概述

这个策略是一个结合了多个技术指标的复杂交易系统,旨在捕捉市场趋势并在最佳时机进行交易。它主要利用了相对强弱指数(RSI)、简单移动平均线(SMA)、斐波那契回撤水平以及黄金交叉和死亡交叉等概念。该策略在15分钟时间周期上运行,采用1000美元的初始资金和固定金额的头寸规模。

策略原理

策略的核心逻辑包括以下几个关键组成部分:

- 使用14周期的RSI指标来衡量市场的超买和超卖状态。

- 计算50周期和200周期的简单移动平均线,用于确定总体趋势方向和潜在的交叉信号。

- 动态计算并绘制斐波那契回撤水平(38.2%, 50%, 61.8%),基于过去50个周期的最高价和最低价。

- 定义黄金交叉(短期均线上穿长期均线)和死亡交叉(短期均线下穿长期均线)作为潜在的趋势变化信号。

- 结合上述指标制定入场和出场条件:

- 多头入场:出现黄金交叉,价格在50%斐波那契水平之上,且RSI低于70。

- 空头入场:出现死亡交叉,价格在50%斐波那契水平之下,且RSI高于30。

- 多头平仓:RSI超过70。

- 空头平仓:RSI低于30。

策略优势

- 多指标融合:通过结合RSI、移动平均线和斐波那契回撤,策略可以从多个角度分析市场,提高信号的可靠性。

- 趋势跟踪:使用黄金交叉和死亡交叉有助于捕捉大趋势的开始,提高盈利潜力。

- 风险管理:利用RSI的超买超卖区间作为止损点,可以有效控制风险。

- 动态调整:斐波那契回撤水平会根据最近的价格波动动态调整,使策略能够适应不同的市场环境。

- 可视化:策略在图表上绘制了关键指标和斐波那契水平,便于交易者直观理解市场状况。

策略风险

- 假突破:在震荡市场中,可能会出现频繁的假突破信号,导致连续亏损。

- 滞后性:移动平均线和RSI都是滞后指标,在快速变化的市场中可能反应不够及时。

- 过度交易:结合多个指标可能导致过多的交易信号,增加交易成本。

- 参数敏感性:策略效果高度依赖于所选择的参数,如RSI周期、移动平均线周期等,需要仔细优化。

- 单一时间周期:仅在15分钟周期上运行,可能忽视更大时间周期的重要趋势信息。

策略优化方向

- 多时间周期分析:引入更大的时间周期(如1小时、4小时)来确认主趋势,提高信号质量。

- 动态参数调整:根据市场波动率自动调整RSI和移动平均线的周期,以适应不同的市场状态。

- 增加成交量分析:结合成交量指标,如OBV或CMF,来验证价格趋势的有效性。

- 优化止损策略:除了使用RSI水平,还可以考虑使用ATR(平均真实波幅)来设置动态止损。

- 引入机器学习:使用机器学习算法优化参数选择和信号生成过程,提高策略的适应性。

- 增加回测周期:对策略进行更长时间、不同市场条件下的回测,以确保其稳健性。

- 考虑加入情绪指标:如VIX或Put/Call比率,以捕捉市场情绪变化带来的交易机会。

总结

这个多周期斐波那契RSI黄金交叉趋势跟踪量化交易策略展示了如何将多个经典技术分析工具结合起来,创建一个复杂而全面的交易系统。通过融合RSI、移动平均线交叉和斐波那契回撤等指标,该策略旨在捕捉强劲的市场趋势,同时利用超买超卖水平来管理风险。

尽管该策略具有多角度分析市场的优势,但仍存在一些潜在风险,如假突破信号和过度交易的可能性。为了进一步提高策略的性能和稳健性,可以考虑引入多时间周期分析、动态参数调整、成交量确认等优化方向。

总的来说,这个策略为量化交易者提供了一个很好的起点,展示了如何将不同的技术指标整合到一个连贯的交易系统中。通过持续的优化和回测,这个策略有潜力成为一个强大的趋势跟踪工具,适用于各种市场条件。

策略源码

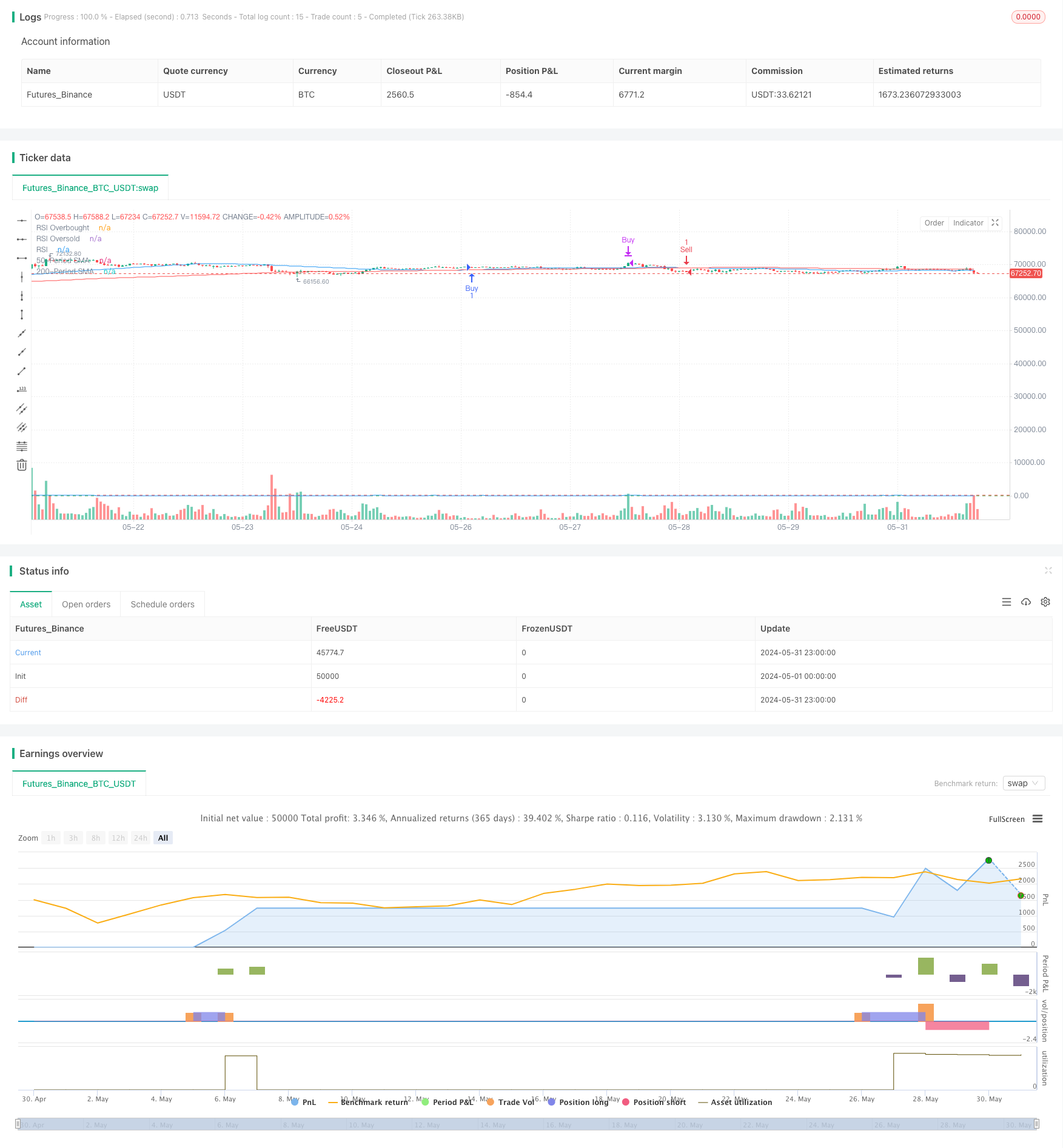

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("15min Fibonacci RSI Golden Cross Scalping Strategy", overlay=true)

// Indicators

rsi_length = 14

rsi = ta.rsi(close, rsi_length)

short_ma_length = 50

long_ma_length = 200

short_ma = ta.sma(close, short_ma_length)

long_ma = ta.sma(close, long_ma_length)

// Fibonacci Retracement Levels

var float fibHigh = na

var float fibLow = na

var float fib38 = na

var float fib50 = na

var float fib61 = na

if (ta.change(ta.highest(close, 50)))

fibHigh := ta.highest(close, 50)

if (ta.change(ta.lowest(close, 50)))

fibLow := ta.lowest(close, 50)

if (not na(fibHigh) and not na(fibLow))

fib38 := fibHigh - (fibHigh - fibLow) * 0.382

fib50 := fibHigh - (fibHigh - fibLow) * 0.50

fib61 := fibHigh - (fibHigh - fibLow) * 0.618

// Plot indicators

plot(short_ma, title="50-Period SMA", color=color.blue)

plot(long_ma, title="200-Period SMA", color=color.red)

hline(70, "RSI Overbought", color=color.red)

hline(30, "RSI Oversold", color=color.green)

plot(rsi, title="RSI", color=color.blue)

// Fibonacci retracement lines

// var line fib38_line = na

// var line fib50_line = na

// var line fib61_line = na

// if (not na(fib38))

// line.delete(fib38_line)

// fib38_line := line.new(x1=bar_index[1], y1=fib38, x2=bar_index, y2=fib38, color=color.yellow, width=1)

// if (not na(fib50))

// line.delete(fib50_line)

// fib50_line := line.new(x1=bar_index[1], y1=fib50, x2=bar_index, y2=fib50, color=color.orange, width=1)

// if (not na(fib61))

// line.delete(fib61_line)

// fib61_line := line.new(x1=bar_index[1], y1=fib61, x2=bar_index, y2=fib61, color=color.green, width=1)

// Entry and Exit Conditions

goldenCross = ta.crossover(short_ma, long_ma)

deathCross = ta.crossunder(short_ma, long_ma)

longCondition = goldenCross and close > fib50 and rsi < 70

shortCondition = deathCross and close < fib50 and rsi > 30

if (longCondition)

strategy.entry("Buy", strategy.long)

if (shortCondition)

strategy.entry("Sell", strategy.short)

// Close position conditions

if (strategy.position_size > 0 and rsi > 70)

strategy.close("Buy")

if (strategy.position_size < 0 and rsi < 30)

strategy.close("Sell")

相关推荐