60-Line Code Realizing One Thought - Contract Bottom Fishing

Author: Ninabadass, Created: 2022-04-02 18:27:54, Updated: 2022-04-02 18:29:4760-Line Code Realizing One Thought - Contract Bottom Fishing

Grid strategy and Martingale strategy, which likes to oscillate the market quotes, have inherent disadvantages, and similar strategies have been tested in the ETH contract market for a period of time. Also I often chat and share experiences with new and old players on FMZ.COM. There is one thing I really agree with a friend about this type of strategy. That is to do contracts in the currency circle, and the risk of doing long is less than that of doing shorting. Or simply speaking, the worst fall is to return to zero, but the rise is infinite.

So, do strategies such as Martingale and Grid only make long, but not short? Is it better to spread the risk of bottom fishing in a long range than to do bilateral? This idea sounds very good, but no one knows whether it can withstand the actual combat. But at least we can simply backtest this idea. Therefore, we have the topic of today’s article - Design a Contract Bottom Fishing Strategy.

Fast Development Based on FMZ.COM

The code to implement this idea is very simple, thanks to the flexibility, interface encapsulation and powerful backtest system of FMZ platform, and so on. The entire code is only 60 lines (for the code writing specifications, many lines that can be abbreviated, are not abbreviated).

The design of the strategy idea is very simple. According to the initial price at the beginning of the logic, place a buy order, if the interval distance is reducing. If the price continues to decline, continue to place a buy order, and keep bottom fishing. Then pend the close position order after the position price adding a certain profit spread, and wait to close. If the position is closed, the above logic is repeated with the current price as the initial price. The strategy does not do short, only does long.

Strategy source code:

function cancelAll() {

while (true) {

var orders = _C(exchange.GetOrders)

if (orders.length == 0) {

break

}

for (var i = 0 ; i < orders.length ; i++) {

exchange.CancelOrder(orders[i].Id, orders[i])

Sleep(interval)

}

}

}

function getLong(arr, kind) {

var ret = null

for (var i = 0 ; i < arr.length ; i++) {

if (arr[i].Type == (kind == "pos" ? PD_LONG : ORDER_TYPE_BUY)) {

ret = arr[i]

}

}

return ret

}

function pendingBidOrders(firstPrice) {

var index = 0

var amount = baseAmount

while (true) {

var pos = _C(exchange.GetPosition)

var price = firstPrice - index * baseSpacing

amount *= ratio

index++

exchange.SetDirection("buy")

exchange.Buy(price, amount)

if (pos.length != 0) {

var longPos = getLong(pos, "pos")

if (longPos) {

exchange.SetDirection("closebuy")

exchange.Sell(longPos.Price + profitTarget, longPos.Amount)

}

}

while (true) {

Sleep(interval)

if (!getLong(_C(exchange.GetOrders), "orders")) {

cancelAll()

break

}

if (!getLong(_C(exchange.GetPosition), "pos")) {

cancelAll()

return

}

}

}

}

function main() {

exchange.SetContractType(symbol)

while (true) {

pendingBidOrders(_C(exchange.GetTicker).Last)

}

}

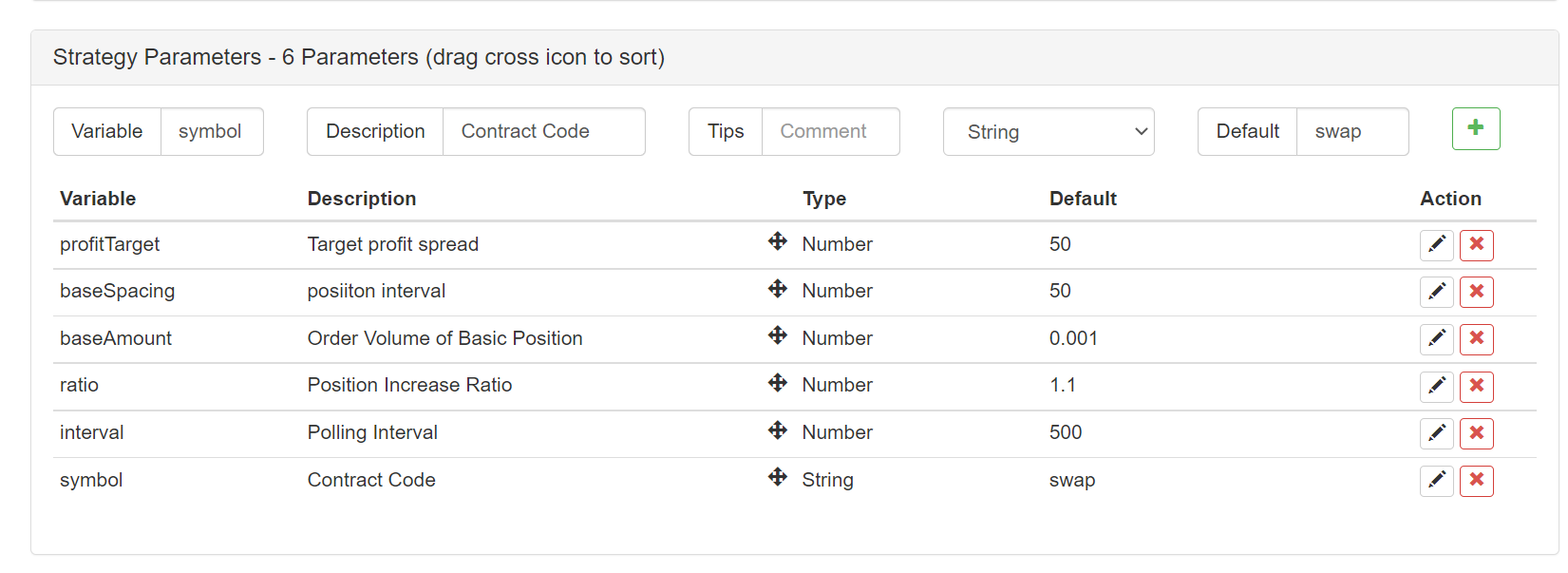

The design of the parameters is also very simple:

There are only several parameters.

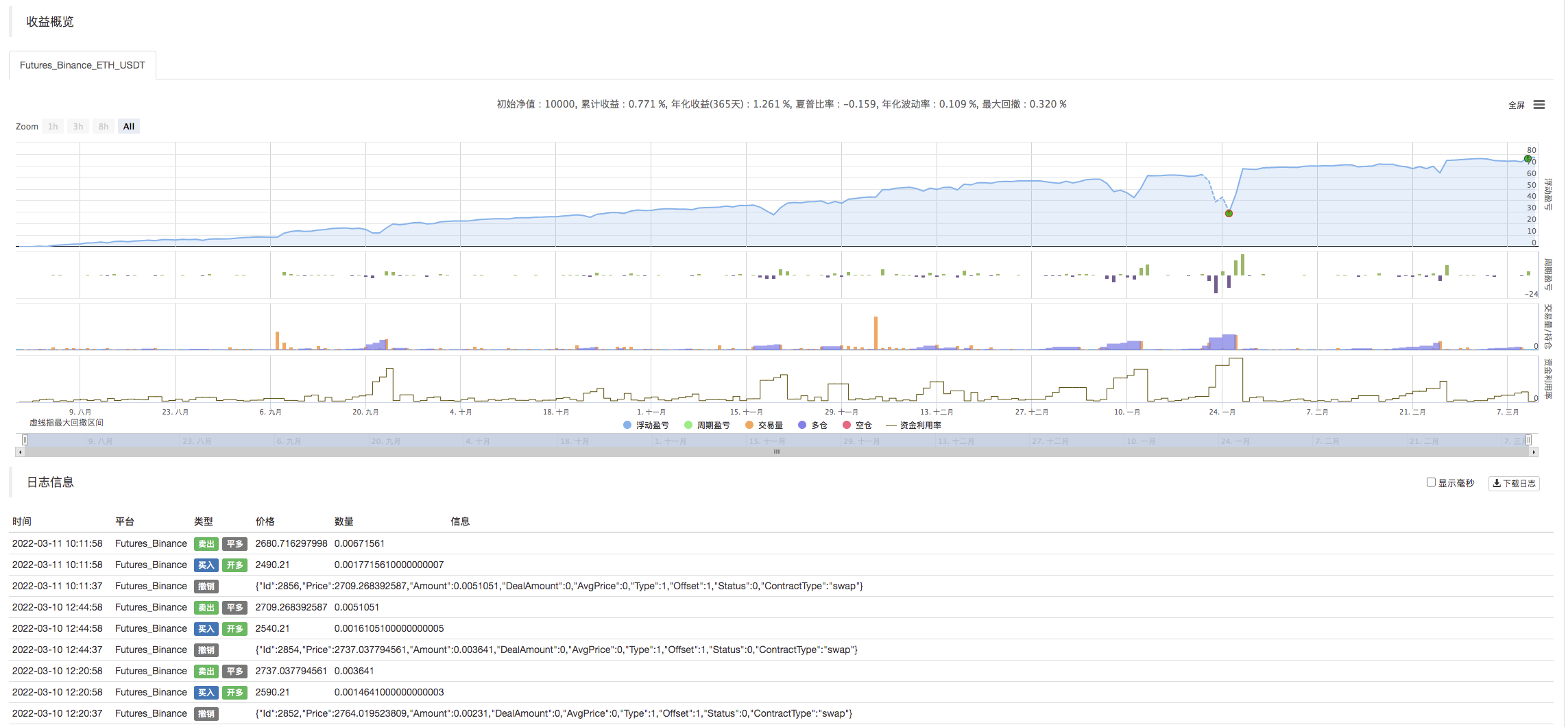

Let’s see the backtest result of dozens of lines of codes

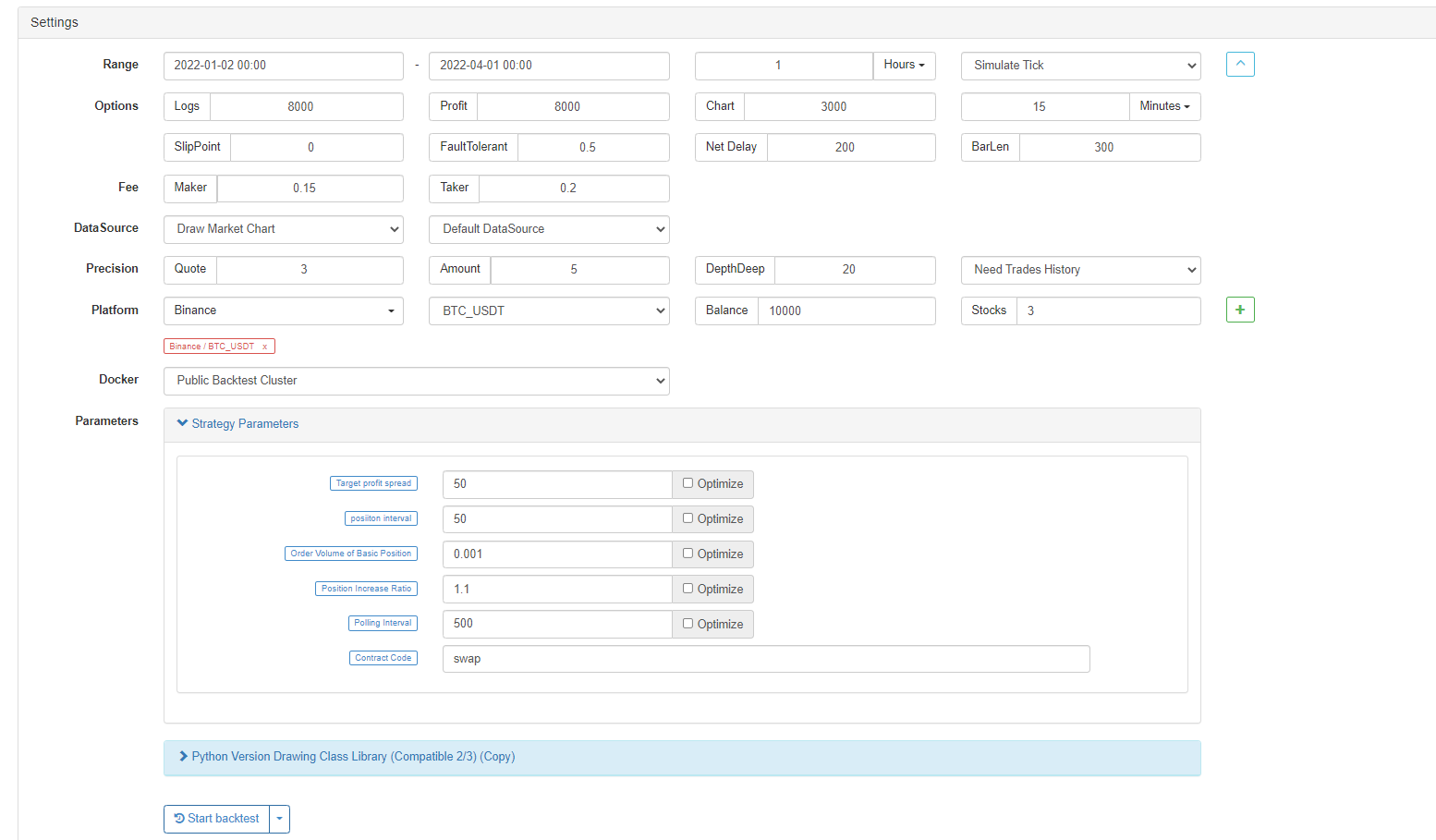

Set the backtest time range randomly:

Backtest:

It looks like a grid or Martingale type strategy. Are new learners who just get started very afraid of this kind of long strategies and are easily persuaded to quit? A brief and concise strategy introduction is more suitable, and it is easier to digest strategy ideas and learn logical design.

The strategy codes above are only used for study and research.

- 托管者

- 2021 Cryptocurrency TAQ Review & Simplest Missed Strategy of 10-Time Increase

- Cryptocurrency Futures Multi-Symbol ART Strategy (Teaching)

- Upgrade! Cryptocurrency Futures Martingale Strategy

- Getrecords函数无法获取以秒为单位的K线图

- FMZ Based Order Synchronous Management System Design (2)

- Getticker返回的Volume数据不对

- FMZ Based Order Synchronous Management System Design (1)

- Design a Multiple-Chart Plotting Library

- 模拟盘环境

- FMZ Billing System Upgrade & Adjustment Announcement

- Notice for Ghostwriting Strategies on FMZ

- 报错求助 Futures_OP 3: 504: The upstream server is timing out

- 币安下单报错

- 多品种

- Real Technology of FMZ Quant - How to Break the Limits for Obtaining Tick

- Quick Construction of Your Own Exclusive Multi-User Quantitative Trading Platform Without Cost

- 来个大佬改一个跟单机器人策略,正向跟单改成反向跟单且跟单下单量*2,有意联系微:AL-1322

- Use the extended API on FMZ Quant to realize "TradingView" alert signal trading

- Main Interface Overview and Structure of FMZ Quant Trading Platform