概述

本策略是一个基于多重技术指标的高频量化交易策略。它综合运用了蜡烛图形态分析、趋势跟踪和动量指标,通过多维度信号确认来提高交易的准确性。策略采用1:3的风险收益比设置,这种保守的资金管理方法有助于在波动市场中维持稳定的收益。

策略原理

策略的核心逻辑建立在三个主要技术指标的协同作用上。首先,使用平滑K线(Heiken Ashi)来过滤市场噪音,提供更清晰的趋势方向。其次,布林带(Bollinger Bands)用于识别超买超卖区域,同时提供动态的支撑压力水平。第三,相对强弱指标(RSI)的随机值用于确认价格动量,帮助判断趋势的持续性。策略还整合了ATR指标来动态设置止损和获利目标,使风险管理更加灵活。

策略优势

- 多重信号确认机制显著降低了虚假信号的影响

- 动态的止损和获利设置提高了策略对市场波动的适应能力

- 严格的风险收益比(1:3)有助于长期稳定盈利

- 基于ATR的仓位管理方法使策略具有良好的可扩展性

- 策略逻辑简单明确,易于理解和维护

策略风险

- 高频交易可能面临较高的交易成本

- 在剧烈波动市场中可能出现滑点

- 多重指标可能导致信号滞后

- 固定的风险收益比在某些市场环境下可能错过机会 建议通过严格的资金管理和定期回测来控制这些风险。

策略优化方向

- 引入自适应的指标参数,提高策略对不同市场环境的适应性

- 增加成交量分析来提高信号可靠性

- 开发动态的风险收益比调整机制

- 加入市场波动率过滤器,在高波动期间调整交易频率

- 考虑引入机器学习算法来优化参数选择

总结

这是一个将经典技术分析方法与现代量化交易理念相结合的策略。通过多重指标的配合使用,在保证稳健性的同时追求较高的盈利能力。策略的可扩展性和灵活性使其适合各种市场环境,但需要交易者谨慎控制风险,定期优化参数。

策略源码

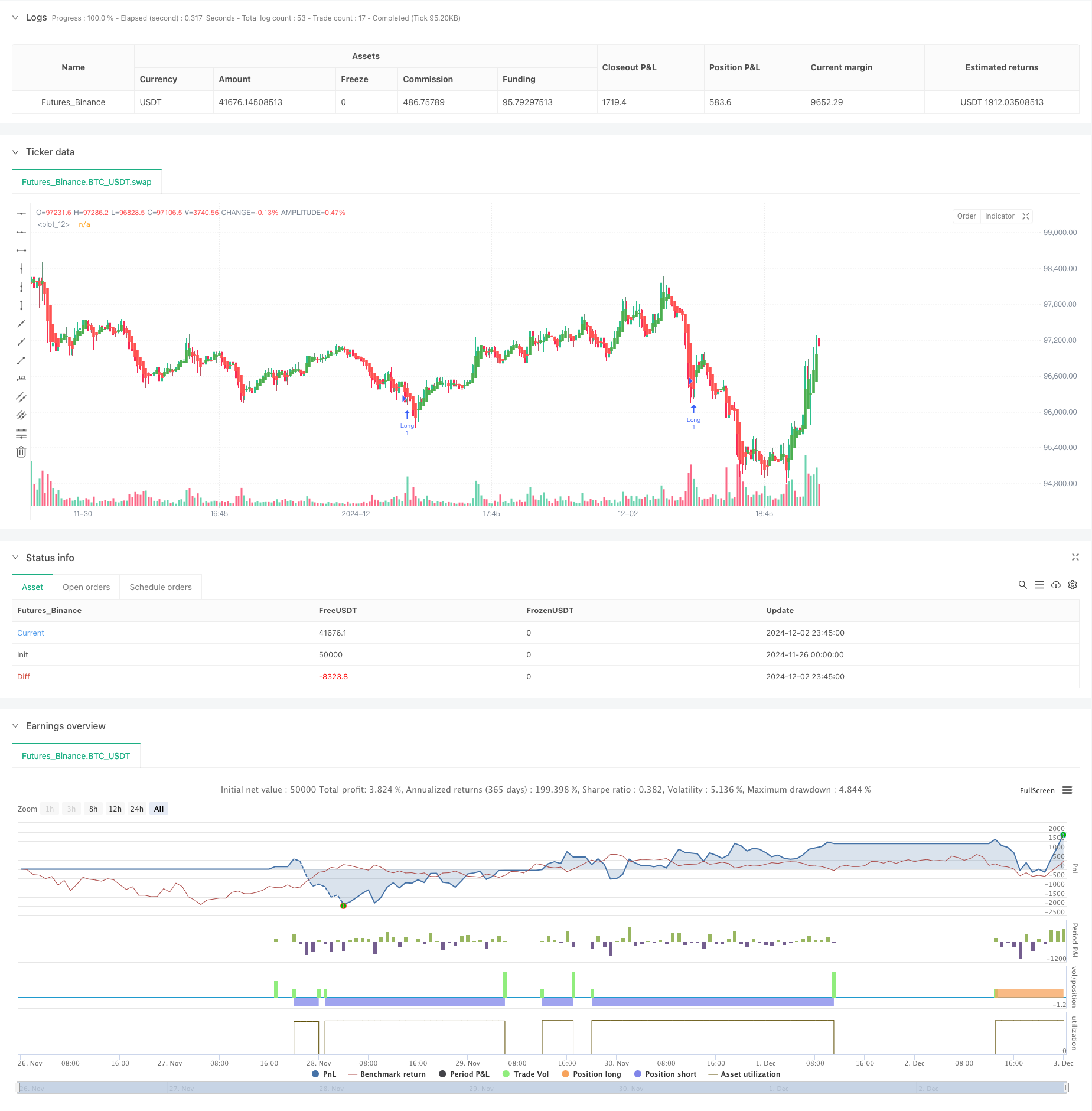

/*backtest

start: 2024-11-26 00:00:00

end: 2024-12-03 00:00:00

period: 15m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("BTC Scalping Strategy with Risk-Reward 1:3", overlay=true)

// Heiken Ashi Candle Calculation

var float haOpen = na

haClose = (open + high + low + close) / 4

haOpen := na(haOpen[1]) ? (open + close) / 2 : (haOpen[1] + haClose[1]) / 2

haHigh = math.max(high, math.max(haOpen, haClose))

haLow = math.min(low, math.min(haOpen, haClose))

// Plot Heiken Ashi Candles

plotcandle(haOpen, haHigh, haLow, haClose, color=haClose >= haOpen ? color.green : color.red)

// Bollinger Bands Calculation

lengthBB = 20

src = close

mult = 2.0

basis = ta.sma(src, lengthBB)

dev = mult * ta.stdev(src, lengthBB)

upperBB = basis + dev

lowerBB = basis - dev

// Stochastic RSI Calculation (fixed parameters)

kLength = 14

dSmoothing = 3

stochRSI = ta.stoch(close, high, low, kLength)

// Average True Range (ATR) for stop loss and take profit

atrLength = 14

atrValue = ta.atr(atrLength)

// Entry conditions

longCondition = ta.crossover(close, lowerBB) and stochRSI < 20

shortCondition = ta.crossunder(close, upperBB) and stochRSI > 80

// Alerts and trade signals

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit", "Long", profit=atrValue*3, loss=atrValue)

alert("Buy Signal Triggered", alert.freq_once_per_bar_close)

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.exit("Take Profit", "Short", profit=atrValue*3, loss=atrValue)

alert("Sell Signal Triggered", alert.freq_once_per_bar_close)

相关推荐