概述

本策略是一个结合了多重指数移动平均线(EMA)交叉、真实波动幅度(ATR)和枢轴点支撑阻力(Pivot Points)的综合交易系统。策略通过短期EMA对中长期EMA的交叉信号,结合ATR波动区间和关键价格水平来捕捉市场趋势转折点,实现精准的交易时机把握。

策略原理

策略主要基于三个维度的技术分析: 1. 趋势识别:使用4期、9期和18期三重EMA,通过短期EMA(4期)对中期EMA(9期)和长期EMA(18期)的同向交叉来确认趋势方向。 2. 波动范围:引入14期ATR指标,用于量化市场波动性并设定动态的交易阈值。 3. 价格支撑阻力:通过每日枢轴点计算系统(PPSignal),建立7个关键价格水平(PP、R1-R3、S1-S3),为交易提供参考。

交易规则明确: - 做多条件:EMA4向上穿越EMA9和EMA18,且收盘价突破EMA9上方ATR距离 - 做空条件:EMA4向下穿越EMA9和EMA18,且收盘价突破EMA9下方ATR距离 - 止损设置:动态跟踪EMA4水平

策略优势

- 多维度分析:结合趋势、波动和价格结构三个维度,提高信号可靠性

- 动态适应:通过ATR和动态支撑阻力位,策略能够适应不同市场环境

- 风险控制完善:采用动态止损机制,能够及时锁定利润并控制风险

- 信号确认充分:要求多重技术指标共振才触发交易,降低假突破风险

策略风险

- 震荡市场风险:在横盘整理阶段可能产生频繁交叉假信号

- 滞后性风险:移动平均线本身具有滞后性,可能错过最佳入场时机

- Gap风险:日间跳空可能导致止损点失效

- 参数敏感性:不同周期参数组合可能产生显著不同的效果

策略优化方向

- 引入成交量指标:在交叉信号确认时加入成交量验证

- 动态参数优化:根据市场波动率自适应调整EMA周期参数

- 完善止损机制:可考虑结合ATR设置浮动止损

- 市场环境过滤:添加趋势强度指标,在强趋势期间才开启交易

- 时间过滤:针对不同时间周期的特征,设置最优交易时段

总结

该策略通过多重技术指标的协同配合,构建了一个较为完整的交易系统。策略的核心优势在于多维度信号确认机制和完善的风险控制体系,但仍需要交易者根据具体市场环境进行参数优化和系统改进。通过建议的优化方向,策略的稳定性和可靠性有望得到进一步提升。

策略源码

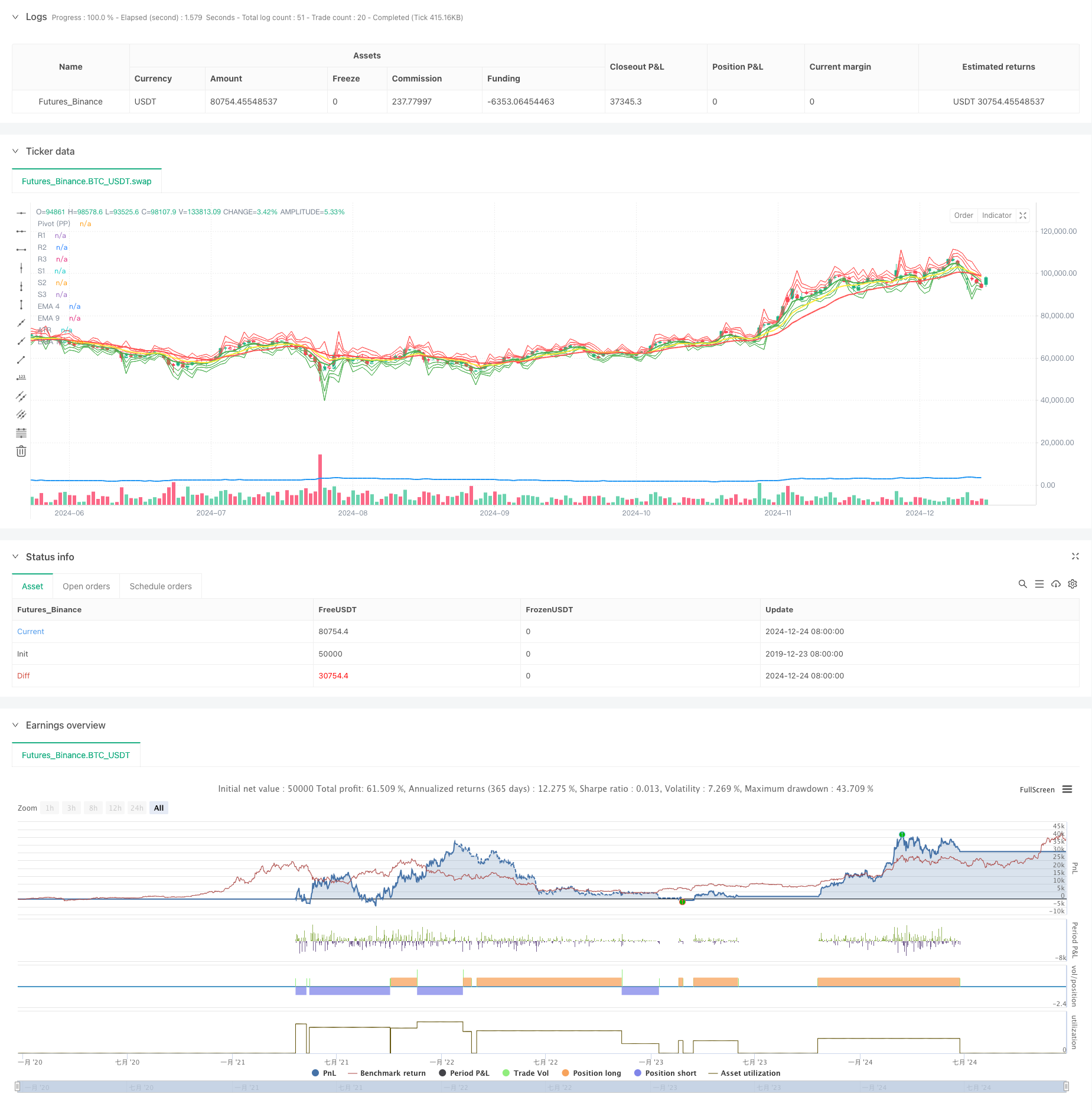

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Crossover + ATR + PPSignal", overlay=true)

//--------------------------------------------------------------------

// 1. Cálculo de EMAs y ATR

//--------------------------------------------------------------------

ema4 = ta.ema(close, 4)

ema9 = ta.ema(close, 9)

ema18 = ta.ema(close, 18)

atrLength = 14

atr = ta.atr(atrLength)

//--------------------------------------------------------------------

// 2. Cálculo de Pivot Points diarios (PPSignal)

// Tomamos datos del día anterior (timeframe D) para calcularlos

//--------------------------------------------------------------------

dayHigh = request.security(syminfo.tickerid, "D", high[1])

dayLow = request.security(syminfo.tickerid, "D", low[1])

dayClose = request.security(syminfo.tickerid, "D", close[1])

// Fórmula Pivot Points estándar

pp = (dayHigh + dayLow + dayClose) / 3.0

r1 = 2.0 * pp - dayLow

s1 = 2.0 * pp - dayHigh

r2 = pp + (r1 - s1)

s2 = pp - (r1 - s1)

r3 = dayHigh + 2.0 * (pp - dayLow)

s3 = dayLow - 2.0 * (dayHigh - pp)

//--------------------------------------------------------------------

// 3. Definir colores para las EMAs

//--------------------------------------------------------------------

col4 = color.green // EMA 4

col9 = color.yellow // EMA 9

col18 = color.red // EMA 18

//--------------------------------------------------------------------

// 4. Dibujar indicadores en el gráfico

//--------------------------------------------------------------------

// EMAs

plot(ema4, title="EMA 4", color=col4, linewidth=2)

plot(ema9, title="EMA 9", color=col9, linewidth=2)

plot(ema18, title="EMA 18", color=col18, linewidth=2)

// ATR

plot(atr, title="ATR", color=color.blue, linewidth=2)

// Pivot Points (PPSignal)

plot(pp, title="Pivot (PP)", color=color.new(color.white, 0), style=plot.style_line, linewidth=1)

plot(r1, title="R1", color=color.new(color.red, 0), style=plot.style_line, linewidth=1)

plot(r2, title="R2", color=color.new(color.red, 0), style=plot.style_line, linewidth=1)

plot(r3, title="R3", color=color.new(color.red, 0), style=plot.style_line, linewidth=1)

plot(s1, title="S1", color=color.new(color.green, 0), style=plot.style_line, linewidth=1)

plot(s2, title="S2", color=color.new(color.green, 0), style=plot.style_line, linewidth=1)

plot(s3, title="S3", color=color.new(color.green, 0), style=plot.style_line, linewidth=1)

//--------------------------------------------------------------------

// 5. Condiciones de cruce (EMA4 vs EMA9 y EMA18) y estrategia

//--------------------------------------------------------------------

crossedAbove = ta.crossover(ema4, ema9) and ta.crossover(ema4, ema18)

crossedBelow = ta.crossunder(ema4, ema9) and ta.crossunder(ema4, ema18)

// Señales de Buy y Sell basadas en cruces + condición con ATR

if crossedAbove and close > ema9 + atr

strategy.entry("Buy", strategy.long)

strategy.exit("Sell", "Buy", stop=ema4)

if crossedBelow and close < ema9 - atr

strategy.entry("Sell", strategy.short)

strategy.exit("Cover", "Sell", stop=ema4)

相关推荐