2021 Cryptocurrency TAQ Review & Simplest Missed Strategy of 10-Time Increase

Author: Ninabadass, Created: 2022-04-07 11:36:32, Updated: 2022-04-13 09:25:232021 Cryptocurrency TAQ Review & Simplest Missed Strategy of 10-Time Increase

2021 Conclusion and Future Strategy.ipynb

2021 is coming to an end, and hot spots from DEFI to GAMEFI are emerging one after another, and the overall market is still in a bull market. Looking back now, how much have you earned in 2021? What opportunity was missed? Are there any successful investments? Recently, I pulled the history market quotes of the past year and found an unexpectedly simple profiteering strategy, but it is a multi-currency index.

There are too many currency symbols listed in platforms, and many are destined to be unknown and may even be withdrawn from trading. Here we choose the currency symbols that have been listed on Binance Perpetual Swap. They have generally been tested and are recognized as mainstream currencies, which are relatively safe. After a simple screening, some index currencies were removed, and 134 currencies finally survived.

In [1]: import requests from datetime import date,datetime import time import pandas as pd import numpy as np import matplotlib.pyplot as plt %matplotlib inline

In [144]: ##current trading pair Info = requests.get(’https://fapi.binance.com/fapi/v1/exchangeInfo’) symbols = [s[‘symbol’] for s in Info.json()[‘symbols’]]

In [154]: symbolsf = list(set(filter(lambda x: x[-4:] == ‘USDT’, [s.split(’’)[0] for s in symbols]))- set([‘1000SHIBUSDT’,‘1000XECUSDT’,‘BTCDOMUSDT’,‘DEFIUSDT’,‘BTCSTUSDT’])) + [‘SHIBUSDT’,‘XECUSDT’] print(symbols_f)

In [155]: print(len(symbols_f))

Market in the Past Year

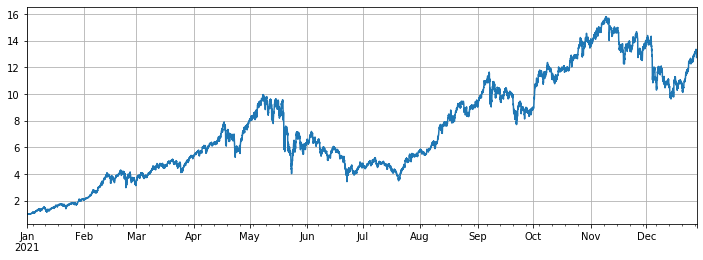

Then, we get their daily close prices in the past year, and we notice that some currency symbols were only on the market for a short period of time, so the data needs unitization processing. By unitizing the data, the index can be calculated.

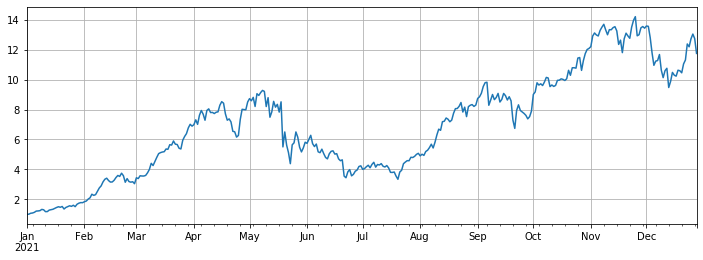

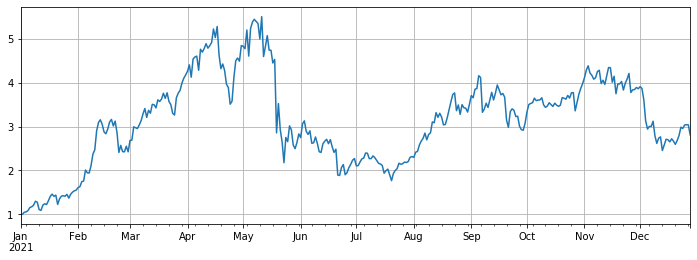

The final index profit is about 12 times, that is to say, if you buy these 134 currency symbols on average on January 1, 2021, the final profit of doing nothing is 12 times, and it is estimated that more than 90% of people do not outperform the average index. Among them, the currency symbols with the largest decline: ICP fell by 93%, DODO fell by 85%, and LINA fell by 75%. The increase of nearly a hundred times: SOL, FTM, LUNA, MATIC, SAND, AXS. Among them, AXS has increased by 168 times and is the biggest dark horse. The median increased 3 times. It can be said that the index is mainly driven by the public chains and games. In order to prevent survivorship bias, excluding the newly listed currency symbols during the period, it also achieved a profit of nearly 11 times. It is 7 times the profit of simply holding BTC.

This is a desperate profit ratio. I have worked hard and tried all kinds of strategies, and I have not made as much profit as a year when I did not make any extra efforts. However, it should be noted that several of the ratio increases are too huge, and obviously deviate from the index. If these currency symbols are not selected at the beginning of the year, the profit will be close to the median, which is far less prominent.

In [157]: #function to obtain K-line in any period def GetKlines(symbol=‘BTCUSDT’,start=‘2020-8-10’,end=‘2021-8-10’,period=‘1h’,base=‘fapi’,v = ‘v1’): Klines = [] start_time = int(time.mktime(datetime.strptime(start, “%Y-%m-%d”).timetuple()))*1000 + 8*60*60*1000 end_time = int(time.mktime(datetime.strptime(end, “%Y-%m-%d”).timetuple()))*1000 + 8*60*60*1000 intervel_map = {’m’:60*1000,‘h’:60*60*1000,’d’:24*60*60*1000} while start_time < end_time: mid_time = min(start_time+1000*int(period[:-1])*intervel_map[period[-1]],end_time) url = ‘https://’+base+‘.binance.com/’+base+‘/’+v+‘/klines?symbol=%s&interval=%s&startTime=%s&endTime=%s&limit=1000’%(symbol,period,start_time,mid_time) res = requests.get(url) res_list = res.json() if type(res_list) == list and len(res_list) > 0: start_time = res_list[-1][0] Klines += res_list elif type(res_list) == list: start_time = start_time+1000*int(period[:-1])*intervel_map[period[-1]] else: break

df = pd.DataFrame(Klines,columns=['time','open','high','low','close','amount','end_time','volume','count','buy_amount','buy_volume','null']).astype('float')

df.index = pd.to_datetime(df.time,unit='ms')

profit df

In [164]: df_all_s = pd.DataFrame(index=pd.date_range(start=‘2021-1-1’, end=‘2021-12-28’, freq=‘1d’),columns=symbols_s) for i in range(len(symbols_f)): #print(symbols_s[i]) symbol_s = symbols_f[i] df_s = GetKlines(symbol=symbol_s,start=‘2021-1-1’,end=‘2021-12-28’,period=‘1d’,base=‘api’,v=‘v3’) df_all_s[symbol_s] = df_s[~df_s.index.duplicated(keep=‘first’)].close

In [165]: df_all_s.tail() #data structure Out[165]:

In [174]:

df_all = df_all_s.fillna(method=‘bfill’)#fill data

df_norm = df_all/df_all.iloc[0] #unitization

df_norm.mean(axis=1).plot(figsize=(12,4),grid=True);

#chart of final index profit

Out[174]:

In [175]:

#median increase

df_norm.median(axis=1).plot(figsize=(12,4),grid=True);

Out[175]:

In [168]: #rise and fall sorting print(df_norm.iloc[-1].round(2).sort_values().to_dict())

In [317]: #maximum withdraw of the current price compared to the highest price in the past year print((1-df_norm.iloc[-1]/df_norm.max()).round(2).sort_values().to_dict())

In [177]: df_all_f = pd.DataFrame(index=pd.date_range(start=‘2021-1-1’, end=‘2021-12-28’, freq=‘1d’),columns=symbols_s) for i in range(len(symbols_f)): #print(symbols_s[i]) symbol_f = symbols_f[i] df_f = GetKlines(symbol=symbol_f,start=‘2021-1-1’,end=‘2021-12-28’,period=‘1d’,base=‘fapi’,v=‘v1’) df_all_f[symbol_f] = df_f[~df_f.index.duplicated(keep=‘first’)].close

In [208]:

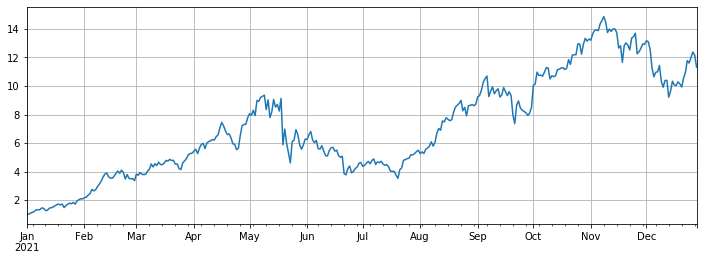

#not includde new symbols

df = df_all_s[df_all_s.columns[~df_all_f.iloc[0].isnull()]]

df = df.fillna(method=‘bfill’)

df = df/df.iloc[0]

df.mean(axis=1).plot(figsize=(12,4),grid=True);

Out[208]:

In [212]:

#compared to BTC

(df.mean(axis=1)/df.BTCUSDT).plot(figsize=(12,4),grid=True);

Out[212]:

In [213]: #use the old backtest engine class Exchange:

def __init__(self, trade_symbols, fee=0.0004, initial_balance=10000):

self.initial_balance = initial_balance #initial asset

self.fee = fee

self.trade_symbols = trade_symbols

self.account = {'USDT':{'realised_profit':0, 'unrealised_profit':0, 'total':initial_balance, 'fee':0}}

for symbol in trade_symbols:

self.account[symbol] = {'amount':0, 'hold_price':0, 'value':0, 'price':0, 'realised_profit':0,'unrealised_profit':0,'fee':0}

def Trade(self, symbol, direction, price, amount):

cover_amount = 0 if direction*self.account[symbol]['amount'] >=0 else min(abs(self.account[symbol]['amount']), amount)

open_amount = amount - cover_amount

self.account['USDT']['realised_profit'] -= price*amount*self.fee #deduct service fee

self.account['USDT']['fee'] += price*amount*self.fee

self.account[symbol]['fee'] += price*amount*self.fee

if cover_amount > 0: #close first

self.account['USDT']['realised_profit'] += -direction*(price - self.account[symbol]['hold_price'])*cover_amount #profit

self.account[symbol]['realised_profit'] += -direction*(price - self.account[symbol]['hold_price'])*cover_amount

self.account[symbol]['amount'] -= -direction*cover_amount

self.account[symbol]['hold_price'] = 0 if self.account[symbol]['amount'] == 0 else self.account[symbol]['hold_price']

if open_amount > 0:

total_cost = self.account[symbol]['hold_price']*direction*self.account[symbol]['amount'] + price*open_amount

total_amount = direction*self.account[symbol]['amount']+open_amount

self.account[symbol]['hold_price'] = total_cost/total_amount

self.account[symbol]['amount'] += direction*open_amount

def Buy(self, symbol, price, amount):

self.Trade(symbol, 1, price, amount)

def Sell(self, symbol, price, amount):

self.Trade(symbol, -1, price, amount)

def Update(self, close_price): #update asset

self.account['USDT']['unrealised_profit'] = 0

for symbol in self.trade_symbols:

self.account[symbol]['unrealised_profit'] = (close_price[symbol] - self.account[symbol]['hold_price'])*self.account[symbol]['amount']

self.account[symbol]['price'] = close_price[symbol]

self.account[symbol]['value'] = abs(self.account[symbol]['amount'])*close_price[symbol]

self.account['USDT']['unrealised_profit'] += self.account[symbol]['unrealised_profit']

self.account['USDT']['total'] = round(self.account['USDT']['realised_profit'] + self.initial_balance + self.account['USDT']['unrealised_profit'],6)

In [418]: #for more accurate backtest, crawl 1-hour k-line df_all_s = pd.DataFrame(index=pd.date_range(start=‘2021-1-1’, end=‘2021-12-28’, freq=‘1h’),columns=symbols_s) for i in range(len(symbols_f)): #print(symbols_s[i]) symbol_s = symbols_f[i] df_s = GetKlines(symbol=symbol_s,start=‘2021-1-1’,end=‘2021-12-28’,period=‘1h’,base=‘api’,v=‘v3’) df_all_s[symbol_s] = df_s[~df_s.index.duplicated(keep=‘first’)].close

In [419]:

df = df_all_s[df_all_s.columns[~df_all_f.iloc[0].isnull()]]

df = df.fillna(method=‘bfill’)

df = df/df.iloc[0]

df.mean(axis=1).plot(figsize=(12,4),grid=True);

Out[419]:

Balanced Strategy Performance

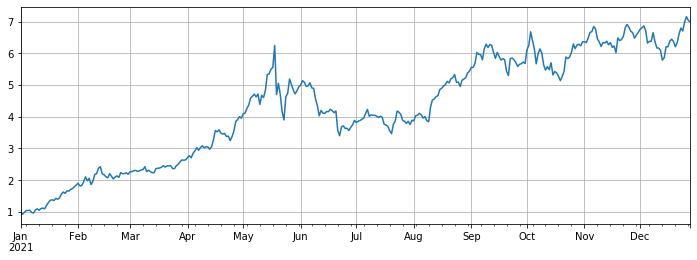

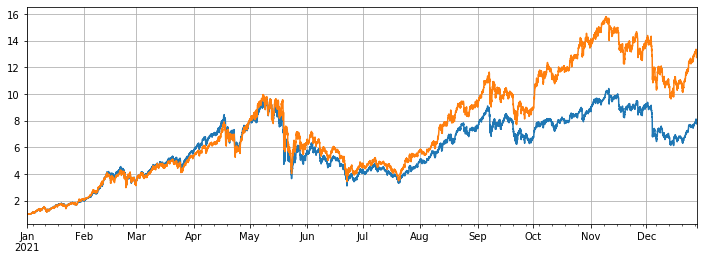

The backtest selected all the currency symbols listed on Binance Perpetual contracts on January 1, 2021. The K-line period is 1h, and the parameter is that start to buy when position amount is less than 5% of the average and start to sell when over 5%. When the backtest is of all currency symbols, the final strategy profit is 7.7 times. Significantly worse than the average profit of 13 times. That is also in my expectation. After all, those currency symbols that increased by a hundred times are too special, and the balanced strategy will sell them all.

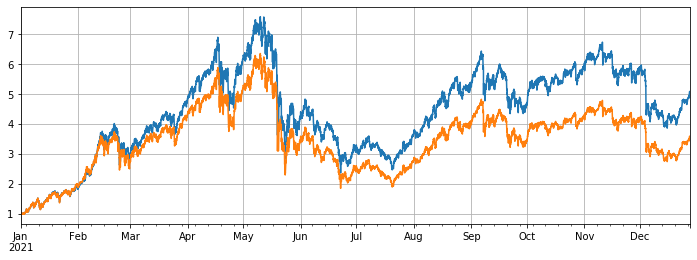

If the backtest chooses to remove the 10 currency symbols with the highest increase, and only examine the relatively mediocre currency symbols, the final profit is 4.8 times, far exceeding the average performance of 3.4 times.

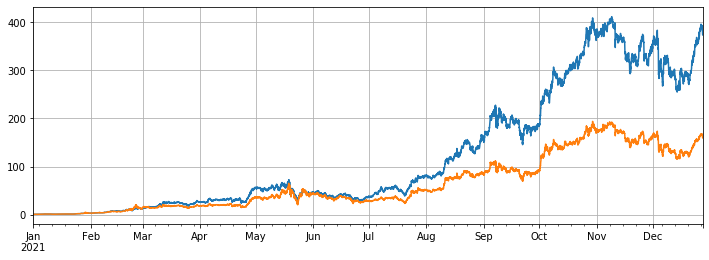

If only the 3 currency symbols with the highest increase are rotated, the final profit is 373 times, far exceeding the average performance of 160 times. It shows that if the trend and increase of the selected rotated currency symbol tend to be consistent, the result of the rotation will be much better than the non-rotation.

In [494]: #backtest of all symbols symbols = list(df.iloc[-1].sort_values()[:].index) e = Exchange(symbols, fee=0.001, initial_balance=10000) res_list = [] avg_pct = 1/len(symbols) for row in df[symbols].iterrows(): prices = row[1] total = e.account[‘USDT’][‘total’] e.Update(prices) for symbol in symbols: pct = e.account[symbol][‘value’]/total if pct < 0.95*avg_pct: e.Buy(symbol,prices[symbol],(avg_pct-pct)*total/prices[symbol]) if pct > 1.05*avg_pct: e.Sell(symbol,prices[symbol],(pct-avg_pct)*total/prices[symbol]) res_list.append([e.account[symbol][‘value’] for symbol in symbols] + [e.account[‘USDT’][‘total’]]) res = pd.DataFrame(data=res_list, columns=symbols+[‘total’],index = df.index)

In [495]: e.account[‘USDT’] Out[495]:

In [496]:

#backtest performance of all symbols

(res.total/10000).plot(figsize=(12,4),grid = True);

df[symbols].mean(axis=1).plot(figsize=(12,4),grid=True);

Out[496]:

In [498]: #reduce symbols with huge increase symbols = list(df.iloc[-1].sort_values()[:-10].index) e = Exchange(symbols, fee=0.001, initial_balance=10000) res_list = [] avg_pct = 1/len(symbols) for row in df[symbols].iterrows(): prices = row[1] total = e.account[‘USDT’][‘total’] e.Update(prices) for symbol in symbols: pct = e.account[symbol][‘value’]/total if pct < 0.95*avg_pct: e.Buy(symbol,prices[symbol],(avg_pct-pct)*total/prices[symbol]) if pct > 1.05*avg_pct: e.Sell(symbol,prices[symbol],(pct-avg_pct)*total/prices[symbol]) res_list.append([e.account[symbol][‘value’] for symbol in symbols] + [e.account[‘USDT’][‘total’]]) res = pd.DataFrame(data=res_list, columns=symbols+[‘total’],index = df.index)

In [501]: e.account[‘USDT’] Out[501]:

In [499]:

(res.total/10000).plot(figsize=(12,4),grid = True);

df[symbols].mean(axis=1).plot(figsize=(12,4),grid=True);

Out[499]:

In [503]: #only test the symbols with the highest increase symbols = list(df.iloc[-1].sort_values()[-3:].index) e = Exchange(symbols, fee=0.001, initial_balance=10000) res_list = [] avg_pct = 1/len(symbols) for row in df[symbols].iterrows(): prices = row[1] total = e.account[‘USDT’][‘total’] e.Update(prices) for symbol in symbols: pct = e.account[symbol][‘value’]/total if pct < 0.95*avg_pct: e.Buy(symbol,prices[symbol],(avg_pct-pct)*total/prices[symbol]) if pct > 1.05*avg_pct: e.Sell(symbol,prices[symbol],(pct-avg_pct)*total/prices[symbol]) res_list.append([e.account[symbol][‘value’] for symbol in symbols] + [e.account[‘USDT’][‘total’]]) res = pd.DataFrame(data=res_list, columns=symbols+[‘total’],index = df.index)

In [504]: e.account[‘USDT’] Out[504]:

In [505]:

(res.total/10000).plot(figsize=(12,4),grid = True);

df[symbols].mean(axis=1).plot(figsize=(12,4),grid=True);

Out[505]:

Conclusion

In general, 2021 was a big bull market for copy currencies and a desolate year for BTC. The market value of BTC has fallen from 70% at the beginning of the year to 40% now, which is already the lowest level in history. Therefore, the average profit of buying copycat currency symbols and holding them in the past year was much higher than that of holding BTC. Looking forward to 2022, if you think that there are still several hundred times of currencies born in the current market in the future, you can boldly diversify the currency symbols you are holding and wait patiently. If you are particularly optimistic about a few currency symbols or the average market, you can use the rotation strategy to obtain excess profits without thinking. If you agree that things will develop in the opposite direction when they become extreme, you can bottom-fish BTC for better profits and security.

- 忽略,已解决

- 面值问题

- dYdX Strategy Design Example

- Initial Exploration of Applying Python Crawler on FMZ — Crawling Binance Announcement Content

- Hedge Strategy Design Research & Example of Pending Spot and Futures Orders

- Recent Situation and Recommended Operation of Funding Rate Strategy

- Dual Moving Average Breakpoint Strategy of Cryptocurrency Futures (Teaching)

- Cryptocurrency Spot Multi-Symbol Dual Moving Average Strategy (Teaching)

- Realization of Fisher Indicator in JavaScript & Plotting on FMZ

- 托管者

- Cryptocurrency Futures Multi-Symbol ART Strategy (Teaching)

- Upgrade! Cryptocurrency Futures Martingale Strategy

- Getrecords函数无法获取以秒为单位的K线图

- FMZ Based Order Synchronous Management System Design (2)

- Getticker返回的Volume数据不对

- FMZ Based Order Synchronous Management System Design (1)

- Design a Multiple-Chart Plotting Library

- 模拟盘环境

- 60-Line Code Realizing One Thought - Contract Bottom Fishing

- FMZ Billing System Upgrade & Adjustment Announcement