概述

该策略使用布林带和随机RSI指标来生成可能表明价格反转的信号。默认情况下,看跌信号显示为红色箭头,看涨信号显示为绿色箭头。在发出信号之前,该策略会寻找以下情况:(看涨)蜡烛线在布林带上轨之上收盘,随后的蜡烛线在上轨内收盘,随机RSI低于预设阈值(默认为10);(看跌)蜡烛线在布林带下轨之下收盘,随后的蜡烛线在下轨内收盘,随机RSI高于预设阈值(默认为90)。

策略原理

该策略的核心原理是利用布林带和随机RSI这两个技术指标来捕捉潜在的价格反转信号。布林带由一条中轨(通常是移动平均线)和两条上下轨道(中轨加减标准差)组成,可以反映价格的波动情况。当价格突破上轨或下轨时,通常意味着市场情绪过于乐观或悲观,价格可能会出现反转。随机RSI是在RSI指标的基础上再次应用随机指标,更加灵敏地反映了市场的超买超卖状态。当随机RSI达到极值区域(如超过90或低于10)时,也预示着潜在的反转。该策略结合布林带突破和随机RSI极值这两个条件,可以比较可靠地捕捉到价格反转的时机。

策略优势

- 双重确认:该策略同时使用布林带和随机RSI两个指标,形成了双重确认机制,可以有效过滤掉假信号,提高信号的可靠性。

- 及时捕捉反转:布林带突破和随机RSI极值是市场情绪逆转的重要标志,策略能够及时捕捉到这些关键时刻,为投资者提供及时的交易信号。

- 参数灵活:策略的参数设置较为灵活,如布林带的周期和宽度,随机RSI的周期和超买超卖阈值等,可以根据不同市场和品种进行优化调整。

- 适用范围广:该策略可以适用于各类金融市场和交易品种,如股票、期货、外汇、加密货币等,通过参数调整可以适应不同的市场特征。

策略风险

- 震荡市中表现欠佳:在震荡市场中,价格经常在布林带上下轨附近波动,随机RSI也频繁进入超买超卖区域,可能会给出较多的假信号,导致频繁交易和资金损耗。

- 趋势市中滞后:在强趋势市场中,价格可能长时间突破布林带上轨或下轨,随机RSI也可能长时间维持在超买超卖区域,此时该策略可能会发出滞后的反转信号,错失趋势交易机会。

- 参数设置敏感:该策略的表现对于参数设置较为敏感,不同的参数组合可能带来显著不同的结果,参数设置需要根据市场状况不断调试和优化,增加了使用难度。

策略优化方向

- 加入趋势确认:在当前策略的基础上,可以加入一些趋势确认指标,如移动平均线,MACD等,用于甄别当前的趋势方向和强度,在趋势明确的情况下避免逆势交易,提高策略的适应性。

- 动态调整参数:可以根据市场波动率的变化,动态调整布林带的宽度和随机RSI的超买超卖阈值,在波动率较高时使用较宽的布林带和较高的阈值,降低交易频率;在波动率较低时使用较窄的布林带和较低的阈值,提高交易灵敏度。

- 引入止损止盈:在策略产生交易信号后,可以设置相应的止损和止盈规则,控制单次交易的风险敞口和盈利目标,提高策略的风险收益比。

- 结合其他技术指标:可以将该策略与其他技术指标相结合,如支撑阻力位,交易量等,形成更加稳健的信号确认机制,提高策略的可靠性和盈利能力。

总结

布林带随机RSI极值信号策略通过结合布林带和随机RSI两个技术指标,以价格突破布林带上下轨和随机RSI达到超买超卖极值区域作为潜在的反转信号,形成了一套简单易用的交易策略。该策略具有信号可靠,适用范围广等优势,但在震荡市中表现欠佳,趋势市中可能滞后,对参数设置也比较敏感。因此在实际应用中,可以考虑从趋势确认,动态参数,止损止盈,结合其他指标等方面对策略进行优化和改进,以提高其适应性和盈利能力,更好地服务于量化交易实践。

策略源码

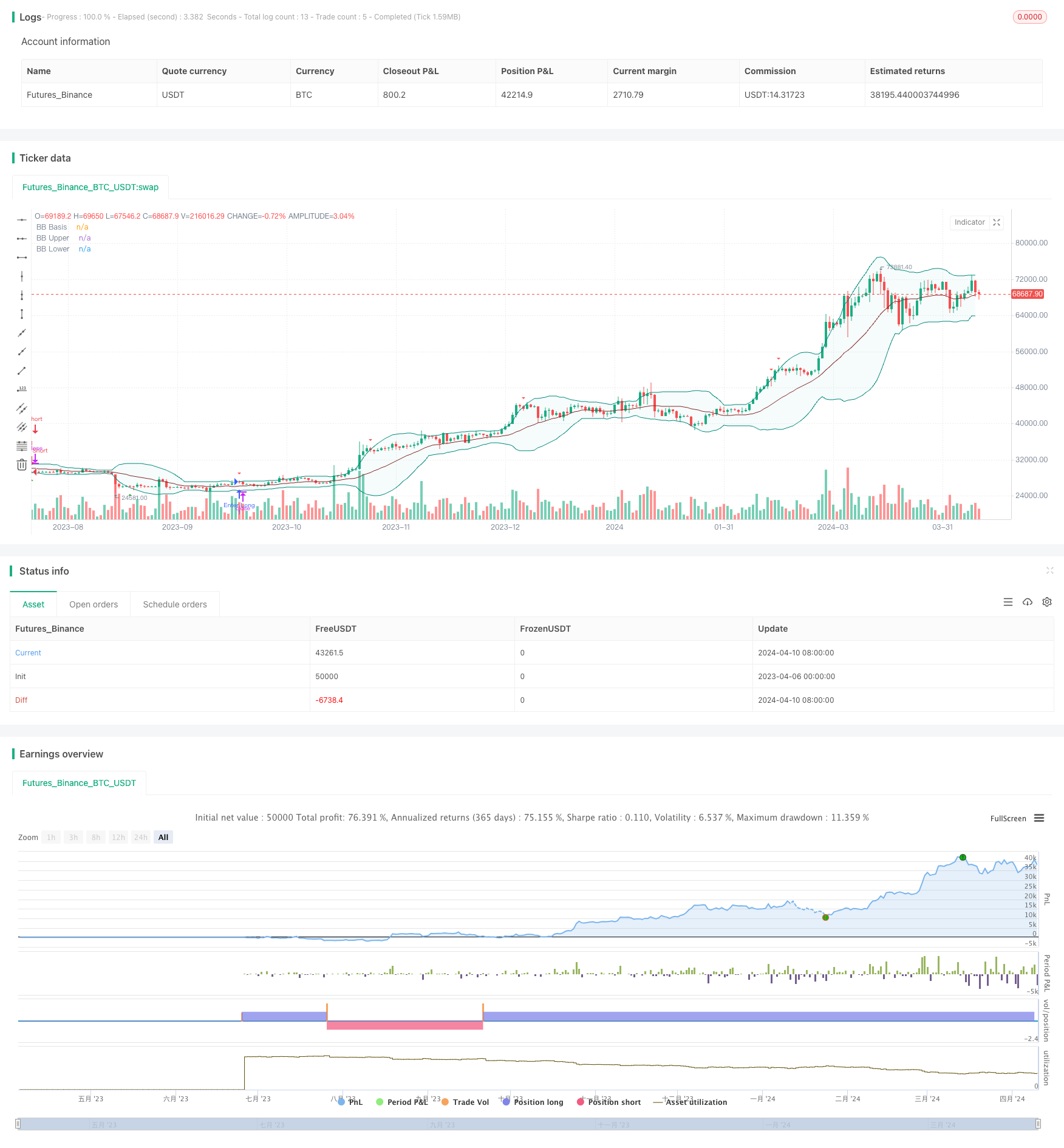

/*backtest

start: 2023-04-06 00:00:00

end: 2024-04-11 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(shorttitle='BBSR Extreme', title='Bollinger Bands Stochastic RSI Extreme Signal', overlay=true)

//General Inputs

src = input(close, title='Source')

offset = input.int(0, 'Offset', minval=-500, maxval=500)

//Bollinger Inputs

length = input.int(20, title='Bollinger Band Length', minval=1)

mult = input.float(2.0, minval=0.001, maxval=50, title='StdDev')

//Bollinger Code

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

plot(basis, 'BB Basis', color=color.new(#872323, 0), offset=offset)

p1 = plot(upper, 'BB Upper', color=color.new(color.teal, 0), offset=offset)

p2 = plot(lower, 'BB Lower', color=color.new(color.teal, 0), offset=offset)

fill(p1, p2, title='BB Background', color=color.new(#198787, 95))

//Stoch Inputs

smoothK = input.int(3, 'K', minval=1)

smoothD = input.int(3, 'D', minval=1)

lengthRSI = input.int(14, 'RSI Length', minval=1)

lengthStoch = input.int(14, 'Stochastic Length', minval=1)

upperlimit = input.float(90, 'Upper Limit', minval=0.01)

lowerlimit = input.float(10, 'Upper Limit', minval=0.01)

//Stochastic Code

rsi1 = ta.rsi(src, lengthRSI)

k = ta.sma(ta.stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = ta.sma(k, smoothD)

//Evaluation

Bear = close[1] > upper[1] and close < upper and k[1] > upperlimit and d[1] > upperlimit

Bull = close[1] < lower[1] and close > lower and k[1] < lowerlimit and d[1] < lowerlimit

//Plots

plotshape(Bear, style=shape.triangledown, location=location.abovebar, color=color.new(color.red, 0), size=size.tiny)

plotshape(Bull, style=shape.triangleup, location=location.belowbar, color=color.new(color.green, 0), size=size.tiny)

// Alert Functionality

alertcondition(Bear or Bull, title='Any Signal', message='{{exchange}}:{{ticker}}' + ' {{interval}}' + ' BB Stochastic Extreme!')

alertcondition(Bear, title='Bearish Signal', message='{{exchange}}:{{ticker}}' + ' {{interval}}' + ' Bearish BB Stochastic Extreme!')

alertcondition(Bull, title='Bullish Signal', message='{{exchange}}:{{ticker}}' + ' {{interval}}' + ' Bullish BB Stochastic Extreme!')

if Bear

strategy.entry('Enter Long', strategy.long)

else if Bull

strategy.entry('Enter Short', strategy.short)

相关推荐