FMZ Based Order Synchronous Management System Design (2)

Author: Ninabadass, Created: 2022-04-06 17:12:00, Updated: 2022-04-06 17:20:08FMZ Based Order Synchronous Management System Design (2)

Order Synchronous Management System (Synchronous Server)

Let’s continue the discussion in last article: FMZ Based Order Synchronous Management System Design (1), to design a synchronous order supervising strategy. Please consider of the following designing questions:

- 1.If you do not want to synchronously supervise orders for a while, can it be stopped? Once it is stopped, disable the restart from extended API, and use password verification.

To implement this function, add 2 global variables:

var isStopFollow = false // used to mark whether to currently supervise orders or not var reStartPwd = null // used to record the restart password

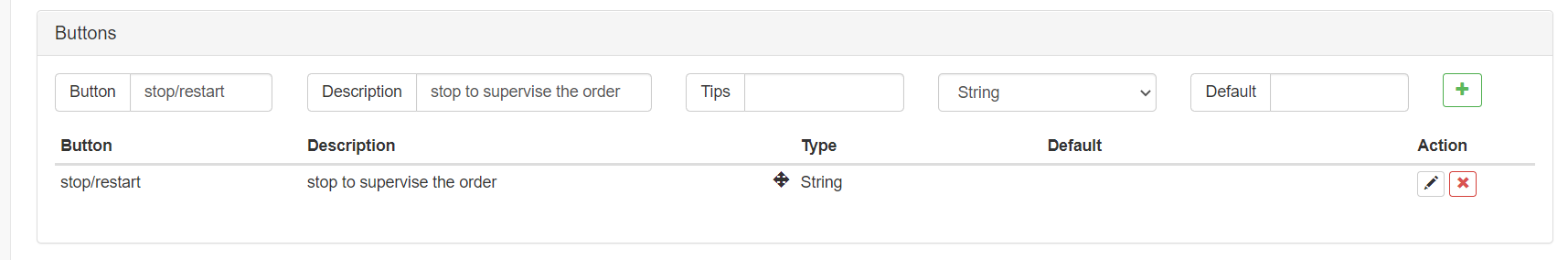

Then add interactive controls on the strategy editing page to stop/restart the strategy (it is not to stop the bot, just stop the logic, to not follow and supervise orders, without doing anything). When to stop it, you can set a stop password, so that even if there is a bot of the Order Synchronous Management System Library (Single Server) of your extended API KEY, it will not be able to invoke your strategy. When restart to supervise orders, enter the preset password to invoke the order supervising function.

Implementation code of the related function:

...

// Judge the interactive command

if (arr.length == 2) {

// Buttons with controls

if (arr[0] == "stop/restart") {

// Stop/restart to supervise orders

if (!isStopFollow) {

isStopFollow = true

reStartPwd = arr[1]

Log("stopped to supervise orders,", "the set restart password is:", reStartPwd, "#FF0000")

} else if (isStopFollow && arr[1] == reStartPwd) {

isStopFollow = false

reStartPwd = null

Log("restarted to supervise orders,", "clear the restart password.", "#FF0000")

} else if (isStopFollow && arr[1] != reStartPwd) {

Log("Wrong restart password!")

}

}

continue

}

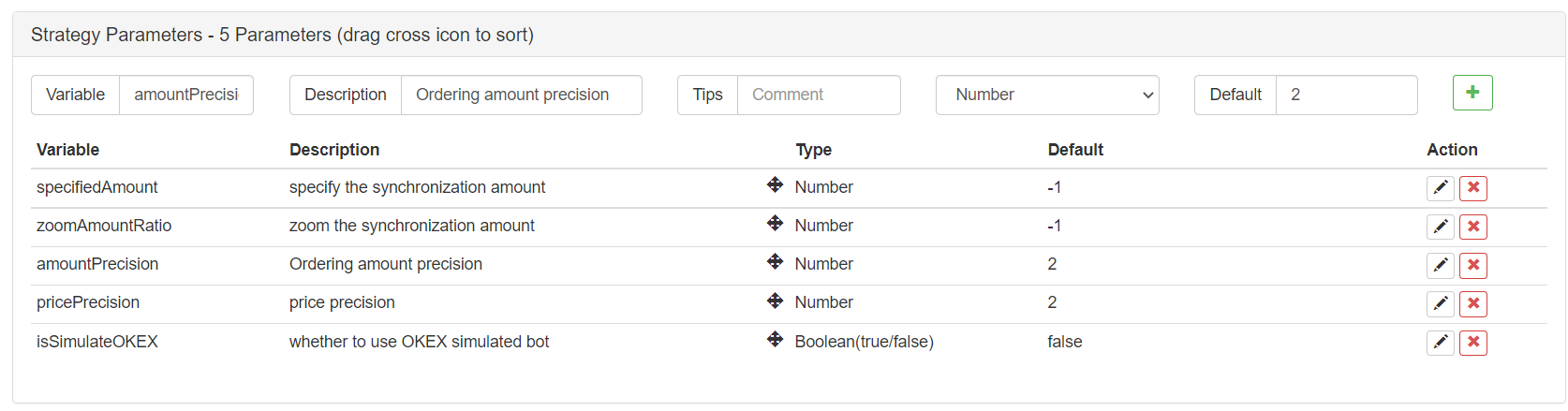

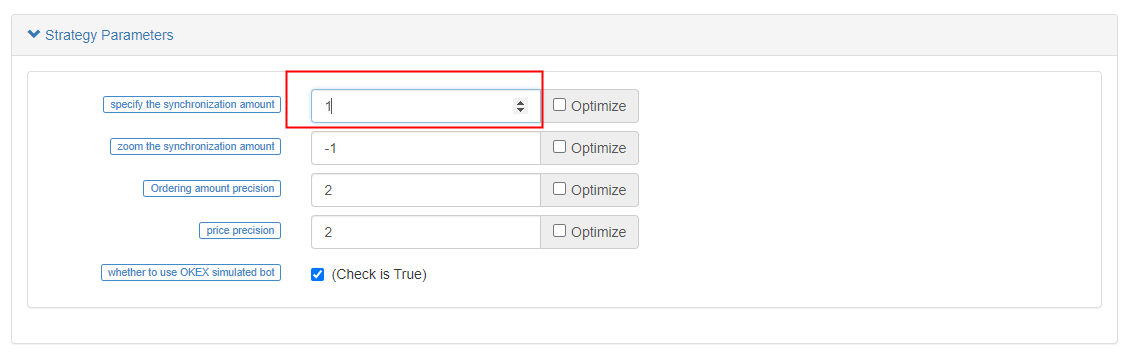

- 2.The ordering amount of the supervised order can be specified or it can be zoomed by ratio:

specifiedAmount: specify amount of the supervised order; default is -1, namely not specified.

zoomAmountRatio: zoom according to the ordering amount in the signal sent. For example, the signal sent is: ETH_USDT,swap,buy,1, then multiply the value of the ordering amount by zoomAmountRatio; default is -1, namely not zoomed.

var amount = specifiedAmount == -1 ? action.amount : specifiedAmount

amount = zoomAmountRatio == -1 ? amount : amount * zoomAmountRatio

Here we have realized to zoom the ordering amount or specify a certain value, according to the signal received.

- 3.Write codes as simple as possible, and use other template libraries to deal with placing orders.

Template library used for placing spot orders: https://www.fmz.com/strategy/10989 Template library used for placing futures orders: https://www.fmz.com/strategy/203258

function trade(action) {

// Switch the trading pair, and set contract

exchange.SetCurrency(action.symbol)

if (action.ct != "spot") {

exchange.SetContractType(action.ct)

}

var retTrade = null

var amount = specifiedAmount == -1 ? action.amount : specifiedAmount

amount = zoomAmountRatio == -1 ? amount : amount * zoomAmountRatio

if (action.direction == "buy") {

retTrade = action.ct == "spot" ? $.Buy(amount) : $.OpenLong(exchange, action.ct, amount)

} else if (action.direction == "sell") {

retTrade = action.ct == "spot" ? $.Sell(amount) : $.OpenShort(exchange, action.ct, amount)

} else if (action.direction == "closebuy") {

retTrade = action.ct == "spot" ? $.Sell(amount) : $.CoverLong(exchange, action.ct, amount)

} else if (action.direction == "closesell") {

retTrade = action.ct == "spot" ? $.Buy(amount) : $.CoverShort(exchange, action.ct, amount)

}

return retTrade

}

Therefore, it can been seen that placing an order only needs one statement: $.Sell(amount), $.Buy(amount), $.OpenLong(exchange, action.ct, amount), etc.

Strategy Code:

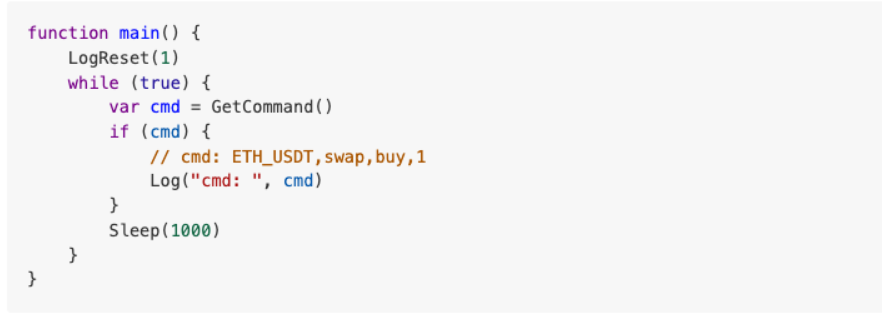

The temporary code in the previous Order Synchronous Management System (Synchronous Server) is as follows:

Now, let’s design the Order Synchronous Management System (Synchronous Server) again:

// Global variables

var isStopFollow = false

var reStartPwd = null

function trade(action) {

// Switch the trading pair, and set contract

exchange.SetCurrency(action.symbol)

if (action.ct != "spot") {

exchange.SetContractType(action.ct)

}

var retTrade = null

var amount = specifiedAmount == -1 ? action.amount : specifiedAmount

amount = zoomAmountRatio == -1 ? amount : amount * zoomAmountRatio

if (action.direction == "buy") {

retTrade = action.ct == "spot" ? $.Buy(amount) : $.OpenLong(exchange, action.ct, amount)

} else if (action.direction == "sell") {

retTrade = action.ct == "spot" ? $.Sell(amount) : $.OpenShort(exchange, action.ct, amount)

} else if (action.direction == "closebuy") {

retTrade = action.ct == "spot" ? $.Sell(amount) : $.CoverLong(exchange, action.ct, amount)

} else if (action.direction == "closesell") {

retTrade = action.ct == "spot" ? $.Buy(amount) : $.CoverShort(exchange, action.ct, amount)

}

return retTrade

}

function parseCmd(cmd) {

var objAction = {}

// Parse cmd, such as: ETH_USDT,swap,buy,1

var arr = cmd.split(",")

if (arr.length != 4) {

return null

}

objAction.symbol = arr[0]

objAction.ct = arr[1]

objAction.direction = arr[2]

objAction.amount = arr[3]

return objAction

}

function main() {

// Clear all logs

LogReset(1)

if (isSimulateOKEX) {

exchange.IO("simulate", true)

Log("Switch to OKEX simulated bot!")

}

// set precision

exchange.SetPrecision(pricePrecision, amountPrecision)

// Check specifiedAmount and zoomAmountRatio, for they cannot be set at the same time

if (specifiedAmount != -1 && zoomAmountRatio != -1) {

throw "cannot set specifiedAmount and zoomAmountRatio at the same time"

}

while (true) {

var cmd = GetCommand()

if (cmd) {

Log("cmd: ", cmd)

var arr = cmd.split(":")

// Judge the interactive command

if (arr.length == 2) {

// Buttons with controls

if (arr[0] == "stop/restart") {

// Stop/restart to supervise orders

if (!isStopFollow) {

isStopFollow = true

reStartPwd = arr[1]

Log("stopped to supervise orders,", "the set restart password is:", reStartPwd, "#FF0000")

} else if (isStopFollow && arr[1] == reStartPwd) {

isStopFollow = false

reStartPwd = null

Log("restarted to supervise orders,", "Clear the restart password", "#FF0000")

} else if (isStopFollow && arr[1] != reStartPwd) {

Log("Wrong restart password!")

}

}

continue

}

// Allow to supervise orders

if (!isStopFollow) {

// Parse the interactive command of the order supervising signal

var objAction = parseCmd(cmd)

if (objAction) {

// Parse correctly

var ret = trade(objAction)

} else {

Log("Wrong signal cmd:", cmd)

}

}

}

// Display the order supervising status

LogStatus(_D(), isStopFollow ? "Stop synchronization" : "Maintain synchronization", "\n")

Sleep(1000)

}

}

Test

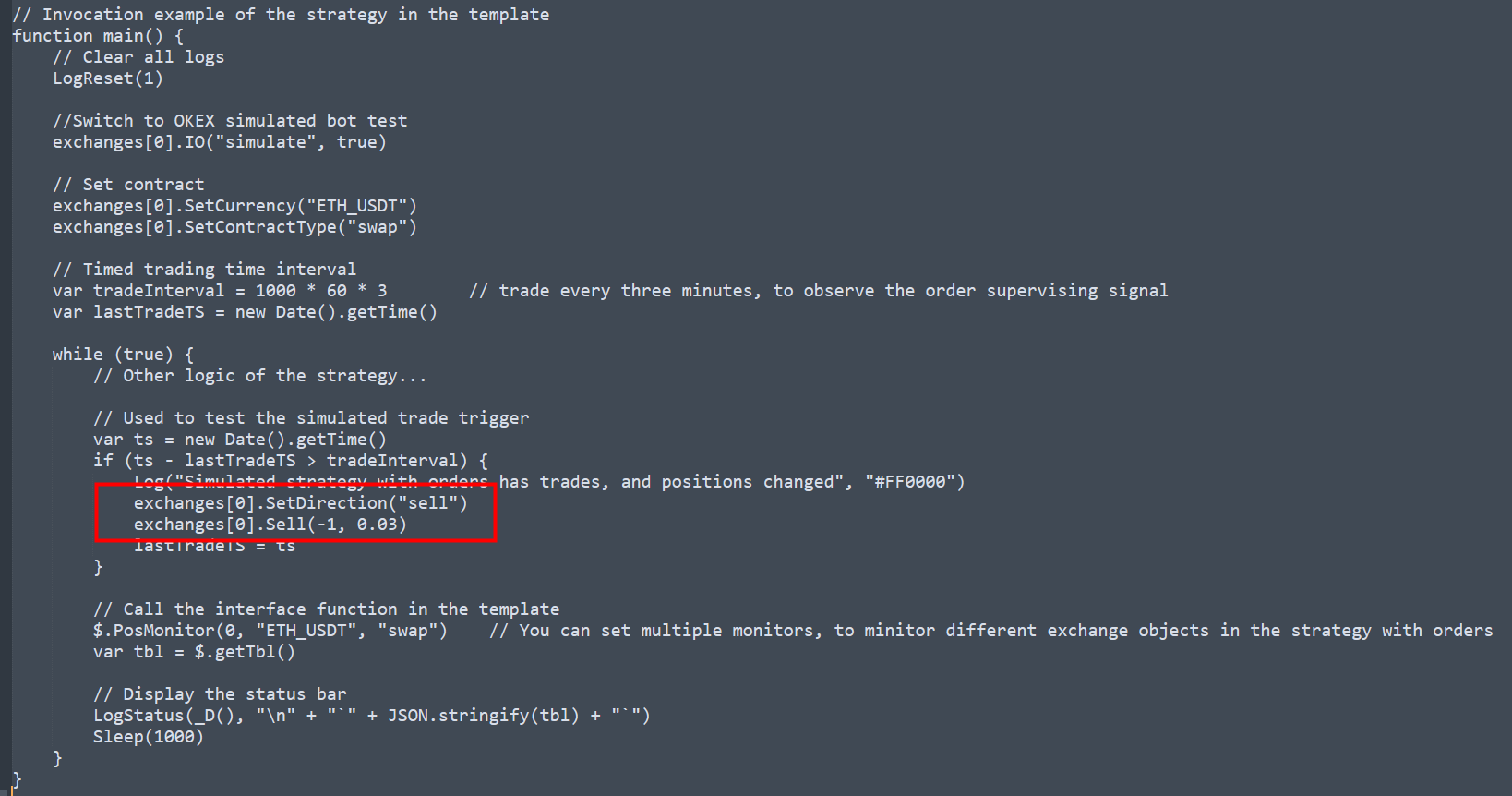

This time, the Binance real tick test is used for the account with orders, and the OKEX account is used for the order supervising bot. For the order supervising, we still use the testing function used in the previous article (the main function in the Order Synchronous Management System Library (Single Server) template).

It’s just that we changed the trading direction to short, and the trading volume was changed to 0.003 (Binance USDT-margined contracts can be placed in decimals). However, the OKEX account with orders must be an integer (the order placed by OKEX must be an integer number), so the parameter I specify the strategy parameter specifiedAmount as 1.

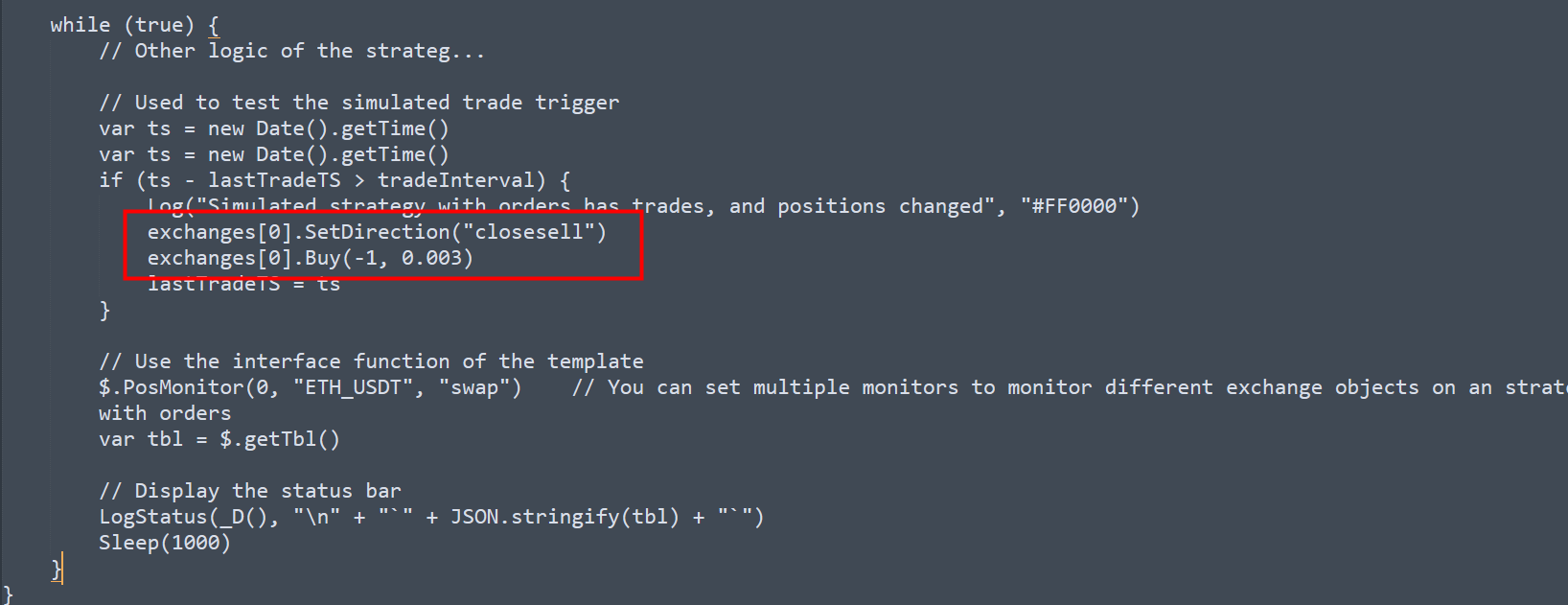

The bot of the testing function in Order Synchronous Management System Library (Single Server) triggered the trade.

The order supervising bot strategy received the signal, and execute the supervision action:

The platform opened the corresponding order.

Next, test closing positions, and change the order direction in the main function to close short position, 0.003.

Then restart the bot which is responsible for carrying orders (Order Synchronous Management System Library (Single Server)).

The same operation is also triggered in the order supervising bot:

Strategy Address: Order Synchronous Management System Library (Single Server) Order Synchronous Management System (Synchronous Server)

Those strategies are only used for communication and study; for actual use, you need to modify, adjust and optimize them by yourself.

- Hedge Strategy Design Research & Example of Pending Spot and Futures Orders

- Recent Situation and Recommended Operation of Funding Rate Strategy

- Dual Moving Average Breakpoint Strategy of Cryptocurrency Futures (Teaching)

- Cryptocurrency Spot Multi-Symbol Dual Moving Average Strategy (Teaching)

- Realization of Fisher Indicator in JavaScript & Plotting on FMZ

- 托管者

- 2021 Cryptocurrency TAQ Review & Simplest Missed Strategy of 10-Time Increase

- Cryptocurrency Futures Multi-Symbol ART Strategy (Teaching)

- Upgrade! Cryptocurrency Futures Martingale Strategy

- Getrecords函数无法获取以秒为单位的K线图

- Getticker返回的Volume数据不对

- FMZ Based Order Synchronous Management System Design (1)

- Design a Multiple-Chart Plotting Library

- 模拟盘环境

- 60-Line Code Realizing One Thought - Contract Bottom Fishing

- FMZ Billing System Upgrade & Adjustment Announcement

- Notice for Ghostwriting Strategies on FMZ

- 报错求助 Futures_OP 3: 504: The upstream server is timing out

- 币安下单报错

- 多品种