মূল বিপরীতমুখী ব্যাকটেস্ট কৌশল

লেখক:চাওঝাংট্যাগঃ

সারসংক্ষেপ

কৌশল নীতি

সুবিধা বিশ্লেষণ

ঝুঁকি বিশ্লেষণ

অপ্টিমাইজেশান নির্দেশাবলী

-

ভুল মূল্যায়ন এড়াতে অন্যান্য প্রযুক্তিগত সূচকগুলির সাথে ফিল্টার শর্ত যুক্ত করুন। উদাহরণস্বরূপ, arbitrage অপারেশন দ্বারা বিভ্রান্তিকর এড়াতে ট্রেডিং ভলিউমের সাথে বিপরীত সংকেতগুলি নিশ্চিত করুন।

সংক্ষিপ্তসার

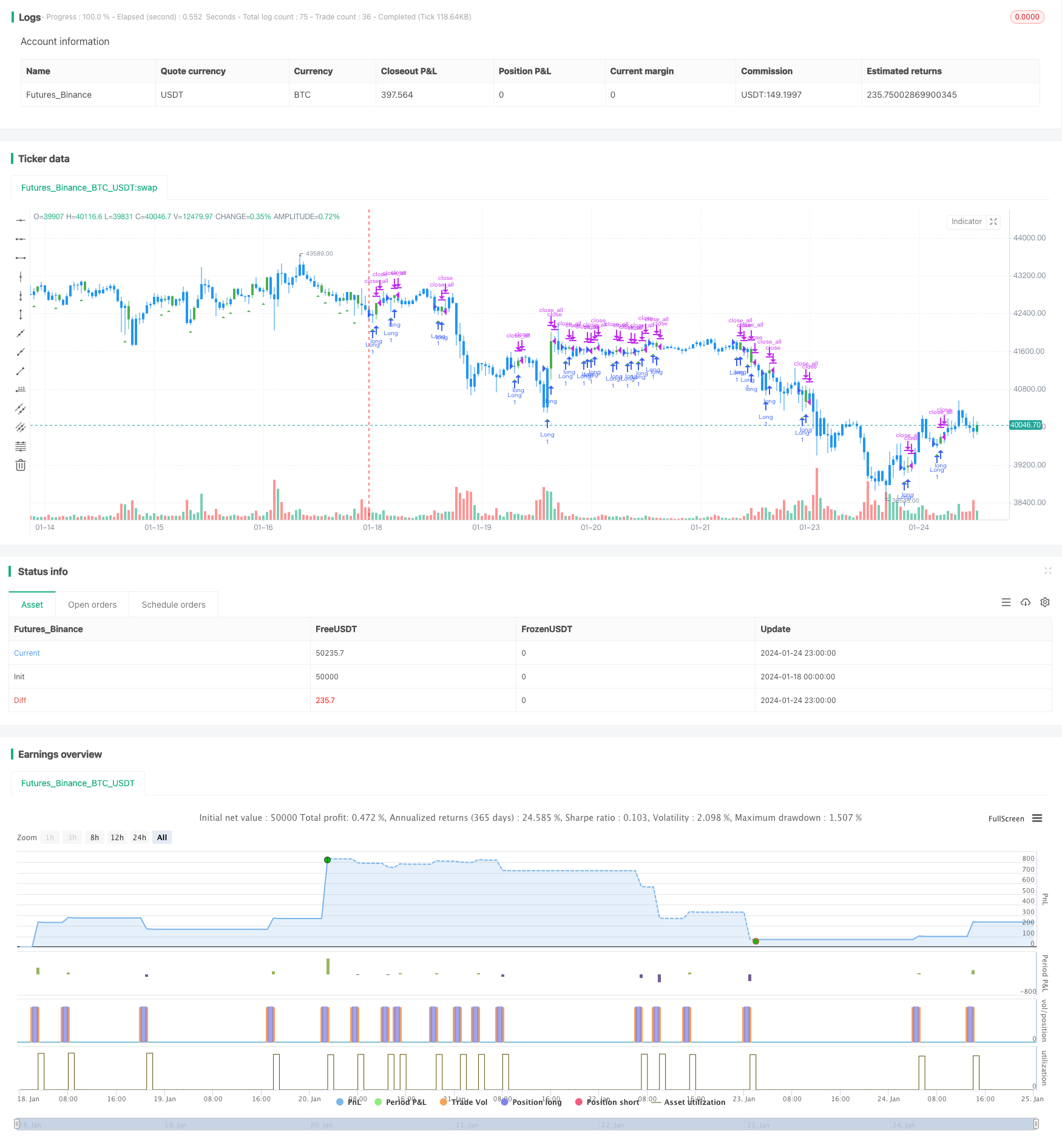

/*backtest

start: 2024-01-18 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 21/01/2020

//

// A key reversal is a one-day trading pattern that may signal the reversal of a trend.

// Other frequently-used names for key reversal include "one-day reversal" and "reversal day."

// How Does a Key Reversal Work?

// Depending on which way the stock is trending, a key reversal day occurs when:

// In an uptrend -- prices hit a new high and then close near the previous day's lows.

// In a downtrend -- prices hit a new low, but close near the previous day's highs

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="Key Reversal Up Backtest", shorttitle="KRU Backtest", overlay = true)

nLength = input(1, minval=1, title="Enter the number of bars over which to look for a new low in prices.")

input_takeprofit = input(20, title="Take Profit pip", step=0.01)

input_stoploss = input(10, title="Stop Loss pip", step=0.01)

xLL = lowest(low[1], nLength)

C1 = iff(low < xLL and close > close[1], true, false)

plotshape(C1, style=shape.triangleup, size = size.small, color=color.green, location = location.belowbar )

posprice = 0.0

pos = 0

barcolor(nz(pos[1], 0) == -1 ? color.red: nz(pos[1], 0) == 1 ? color.green : color.blue )

posprice := iff(C1== true, close, nz(posprice[1], 0))

pos := iff(posprice > 0, 1, 0)

if (pos == 0)

strategy.close_all()

if (pos == 1)

strategy.entry("Long", strategy.long)

posprice := iff(low <= posprice - input_stoploss and posprice > 0, 0 , nz(posprice, 0))

posprice := iff(high >= posprice + input_takeprofit and posprice > 0, 0 , nz(posprice, 0))

আরো

- ক্রসওভার EMA স্বল্পমেয়াদী ট্রেডিং কৌশল

- ডাবল ইএমএ ক্রসওভারের গতিশীল স্টপ লস-ভিত্তিক কৌশল অনুসরণ করে প্রবণতা

- বুল মার্কেট ব্রেকআউট দারভাস বক্স কিনে নেওয়ার কৌশল

- আপেক্ষিক গতির কৌশল

- কোয়ান্ট কৌশল অনুসরণ করে ওয়েভ ট্রেন্ড এবং ভিডব্লিউএমএ ভিত্তিক ট্রেন্ড

- অভিযোজিত ট্রিপল সুপারট্রেন্ড কৌশল

- চলমান গড় ক্রসওভার কৌশল

- একাধিক সূচকযুক্ত পরিমাণগত ট্রেডিং কৌশল

- মার্কেট সাইফার ওয়েভ বি অটোমেটেড ট্রেডিং কৌশল

- তিনটি ইএমএ স্টোকাস্টিক আরএসআই ক্রসওভার গোল্ডেন ক্রস কৌশল

- সুইং হাই লো প্রাইস চ্যানেল স্ট্র্যাটেজি V.1

- ইম্পটেম রিভার্সাল ট্রেডিং কৌশল

- অ্যাডাপ্টিভ লিনিয়ার রিগ্রেশন চ্যানেল কৌশল

- চলমান গড় পার্থক্য শূন্য ক্রস কৌশল

- একাধিক সূচক কৌশল অনুসরণ করে

- কৌশল অনুসরণ করে দৃঢ় প্রবণতা

- কৌশল অনুসরণ করে মূল্য ক্রসিং চলমান গড় প্রবণতা