Real Technology of FMZ Quant - How to Break the Limits for Obtaining Tick

Author: Ninabadass, Created: 2022-03-31 11:14:14, Updated: 2022-03-31 14:02:25In a high-frequency trading strategy of commodity futures, the receiving speed of the Tick market quotes has a decisive influence on the profit result of the strategy. However, most of the trading frameworks on the market use the callback mode mechanism. It would be nice not to miss onBar/onTick and Tick, so why? Because in the onBar/onTick function, you have to deal with the entire code logic, which is a waste of time; whether you want it or not, your strategy logic must be interrupted, and you must use a state machine mode, such as:

var state = STATE_IDLE;

function onTick() {

if (state == STATE_IDLE) {

// do something...

} else if (state == ....) {

// do something

}

}

FFMZ Quant does not adopt the backward callback mechanism, but adopts the “main” function entry mechanism that does not interrupt the strategy logic, so that users can control the strategy flow more naturally; use C++ and Golang as the stable strategy underlayer, and use Javascript/Python on the upper layer to deal with logic problems. Do not think the scripting language is slow, unless you use it for NNS training; even if you use NNS training, after adding Jit hot compilation, it will be enough for any occasion; Chrome defeating IE instantly is an example. Combined with the event triggering mechanism, the strategy can also process TAQ at the fastest speed in the first time. The entry-level strategy will not be written here, as far as the synthesis of high-frequency ticks in futures is concerned, For example, when we access a futures company, we can only receive the TAQ of this futures company. The speed and quality of the TAQ we get is related to our own network, and also related to the load of the futures company’s front-end machine. So, how can we obtain more accurate futures tick data faster?

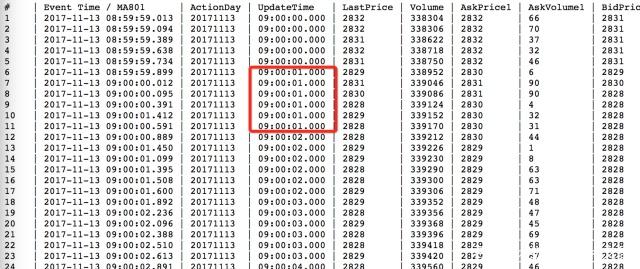

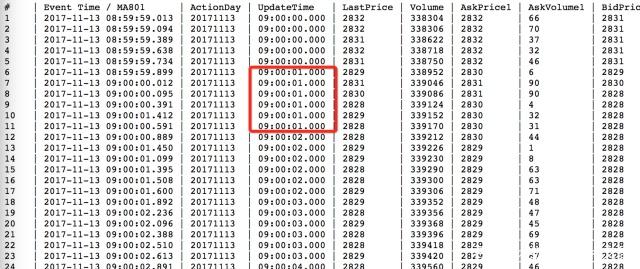

Under the strategy model, you can easily operate the accounts of N different futures companies, merge their TAQ, and place orders at the fastest speed. Under normal circumstances, we can get two ticks per second from the futures companies, but by the technology of merging TAQ, taking MA801 as an example, we can get a maximum of 6 non-repetitive ticks per second.

Let’s go straight to the code (the code can only be operated in the bot, not in the backtest), and the use of IO function can refer to: https://www.fmz.cn/api#io%E5%87%BD%E6%95%B0

When a bot adds a platform, N futures companies can be added to process the concurrent merging of TAQ; here we temporarily add two, and demonstrate this:

Code as follows:

function main() {

Log("Prepare to access the platform and subscribe to TAQ")

// Step 1: all futures front-end processors are subscribing for symbols

_.each(exchanges, function(e) {

// wait to access the platform, and yes, the strategy runs continuously for 365 days, and it can run even after the market is closed, and it is not the logic of event callback

good mistake

while (!e.IO("status")) Sleep(1000);

// Use the _C retry function to eliminate network errors, and subscribe to TAQ just access to the platform; there may be an error that CTP is not ready

_C(e.SetContractType, "MA801")

// Switch the TAQ receiving mode to immediate return mode instead of event trigger mode, please refer to the API documentation

e.IO("mode", 0)

})

Log("Start to merge data...")

// Step 2: here comes the important part

var preVolume = 0

while (true) {

var ts = new Date().getTime()

// If any platform has tick event, return

var e = exchange.IO("wait_any")

// Reset Volume at a proper time

if (e.Nano/1000000 - ts > 60000) {

preVolume = 0

}

if (e.Event == 'tick' && e.Ticker.Volume >= preVolume) {

Log(ret, e.Ticker.Last, e.Ticker.Volume)

preVolume = e.Ticker.Volume

}

}

}

Result as follows:

It can be seen that at 21:24:44, the data of the first futures company arrives before the second one, and the result can be seen by adding two futures companies. If more than 5 futures companies are added to merge together Then you basically have no chance to miss Tick. If you use it to develop high-frequency trading strategies, you have solved a very important and decisive step, that is, the speed, stability and reliability of obtaining Tick.

FMZ Quant (former BotVS) is a platform specially created for developers who have critical requirements on strategy stability and speed. The underlayer protocol technology is independently developed, which can be operated under Linux/Windows/Mac/ARM single chip microcomputers or even mobile phones, and its ordering speed is extremely fast. The reaction to TAQ is fast, and it is the best choice for developing high-frequency strategies.

- Getticker返回的Volume数据不对

- FMZ Based Order Synchronous Management System Design (1)

- Design a Multiple-Chart Plotting Library

- 模拟盘环境

- 60-Line Code Realizing One Thought - Contract Bottom Fishing

- FMZ Billing System Upgrade & Adjustment Announcement

- Notice for Ghostwriting Strategies on FMZ

- 报错求助 Futures_OP 3: 504: The upstream server is timing out

- 币安下单报错

- 多品种

- Quick Construction of Your Own Exclusive Multi-User Quantitative Trading Platform Without Cost

- 来个大佬改一个跟单机器人策略,正向跟单改成反向跟单且跟单下单量*2,有意联系微:AL-1322

- Use the extended API on FMZ Quant to realize "TradingView" alert signal trading

- Main Interface Overview and Structure of FMZ Quant Trading Platform

- How to Pend Market orders (Only Passively Traded) and Place Orders in Batch on BitMEX (IO Demo)

- FMZ Launched Python Local Backtest Engine

- FMZ Feedback to New and Old Users by Affiliation

- 哪个大佬有梦总的类马丁多品种版

- 制作一个简易价格提醒机器人

- 调用行情接口问题