概述

本文介绍了一种名为”多指标高杠杆短线交易策略”的量化交易方法。该策略旨在利用多个技术指标的组合,在短时间内捕捉市场波动,实现快速获利。策略核心是通过指数移动平均线(EMA)、相对强弱指标(RSI)、移动平均线趋同散度指标(MACD)以及平均真实范围(ATR)的协同作用,精准定位入场和出场时机,同时运用高杠杆放大收益。

策略原理

趋势识别:使用5周期和15周期的EMA交叉来判断短期趋势方向。当短期EMA上穿长期EMA时,视为上升趋势;反之则为下降趋势。

超买超卖判断:采用7周期的RSI指标,设定80为超买阈值,20为超卖阈值。RSI低于80时考虑做多,高于20时考虑做空,避免在极端区域开仓。

趋势确认:利用MACD指标(参数为6,13,5)进一步验证趋势强度。MACD线位于信号线上方支持做多,位于下方支持做空。

风险管理:基于5周期ATR设置动态止损和止盈水平,乘数为1.5倍,以适应市场波动性。

入场条件:

- 做多:短期EMA上穿长期EMA,RSI低于80,MACD线在信号线上方。

- 做空:短期EMA下穿长期EMA,RSI高于20,MACD线在信号线下方。

出场条件:达到基于ATR设置的动态止损或止盈位。

策略优势

多维度分析:结合趋势、动量和波动性指标,全面评估市场状况,提高交易准确性。

快速反应:短周期指标设置使策略能够迅速捕捉市场变化,适合短线交易。

风险控制:动态止损止盈机制根据市场波动自动调整,有效控制风险。

高收益潜力:利用高杠杆放大收益,适合风险承受能力较强的交易者。

自适应性:ATR based风险管理使策略能够适应不同市场环境。

清晰的交易信号:多指标协同提供明确的入场和出场信号,减少主观判断。

策略风险

高杠杆风险:虽然高杠杆可以放大收益,但同时也会放大损失,可能导致账户快速亏损。

假突破风险:短期EMA交叉可能产生假信号,导致频繁交易和不必要的手续费损失。

趋势反转风险:在强趋势市场中,RSI可能长期处于超买或超卖状态,影响策略表现。

市场波动风险:在剧烈波动行情下,ATR based止损可能过宽,增加单笔交易风险。

滑点风险:高频交易可能面临严重滑点,实际执行价格可能与预期有较大偏差。

系统风险:依赖多个指标的复杂策略可能因单个指标失效而整体表现下降。

策略优化方向

参数优化:可通过回测对EMA、RSI、MACD和ATR的参数进行细致调优,以适应不同市场周期。

增加过滤器:引入成交量、波动率等额外指标作为过滤条件,减少假信号。

时间过滤:加入交易时间窗口限制,避开波动较大或流动性不足的时段。

动态杠杆管理:根据市场波动性和账户净值动态调整杠杆率,平衡风险和收益。

趋势强度评估:整合趋势强度指标,如ADX,仅在强趋势市场开仓,提高胜率。

机器学习优化:利用机器学习算法动态调整指标权重,提高策略适应性。

多时间框架分析:结合更长周期指标确认大趋势,提高交易方向的准确性。

风险敞口管理:设置最大允许亏损金额和最大持仓数量,控制整体风险。

总结

“多指标高杠杆短线交易策略”是一种结合多种技术指标,旨在短期内捕捉市场机会的高频交易方法。通过EMA、RSI、MACD和ATR的协同作用,该策略能够快速识别趋势,确定入场和出场时机,同时利用高杠杆放大收益。尽管策略具有反应迅速、收益潜力大等优势,但也面临高杠杆风险、假突破风险等挑战。为了提高策略的稳定性和盈利能力,可以从参数优化、增加过滤条件、动态风险管理等方面进行改进。总的来说,这是一个适合经验丰富、风险承受能力强的交易者的复杂策略,在实际应用中需要谨慎管理风险,并根据市场变化不断优化调整。

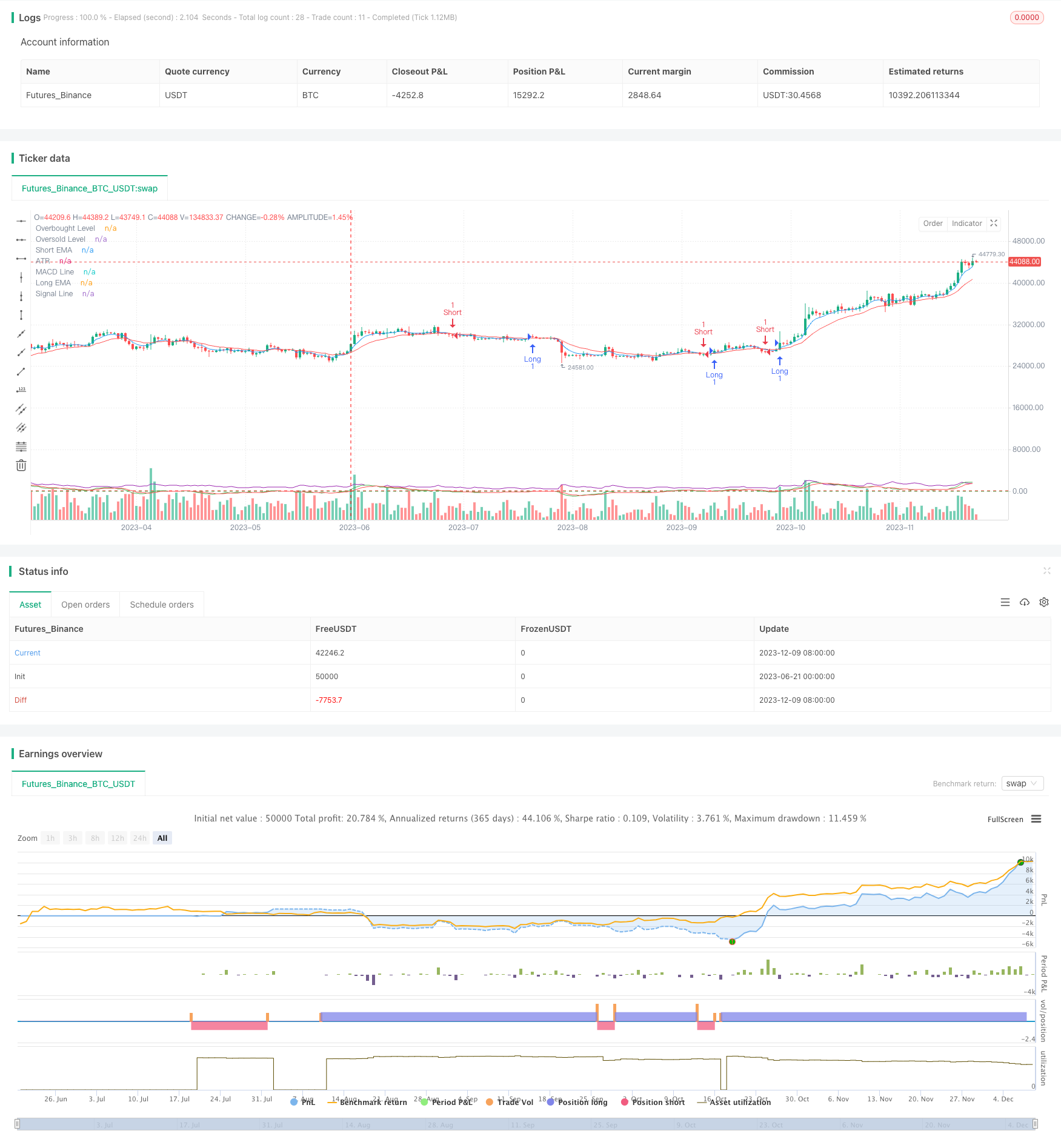

/*backtest

start: 2023-06-21 00:00:00

end: 2023-12-10 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("High Leverage Scalping Strategy", overlay=true)

// Parameters

shortEmaLength = input.int(5, minval=1, title="Short EMA Length")

longEmaLength = input.int(15, minval=1, title="Long EMA Length")

rsiLength = input.int(7, minval=1, title="RSI Length")

rsiOverbought = input.int(80, minval=50, maxval=100, title="RSI Overbought Level")

rsiOversold = input.int(20, minval=0, maxval=50, title="RSI Oversold Level")

macdFastLength = input.int(6, minval=1, title="MACD Fast Length")

macdSlowLength = input.int(13, minval=1, title="MACD Slow Length")

macdSignalSmoothing = input.int(5, minval=1, title="MACD Signal Smoothing")

atrLength = input.int(5, minval=1, title="ATR Length")

atrMultiplier = input.float(1.5, minval=0.1, title="ATR Multiplier")

// Indicators

shortEma = ta.ema(close, shortEmaLength)

longEma = ta.ema(close, longEmaLength)

rsi = ta.rsi(close, rsiLength)

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalSmoothing)

atr = ta.atr(atrLength)

// Conditions

longCondition = ta.crossover(shortEma, longEma) and rsi < rsiOverbought and macdLine > signalLine

shortCondition = ta.crossunder(shortEma, longEma) and rsi > rsiOversold and macdLine < signalLine

// Dynamic stop-loss and take-profit levels

longStopLoss = close - (atr * atrMultiplier)

longTakeProfit = close + (atr * atrMultiplier)

shortStopLoss = close + (atr * atrMultiplier)

shortTakeProfit = close - (atr * atrMultiplier)

// Long Entry

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit/Stop Loss", from_entry="Long", limit=longTakeProfit, stop=longStopLoss)

// Short Entry

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.exit("Take Profit/Stop Loss", from_entry="Short", limit=shortTakeProfit, stop=shortStopLoss)

// Plotting

plot(shortEma, color=color.blue, title="Short EMA")

plot(longEma, color=color.red, title="Long EMA")

hline(rsiOverbought, "Overbought Level", color=color.red)

hline(rsiOversold, "Oversold Level", color=color.green)

plot(macdLine, color=color.green, title="MACD Line")

plot(signalLine, color=color.red, title="Signal Line")

plot(atr, color=color.purple, title="ATR")