概述

该策略的主要思路是利用三分钟K线的高低点作为突破点,当价格突破三分钟K线的高点时做多,突破低点时做空。该策略适用于日内交易,每日收盘时平仓,第二天继续交易。该策略的优势在于简单易懂,容易实现,风险也相对较低。但是该策略也存在一些风险,如市场波动较大时,可能会出现较大的回撤。

策略原理

- 获取每日开盘后前三分钟的K线数据,记录第三根K线的最高价和最低价。

- 当价格突破第三根K线的最高价时,开多单,目标价格为开仓价加100点,直到收盘或达到目标价格平仓。

- 当价格突破第三根K线的最低价时,开空单,目标价格为开仓价减100点,直到收盘或达到目标价格平仓。

- 每日收盘时平仓,第二天继续交易。

策略优势

- 简单易懂,易于实现。

- 适用于日内交易,资金利用率高。

- 风险相对较低,止损位置明确。

- 适用于趋势性较强的市场。

策略风险

- 市场波动较大时,可能会出现较大的回撤。

- 开盘时间段价格波动较大,风险较高。

- 突破点位置不好把握,容易出现误判。

策略优化方向

- 可以考虑加入移动平均线等指标,过滤震荡市中的噪音信号。

- 可以考虑优化开仓时间,避开开盘时间段。

- 可以考虑优化止盈止损点位,提高策略稳定性。

- 可以考虑加入仓位管理,控制回撤风险。

总结

该策略基于三分钟K线的高低点突破,适用于日内交易。优势是简单易懂,易于实现,风险相对较低。但是也存在一些风险,如市场波动较大时,可能会出现较大的回撤。可以考虑从过滤信号、优化开仓时间、优化止盈止损点位、加入仓位管理等方面对该策略进行优化,以提高策略的稳定性和盈利能力。

策略源码

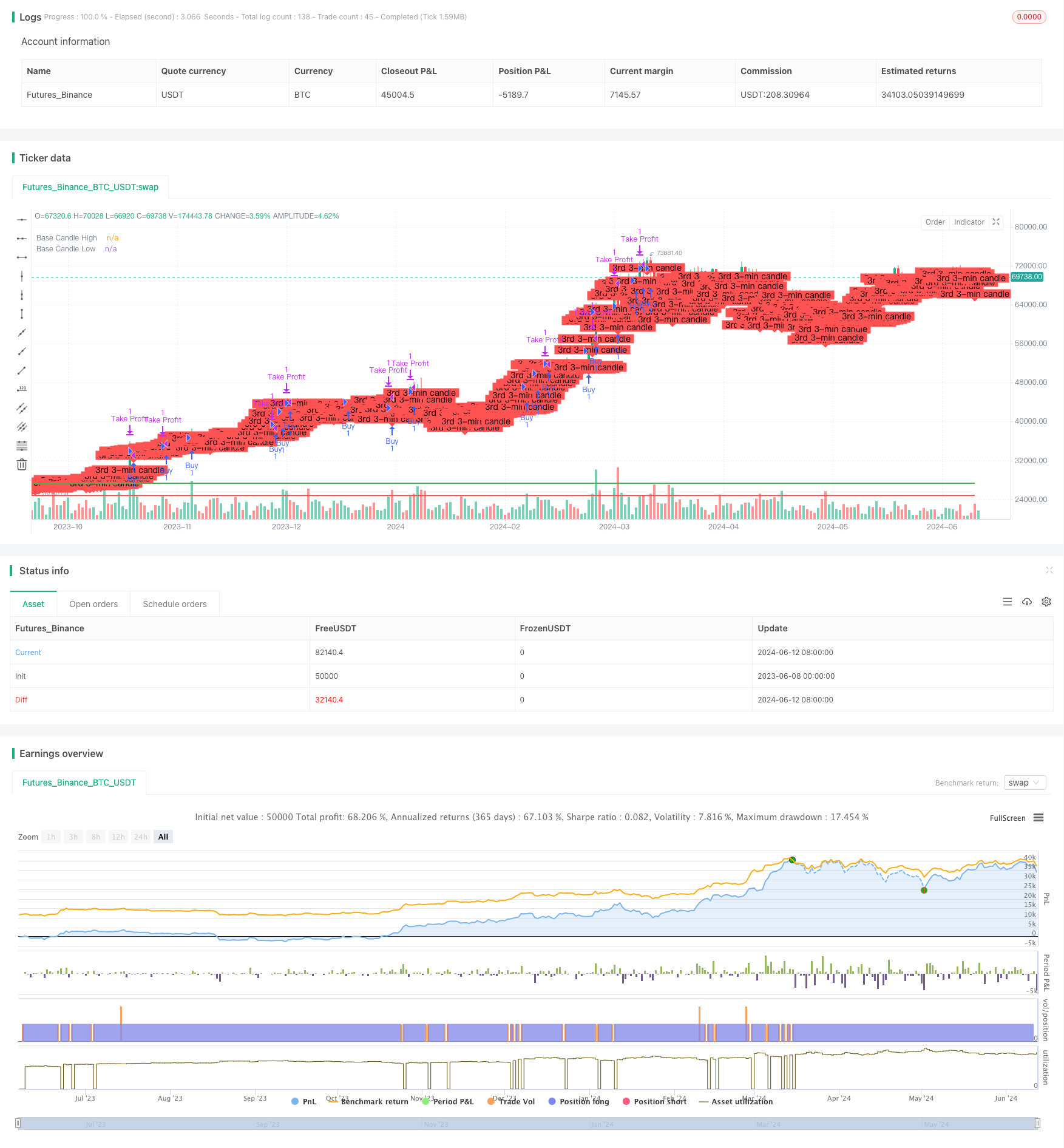

/*backtest

start: 2023-06-08 00:00:00

end: 2024-06-13 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Banknifty Strategy", overlay=true, default_qty_type=strategy.fixed, default_qty_value=1)

// Parameters

start_date = input(timestamp("2024-01-01 00:00"), title="Start Date")

end_date = input(timestamp("2024-06-07 23:59"), title="End Date")

// Time settings

var startTime = timestamp("2024-06-09 09:15")

var endTime = timestamp("2024-06-09 09:24")

// Variables to store the 3rd 3-minute candle

var bool isCandleFound = false

var float thirdCandleHigh = na

var float thirdCandleLow = na

var float baseCandleHigh = na

var float baseCandleLow = na

var float entryPrice = na

var float targetPrice = na

// Check if the current time is within the specified date range

inDateRange = true

// Capture the 3rd 3-minute candle

if (inDateRange and not isCandleFound)

var int candleCount = 0

if (true)

candleCount := candleCount + 1

if (candleCount == 3)

thirdCandleHigh := high

thirdCandleLow := low

isCandleFound := true

// Wait for a candle to close above the high of the 3rd 3-minute candle

if (isCandleFound and na(baseCandleHigh) and close > thirdCandleHigh)

baseCandleHigh := close

baseCandleLow := low

// Strategy logic for buying and selling

if (not na(baseCandleHigh))

// Buy condition

if (high > baseCandleHigh and strategy.opentrades == 0)

entryPrice := high

targetPrice := entryPrice + 100

strategy.entry("Buy", strategy.long, limit=entryPrice)

// Sell condition

if (low < baseCandleLow and strategy.opentrades == 0)

entryPrice := low

targetPrice := entryPrice - 100

strategy.entry("Sell", strategy.short, limit=entryPrice)

// Exit conditions

if (strategy.opentrades > 0)

// Exit BUY trade when profit is 100 points or carry forward to next day

if (strategy.position_size > 0 and high >= targetPrice)

strategy.exit("Take Profit", from_entry="Buy", limit=targetPrice)

// Exit SELL trade when profit is 100 points or carry forward to next day

if (strategy.position_size < 0 and low <= targetPrice)

strategy.exit("Take Profit", from_entry="Sell", limit=targetPrice)

// Close trades at the end of the day

if (time == timestamp("2024-06-09 15:30"))

strategy.close("Buy", comment="Market Close")

strategy.close("Sell", comment="Market Close")

// Plotting for visualization

plotshape(series=isCandleFound, location=location.belowbar, color=color.red, style=shape.labeldown, text="3rd 3-min candle")

plot(baseCandleHigh, title="Base Candle High", color=color.green, linewidth=2, style=plot.style_line)

plot(baseCandleLow, title="Base Candle Low", color=color.red, linewidth=2, style=plot.style_line)

相关推荐