概述

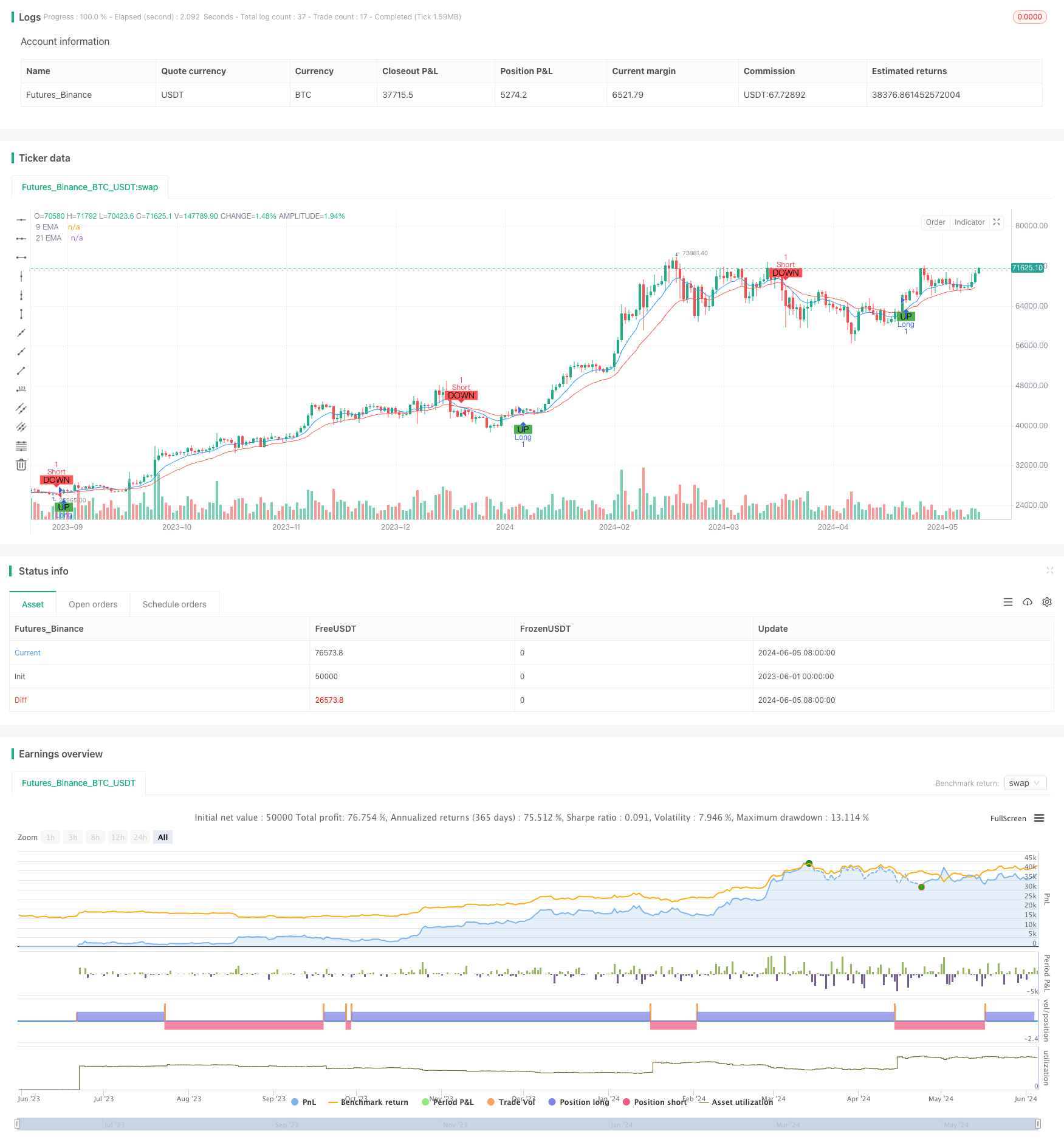

该策略使用两条指数移动平均线(EMA)来捕捉价格趋势的变化。当短期EMA从下方向上穿越长期EMA时,产生买入信号;当短期EMA从上方向下穿越长期EMA时,产生卖出信号。该策略同时设置了每日止损和止盈限制,以控制单日亏损和盈利。

策略原理

- 计算短期EMA(默认周期为9)和长期EMA(默认周期为21)。

- 当短期EMA向上穿越长期EMA时,开仓做多;当短期EMA向下穿越长期EMA时,开仓做空。

- 记录每个交易日开始时的账户权益,并计算当前账户权益与之的差值,即当日盈亏。

- 如果当日亏损超过最大允许亏损(账户初始资金的0.25%),平掉所有仓位。

- 如果当日盈利超过最大允许盈利(账户初始资金的2%),平掉所有仓位。

策略优势

- 简单易懂:该策略逻辑清晰,仅使用两条移动平均线即可产生交易信号,易于理解和实现。

- 趋势跟踪:通过EMA快慢线的交叉,能够较好地捕捉价格趋势的变化,适合在趋势市场中使用。

- 风险控制:设置了每日止损和止盈限制,可以有效控制单日亏损和盈利,防止账户出现过大波动。

策略风险

- 参数优化:该策略的表现很大程度上取决于EMA周期的选择,不同的参数设置可能导致截然不同的结果。因此,需要在不同市场环境下进行参数优化和回测。

- 震荡市:在震荡市场中,价格频繁在EMA上下波动,可能会产生较多的虚假信号,导致频繁交易和资金损耗。

- 趋势转折:当市场趋势发生转折时,该策略可能会延迟入场或出场,错过最佳交易时机。

策略优化方向

- 引入其他技术指标,如RSI、MACD等,以辅助判断趋势强度和方向,提高信号准确性。

- 优化止损和止盈规则,如采用移动止损或动态止盈,以更好地保护利润和控制风险。

- 根据市场波动性动态调整EMA周期,以适应不同的市场状态。

- 结合基本面分析,如经济数据、重大事件等,对交易信号进行过滤和确认。

总结

EMA双均线交叉策略是一个简单易懂、适合趋势市场的交易策略。通过快慢均线的交叉,可以较好地捕捉价格趋势的变化。同时,每日止损和止盈的设置可以有效控制风险。但该策略在震荡市或趋势转折时可能表现欠佳,需要结合其他技术指标和分析方法进行优化和改进。

策略源码

/*backtest

start: 2023-06-01 00:00:00

end: 2024-06-06 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © DD173838

//@version=5

strategy("Moving Average Strategy with Daily Limits", overlay=true)

// Moving Average settings

shortMaLength = input.int(9, title="Short MA Length")

longMaLength = input.int(21, title="Long MA Length")

// Calculate MAs

shortMa = ta.ema(close, shortMaLength)

longMa = ta.ema(close, longMaLength)

// Plot MAs

plot(shortMa, title="9 EMA", color=color.blue)

plot(longMa, title="21 EMA", color=color.red)

// Strategy conditions

crossUp = ta.crossover(shortMa, longMa)

crossDown = ta.crossunder(shortMa, longMa)

// Debug plots to check cross conditions

plotshape(series=crossUp, title="Cross Up", location=location.belowbar, color=color.green, style=shape.labelup, text="UP")

plotshape(series=crossDown, title="Cross Down", location=location.abovebar, color=color.red, style=shape.labeldown, text="DOWN")

// Entry at cross signals

if (crossUp)

strategy.entry("Long", strategy.long)

if (crossDown)

strategy.entry("Short", strategy.short)

// Daily drawdown and profit limits

var float startOfDayEquity = na

if (na(startOfDayEquity) or ta.change(time('D')) != 0)

startOfDayEquity := strategy.equity

maxDailyLoss = 50000 * 0.0025

maxDailyProfit = 50000 * 0.02

currentDailyPL = strategy.equity - startOfDayEquity

if (currentDailyPL <= -maxDailyLoss)

strategy.close_all(comment="Max Daily Loss Reached")

if (currentDailyPL >= maxDailyProfit)

strategy.close_all(comment="Max Daily Profit Reached")

相关推荐