三次指数平均移动线与相对强弱指数结合的1分钟图表加密货币量化交易策略

Author: ChaoZhang, Date: 2024-03-29 11:16:10Tags:

概述

该策略采用了三次指数平均移动线(Triple MACD)和相对强弱指数(RSI)相结合的方法,专门针对1分钟时间周期的加密货币市场进行量化交易。策略的主要思路是利用不同周期参数的MACD指标捕捉市场的多空动量变化,同时使用RSI指标来确认趋势的强度。通过对三次MACD信号进行平均,可以有效平滑噪音,提高交易信号的可靠性。同时,策略还运用了线性回归技术来识别市场的盘整阶段,以避免在震荡行情中频繁交易。整个策略适合用于网格交易机器人,可以在加密货币市场的快速波动中获取稳健的收益。

策略原理

该策略使用了三个不同参数的MACD指标,分别为快线周期为5/13/34,慢线周期为8/21/144,计算它们之间的差值得到MACD值。然后对这三个MACD进行平均,用平均后的MACD值减去其Signal值(即MACD的N周期EMA),得到最终的MACD柱状图。同时计算14周期的RSI指标,辅助判断趋势强度。在平均MACD柱状图从负转正、RSI小于55且多头排列时产生做多信号;反之,当平均MACD柱状图从正转负、RSI大于45且空头排列时产生平仓信号。此外,策略还应用11周期的线性回归对K线进行拟合,通过分析K线实体和影线长度的比例来识别盘整行情。

优势分析

- 采用多周期参数的MACD指标组合,能够客观反映市场在不同时间尺度下的趋势变化,提高趋势判断的准确性。

- 将MACD与RSI指标相结合,形成严格的开平仓条件,有助于提高策略收益并控制回撤。

- 平均MACD信号可以有效消除指标频繁震荡带来的虚假信号,使交易信号更加可靠。

- 运用线性回归判断盘整行情,可以避免在震荡市趋势不明朗时入场,从而减少亏损交易。

- 在快速变化的加密货币市场中,1分钟级别的量化交易策略更能及时捕捉市场波动带来的交易机会。

风险分析

- 策略在单边趋势行情中表现更佳,若市场长期处于宽幅震荡状态,则交易信号可能频繁失效。

- 由于加密货币市场波动较大,如果行情短时出现极端异常波动,可能导致较大幅度的回撤。

- 策略参数的选取对整体收益有明显影响,参数设置不当可能导致策略失效。因此实盘前需要对不同品种进行充分的参数优化和回测验证。

优化方向

- 可以考虑引入ATR等与价格波动率相关的指标,对开仓信号进行过滤,减少市场异常波动可能带来的损失。

- 对于盘整行情的判断,除了线性回归以外,还可以尝试使用其他方法如支撑阻力位、布林带通道等,以进一步提高识别准确率。

- 在趋势行情中,可以通过引入移动止盈来优化平仓点位,从而最大化单次交易的收益。

- 考虑到不同交易品种的特性差异,可以针对不同品种设置不同的策略参数,提高整体策略的适应性和稳定性。

总结

该策略巧妙地将三次MACD与RSI指标相结合,并利用线性回归技术识别盘整行情,形成了一套完整的高频量化交易策略。策略严格的开平仓条件和平均MACD信号的应用,有助于提高交易准确率并控制回撤。虽然策略在单边趋势行情中表现更佳,但通过引入波动率过滤、优化盘整行情识别方法、设置移动止盈以及针对不同品种设置独立参数等措施,可以进一步提升策略的适应性和稳健性。总的来说,这是一个非常有潜力的加密货币量化交易策略,值得进一步优化和实盘应用。

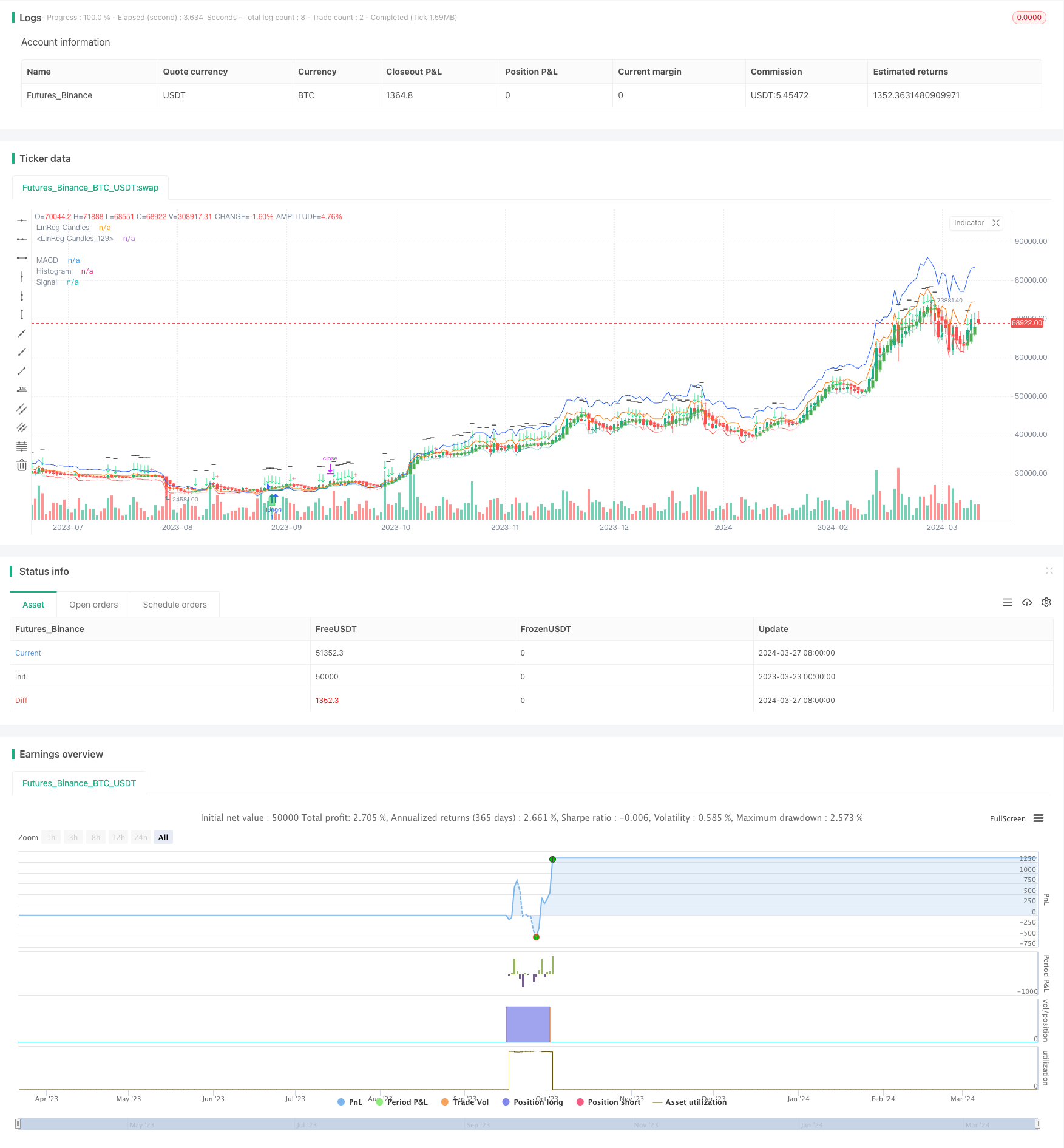

/*backtest

start: 2023-03-23 00:00:00

end: 2024-03-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="TrippleMACD", shorttitle="TrippleMACD + RSI strategy", format=format.price, precision=4, overlay=true)

// RSI

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"Bollinger Bands" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

rsiLengthInput = input.int(14, minval=1, title="RSI Length", group="RSI Settings")

rsiSourceInput = input.source(close, "Source", group="RSI Settings")

maTypeInput = input.string("SMA", title="MA Type", options=["SMA", "Bollinger Bands", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="MA Settings")

maLengthInput = input.int(14, title="MA Length", group="MA Settings")

bbMultInput = input.float(2.0, minval=0.001, maxval=50, title="BB StdDev", group="MA Settings")

showDivergence = input.bool(false, title="Show Divergence", group="RSI Settings")

up = ta.rma(math.max(ta.change(rsiSourceInput), 0), rsiLengthInput)

down = ta.rma(-math.min(ta.change(rsiSourceInput), 0), rsiLengthInput)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsiMA = ma(rsi, maLengthInput, maTypeInput)

isBB = maTypeInput == "Bollinger Bands"

bbUpperBand = plot(isBB ? rsiMA + ta.stdev(rsi, maLengthInput) * bbMultInput : na, title = "Upper Bollinger Band", color=color.green)

bbLowerBand = plot(isBB ? rsiMA - ta.stdev(rsi, maLengthInput) * bbMultInput : na, title = "Lower Bollinger Band", color=color.green)

// Divergence

lookbackRight = 5

lookbackLeft = 5

rangeUpper = 60

rangeLower = 5

bearColor = color.red

bullColor = color.green

textColor = color.white

noneColor = color.new(color.white, 100)

plFound = na(ta.pivotlow(rsi, lookbackLeft, lookbackRight)) ? false : true

phFound = na(ta.pivothigh(rsi, lookbackLeft, lookbackRight)) ? false : true

_inRange(cond) =>

bars = ta.barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

//------------------------------------------------------------------------------

// Regular Bullish

// rsi: Higher Low

rsiHL = rsi[lookbackRight] > ta.valuewhen(plFound, rsi[lookbackRight], 1) and _inRange(plFound[1])

// Price: Lower Low

priceLL = low[lookbackRight] < ta.valuewhen(plFound, low[lookbackRight], 1)

bullCondAlert = priceLL and rsiHL and plFound

bullCond = showDivergence and bullCondAlert

// rsi: Lower High

rsiLH = rsi[lookbackRight] < ta.valuewhen(phFound, rsi[lookbackRight], 1) and _inRange(phFound[1])

// Price: Higher High

priceHH = high[lookbackRight] > ta.valuewhen(phFound, high[lookbackRight], 1)

bearCondAlert = priceHH and rsiLH and phFound

bearCond = showDivergence and bearCondAlert

// Getting inputs

stopLuse = input(1.040)

fast_length = input(title = "Fast Length", defval = 5)

slow_length = input(title = "Slow Length", defval = 8)

fast_length2 = input(title = "Fast Length2", defval = 13)

slow_length2 = input(title = "Slow Length2", defval = 21)

fast_length3 = input(title = "Fast Length3", defval = 34)

slow_length3 = input(title = "Slow Length3", defval = 144)

fast_length4 = input(title = "Fast Length3", defval = 68)

slow_length4 = input(title = "Slow Length3", defval = 288)

src = input(title = "Source", defval = close)

signal_length2 = input.int(title="Signal Smoothing", minval = 1, maxval = 200, defval = 11)

signal_length = input.int(title = "Signal Smoothing", minval = 1, maxval = 50, defval = 9)

sma_source = input.string(title = "Oscillator MA Type", defval = "EMA", options = ["SMA", "EMA"])

sma_signal = input.string(title = "Signal Line MA Type", defval = "EMA", options = ["SMA", "EMA"])

// Calculating

fast_ma = sma_source == "SMA" ? ta.sma(src, fast_length) : ta.ema(src, fast_length)

slow_ma = sma_source == "SMA" ? ta.sma(src, slow_length) : ta.ema(src, slow_length)

fast_ma2 = sma_source == "SMA2" ? ta.sma(src, fast_length2) : ta.ema(src, fast_length2)

slow_ma2 = sma_source == "SMA2" ? ta.sma(src, slow_length2) : ta.ema(src, slow_length2)

fast_ma3 = sma_source == "SMA3" ? ta.sma(src, fast_length3) : ta.ema(src, fast_length3)

slow_ma3 = sma_source == "SMA3" ? ta.sma(src, slow_length3) : ta.ema(src, slow_length3)

fast_ma4 = sma_source == "SMA3" ? ta.sma(src, fast_length3) : ta.ema(src, fast_length3)

slow_ma4 = sma_source == "SMA3" ? ta.sma(src, slow_length3) : ta.ema(src, slow_length3)

macd = fast_ma - slow_ma

macd2 = fast_ma2 - slow_ma2

macd3 = fast_ma3 - slow_ma3

macd4 = fast_ma4 - slow_ma4

signal = sma_signal == "SMA" ? ta.sma(macd, signal_length) : ta.ema(macd, signal_length)

signal2 = sma_signal == "SMA" ? ta.sma(macd2, signal_length) : ta.ema(macd2, signal_length)

signal3 = sma_signal == "SMA" ? ta.sma(macd3, signal_length) : ta.ema(macd3, signal_length)

signal4 = sma_signal == "SMA" ? ta.sma(macd4, signal_length) : ta.ema(macd4, signal_length)

//hist = (macd + macd2 + macd3)/1 - (signal + signal2 + signal3)/1

hist = (macd + macd2 + macd3 + macd4)/4 - (signal + signal2 + signal3 + signal4)/4

signal5 = (signal + signal2 + signal3)/3

sma_signal2 = input.bool(title="Simple MA (Signal Line)", defval=true)

lin_reg = input.bool(title="Lin Reg", defval=true)

linreg_length = input.int(title="Linear Regression Length", minval = 1, maxval = 200, defval = 11)

bopen = lin_reg ? ta.linreg(open, linreg_length, 0) : open

bhigh = lin_reg ? ta.linreg(high, linreg_length, 0) : high

blow = lin_reg ? ta.linreg(low, linreg_length, 0) : low

bclose = lin_reg ? ta.linreg(close, linreg_length, 0) : close

shadow = (bhigh - bclose) + (bopen - blow)

body = bclose - bopen

perc = (shadow/body)

cond2 = perc >=2 and bclose+bclose[1]/2 > bopen+bopen[1]/2

r = bopen < bclose

//signal5 = sma_signal2 ? ta.sma(bclose, signal_length) : ta.ema(bclose, signal_length)

plotcandle(r ? bopen : na, r ? bhigh : na, r ? blow: na, r ? bclose : na, title="LinReg Candles", color= color.green, wickcolor=color.green, bordercolor=color.green, editable= true)

plotcandle(r ? na : bopen, r ? na : bhigh, r ? na : blow, r ? na : bclose, title="LinReg Candles", color=color.red, wickcolor=color.red, bordercolor=color.red, editable= true)

//alertcondition(hist[1] >= 0 and hist < 0, title = 'Rising to falling', message = 'The MACD histogram switched from a rising to falling state')

//alertcondition(hist[1] <= 0 and hist > 0, title = 'Falling to rising', message = 'The MACD histogram switched from a falling to rising state')

green = hist >= 0 ? (hist[1] < hist ? "G" : "GL") : (hist[1] < hist ? "RL" : "R")

Buy = green == "G" and green[1] != "G" and green[1] != "GL" and bopen < bclose and rsi < 55.0 //and not cond2

//StopBuy = (green == "R" or green == "RL" or green == "RL") and bopen > bclose and bopen[1] < bclose[1]

StopBuy = bopen > bclose and bopen[1] < bclose[1] and (green == "G" or green == "GL" or green == "R") and bopen[2] < bclose[2] and bopen[3] < bclose[3]

hists = close[3] < close[2] and close[2] < close[1]

//Buy = green == "RL" and hist[0] > -0.07 and hist[0] < 0.00 and rsi < 55.0 and hists

//StopBuy = green == "GL" or green == "R"

alertcondition(Buy, "Long","Покупка в лонг")

alertcondition(StopBuy, "StopLong","Закрытие сделки")

//hline(0, "Zero Line", color = color.new(#787B86, 50))

plot(hist + (close - (close * 0.03)), title = "Histogram", style = plot.style_line, color = (hist >= 0 ? (hist[1] < hist ? #26A69A : #B2DFDB) : (hist[1] < hist ? #FFCDD2 : #FF5252)))

plotshape(Buy ? low : na, 'Buy', shape.labelup, location.belowbar , color=color.new(#0abe40, 50), size=size.small, offset=0)

plotshape(StopBuy ? low : na, 'Buy', shape.cross, location.abovebar , color=color.new(#be0a0a, 50), size=size.small, offset=0)

plot(macd4 + (close - (close * 0.01)), title = "MACD", color = #2962FF)

plot(signal5 + (close - (close * 0.01)), title = "Signal", color = #FF6D00)

plotchar(cond2 , char='↓', color = color.rgb(0, 230, 119), text = "-")

if (Buy)

strategy.entry("long", strategy.long)

// if (startShortTrade)

// strategy.entry("short", strategy.short)

profitTarget = strategy.position_avg_price * stopLuse

strategy.exit("Take Profit", "long", limit=profitTarget)

// strategy.exit("Take Profit", "short", limit=profitTarget)

更多内容

- EMA-MACD-SuperTrend-ADX-ATR多重指标交易信号策略

- 趋势跟随可变仓位网格策略

- 超级趋势与布林带组合策略

- MACD趋势跟踪策略

- EMA双均线交叉策略

- 黄金短线交易策略 (XAUUSD Scalper 1m)

- 基于向量蜡烛图的通道突破与自定义ChoCH策略

- 突破最高价EMA交叉策略

- 动态趋势追踪策略

- 超级趋势ATR策略

- 基于RSI和双均线的1小时趋势追踪策略

- 指数移动平均线交叉量化交易策略

- 基于均线的BankNifty期货交易策略

- 布林带与RSI交易策略

- 高斯通道自适应均线策略

- 基于目标止损比例和固定仓位的EMA交叉策略

- 移动平均回调追踪策略

- RSI止损追踪交易策略

- SMA均线交叉策略

- 布林5分钟突破日内交易策略