Recent Situation and Recommended Operation of Funding Rate Strategy

Author: Ninabadass, Created: 2022-04-08 12:00:56, Updated: 2022-04-25 11:39:26In the last Binance Thousand League combat, FMZ released a funding rate strategy: https://www.fmz.com/bbs-topic/9276. This strategy is used by many users. In this bull market, the annualized rate exceeded 100% at one point, and there were several opportunities to close positions at a large negative premium. As for the overall profit, it is a sound arbitrage strategy. However, as arbitrageurs and capital increase, the market becomes more efficient, and the situation faced by the strategy has somehow changed:

- 1.The first is that the positive premium is generally getting lower. At the beginning, the open premium was generally 5⁄1000. Currently, it is generally 1⁄1000, and the opportunity of opening positions has become worse.

- 2. The negative premium is reduced. It turns out that with the rapid decline of the market, the negative premium will be very exaggerated, and even a -20% premium has occurred. At this time, the profit of closing positions is very considerable. But the current declines tend to be slow ones, with small negative premiums.

- 3. The slippoint increases. When the strategy is first released, it can open positions at a premium of 3⁄1000, and close at a premium of 3⁄1000. As long as the fee can be covered, you can get a little profit from each trade, increasing the arbitrage profit. At present, even if you see a premium, the opportunity often disappears quickly, and it is likely to make loss when you grab the opportunity, and it is basically impossible to earn a premium.

- 4. The annualized funding rate is reduced. The annualized funding rate of more than 100% has not been seen for a long time, and the rate will be lower and lower in the future. Even if the market continues to grow, it should be difficult to see a high annualized rate.

Of course, the change mentioned above is in the expectation. After all, the funding rate arbitrage is a public method, so the extra profit cannot be maintained for long.

FTX platform also has perpetual contracts,which are charged every hour. Obtain the history data by crawling, and convert to 8-hour calculation. Only the funding rates of few currency symbols are high; compared to the recent funding rate of Binance perpetual contract, there is no big difference.

| symbol | rate | symbol | rate |

|---|---|---|---|

| AMPL | 0.001250 | UNISWAP | 0.001229 |

| SRN | 0.001069 | DAWN | 0.000573 |

| MTA | 0.000510 | MCB | 0.000497 |

| FLOW | 0.000386 | PUNDIX | 0.000330 |

| TONCOIN | 0.000327 | CELO | 0.000327 |

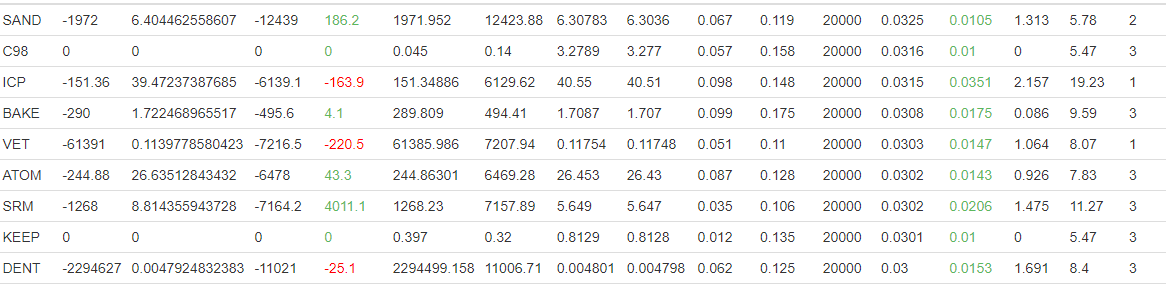

Binance recent funding rate status (December 2, 2021):

However, FTX also has corresponding advantages. For spot, you can seamlessly and directly sell and make short by loaning currencies, and then repay the loan automatically after buy, so it is more convenient to do negative rate arbitrage.

If you still choose a perpetual contract for funding rate arbitrage, here are some suggestions:

- 1.From decentralized positions to a small number of high-rate positions, the original decentralized positions reduced risks, but at the same time, they also dispersed the benefits. Currently, high rates are not a common phenomenon, so centralized positions are required.

- 2. Multiple platforms and mainstream platforms basically have perpetual contracts, which will further increase trading opportunities.

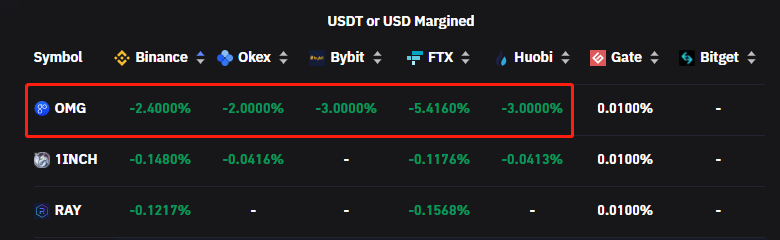

- 3. Seize the opportunity of extreme funding rate, such as the recent OMG airdrop event, which resulted in an extreme funding rate of -5.4%. Of course, there are often special reasons for such situations, which need to be handled with caution.

Recently, a small strategy tool has been released to count the funding rates of six mainstream platforms, which can be further improved on the basis to assist in billing.

Strategy public address: https://www.fmz.com/strategy/333315 Bot address: https://www.fmz.com/robot/406857

- Quick Start of FMZ Quant Trading Platform APP

- Realize a Simple Order Supervising Bot of Cryptocurrency Spot

- 基于FMZ做成跟单平台

- Cryptocurrency Contract Simple Order-Supervising Bot

- 在用getdepth时想获取对应时间戳

- 忽略,已解决

- 面值问题

- dYdX Strategy Design Example

- Initial Exploration of Applying Python Crawler on FMZ — Crawling Binance Announcement Content

- Hedge Strategy Design Research & Example of Pending Spot and Futures Orders

- Dual Moving Average Breakpoint Strategy of Cryptocurrency Futures (Teaching)

- Cryptocurrency Spot Multi-Symbol Dual Moving Average Strategy (Teaching)

- Realization of Fisher Indicator in JavaScript & Plotting on FMZ

- 托管者

- 2021 Cryptocurrency TAQ Review & Simplest Missed Strategy of 10-Time Increase

- Cryptocurrency Futures Multi-Symbol ART Strategy (Teaching)

- Upgrade! Cryptocurrency Futures Martingale Strategy

- Getrecords函数无法获取以秒为单位的K线图

- FMZ Based Order Synchronous Management System Design (2)

- Getticker返回的Volume数据不对