Quantitative Practice of DEX Exchanges (2) -- Hyperliquid User Guide

0

0

610

610

Preface

Recently, the FMZ platform has added support for Hyperliquid DEX, a high-performance decentralized exchange, providing users with more options for participating in decentralized tradings. At present, the docker function of the FMZ platform has been fully updated to support Hyperliquid’s spot and perpetual contract tradings, and cover all API functions of the DEX.

Hyperliquid platform overview

Hyperliquid is a high-performance L1 blockchain optimized from scratch, with the vision of building a fully on-chain open financial system. Users can create applications independently by interacting with efficient native components while ensuring a smooth end-user experience.

Hyperliquid L1’s performance is sufficient to support a permissionless financial application ecosystem. All orders, withdrawals, transactions, and liquidations are completed on-chain in a completely transparent manner, with a block latency of less than 1 second. At present, the chain supports a processing capacity of up to 100,000 orders per second.

Hyperliquid L1 uses a custom consensus algorithm called HyperBFT, which is inspired by Hotstuff and its subsequent algorithms. Both the consensus mechanism and the network architecture are optimized from the bottom up to meet the needs of high-performance blockchains.

Through this guide, we hope to help you get started with programmatic and quantitative trading quickly on Hyperliquid DEX on the FMZ platform and discover more trading opportunities.

Practice Contents

REST Protocol

- Market interface practice.

- Trading interface practice (order placement, order withdrawal).

- Transaction-related query practice (positions, orders).

- Other functions (spot, contract transfer, vault withdrawal, transfer of assets to wallet, etc.).

Websocket Protocol

- Exchange information subscription practice (there is no Trades interface in the REST interface, which is supplemented by the Websocket interface)

Hyperliquid

- Trading varieties Hyperliquid is divided into spot and perpetual contracts based on the trading varieties. Based on the architecture of the FMZ platform, it is also divided into Hyperliquid spot exchange objects and Hyperliquid futures exchange objects on the FMZ platform, corresponding to different varieties in Hyperliquid DEX respectively.

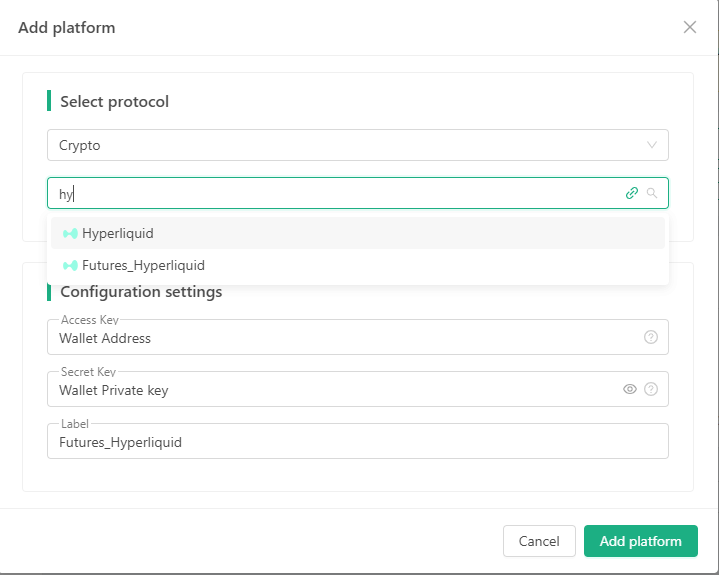

On the Add platform page of the FMZ platform, you can configure Hyperliquid spot and futures exchange objects:

- Environment Division Like most exchanges, Hyperliquid also has a testing environment.

Mainnet APP address:

In actual use, the main network is relatively stable and has a good speed.

The corresponding REST protocol API interface node address is: https://api.hyperliquid.xyz.

The message signature related information is also different: source == "a",chainId = 42161.

Test network APP address:

The test network often crashes, but it is only used as a test interface and to familiarize yourself with the trading functions on DEX.

The corresponding REST protocol API interface node address is: https://api.hyperliquid-testnet.xyz.

The message signature related information is also different: source == "b",chainId = 421614.

Wallet Connection, Login and Configuration Information

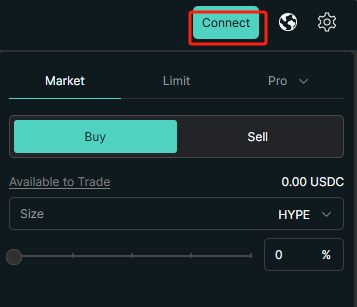

Just like the wallet connection method of most DEX exchanges, you can use the wallet APP to scan the QR code to connect to Hyperliquid (switch the wallet to Arbitrum and scan the code to log in, the test network and main network are the same).

- Wallet connected to Hyperliquid

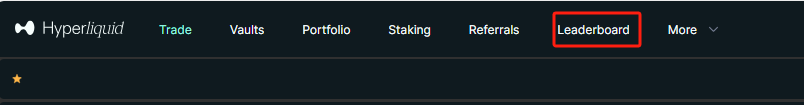

- Testnet Leaderboard (deposit test USDC assets) If you want to familiarize yourself with the testnet first, you can find the Leaderboard directly on the Hyperliquid page after connecting your wallet to Hyperliquid.

You can claim test assets. After receiving the USDC for testing, click the “Deposit” button to deposit it into Hyperliquid (it is best to have some ETH for the Arbitrum test network).

- Deposit USDC assets on the mainnet

Click the “Deposit” button to deposit, which requires wallet verification and will consume a little ETH on Arbitrum.

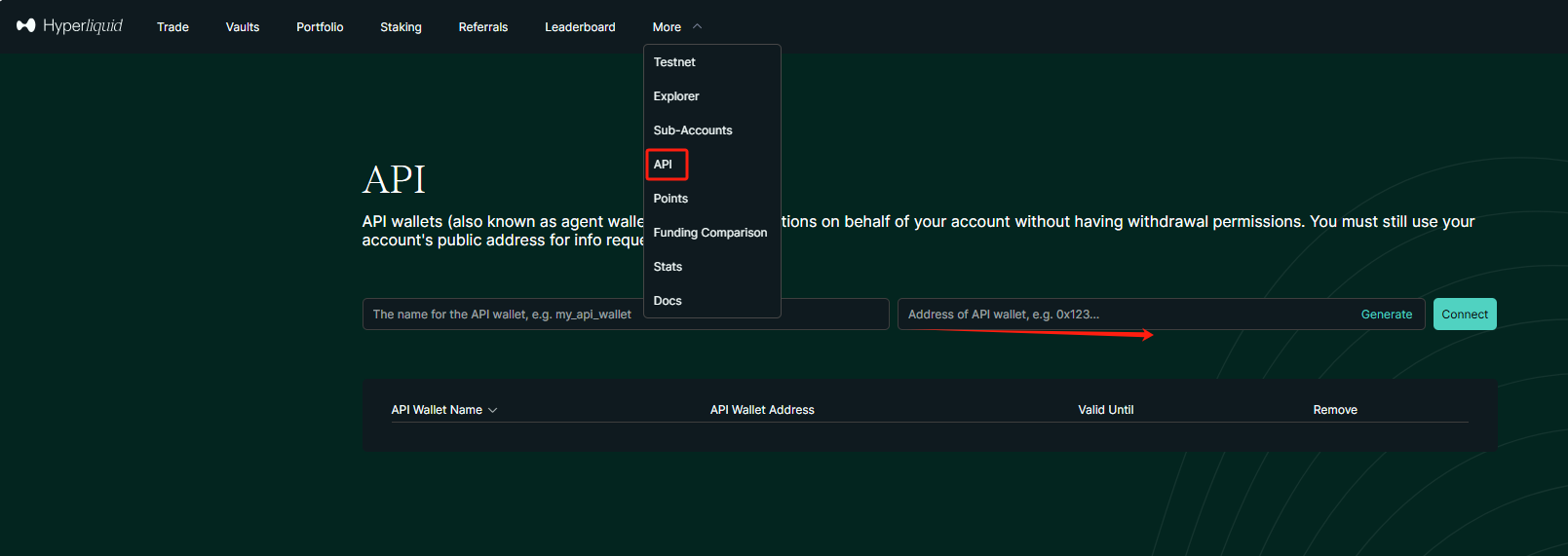

- Create a proxy wallet configuration

When performing manual transactions on the Hyperliquid APP page, the page will automatically generate a proxy wallet address and private key, which are recorded in the browser and used for operations such as placing orders on the browser page. So if we want to do programmatic and quantitative trading, how do we get this configuration information?

You can create the required proxy wallet address and corresponding private key on the Hyperliquid API page:

- Give a name to the proxy wallet to be created.

- Generate address and private key.

- Authorize the proxy wallet using the wallet connected to Hyperliquid.

- Configure the proxy wallet address and private key on FMZ

Then you can configure this information on the FMZ platform (the configuration interface is mentioned above).

Wallet Address: The wallet address connected to Hyperliquid (note, not the proxy wallet address). Wallet PrivateKey: The wallet private key connected to Hyperliquid (optional, only required when calling APIs such as transfers, it can be left blank). Secret Key: Proxy wallet private key (generated in the previous step, the private key displayed after authorization).

Hyperliquid Practice on FMZ

Information required to configure the exchange object:

- Wallet Address is used to query user transaction information

- Wallet PrivateKey is used for transfer and other operations

- Secret Key is used for transaction-related operations

Once the configuration is complete, we can test it on the FMZ platform. We directly use the “debugging tool” of the FMZ platform for testing practice.

If you are using a Hyperliquid exchange object configured with testnet information, you will need to do some switching operations when using it, for example:

function main() {

// REST protocol API address switched to testnet

exchange.SetBase("https://api.hyperliquid-testnet.xyz")

// source : a Mainnet, b Testnet

exchange.IO("source", "b")

return exchange.GetAccount()

}

The mainnet configuration does not require the above switching operation. The API interfaces related to spot and futures products in the Hyperliquid DEX exchange are almost the same, with only slight differences in details. Next, we use the Hyperliquid Futures Exchange objects of the mainnet configuration information and the testnet configuration information for testing.

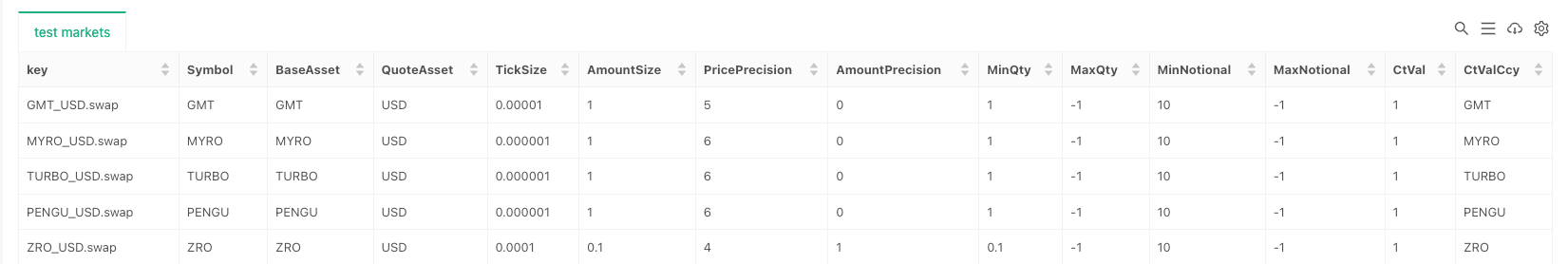

Variety Information

function main() {

var markets = exchange.GetMarkets()

if (!markets) {

throw "get markets error"

}

var tbl = {

type: "table",

title: "test markets",

cols: [

"key", "Symbol", "BaseAsset", "QuoteAsset", "TickSize", "AmountSize", "PricePrecision", "AmountPrecision", "MinQty",

"MaxQty", "MinNotional", "MaxNotional", "CtVal", "CtValCcy"

],

rows: []

}

for (var symbol in markets) {

var market = markets[symbol]

tbl.rows.push([

symbol, market.Symbol, market.BaseAsset, market.QuoteAsset, market.TickSize, market.AmountSize,

market.PricePrecision, market.AmountPrecision, market.MinQty, market.MaxQty, market.MinNotional, market.MaxNotional, market.CtVal, market.CtValCcy

])

}

LogStatus("`" + JSON.stringify(tbl) + "`")

}

Order Book Data

function main() {

var depth = exchange.GetDepth("ETH_USD.swap")

var asks = depth.Asks

var bids = depth.Bids

Log("asks 3", bids[2])

Log("asks 2", bids[1])

Log("asks 1", bids[0])

Log("bids 1", asks[0])

Log("bids 2", asks[1])

Log("bids 3", asks[2])

}

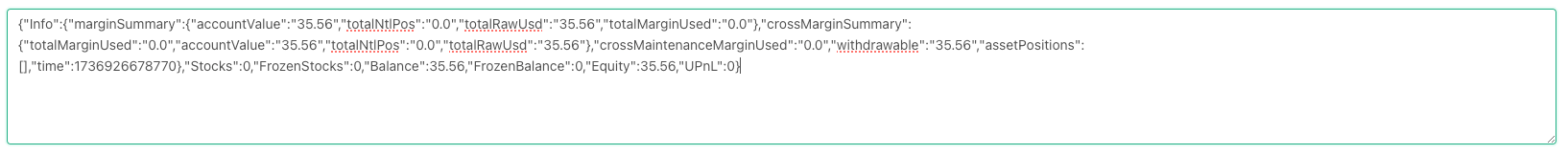

Account Assets

function main() {

var account = exchange.GetAccount()

return account

}

Function results:

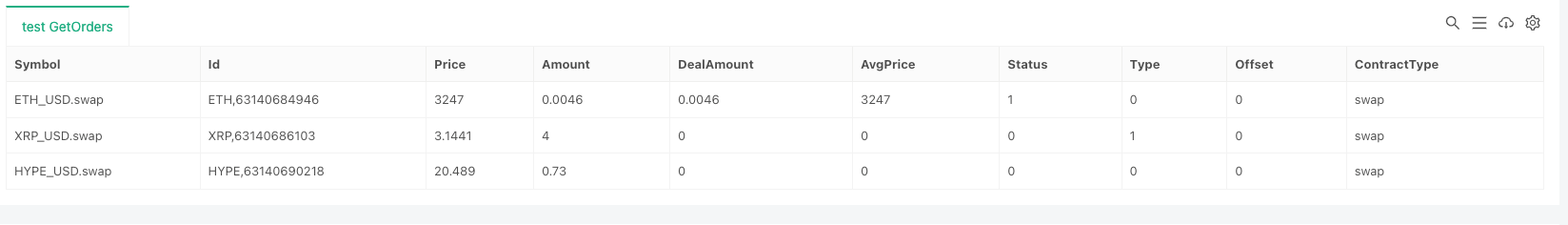

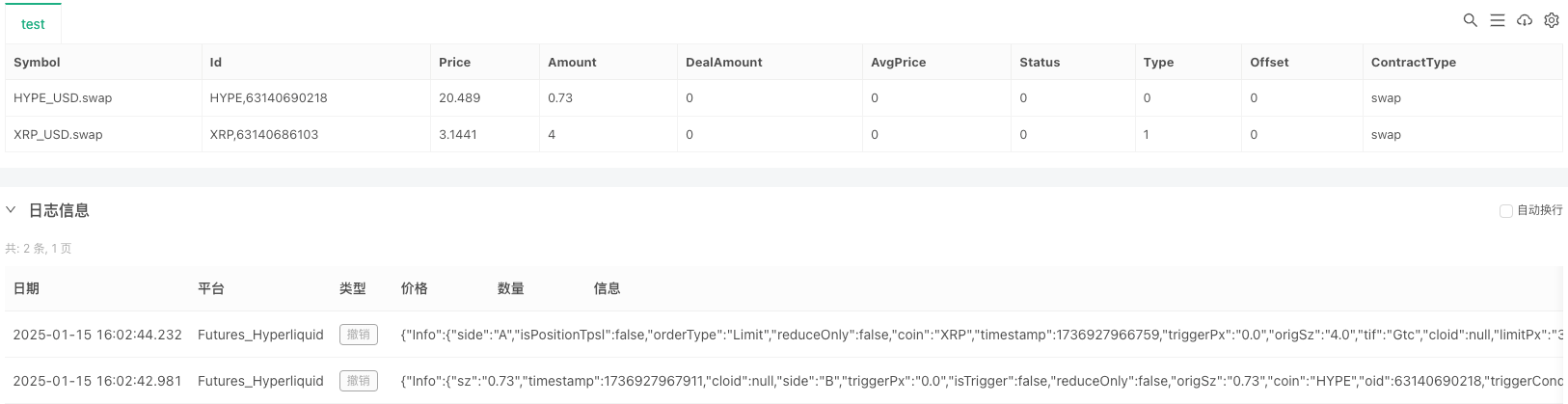

Order and Check

function main() {

var symbols = ["ETH_USD.swap", "XRP_USD.swap", "HYPE_USD.swap"]

var arrDir = ["market_buy", "sell", "buy"]

var markets = exchange.GetMarkets()

var ids = []

for (var i in symbols) {

var symbol = symbols[i]

var side = arrDir[i]

var ticker = exchange.GetTicker(symbol)

var info = markets[symbol]

exchange.SetPrecision(info.PricePrecision, info.AmountPrecision)

// USDC

var qty = 15

var price = null

var amount = null

if (side == "market_buy") {

price = -1

side = "buy"

amount = qty / ticker.Last

} else {

price = side == "buy" ? ticker.Last * 0.9 : ticker.Last * 1.1

amount = qty / price

}

var id = exchange.CreateOrder(symbol, side, price, amount)

ids.push(id)

}

var tbl = {type: "table", title: "test", cols: ["Symbol", "Id", "Price", "Amount", "DealAmount", "AvgPrice", "Status", "Type", "Offset", "ContractType"], rows: []}

for (var id of ids) {

var order = exchange.GetOrder(id)

tbl.rows.push([order.Symbol, order.Id, order.Price, order.Amount, order.DealAmount, order.AvgPrice, order.Status, order.Type, order.Offset, order.ContractType])

Sleep(500)

}

LogStatus("`" + JSON.stringify(tbl) + "`")

}

Cancel All Orders

function main() {

var orders = exchange.GetOrders("USD.swap")

for (var order of orders) {

exchange.CancelOrder(order.Id, order)

Sleep(1000)

}

var tbl = {type: "table", title: "test", cols: ["Symbol", "Id", "Price", "Amount", "DealAmount", "AvgPrice", "Status", "Type", "Offset", "ContractType"], rows: []}

for (var order of orders) {

tbl.rows.push([order.Symbol, order.Id, order.Price, order.Amount, order.DealAmount, order.AvgPrice, order.Status, order.Type, order.Offset, order.ContractType])

}

LogStatus("`" + JSON.stringify(tbl) + "`")

}

Switch Leverage, Switch Cross/Isolated Position

function main() {

// Set the current position to cross position

exchange.IO("cross", true)

// Set leverage

exchange.SetMarginLevel("ETH_USD.swap", 10)

return exchange.GetRawJSON()

}

Function results:

exchange.GetRawJSON() returns the response information of the leverage setting request:

{“status”:“ok”,“response”:{“type”:“default”}}

Other Interfaces

Since the interface parameters of the exchange are relatively complex and cannot be passed using the URL encoding method, when using exchange.IOfunction calls, only JSON strings can be passed in as parameters. The following are examples of various interface calls.

hyperliquid reference documentation: https://hyperliquid.gitbook.io/hyperliquid-docs/for-developers/api/exchange-endpoint#place-an-order

Schedule Cancel (dead man’s switch)

var params = {"type": "scheduleCancel", "time": new Date().getTime()}

return exchange.IO("api", "POST", "/exchange", null, JSON.stringify(params))

{“status”:“err”,“response”:“Cannot set scheduled cancel time until enough volume traded. Required: \(1000000. Traded: \)174.57424.”}

This function has restrictions: the account must reach the trading level to use this function.

twapOrder

Create a TWAP order.

function main() {

var params = {

"type": "twapOrder",

"twap": {

"a": 0,

"b": true,

"s": "1",

"r": false,

"m": 10,

"t": false

}

}

// SOL_USDT.swap , Order Quantity: 1 , twapOrder order has position requirement, minimum value of 100 USD

// a: 0, i.e. SOL_USDT.swap

return exchange.IO("api", "POST", "/exchange", null, JSON.stringify(params))

}

twapCancel

Cancel TWAP order.

function main() {

var params = {

"type": "twapCancel",

"a": 0,

"t": 3805

}

return exchange.IO("api", "POST", "/exchange", null, JSON.stringify(params))

}

approveAgent

Testnet, authorize a new proxy wallet.

function main() {

var params = {

"type": "approveAgent",

"hyperliquidChain": "Testnet",

"signatureChainId": "0x66eee",

"agentAddress": "0xAAAA",

"agentName": "test02",

"nonce": new Date().getTime()

}

return exchange.IO("api", "POST", "/exchange", null, JSON.stringify(params))

}

Authorization successfully, returns:

{“status”:“ok”,“response”:{“type”:“default”}}

- Create an API proxy wallet. 0xAAAA is the generated wallet address (just an example). Save the corresponding private key when generating it.

- “test02” is the API proxy wallet name. The generated key pair will be displayed on the hyperliquid APP page

https://app.hyperliquid-testnet.xyz/API.

vaultTransfer

Withdraw assets from the vault.

function main() {

var params = {

"type": "vaultTransfer",

"vaultAddress": "0xAAA",

"isDeposit": true,

"usd": 5000000

}

return exchange.IO("api", "POST", "/exchange", null, JSON.stringify(params))

}

- “usd”: 5000000 means 5 USDC.

- “0xAAA”: is the vault address.

- “isDeposit”: true, controls deposit and deposit.

withdraw3

Testnet, withdraw assets to wallet.

function main() {

var params = {

"type": "withdraw3",

"hyperliquidChain": "Testnet",

"signatureChainId": "0x66eee",

"amount": "5",

"time": new Date().getTime(),

"destination": "0xAAA"

}

return exchange.IO("api", "POST", "/exchange", null, JSON.stringify(params))

}

- Withdraw money to your current wallet address: “0xAAA”.

usdClassTransfer

Transfer of assets between spot/futures (perpetual contracts).

function main() {

var params = {

"type": "usdClassTransfer",

"hyperliquidChain": "Testnet",

"signatureChainId": "0x66eee",

"amount": "5",

"toPerp": false,

"nonce": new Date().getTime()

}

return exchange.IO("api", "POST", "/exchange", null, JSON.stringify(params))

}

- The parameter “toPerp” is set to

false, indicating the direction of rotation: futures -> spot. - The parameter “toPerp” is set to

true, indicating the direction of rotation: spot -> futures.

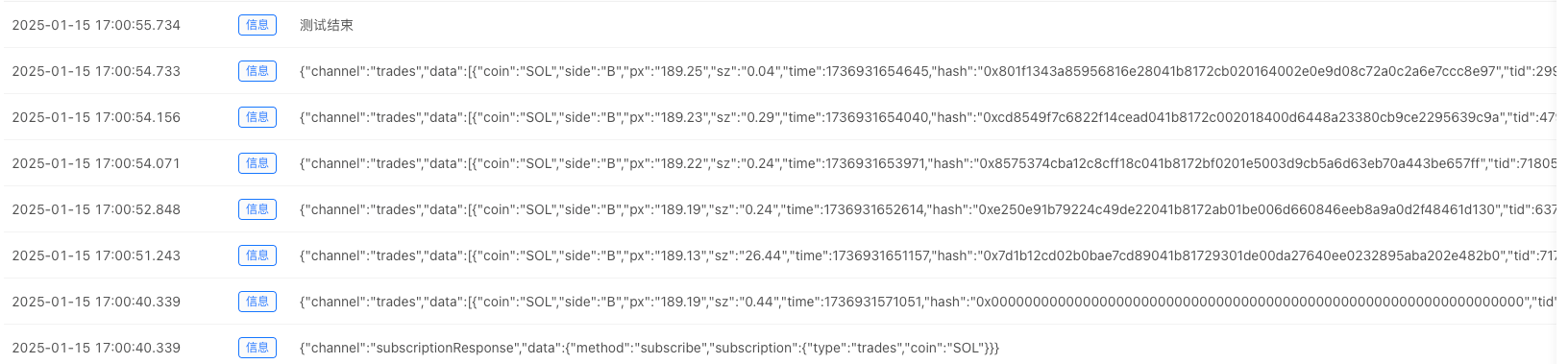

Websocket Interface Usage

Main network WS interface address:

Mainnet: wss://api.hyperliquid.xyz/ws

Since the REST protocol API interface does not have an interface for obtaining recent transaction data, the Websocket interface has this channel that can be subscribed.

Subscription message structure

{

"method": "subscribe",

"subscription": {

"type": "trades",

"coin": "SOL"

}

}

Example of test executed in debugging tools:

function main() {

var loopCount = 20

var subMsg = {

"method": "subscribe",

"subscription": {

"type": "trades",

"coin": "SOL"

}

}

var conn = Dial("wss://api.hyperliquid.xyz/ws")

conn.write(JSON.stringify(subMsg))

if (conn) {

for (var i = 0; i < loopCount; i++) {

var msg = conn.read(1000)

if (msg) {

Log(msg)

}

}

}

conn.close()

Log("End of test")

}

END

The above tests are based on the latest docker. You need to download the latest docker to support the Hyperliquid DEX exchange.

Thank you for your support and thank you for reading.

- Design and Implementation of DEX-CEX Exchange Price Difference Monitoring Based on FMZ Quant

- 基于FMZ量化的DEX-CEX交易所差价监控设计与实现

- Quantitative Analysis Helps Grid Strategy (II): Relationship Between Grid Number and Yield

- Quantitative Analysis Helps Grid Strategy (I): Screening Target Currencies

- Quantitative Practice of DEX Exchanges (3) - Vertex Protocol User Guide

- 量化分析助力网格策略(二):网格数和收益率关系

- DEX交易所量化实践(3)-- Vertex 协议 使用指南

- 量化分析助力网格策略(一):筛选目标币种

- Quantitative Implementation of Currency-Based Short-Selling Fee Arbitrage Strategy

- 币本位做空资费套利策略的量化实现

- DEX交易所量化实践(2)-- Hyperliquid 使用指南

- Quantitative Practice of DEX Exchanges (1) -- dYdX v4 User Guide

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (3)

- DEX交易所量化实践(1)-- dYdX v4 使用指南

- 数字货币中的Lead-Lag套利介绍(3)

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- 数字货币中的Lead-Lag套利介绍(2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- FMZ平台外部信号接收的探讨:策略内置Http服务接收信号的完整方案

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)