概述

MACD Valley Detector 策略是一个基于 MACD 指标的交易策略。该策略通过检测 MACD 指标的谷底来生成买入信号。当 MACD 指标形成谷底,并且 MACD 值小于等于-0.4,且 MACD 与其信号线之间的差值小于0时,策略会发出买入信号,同时设置止盈价格。

策略原理

MACD Valley Detector 策略的核心是利用 MACD 指标来捕捉潜在的反转机会。MACD 指标由两条指数移动平均线(EMA)之差计算得出,反映了价格的动量变化。当 MACD 指标形成谷底时,表明价格的下跌动能可能减弱,存在反转的可能性。

该策略使用以下条件来判断 MACD 谷底: 1. 当前 MACD 与信号线之差大于前一个差值 2. 前一个差值小于前两个差值 3. MACD 值小于等于-0.4 4. MACD 与信号线之差小于0

当以上条件同时满足时,策略认为出现了 MACD 谷底,并发出买入信号。同时,策略设置了固定的止盈价格,即买入价格加上一个固定的价格差值(takeProfitValue)。

优势分析

- MACD 指标是一个广泛使用的动量指标,能够有效地捕捉价格的趋势变化。

- 通过检测 MACD 谷底,策略试图捕捉潜在的反转机会,在价格下跌后寻找买入机会。

- 策略使用了多个条件来确认 MACD 谷底,提高了信号的可靠性。

- 设置固定的止盈价格,有助于控制风险和锁定利润。

风险分析

- MACD 指标存在滞后性,可能会发出延迟的信号。

- 策略依赖于固定的参数设置,如快速和慢速移动平均线的长度,MACD 信号线的长度等,可能在不同的市场条件下表现不佳。

- 策略缺乏明确的止损机制,可能在市场持续下跌时遭受较大损失。

- 固定的止盈价格可能限制了策略的获利潜力,尤其是在强趋势市场中。

优化方向

- 考虑加入动态止损机制,如基于 ATR 指标的止损,以better地控制风险。

- 对 MACD 指标的参数进行优化,如使用遗传算法等方法寻找最优参数组合。

- 结合其他技术指标或市场状态过滤器,如 RSI、布林带等,以提高信号的质量和可靠性。

- 探索动态止盈策略,如基于市场波动性或价格行为调整止盈水平,以充分利用趋势行情。

总结

MACD Valley Detector 策略是一个基于 MACD 指标谷底检测的交易策略。通过捕捉 MACD 指标的谷底,策略试图找到潜在的反转机会并进行买入。策略使用了多个条件来确认信号,并设置了固定的止盈价格。尽管该策略具有一定的优势,如利用广泛使用的 MACD 指标和多条件确认,但也存在一些风险和局限性,如滞后性、固定参数、缺乏明确止损等。为了改进策略,可以考虑引入动态止损、参数优化、结合其他指标过滤以及动态止盈等方法。总的来说,MACD Valley Detector 策略为捕捉反转机会提供了一种思路,但仍需要根据实际市场条件和交易需求进行优化和改进。

策略源码

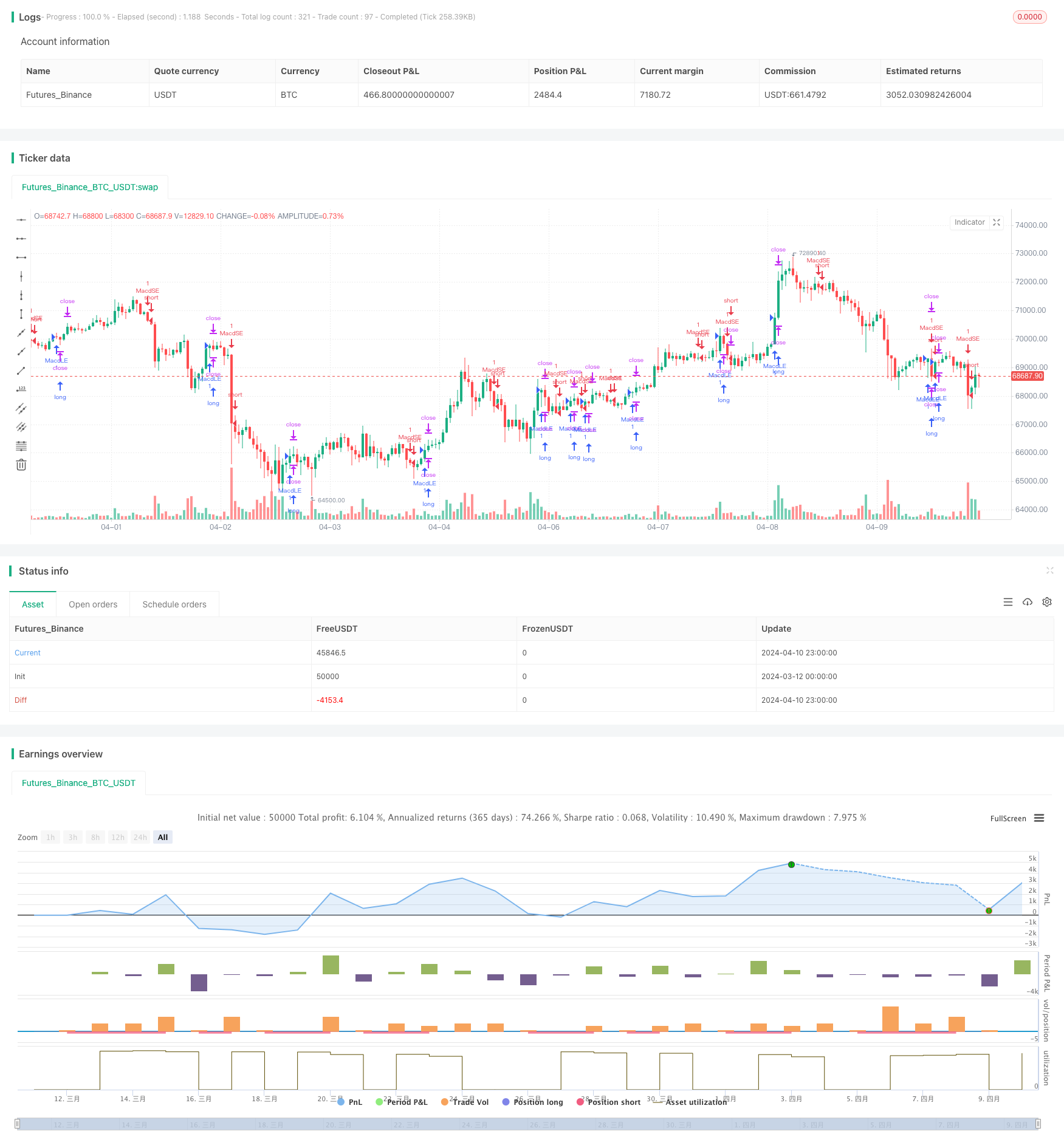

/*backtest

start: 2024-03-12 00:00:00

end: 2024-04-11 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © freditansari

//@version=5

//@version=5

strategy("MACD Valley Detector", overlay=true)

fastLength = input(12)

slowlength = input(26)

MACDLength = input(9)

MACD = ta.ema(close, fastLength) - ta.ema(close, slowlength)

aMACD = ta.ema(MACD, MACDLength)

delta = MACD - aMACD

rsi = ta.rsi(close, 14)

atr = ta.atr(14)

qty=1

takeProfitValue =7

// stopLossValue = 1

// close[0] < close[1] and close[1] > close[2]

is_valley= delta[0] > delta[1] and delta[1]<delta[2]? 1:0

// plot(is_valley , "valley?")

if(is_valley==1 and MACD<=-0.4 and delta <0)

takeProfit = close +takeProfitValue

action = "buy"

// strategy.entry("long", strategy.long, qty=qty)

// // strategy.exit("exit", "long", stop=stopLoss, limit=takeProfit)

// strategy.exit("exit", "long", limit=takeProfit)

alert('{"TICKER":"'+syminfo.ticker+'","ACTION":"'+action+'","PRICE":"'+str.tostring(close)+'","TAKEPROFIT":"'+str.tostring(takeProfit)+'","QTY":"'+str.tostring(qty)+'"}')

if (ta.crossover(delta, 0))

stopLoss = low -0.3

takeProfit = high +0.3

strategy.entry("MacdLE", strategy.long,qty=qty, comment="MacdLE")

strategy.exit("exit long", "MacdLE", limit=takeProfit)

// strategy.exit("exit long", "MacdLE", stop=stopLoss, limit=takeProfit)

if (ta.crossunder(delta, 0))

stopLoss = high + 0.3

takeProfit = low - 0.3

strategy.entry("MacdSE", strategy.short,qty=qty, comment="MacdSE")

strategy.exit("exit long", "MacdLE", limit=takeProfit)

// strategy.exit("exit short", "MacdSE", stop=stopLoss, limit=takeProfit)

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)

相关推荐