লেখক:চাওঝাং

ট্যাগঃ

ট্যাগঃ

সারসংক্ষেপ

কৌশলগত যুক্তি

সুবিধা বিশ্লেষণ

ঝুঁকি বিশ্লেষণ

অপ্টিমাইজেশান নির্দেশাবলী

এই কৌশলটির মূল অপ্টিমাইজেশান দিকগুলি হলঃ

-

স্টপ লস মেকানিজম যোগ করুন। লাভ লক করতে এবং ড্রডাউন হ্রাস করতে ট্রেলিং স্টপ বা অপেক্ষমান অর্ডার সেট করুন।

-

অন্যান্য সূচক বা প্যাটার্নের সাথে সংযুক্ত করুন। একাধিক ফিল্টার শর্ত যুক্ত করতে এবং ঝুঁকি আরও হ্রাস করতে অস্থিরতা সূচক, চলমান গড় ইত্যাদির সাথে সংযুক্ত করার বিষয়টি বিবেচনা করুন।

সংক্ষিপ্তসার

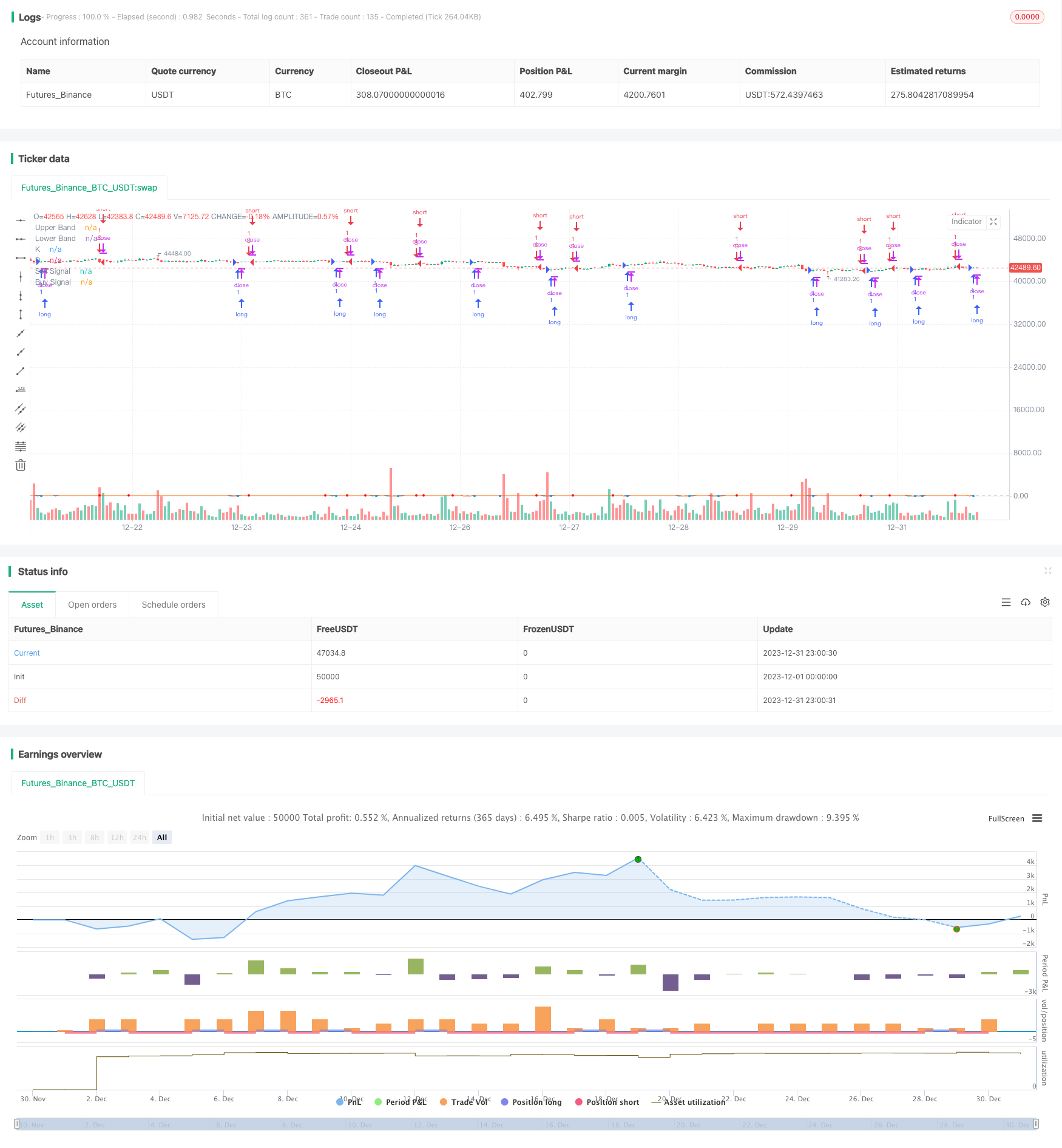

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("ES Stoch RSI Strategy [krypt]", overlay=true, calc_on_order_fills=true, calc_on_every_tick=true, initial_capital=10000, currency='USD')

//Backtest Range

FromMonth = input(defval = 06, title = "From Month", minval = 1)

FromDay = input(defval = 1, title = "From Day", minval = 1)

FromYear = input(defval = 2018, title = "From Year", minval = 2014)

ToMonth = input(defval = 7, title = "To Month", minval = 1)

ToDay = input(defval = 30, title = "To Day", minval = 1)

ToYear = input(defval = 2018, title = "To Year", minval = 2014)

PI = 3.14159265359

drop1st(src) =>

x = na

x := na(src[1]) ? na : src

xlowest(src, len) =>

x = src

for i = 1 to len - 1

v = src[i]

if (na(v))

break

x := min(x, v)

x

xhighest(src, len) =>

x = src

for i = 1 to len - 1

v = src[i]

if (na(v))

break

x := max(x, v)

x

xstoch(c, h, l, len) =>

xlow = xlowest(l, len)

xhigh = xhighest(h, len)

100 * (c - xlow) / (xhigh - xlow)

Stochastic(c, h, l, length) =>

rawsig = xstoch(c, h, l, length)

min(max(rawsig, 0.0), 100.0)

xrma(src, len) =>

sum = na

sum := (src + (len - 1) * nz(sum[1], src)) / len

xrsi(src, len) =>

msig = nz(change(src, 1), 0.0)

up = xrma(max(msig, 0.0), len)

dn = xrma(max(-msig, 0.0), len)

rs = up / dn

100.0 - 100.0 / (1.0 + rs)

EhlersSuperSmoother(src, lower) =>

a1 = exp(-PI * sqrt(2) / lower)

coeff2 = 2 * a1 * cos(sqrt(2) * PI / lower)

coeff3 = -pow(a1, 2)

coeff1 = (1 - coeff2 - coeff3) / 2

filt = na

filt := nz(coeff1 * (src + nz(src[1], src)) + coeff2 * filt[1] + coeff3 * filt[2], src)

smoothK = input(7, minval=1, title="K")

smoothD = input(2, minval=1, title="D")

lengthRSI = input(10, minval=1, title="RSI Length")

lengthStoch = input(3, minval=1, title="Stochastic Length")

showsignals = input(true, title="Buy/Sell Signals")

src = input(close, title="Source")

ob = 80

os = 20

midpoint = 50

price = log(drop1st(src))

rsi1 = xrsi(price, lengthRSI)

rawsig = Stochastic(rsi1, rsi1, rsi1, lengthStoch)

sig = EhlersSuperSmoother(rawsig, smoothK)

ma = sma(sig, smoothD)

plot(sig, color=#0094ff, title="K", transp=0)

plot(ma, color=#ff6a00, title="D", transp=0)

lineOB = hline(ob, title="Upper Band", color=#c0c0c0)

lineOS = hline(os, title="Lower Band", color=#c0c0c0)

fill(lineOB, lineOS, color=purple, title="Background")

// Buy/Sell Signals

// use curvature information to filter out some false positives

mm1 = change(change(ma, 1), 1)

mm2 = change(change(ma, 2), 2)

ms1 = change(change(sig, 1), 1)

ms2 = change(change(sig, 2), 2)

sellsignals = showsignals and (mm1 + ms1 < 0 and mm2 + ms2 < 0) and crossunder(sig, ma) and sig[1] > ob

buysignals = showsignals and (mm1 + ms1 > 0 and mm2 + ms2 > 0) and crossover(sig, ma) and sig[1] < os

ploff = 4

plot(buysignals ? sig[1] - ploff : na, style=circles, color=#008fff, linewidth=3, title="Buy Signal", transp=0)

plot(sellsignals ? sig[1] + ploff : na, style=circles, color=#ff0000, linewidth=3, title="Sell Signal", transp=0)

longCondition = buysignals

if (longCondition)

strategy.entry("L", strategy.long, comment="Long", when=(buysignals))

shortCondition = sellsignals

if (shortCondition)

strategy.entry("S", strategy.short, comment="Short", when=(sellsignals))

আরো

- আপেক্ষিক গতির কৌশল

- কোয়ান্ট কৌশল অনুসরণ করে ওয়েভ ট্রেন্ড এবং ভিডব্লিউএমএ ভিত্তিক ট্রেন্ড

- অভিযোজিত ট্রিপল সুপারট্রেন্ড কৌশল

- চলমান গড় ক্রসওভার কৌশল

- একাধিক সূচকযুক্ত পরিমাণগত ট্রেডিং কৌশল

- মার্কেট সাইফার ওয়েভ বি অটোমেটেড ট্রেডিং কৌশল

- মূল বিপরীতমুখী ব্যাকটেস্ট কৌশল

- তিনটি ইএমএ স্টোকাস্টিক আরএসআই ক্রসওভার গোল্ডেন ক্রস কৌশল

- সুইং হাই লো প্রাইস চ্যানেল স্ট্র্যাটেজি V.1

- ইম্পটেম রিভার্সাল ট্রেডিং কৌশল

- অ্যাডাপ্টিভ লিনিয়ার রিগ্রেশন চ্যানেল কৌশল

- চলমান গড় পার্থক্য শূন্য ক্রস কৌশল

- একাধিক সূচক কৌশল অনুসরণ করে

- কৌশল অনুসরণ করে দৃঢ় প্রবণতা

- কৌশল অনুসরণ করে মূল্য ক্রসিং চলমান গড় প্রবণতা

- ডাবল ইএমএ গোল্ডেন ক্রস ব্রেকআউট কৌশল

- ধীরে ধীরে বিবি কেসি ট্রেন্ড কৌশল

- ট্রিপল এসএমএ অটো-ট্র্যাকিং কৌশল