Chiến lược chênh lệch giá v1.0

Tác giả:ChaoZhang, Ngày: 2022-05-31 18:31:45Tags:MACDRSI

Được tạo ra theo yêu cầu: Đây là một chiến lược giao dịch xu hướng sử dụng các tín hiệu phát hiện chênh lệch giá được xác nhận bởi

Mã chiến lược dựa trên:

Máy phát hiện chênh lệch giá V2 của RicardoSantos

UCS_Murrey

backtest

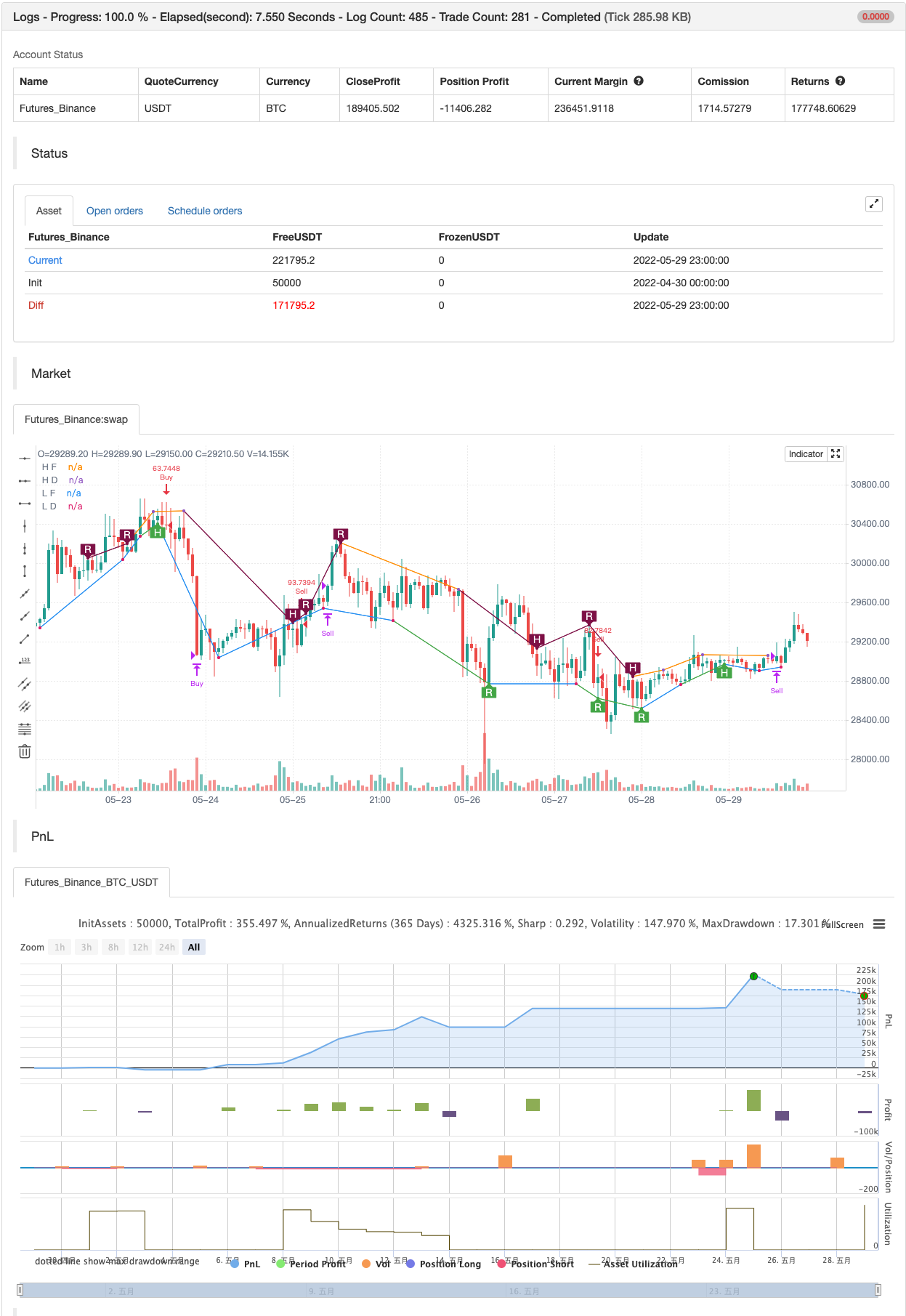

/*backtest

start: 2022-04-30 00:00:00

end: 2022-05-29 23:59:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

// Title: [STRATEGY][UL]Price Divergence Strategy V1.1

// Author: JustUncleL

// Date: 23-Oct-2016

// Version: v1.1

//

// Description:

// A trend trading strategy the uses Price Divergence detection signals, that

// are confirmed by the "Murrey's Math Oscillator" (Donchanin Channel based).

//

// *** USE AT YOUR OWN RISK ***

//

// Mofidifications:

// 1.0 - original

// 1.1 - Pinescript V4 update 21-Aug-2021

//

// References:

// Strategy Based on:

// - [RS]Price Divergence Detector V2 by RicardoSantos

// - UCS_Murrey's Math Oscillator by Ucsgears

// Some Code borrowed from:

// - "Strategy Code Example by JayRogers"

// Information on Divergence Trading:

// - http://www.babypips.com/school/high-school/trading-divergences

//

strategy(title='[STRATEGY][UL]Price Divergence Strategy v1.1', pyramiding=0, overlay=true, initial_capital=10000, calc_on_every_tick=false, currency=currency.USD,

default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// || General Input:

method = input(title='Method (0=rsi, 1=macd, 2=stoch, 3=volume, 4=acc/dist, 5=fisher, 6=cci):', type=input.integer, defval=1, minval=0, maxval=6)

SHOW_LABEL = input(title='Show Labels', type=input.bool, defval=true)

SHOW_CHANNEL = input(title='Show Channel', type=input.bool, defval=false)

uHid = input(true, title="Use Hidden Divergence in Strategy")

uReg = input(true, title="Use Regular Divergence in Strategy")

// || RSI / STOCH / VOLUME / ACC/DIST Input:

rsi_smooth = input(title='RSI/STOCH/Volume/ACC-DIST/Fisher/cci Smooth:', type=input.integer, defval=5)

// || MACD Input:

macd_src = input(title='MACD Source:', type=input.source, defval=close)

macd_fast = input(title='MACD Fast:', type=input.integer, defval=12)

macd_slow = input(title='MACD Slow:', type=input.integer, defval=26)

macd_smooth = input(title='MACD Smooth Signal:', type=input.integer, defval=9)

// || Functions:

f_top_fractal(_src) =>

_src[4] < _src[2] and _src[3] < _src[2] and _src[2] > _src[1] and

_src[2] > _src[0]

f_bot_fractal(_src) =>

_src[4] > _src[2] and _src[3] > _src[2] and _src[2] < _src[1] and

_src[2] < _src[0]

f_fractalize(_src) =>

f_bot_fractal__1 = f_bot_fractal(_src)

f_top_fractal(_src) ? 1 : f_bot_fractal__1 ? -1 : 0

// ||••> START MACD FUNCTION

f_macd(_src, _fast, _slow, _smooth) =>

_fast_ma = sma(_src, _fast)

_slow_ma = sma(_src, _slow)

_macd = _fast_ma - _slow_ma

_signal = ema(_macd, _smooth)

_hist = _macd - _signal

_hist

// ||<•• END MACD FUNCTION

// ||••> START ACC/DIST FUNCTION

f_accdist(_smooth) =>

_return = sma(cum(close == high and close == low or high == low ? 0 : (2 * close - low - high) / (high - low) * volume), _smooth)

_return

// ||<•• END ACC/DIST FUNCTION

// ||••> START FISHER FUNCTION

f_fisher(_src, _window) =>

_h = highest(_src, _window)

_l = lowest(_src, _window)

_value0 = 0.0

_fisher = 0.0

_value0 := .66 * ((_src - _l) / max(_h - _l, .001) - .5) + .67 * nz(_value0[1])

_value1 = _value0 > .99 ? .999 : _value0 < -.99 ? -.999 : _value0

_fisher := .5 * log((1 + _value1) / max(1 - _value1, .001)) + .5 * nz(_fisher[1])

_fisher

// ||<•• END FISHER FUNCTION

rsi_1 = rsi(high, rsi_smooth)

f_macd__1 = f_macd(macd_src, macd_fast, macd_slow, macd_smooth)

stoch_1 = stoch(close, high, low, rsi_smooth)

sma_1 = sma(volume, rsi_smooth)

f_accdist__1 = f_accdist(rsi_smooth)

f_fisher__1 = f_fisher(high, rsi_smooth)

cci_1 = cci(high, rsi_smooth)

method_high = method == 0 ? rsi_1 : method == 1 ? f_macd__1 :

method == 2 ? stoch_1 : method == 3 ? sma_1 : method == 4 ? f_accdist__1 :

method == 5 ? f_fisher__1 : method == 6 ? cci_1 : na

rsi_2 = rsi(low, rsi_smooth)

f_macd__2 = f_macd(macd_src, macd_fast, macd_slow, macd_smooth)

stoch_2 = stoch(close, high, low, rsi_smooth)

sma_2 = sma(volume, rsi_smooth)

f_accdist__2 = f_accdist(rsi_smooth)

f_fisher__2 = f_fisher(low, rsi_smooth)

cci_2 = cci(low, rsi_smooth)

method_low = method == 0 ? rsi_2 : method == 1 ? f_macd__2 :

method == 2 ? stoch_2 : method == 3 ? sma_2 : method == 4 ? f_accdist__2 :

method == 5 ? f_fisher__2 : method == 6 ? cci_2 : na

fractal_top = f_fractalize(method_high) > 0 ? method_high[2] : na

fractal_bot = f_fractalize(method_low) < 0 ? method_low[2] : na

high_prev = valuewhen(fractal_top, method_high[2], 1)

high_price = valuewhen(fractal_top, high[2], 1)

low_prev = valuewhen(fractal_bot, method_low[2], 1)

low_price = valuewhen(fractal_bot, low[2], 1)

regular_bearish_div = fractal_top and high[2] > high_price and method_high[2] < high_prev

hidden_bearish_div = fractal_top and high[2] < high_price and method_high[2] > high_prev

regular_bullish_div = fractal_bot and low[2] < low_price and method_low[2] > low_prev

hidden_bullish_div = fractal_bot and low[2] > low_price and method_low[2] < low_prev

plot(title='H F', series=fractal_top ? high[2] : na, color=regular_bearish_div or hidden_bearish_div ? color.maroon : not SHOW_CHANNEL ? na : color.silver, offset=-2)

plot(title='L F', series=fractal_bot ? low[2] : na, color=regular_bullish_div or hidden_bullish_div ? color.green : not SHOW_CHANNEL ? na : color.silver, offset=-2)

plot(title='H D', series=fractal_top ? high[2] : na, style=plot.style_circles, color=regular_bearish_div or hidden_bearish_div ? color.maroon : not SHOW_CHANNEL ? na : color.silver, linewidth=3, offset=-2)

plot(title='L D', series=fractal_bot ? low[2] : na, style=plot.style_circles, color=regular_bullish_div or hidden_bullish_div ? color.green : not SHOW_CHANNEL ? na : color.silver, linewidth=3, offset=-2)

plotshape(title='+RBD', series=not SHOW_LABEL ? na : regular_bearish_div ? high[2] : na, text='R', style=shape.labeldown, location=location.absolute, color=color.maroon, textcolor=color.white, offset=-2)

plotshape(title='+HBD', series=not SHOW_LABEL ? na : hidden_bearish_div ? high[2] : na, text='H', style=shape.labeldown, location=location.absolute, color=color.maroon, textcolor=color.white, offset=-2)

plotshape(title='-RBD', series=not SHOW_LABEL ? na : regular_bullish_div ? low[2] : na, text='R', style=shape.labelup, location=location.absolute, color=color.green, textcolor=color.white, offset=-2)

plotshape(title='-HBD', series=not SHOW_LABEL ? na : hidden_bullish_div ? low[2] : na, text='H', style=shape.labelup, location=location.absolute, color=color.green, textcolor=color.white, offset=-2)

// Code borrowed from UCS_Murrey's Math Oscillator by Ucsgears

// - UCS_MMLO

// Inputs

length = input(100, minval=10, title="MMLO Look back Length")

quad = input(2, minval=1, maxval=4, step=1, title="Mininum Quadrant for MMLO Support")

mult = 0.125

// Donchanin Channel

hi = highest(high, length)

lo = lowest(low, length)

range = hi - lo

multiplier = range * mult

midline = lo + multiplier * 4

oscillator = (close - midline) / (range / 2)

a = oscillator > 0

b = oscillator > 0 and oscillator > mult * 2

c = oscillator > 0 and oscillator > mult * 4

d = oscillator > 0 and oscillator > mult * 6

z = oscillator < 0

y = oscillator < 0 and oscillator < -mult * 2

x = oscillator < 0 and oscillator < -mult * 4

w = oscillator < 0 and oscillator < -mult * 6

// Strategy: (Thanks to JayRogers)

// === STRATEGY RELATED INPUTS ===

//tradeInvert = input(defval = false, title = "Invert Trade Direction?")

// the risk management inputs

inpTakeProfit = input(defval=0, title="Take Profit Points", minval=0)

inpStopLoss = input(defval=0, title="Stop Loss Points", minval=0)

inpTrailStop = input(defval=100, title="Trailing Stop Loss Points", minval=0)

inpTrailOffset = input(defval=0, title="Trailing Stop Loss Offset Points", minval=0)

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

// === STRATEGY - LONG POSITION EXECUTION ===

enterLong() => // functions can be used to wrap up and work out complex conditions

(uReg and regular_bullish_div or uHid and hidden_bullish_div) and

(quad == 1 ? a[1] :

quad == 2 ? b[1] : quad == 3 ? c[1] : quad == 4 ? d[1] : false)

exitLong() =>

oscillator <= 0

strategy.entry(id="Buy", long=true, when=enterLong()) // use function or simple condition to decide when to get in

strategy.close(id="Buy", when=exitLong()) // ...and when to get out

// === STRATEGY - SHORT POSITION EXECUTION ===

enterShort() =>

(uReg and regular_bearish_div or uHid and hidden_bearish_div) and

(quad == 1 ? z[1] :

quad == 2 ? y[1] : quad == 3 ? x[1] : quad == 4 ? w[1] : false)

exitShort() =>

oscillator >= 0

strategy.entry(id="Sell", long=false, when=enterShort())

strategy.close(id="Sell", when=exitShort())

// === STRATEGY RISK MANAGEMENT EXECUTION ===

// finally, make use of all the earlier values we got prepped

strategy.exit("Exit Buy", from_entry="Buy", profit=useTakeProfit, loss=useStopLoss, trail_points=useTrailStop, trail_offset=useTrailOffset)

strategy.exit("Exit Sell", from_entry="Sell", profit=useTakeProfit, loss=useStopLoss, trail_points=useTrailStop, trail_offset=useTrailOffset)

//EOF

Nội dung liên quan

- Chiến lược tối ưu hóa động lực xu hướng động lực kết hợp với các chỉ số kênh G

- Nghiên cứu phiên bản tối ưu hóa chiến lược nhập khẩu linh hoạt qua 5 ngày dựa trên RSI và MACD

- Hệ thống giao dịch đa tín hiệu RSI-MACD kết hợp với chiến lược dừng và dừng lỗ động

- Nhiều chỉ số đi ngược lại với chiến lược mua bán và tự điều chỉnh

- Chiến lược giao dịch đường dài kết hợp với MACD và RSI

- Chiến lược đa không gian kết hợp RSI và MACD

- Darvas phá vỡ hộp và chiến lược quản lý rủi ro

- Chiến lược chuyển hướng theo dõi các biểu đồ đám mây

- Chiến lược kim tự tháp thông minh đa chỉ số

- Chiến lược giao dịch tần số cao tiền điện tử rủi ro thấp và ổn định dựa trên RSI và MACD

Nhiều hơn nữa

- Xu hướng tuyến tính

- Mô hình thời gian Fibonacci

- Darvas Box mua bán

- Chỉ số thiết lập Demark

- Bollinger Bands Stochastic RSI cực

- Chỉ số AK MACD BB V 1.00

- SAR Parabolic

- Chỉ số RSI Divergence

- Chỉ số OBV MACD

- Xu hướng chuyển động

- Sự phá vỡ hỗ trợ-kháng cự

- Đường trung bình động thích nghi độ dốc

- Chiến lược dao động Delta-RSI

- Low Scanner chiến lược crypto

- [blackcat] L2 Reversal Label Chiến lược

- SuperB

- SAR cao thấp

- SuperTREX

- Máy phát hiện đỉnh

- Tìm thấp