSI Momentum")

src = input(ohlc4, title="RSI Source",group= "RSI Momentum")

rsi1 = ta.rsi(src, lengthRSI)

k = ((ta.sma(ta.stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK))-50)/100

WTF=math.avg(mom,normalizedRSI,k)

smmaLen = input.int(25, minval=1, title="SMMA Length", group = "RSI Momentum")

smmaLen1= 2

smmaSrc = WTF

WTFsmma = 0.0

WTFsmma := na(WTFsmma[1]) ? ta.sma(smmaSrc, smmaLen1) : (WTFsmma[1] * (smmaLen1 - 1) + smmaSrc) / smmaLen1

smma = 0.0

smma := na(smma[1]) ? ta.sma(smmaSrc, smmaLen) : (smma[1] * (smmaLen - 1) + smmaSrc) / smmaLen

color1a= #0E3F01

color2a = #31FA2A

color3a = #FA6B6B

color4a = #971643

momentumColor= WTF>WTF[1] and WTF>smma ? color1a : WTF<WTF[1] and WTF>smma ? color2a : WTF>WTF[1] and WTF<smma ? color3a : WTF<WTF[1] and WTF<smma ? color4a : na

plot(showMomentum ? WTF:na, color=momentumColor, linewidth=3)

plot(showMomentum ? smma:na , linewidth=2, color=color.white)

osc= displayRSI =="RSI Divergence" ? rsiValue1 : displayRSI =="RSI Smoothed" ? rsisrc:na

///////////divergence

plFound = na(ta.pivotlow(osc, lbL, lbR)) ? false : true

phFound = na(ta.pivothigh(osc, lbL, lbR)) ? false : true

_inRange(cond) =>

bars = ta.barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

//------------------------------------------------------------------------------

// Regular Bullish

// Osc: Higher Low

oscHL = osc[lbR] > ta.valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Lower Low

priceLL = low[lbR] < ta.valuewhen(plFound, low[lbR], 1)

bullCond = plotBull and priceLL and oscHL and plFound

plot(

displayRSI !="RSI Momentum"and plFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish",

linewidth=2,

color=(bullCond ? bullColorrsidiv : noneColor)

)

//------------------------------------------------------------------------------

// Hidden Bullish

// Osc: Lower Low

oscLL = osc[lbR] < ta.valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Higher Low

priceHL = low[lbR] > ta.valuewhen(plFound, low[lbR], 1)

hiddenBullCond = plotHiddenBull and priceHL and oscLL and plFound

plot(

displayRSI !="RSI Momentum" and plFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish",

linewidth=2,

color=(hiddenBullCond ? hiddenBullColor : noneColor)

)

//------------------------------------------------------------------------------

// Regular Bearish

// Osc: Lower High

oscLH = osc[lbR] < ta.valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Higher High

priceHH = high[lbR] > ta.valuewhen(phFound, high[lbR], 1)

bearCond = plotBear and priceHH and oscLH and phFound

plot(

displayRSI !="RSI Momentum" and phFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish",

linewidth=2,

color=(bearCond ? bearColorrsidiv : noneColor)

)

//------------------------------------------------------------------------------

// Hidden Bearish

// Osc: Higher High

oscHH = osc[lbR] > ta.valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Lower High

priceLH = high[lbR] < ta.valuewhen(phFound, high[lbR], 1)

hiddenBearCond = plotHiddenBear and priceLH and oscHH and phFound

plot(

displayRSI !="RSI Momentum" and phFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish",

linewidth=2,

color=(hiddenBearCond ? hiddenBearColor : noneColor)

)

// ### Alerts

if bearCond

alert("Bearish Divergence")

else if hiddenBearCond

alert("Hidden Bearish Divergence")

else if bullCond

alert("Bullish Divergence")

else if hiddenBullCond

alert("Hidden Bullish Divergence")

if hiddenBullCond

strategy.entry("Enter Long", strategy.long)

else if hiddenBearCond

strategy.entry("Enter Short", strategy.short)

// END ###

- Hệ thống chiến lược định lượng xu hướng động lượng hai chỉ số

- Chiến lược giao dịch xu hướng đa tín hiệu RSI

- Chiến lược tối ưu hóa giao dịch trong ngày với hệ thống đường thẳng động kết hợp với chỉ số động lực RSI

- Chiến lược theo dõi xu hướng động lực qua nhiều chỉ số công nghệ

- Đánh dấu các chiến lược theo dõi xu hướng hình dạng trụ voi

- Chiến lược động lực xu hướng RSI hai chu kỳ kết hợp với hệ thống quản lý vị trí kim tự tháp

- Chiến lược giao dịch định lượng các thông số động của RSI hỗ trợ giao dịch đa đường

- Xu hướng động quyết định chiến lược giao thoa chỉ số RSI

- Phương pháp giao dịch phân tích giá theo định lượng với thuật toán hàng xóm K đa chiều

- Hệ thống chuyển đổi động đa chiến lược thích nghi: theo dõi xu hướng hội tụ và chiến lược giao dịch định lượng xung đột giữa các vùng

- Nhiều chỉ số, xu hướng đa chiều, chiến lược định lượng cao

- MA HYBRID BY RAJ

- Xu hướng kim cương

- Nik Stoch

- stoch supertrd atr 200ma

- MTF RSI & Chiến lược STOCH

- EMA + AROON + ASH

- Động lực 2.0

- Chiến lược phạm vi EHMA

- Trung bình chuyển động mua-bán

- Midas Mk. II - Ultimate Crypto Swing

- TV cao và thấp chiến lược

- Chiến lược TradingView tốt nhất

- R3.0 + Tình trạng biến động tăng cao + TP RSI

- Chande Kroll dừng lại

- CCI + EMA với Chiến lược chéo RSI

- EMA bands + leledc + bollinger bands

- RSI MTF Ob+Os

- Chiến lược MACD Willy

- RSI - Bán tín hiệu mua

- Xu hướng Heikin-Ashi