高低点自动预测与交易策略

Author: ChaoZhang, Date: 2024-03-15 17:22:36Tags:

概述

该策略通过识别早盘9:15的高低点,自动计算多空头寸的目标价和止损价,并在满足条件时自动开仓。策略利用相对强弱指标(RSI)来判断超买和超卖状态,结合9:15高低点突破来确定入场机会。

策略原理

- 确定9:00至9:15为高低点形成区间。

- 记录9:15时的最高价和最低价分别为sessionHigh和sessionLow。

- 分别计算多头目标价(sessionHigh+200)、空头目标价(sessionLow-200)以及相应的止损价。

- 获取当前收盘价以及RSI指标。

- 多头开仓条件:收盘价突破sessionHigh且RSI大于超买level。

- 空头开仓条件:收盘价跌破sessionLow且RSI小于超卖level。

- 绘制相关价位,并根据开仓条件自动开多头或空头。

优势分析

- 简单易用:策略基于明确的9:15高低点和RSI指标,逻辑清晰,容易理解和实施。

- 自动化程度高:策略内置了目标价和止损价的计算以及开仓条件的判断,可以自动化执行交易。

- 及时止损:根据9:15高低点设置止损价,一旦开仓即有明确止损位,可以有效控制风险。

- 趋势跟踪:通过RSI指标判断超买超卖,在趋势形成初期介入,有助于顺势而为。

风险分析

- 参数优化风险:策略参数如RSI的长度和超买超卖阈值等需要根据市场特征进行优化,不同参数可能带来不同结果。

- 单一指标风险:策略主要依赖RSI指标,在某些市场情况下可能出现指标失效的情况。

- 盘中波动风险:9:15之后的价格波动可能触发止损而错失趋势行情。

- 缺乏仓位管理:策略缺乏对仓位的控制和资金管理,过于频繁开仓可能带来额外风险。

优化方向

- 动态止损:根据价格波动幅度或ATR等指标对止损位进行动态调整,跟踪价格变化。

- 结合其他指标:引入如MACD、均线系统等其他指标对趋势判断形成印证,提高开仓准确性。

- 优化入场条件:对RSI超买超卖阈值进行自适应调整,避免固定阈值带来的局限性。

- 引入仓位管理:根据市场波动状况对仓位进行控制,例如采用百分比风险模型等方法。

总结

该策略以9:15高低点为基础,运用RSI指标进行趋势判断,自动计算目标价和止损价,并根据开仓条件自动开立多头或空头仓位。策略逻辑简单明了,自动化程度较高,可以快速捕捉趋势行情。但是,策略也存在参数优化、单一指标、盘中波动以及仓位管理等方面的风险。未来可以从动态止损、结合其他指标、优化入场条件和引入仓位管理等方面对策略进行优化和改进,以期获得更稳健的交易表现。

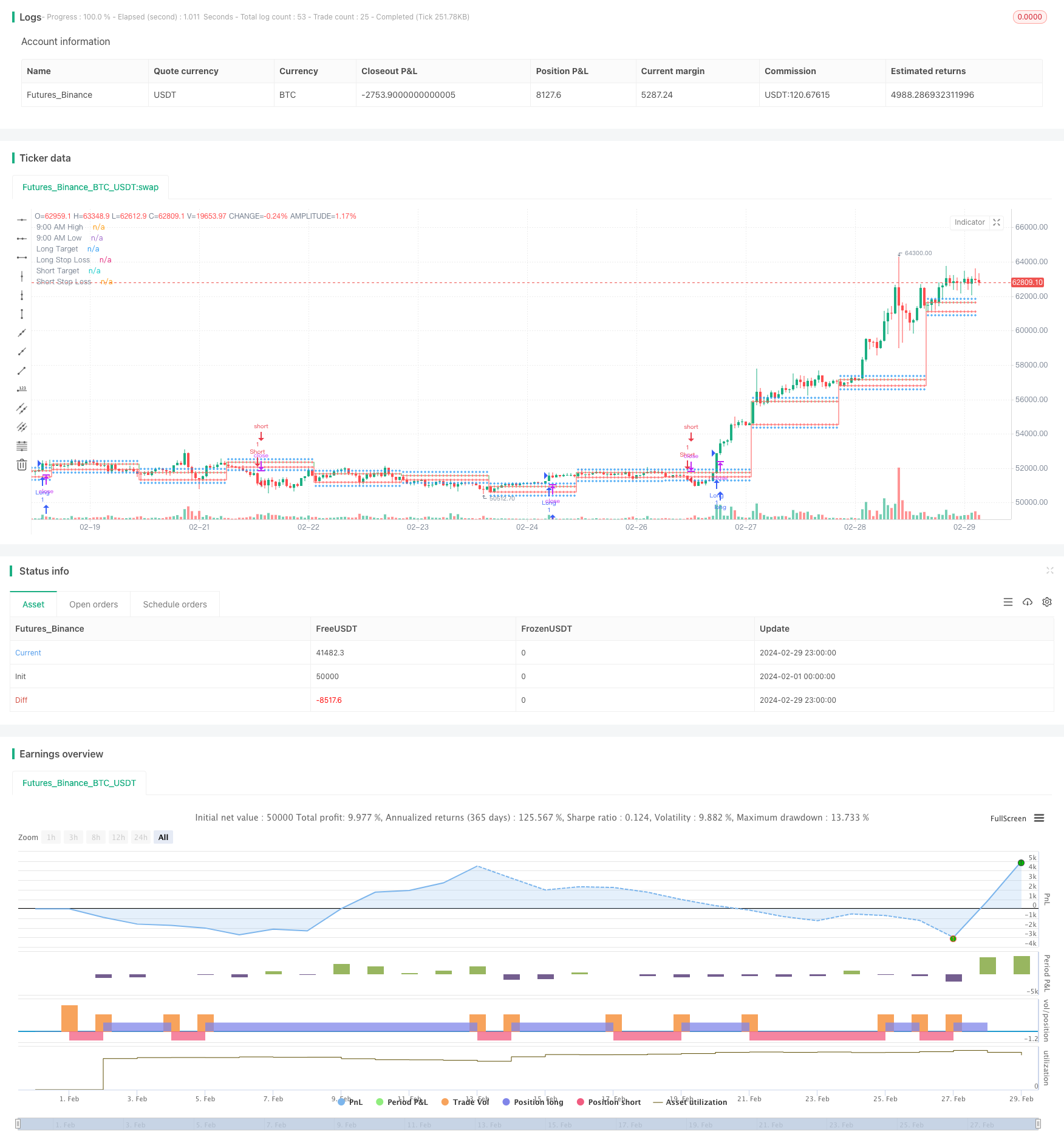

/*backtest

start: 2024-02-01 00:00:00

end: 2024-02-29 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("9:15 AM High/Low with Automatic Forecasting", overlay=true)

// Parameters

showSignals = input(true, title="Show Signals")

// Define session time

sessionStartHour = input(9, title="Session Start Hour")

sessionStartMinute = input(0, title="Session Start Minute")

sessionEndHour = input(9, title="Session End Hour")

sessionEndMinute = input(15, title="Session End Minute")

// Calculate session high and low

var float sessionHigh = na

var float sessionLow = na

if (hour == sessionStartHour and minute == sessionStartMinute)

sessionHigh := high

sessionLow := low

// Update session high and low if within session time

if (hour == sessionStartHour and minute >= sessionStartMinute and minute < sessionEndMinute)

sessionHigh := high > sessionHigh or na(sessionHigh) ? high : sessionHigh

sessionLow := low < sessionLow or na(sessionLow) ? low : sessionLow

// Plot horizontal lines for session high and low

plot(sessionHigh, color=color.green, title="9:00 AM High", style=plot.style_stepline, linewidth=1)

plot(sessionLow, color=color.red, title="9:00 AM Low", style=plot.style_stepline, linewidth=1)

// Calculate targets and stop loss

longTarget = sessionHigh + 200

longStopLoss = sessionLow

shortTarget = sessionLow - 200

shortStopLoss = sessionHigh

// Plot targets and stop loss

plot(longTarget, color=color.blue, title="Long Target", style=plot.style_cross, linewidth=1)

plot(longStopLoss, color=color.red, title="Long Stop Loss", style=plot.style_cross, linewidth=1)

plot(shortTarget, color=color.blue, title="Short Target", style=plot.style_cross, linewidth=1)

plot(shortStopLoss, color=color.red, title="Short Stop Loss", style=plot.style_cross, linewidth=1)

// RSI

rsiLength = input(14, title="RSI Length")

overboughtLevel = input(60, title="Overbought Level")

oversoldLevel = input(40, title="Oversold Level")

rsi = ta.rsi(close, rsiLength)

// Entry conditions

longCondition = close > sessionHigh and rsi > overboughtLevel

shortCondition = close < sessionLow and rsi < oversoldLevel

// Long entry

if (showSignals and longCondition)

strategy.entry("Long", strategy.long)

// Short entry

if (showSignals and shortCondition)

strategy.entry("Short", strategy.short)

更多内容

- 基于9:15高低点自动预测的多空目标止损策略

- MACD与EMA结合的SMC策略

- 基于动态多均线与MACD指标的XAUUSD交易策略

- 基于双移动平均线交叉的量化交易策略

- EMA 200 交叉量价趋势策略

- RSI动态止损止盈策略

- 一文中局部震荡趋势识别策略

- 基于9EMA动态仓位的5分钟双收盘价强势突破策略

- 基于多空自适应动态网格策略

- 基于平均真实波幅和相对强弱指数的钱德勒出场策略

- 日内锤子反转形态多头策略

- CVD背离量化交易策略

- 布林带与相对强弱指数结合策略

- 一目均衡动力指数策略

- AI趋势预测交易策略

- TrendHunter w/MF 多时间框架趋势策略

- 布林带与斐波那契回调策略

- 基于RSI和MACD交叉策略

- 基于双均线交叉的交易策略

- 动态RSI双均线买卖策略