概述

多重因子反转趋势交易策略是一个专门设计的程序化交易系统,用于识别市场中连续上涨或下跌后的潜在反转点。该策略通过分析价格走势,结合成交量确认和通道带(布林带或肯特纳通道)等多个技术指标,以捕捉市场超买或超卖状态下的反转机会。策略的核心是通过多重因子的综合判断,提高交易信号的可靠性和准确度。

策略原理

策略主要基于以下三个核心要素进行交易信号的生成: 1. 连续价格变动识别 - 通过设定连续上涨或下跌的K线数量阈值,识别强势趋势的形成 2. 成交量确认机制 - 可选择性地加入成交量分析,要求在价格连续变动期间成交量同步增加,增加信号可靠性 3. 通道突破验证 - 支持布林带和肯特纳通道两种方式,通过价格与通道边界的交互确认超买超卖

交易信号的触发需要满足设定的条件组合。系统会在确认K线收盘后,在符合条件的位置绘制三角形标记并执行相应的多空操作。策略采用账户权益的80%作为每次交易的仓位大小,并考虑了0.01%的交易手续费。

策略优势

- 多维度信号确认 - 通过价格、成交量和通道线等多个维度的综合分析,有效降低假信号

- 灵活的参数配置 - 支持自定义连续K线数量、选择性使用成交量和通道确认,适应不同市场环境

- 清晰的视觉反馈 - 通过三角形标记直观显示入场点,便于策略监控和回测分析

- 合理的资金管理 - 采用账户比例仓位,动态调整交易规模,有效控制风险

策略风险

- 反转失败风险 - 在强势趋势中,反转信号可能导致错误交易

- 资金效率问题 - 固定使用80%权益可能在某些市场条件下过于激进

- 时滞风险 - 等待K线确认收盘可能导致入场点位不够理想

- 参数敏感性 - 不同参数组合的表现差异较大,需要充分测试

策略优化方向

- 引入动态止损机制 - 建议基于ATR或波动率设置自适应止损位

- 优化仓位管理 - 可考虑根据市场波动性动态调整仓位比例

- 增加趋势过滤器 - 添加均线等趋势指标,避免在主趋势方向做反转

- 完善退出机制 - 设计基于技术指标的获利了结规则

- 市场环境适配 - 根据不同的市场状态动态调整策略参数

总结

多重因子反转趋势交易策略通过综合分析价格形态、成交量变化和通道突破等多个维度的市场信息,为交易者提供了一个系统化的反转交易方案。策略的优势在于其灵活的参数配置和多维度的信号确认机制,但同时也需要注意市场环境适配和风险控制。通过建议的优化方向,策略有望在实盘交易中取得更好的表现。

策略源码

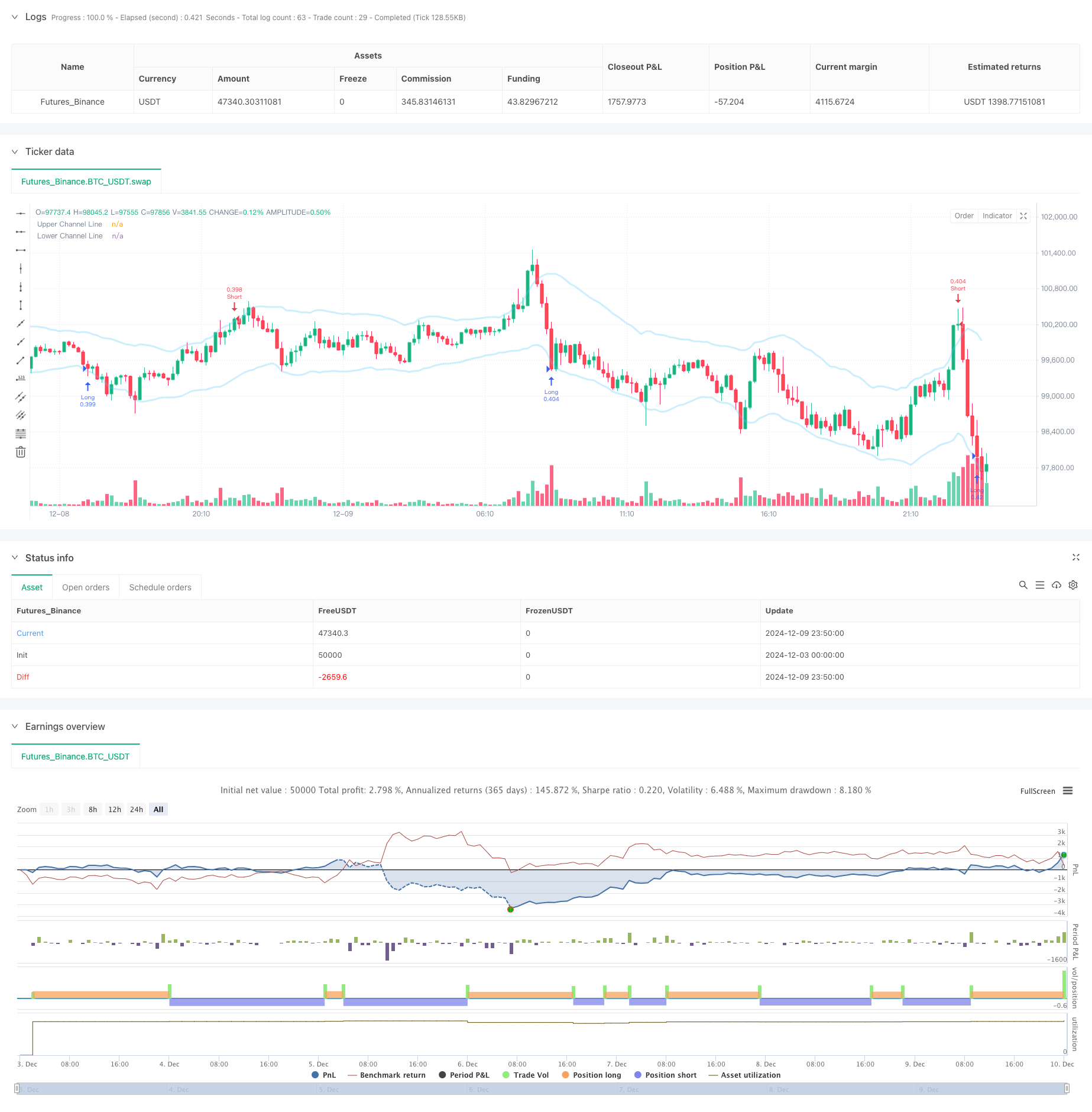

/*backtest

start: 2024-12-03 00:00:00

end: 2024-12-10 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="The Bar Counter Trend Reversal Strategy [TradeDots]", overlay=true, initial_capital = 10000, default_qty_type = strategy.percent_of_equity, default_qty_value = 80, commission_type = strategy.commission.percent, commission_value = 0.01)

// Initialize variables

var bool rise_triangle_ready = false

var bool fall_triangle_ready = false

var bool rise_triangle_plotted = false

var bool fall_triangle_plotted = false

//Strategy condition setup

noOfRises = input.int(3, "No. of Rises", minval=1, group="STRATEGY")

noOfFalls = input.int(3, "No. of Falls", minval=1, group="STRATEGY")

volume_confirm = input.bool(false, "Volume Confirmation", group="STRATEGY")

channel_confirm = input.bool(true, "", inline="CHANNEL", group="STRATEGY")

channel_type = input.string("KC", "", inline="CHANNEL", options=["BB", "KC"],group="STRATEGY")

channel_source = input(close, "", inline="CHANNEL", group="STRATEGY")

channel_length = input.int(20, "", inline="CHANNEL", minval=1,group="STRATEGY")

channel_mult = input.int(2, "", inline="CHANNEL", minval=1,group="STRATEGY")

//Get channel line information

[_, upper, lower] = if channel_type == "KC"

ta.kc(channel_source, channel_length,channel_mult)

else

ta.bb(channel_source, channel_length,channel_mult)

//Entry Condition Check

if channel_confirm and volume_confirm

rise_triangle_ready := ta.falling(close, noOfFalls) and ta.rising(volume, noOfFalls) and high > upper

fall_triangle_ready := ta.rising(close, noOfRises) and ta.rising(volume, noOfRises) and low < lower

else if channel_confirm

rise_triangle_ready := ta.falling(close, noOfFalls) and low < lower

fall_triangle_ready := ta.rising(close, noOfRises) and high > upper

else if volume_confirm

rise_triangle_ready := ta.falling(close, noOfFalls) and ta.rising(volume, noOfFalls)

fall_triangle_ready := ta.rising(close, noOfRises) and ta.rising(volume, noOfRises)

else

rise_triangle_ready := ta.falling(close, noOfFalls)

fall_triangle_ready := ta.rising(close, noOfRises)

// Check if trend is reversed

if close > close[1]

rise_triangle_plotted := false // Reset triangle plotted flag

if close < close[1]

fall_triangle_plotted := false

//Wait for bar close and enter trades

if barstate.isconfirmed

// Plot triangle when ready and counts exceed threshold

if rise_triangle_ready and not rise_triangle_plotted

label.new(bar_index, low, yloc = yloc.belowbar, style=label.style_triangleup, color=color.new(#9CFF87,10))

strategy.entry("Long", strategy.long)

rise_triangle_plotted := true

rise_triangle_ready := false // Prevent plotting again until reset

if fall_triangle_ready and not fall_triangle_plotted

label.new(bar_index, low, yloc = yloc.abovebar, style=label.style_triangledown, color=color.new(#F9396A,10))

strategy.entry("Short", strategy.short)

fall_triangle_plotted := true

fall_triangle_ready := false

// plot channel bands

plot(upper, color = color.new(#56CBF9, 70), linewidth = 3, title = "Upper Channel Line")

plot(lower, color = color.new(#56CBF9, 70), linewidth = 3, title = "Lower Channel Line")

相关推荐