Strategie zur Umkehrung der Drehzahl der Indikatoren

Schriftsteller:ChaoZhang, Datum: 2023-10-26Tags:

Übersicht

Diese Strategie kombiniert drei öffentliche Indikatoren - Trend Magic, Squeeze Momentum und Cumulative Delta Volume - um extreme Bewegungen auf dem Markt zu erkennen. Diese drei Indikatoren überprüfen sich gegenseitig und können Umkehrpunkte auf dem Markt effektiv identifizieren.

Strategie Logik

Diese Strategie verwendet ein 1-minütiges oder 3-minütiges Candlestick-Chart mit einem Stop-Loss von 1,5 mal dem ATR vom Schlusskurs.

Erstens beurteilt der Trend Magic Indikator zusammen mit dem ATR Indikator den Trend und die Volatilität des Marktes. Wenn der CCI Indikator über 0 liegt, zeigt er an, dass eine Volatilität stattfindet. Wenn die ATR Indikatorposition zu diesem Zeitpunkt höher als der Preis ist, zeigt sie einen Aufwärtstrend an, andernfalls zeigt sie einen Abwärtstrend an.

Zweitens beurteilt der Squeeze Momentum-Indikator, wann die Volatilität steigt und abnimmt. Wenn Bollinger-Bänder innerhalb der Keltner-Kanäle komprimiert werden, deutet dies darauf hin, dass die Marktvolatilität abnimmt.

Der cumulative Delta Volume-Indikator zieht die Marktkräfte ab, indem er die Differenz zwischen dem Kauf- und dem Verkaufsvolumen berechnet.

Wenn alle drei Indikatoren gleichzeitig Signale geben, bestätigt dies, dass der Markt sich einem Umkehrpunkt nähert.

Analyse der Vorteile

- Die Verwendung mehrerer Indikatoren zur Bestätigung kann falsche Ausbrüche wirksam vermeiden

- Breaking Bollinger Bands und Keltner Channels haben eine relativ hohe Gewinnrate

- Volumenumkehrungen deuten auf eine Verschiebung der Kräfte hin, die Umkehrsignale unterstützen

- Der Umkehrhandel birgt relativ geringe Risiken und eignet sich für kurzfristige Geschäfte

Risikoanalyse

- Der Handel in einem einzigen Zeitrahmen birgt erhebliche Gefahren, dass man in die Falle gerät

- Die Rückschläge können nicht am ersten Ausbruchspunkt auftreten, da das Risiko besteht, dass der optimale Einstieg verpasst wird.

- Außerdem müssen längere Zeitrahmen überwacht werden, um nicht gegen den Trend zu handeln.

- Kann wählen, ob er nur lang oder kurz geht, basierend auf der Haupttrendrichtung

- Kann ADX-Bedingungen festlegen, um den Handel zu vermeiden, wenn der Trend unklar ist

Optimierungsrichtlinien

- Hinzufügen von Zeitrahmenabschlüssen mit längeren Zeiträumen zur Bestimmung des Trends

- Produktscreening hinzufügen, Produkte mit höherer Volatilität auswählen

- Anpassung der Indikatorparameter zur Optimierung der Indikatoreffekte

- Einbeziehung von Modellen des maschinellen Lernens zur Verbesserung der Gewinnrate

- Kombination von Stimmungsindikatoren, Handel gegen Extreme in der Marktstimmung

Schlussfolgerung

Diese Strategie verwendet mehrere Indikatoren, um Markttrends zu bestimmen, und eröffnet Positionen, wenn mehrere Indikatoren konsistente Signale geben. Im Vergleich zu einzelnen Indikatoren kann sie mehr falsche Signale herausfiltern. Aber da sie nur auf einem einzigen Zeitrahmen arbeitet, ist sie immer noch anfällig für Trending-Märkte. Die nächsten Schritte könnten sein, fortschrittlichere Techniken wie maschinelles Lernen zu integrieren, um die Performance zu verbessern, oder längere Zeitrahmenindikatoren zu kombinieren, um den Handel gegen den Trend zu vermeiden, wodurch die Strategie unter mehr Marktbedingungen lebensfähig wird.

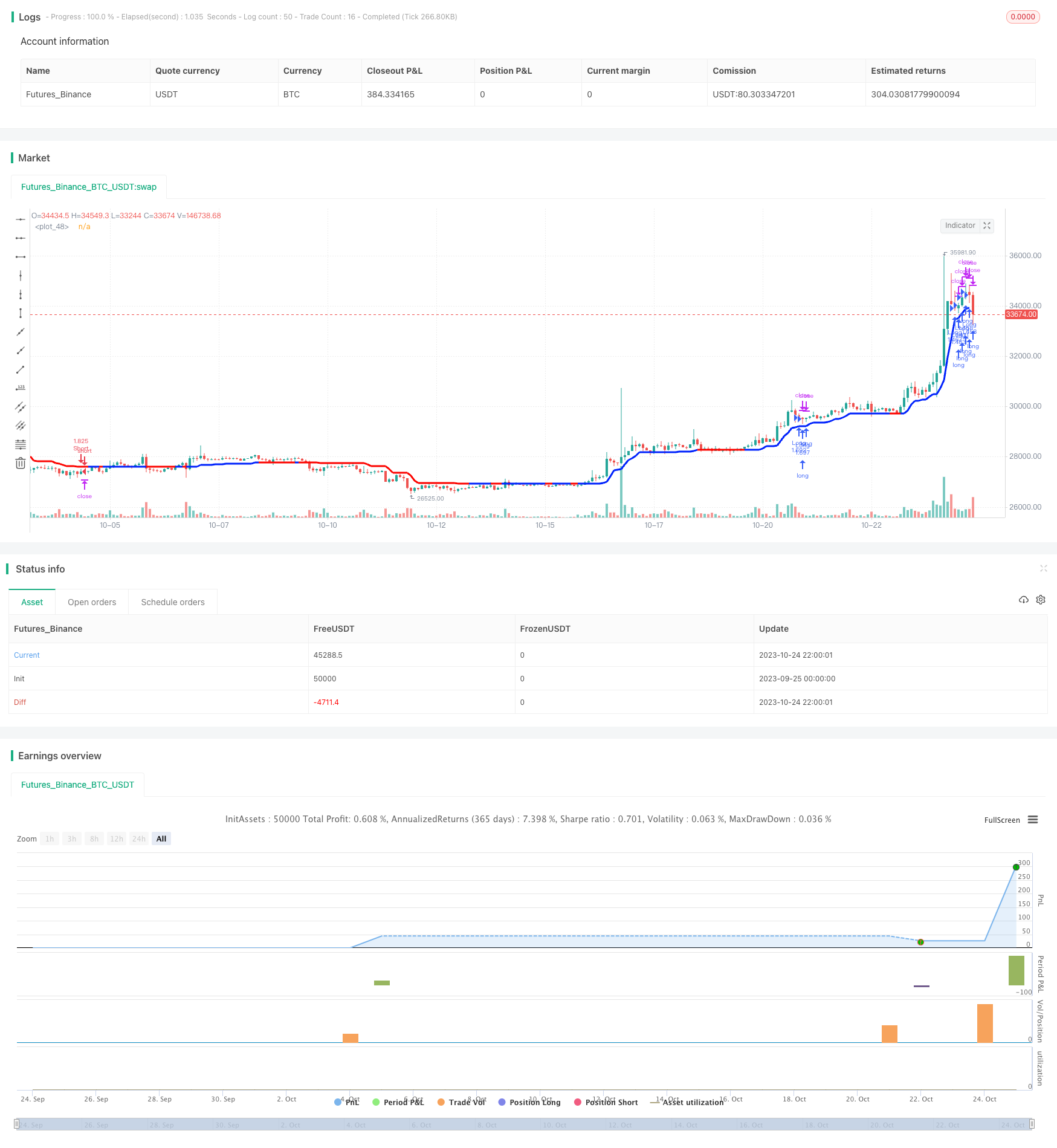

/*backtest

start: 2023-09-25 00:00:00

end: 2023-10-25 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © myn

//@version=5

strategy('Strategy Myth-Busting #11 - TrendMagic+SqzMom+CDV - [MYN]', max_bars_back=5000, overlay=true, pyramiding=0, initial_capital=1000, currency='USD', default_qty_type=strategy.percent_of_equity, default_qty_value=1, commission_value=0.075, use_bar_magnifier = false)

// HA to Regular Candlestick resolover

useHA = input.bool(true, "Use Heiken Ashi")

CLOSE = close

OPEN = open

HIGH = high

LOW = low

CLOSE := useHA ? (OPEN + CLOSE + HIGH + LOW) / 4 : CLOSE

OPEN := useHA ? na(OPEN[1]) ? (OPEN + CLOSE) / 2: (OPEN[1] + CLOSE[1]) / 2 : OPEN

HIGH := useHA ? math.max(HIGH, math.max(OPEN, CLOSE)) : HIGH

LOW := useHA ? math.min(LOW, math.min(OPEN, CLOSE)) : LOW

isCrypto = input.bool(true, "Is Crypto?")

// Functions

f_priorBarsSatisfied(_objectToEval, _numOfBarsToLookBack) =>

returnVal = false

for i = 0 to _numOfBarsToLookBack

if (_objectToEval[i] == true)

returnVal = true

/////////////////////////////////////

//* Put your strategy logic below *//

/////////////////////////////////////

// Trend Magic by KivancOzbilgic

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

period = input(20, 'CCI period')

coeff = input(2, 'ATR Multiplier')

AP = input(5, 'ATR Period')

ATR = ta.sma(ta.tr, AP)

src = CLOSE

upT = LOW - ATR * coeff

downT = HIGH + ATR * coeff

MagicTrend = 0.0

MagicTrend := ta.cci(src, period) >= 0 ? upT < nz(MagicTrend[1]) ? nz(MagicTrend[1]) : upT : downT > nz(MagicTrend[1]) ? nz(MagicTrend[1]) : downT

color1 = ta.cci(src, period) >= 0 ? #0022FC : #FC0400

plot(MagicTrend, color=color1, linewidth=3)

alertcondition(ta.cross(CLOSE, MagicTrend), title='Cross Alert', message='Price - MagicTrend Crossing!')

alertcondition(ta.crossover(LOW, MagicTrend), title='CrossOver Alarm', message='BUY SIGNAL!')

alertcondition(ta.crossunder(HIGH, MagicTrend), title='CrossUnder Alarm', message='SELL SIGNAL!')

i_numLookbackBarsTM = input(17,title="Number of bars to look back to validate Trend Magic trend")

//trendMagicEntryLong = trendMagicEntryConditionLong and f_priorBarsSatisfied(trendMagicEntryConditionLong,i_numLookbackBarsTM)

//trendMagicEntryShort = trendMagicEntryConditionShort and f_priorBarsSatisfied(trendMagicEntryConditionShort,i_numLookbackBarsTM)

trendMagicEntryConditionLong = ta.cci(src, period) >= 0 and src > MagicTrend + (isCrypto ? 5 : 0 )

trendMagicEntryConditionShort = ta.cci(src, period) < 0 and src < MagicTrend - (isCrypto ? 5 : 0)

trendMagicEntryLong = trendMagicEntryConditionLong and ta.barssince(trendMagicEntryConditionShort) > i_numLookbackBarsTM

trendMagicEntryShort = trendMagicEntryConditionShort and ta.barssince(trendMagicEntryConditionLong) > i_numLookbackBarsTM

// Squeeze Momentum by LazyBear

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

length = input(10, title='BB Length', group="Squeeze Momentum")

mult = input(2.0, title='BB MultFactor')

lengthKC = input(10, title='KC Length')

multKC = input(1.5, title='KC MultFactor')

useTrueRange = input(true, title='Use TrueRange (KC)')

// Calculate BB

source = CLOSE

basis = ta.sma(source, length)

dev = multKC * ta.stdev(source, length)

upperBB = basis + dev

lowerBB = basis - dev

// Calculate KC

ma = ta.sma(source, lengthKC)

range_1 = useTrueRange ? ta.tr : HIGH - LOW

rangema = ta.sma(range_1, lengthKC)

upperKC = ma + rangema * multKC

lowerKC = ma - rangema * multKC

sqzOn = lowerBB > lowerKC and upperBB < upperKC

sqzOff = lowerBB < lowerKC and upperBB > upperKC

noSqz = sqzOn == false and sqzOff == false

val = ta.linreg(source - math.avg(math.avg(ta.highest(HIGH, lengthKC), ta.lowest(LOW, lengthKC)), ta.sma(CLOSE, lengthKC)), lengthKC, 0)

iff_1 = val > nz(val[1]) ? color.lime : color.green

iff_2 = val < nz(val[1]) ? color.red : color.maroon

bcolor = val > 0 ? iff_1 : iff_2

scolor = noSqz ? color.blue : sqzOn ? color.black : color.gray

//plot(val, color=bcolor, style=plot.style_histogram, linewidth=4)

//plot(0, color=scolor, style=plot.style_cross, linewidth=2)

i_numLookbackBarsSM = input(14,title="Number of bars to look back to validate Sqz Mom trend")

//sqzmomEntryLong = val > 0 and f_priorBarsSatisfied(val > 0,i_numLookbackBarsSM)

//sqzmomEntryShort = val < 0 and f_priorBarsSatisfied(val < 0,i_numLookbackBarsSM)

sqzmomEntryConditionLong = val > 0

sqzmomEntryConditionShort = val < 0

sqzmomEntryLong = sqzmomEntryConditionLong and ta.barssince(sqzmomEntryConditionShort) > i_numLookbackBarsSM

sqzmomEntryShort = sqzmomEntryConditionShort and ta.barssince(sqzmomEntryConditionLong) > i_numLookbackBarsSM

// Cumulative Delta Volume by LonesomeTheBlue

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

linestyle = input.string(defval='Candle', title='Style', options=['Candle', 'Line'], group="Cumlative Delta Volume")

hacandle = input(defval=true, title='Heikin Ashi Candles?')

showma1 = input.bool(defval=false, title='SMA 1', inline='ma1')

ma1len = input.int(defval=50, title='', minval=1, inline='ma1')

ma1col = input.color(defval=color.lime, title='', inline='ma1')

showma2 = input.bool(defval=false, title='SMA 2', inline='ma2')

ma2len = input.int(defval=200, title='', minval=1, inline='ma2')

ma2col = input.color(defval=color.red, title='', inline='ma2')

showema1 = input.bool(defval=false, title='EMA 1', inline='ema1')

ema1len = input.int(defval=50, title='', minval=1, inline='ema1')

ema1col = input.color(defval=color.lime, title='', inline='ema1')

showema2 = input.bool(defval=false, title='EMA 2', inline='ema2')

ema2len = input.int(defval=200, title='', minval=1, inline='ema2')

ema2col = input.color(defval=color.red, title='', inline='ema2')

colorup = input.color(defval=color.lime, title='Body', inline='bcol')

colordown = input.color(defval=color.red, title='', inline='bcol')

bcolup = input.color(defval=#74e05e, title='Border', inline='bocol')

bcoldown = input.color(defval=#ffad7d, title='', inline='bocol')

wcolup = input.color(defval=#b5b5b8, title='Wicks', inline='wcol')

wcoldown = input.color(defval=#b5b5b8, title='', inline='wcol')

tw = HIGH - math.max(OPEN, CLOSE)

bw = math.min(OPEN, CLOSE) - LOW

body = math.abs(CLOSE - OPEN)

_rate(cond) =>

ret = 0.5 * (tw + bw + (cond ? 2 * body : 0)) / (tw + bw + body)

ret := nz(ret) == 0 ? 0.5 : ret

ret

deltaup = volume * _rate(OPEN <= CLOSE)

deltadown = volume * _rate(OPEN > CLOSE)

delta = CLOSE >= OPEN ? deltaup : -deltadown

cumdelta = ta.cum(delta)

float ctl = na

float o = na

float h = na

float l = na

float c = na

if linestyle == 'Candle'

o := cumdelta[1]

h := math.max(cumdelta, cumdelta[1])

l := math.min(cumdelta, cumdelta[1])

c := cumdelta

ctl

else

ctl := cumdelta

ctl

plot(ctl, title='CDV Line', color=color.new(color.blue, 0), linewidth=2)

float haclose = na

float haopen = na

float hahigh = na

float halow = na

haclose := (o + h + l + c) / 4

haopen := na(haopen[1]) ? (o + c) / 2 : (haopen[1] + haclose[1]) / 2

hahigh := math.max(h, math.max(haopen, haclose))

halow := math.min(l, math.min(haopen, haclose))

c_ = hacandle ? haclose : c

o_ = hacandle ? haopen : o

h_ = hacandle ? hahigh : h

l_ = hacandle ? halow : l

//plotcandle(o_, h_, l_, c_, title='CDV Candles', color=o_ <= c_ ? colorup : colordown, bordercolor=o_ <= c_ ? bcolup : bcoldown, wickcolor=o_ <= c_ ? bcolup : bcoldown)

//plot(showma1 and linestyle == 'Candle' ? ta.sma(c_, ma1len) : na, title='SMA 1', color=ma1col)

//plot(showma2 and linestyle == 'Candle' ? ta.sma(c_, ma2len) : na, title='SMA 2', color=ma2col)

//plot(showema1 and linestyle == 'Candle' ? ta.ema(c_, ema1len) : na, title='EMA 1', color=ema1col)

//plot(showema2 and linestyle == 'Candle' ? ta.ema(c_, ema2len) : na, title='EMA 2', color=ema2col)

i_numLookbackBarsCDV = input(14,title="Number of bars to look back to validate CDV trend")

//cdvEntryLong = o_ < c_ and f_priorBarsSatisfied(o_ < c_,i_numLookbackBarsCDV)

//cdvEntryShort = o_ > c_ and f_priorBarsSatisfied(o_ > c_,i_numLookbackBarsCDV)

cdvEntryConditionLong = o_ <= c_

cdvEntryConditionShort = o_ > c_

cdvEntryLong = cdvEntryConditionLong and ta.barssince(cdvEntryConditionShort) > i_numLookbackBarsCDV

cdvEntryShort = cdvEntryConditionShort and ta.barssince(cdvEntryConditionLong) > i_numLookbackBarsCDV

//////////////////////////////////////

//* Put your strategy rules below *//

/////////////////////////////////////

longCondition = trendMagicEntryLong and sqzmomEntryLong and cdvEntryLong

shortCondition = trendMagicEntryShort and sqzmomEntryShort and cdvEntryShort

//define as 0 if do not want to use

closeLongCondition = 0

closeShortCondition = 0

// ADX

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

adxEnabled = input.bool(defval = false , title = "Average Directional Index (ADX)", tooltip = "", group ="ADX" )

adxlen = input(14, title="ADX Smoothing", group="ADX")

adxdilen = input(14, title="DI Length", group="ADX")

adxabove = input(25, title="ADX Threshold", group="ADX")

adxdirmov(len) =>

adxup = ta.change(HIGH)

adxdown = -ta.change(LOW)

adxplusDM = na(adxup) ? na : (adxup > adxdown and adxup > 0 ? adxup : 0)

adxminusDM = na(adxdown) ? na : (adxdown > adxup and adxdown > 0 ? adxdown : 0)

adxtruerange = ta.rma(ta.tr, len)

adxplus = fixnan(100 * ta.rma(adxplusDM, len) / adxtruerange)

adxminus = fixnan(100 * ta.rma(adxminusDM, len) / adxtruerange)

[adxplus, adxminus]

adx(adxdilen, adxlen) =>

[adxplus, adxminus] = adxdirmov(adxdilen)

adxsum = adxplus + adxminus

adx = 100 * ta.rma(math.abs(adxplus - adxminus) / (adxsum == 0 ? 1 : adxsum), adxlen)

adxsig = adxEnabled ? adx(adxdilen, adxlen) : na

isADXEnabledAndAboveThreshold = adxEnabled ? (adxsig > adxabove) : true

//Backtesting Time Period (Input.time not working as expected as of 03/30/2021. Giving odd start/end dates

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

useStartPeriodTime = input.bool(true, 'Start', group='Date Range', inline='Start Period')

startPeriodTime = input(timestamp('1 Jan 2019'), '', group='Date Range', inline='Start Period')

useEndPeriodTime = input.bool(true, 'End', group='Date Range', inline='End Period')

endPeriodTime = input(timestamp('31 Dec 2030'), '', group='Date Range', inline='End Period')

start = useStartPeriodTime ? startPeriodTime >= time : false

end = useEndPeriodTime ? endPeriodTime <= time : false

calcPeriod = true

// Trade Direction

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tradeDirection = input.string('Long and Short', title='Trade Direction', options=['Long and Short', 'Long Only', 'Short Only'], group='Trade Direction')

// Percent as Points

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

per(pcnt) =>

strategy.position_size != 0 ? math.round(pcnt / 100 * strategy.position_avg_price / syminfo.mintick) : float(na)

// Take profit 1

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp1 = input.float(title='Take Profit 1 - Target %', defval=2, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 1')

q1 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 1')

// Take profit 2

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp2 = input.float(title='Take Profit 2 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 2')

q2 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 2')

// Take profit 3

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp3 = input.float(title='Take Profit 3 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 3')

q3 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 3')

// Take profit 4

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp4 = input.float(title='Take Profit 4 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit')

/// Stop Loss

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

stoplossPercent = input.float(title='Stop Loss (%)', defval=6, minval=0.01, group='Stop Loss') * 0.01

slLongClose = CLOSE < strategy.position_avg_price * (1 - stoplossPercent)

slShortClose = CLOSE > strategy.position_avg_price * (1 + stoplossPercent)

/// Leverage

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

leverage = input.float(1, 'Leverage', step=.5, group='Leverage')

contracts = math.min(math.max(.000001, strategy.equity / CLOSE * leverage), 1000000000)

/// Trade State Management

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

isInLongPosition = strategy.position_size > 0

isInShortPosition = strategy.position_size < 0

/// ProfitView Alert Syntax String Generation

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

alertSyntaxPrefix = input.string(defval='CRYPTANEX_99FTX_Strategy-Name-Here', title='Alert Syntax Prefix', group='ProfitView Alert Syntax')

alertSyntaxBase = alertSyntaxPrefix + '\n#' + str.tostring(OPEN) + ',' + str.tostring(HIGH) + ',' + str.tostring(LOW) + ',' + str.tostring(CLOSE) + ',' + str.tostring(volume) + ','

/// Trade Execution

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

longConditionCalc = (longCondition and isADXEnabledAndAboveThreshold)

shortConditionCalc = (shortCondition and isADXEnabledAndAboveThreshold)

if calcPeriod

if longConditionCalc and tradeDirection != 'Short Only' and isInLongPosition == false

strategy.entry('Long', strategy.long, qty=contracts)

alert(message=alertSyntaxBase + 'side:long', freq=alert.freq_once_per_bar_close)

if shortConditionCalc and tradeDirection != 'Long Only' and isInShortPosition == false

strategy.entry('Short', strategy.short, qty=contracts)

alert(message=alertSyntaxBase + 'side:short', freq=alert.freq_once_per_bar_close)

//Inspired from Multiple %% profit exits example by adolgo https://www.tradingview.com/script/kHhCik9f-Multiple-profit-exits-example/

strategy.exit('TP1', qty_percent=q1, profit=per(tp1))

strategy.exit('TP2', qty_percent=q2, profit=per(tp2))

strategy.exit('TP3', qty_percent=q3, profit=per(tp3))

strategy.exit('TP4', profit=per(tp4))

strategy.close('Long', qty_percent=100, comment='SL Long', when=slLongClose)

strategy.close('Short', qty_percent=100, comment='SL Short', when=slShortClose)

strategy.close_all(when=closeLongCondition or closeShortCondition, comment='Close Postion')

/// Dashboard

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Inspired by https://www.tradingview.com/script/uWqKX6A2/ - Thanks VertMT

showDashboard = input.bool(group="Dashboard", title="Show Dashboard", defval=false)

f_fillCell(_table, _column, _row, _title, _value, _bgcolor, _txtcolor) =>

_cellText = _title + "\n" + _value

table.cell(_table, _column, _row, _cellText, bgcolor=_bgcolor, text_color=_txtcolor, text_size=size.auto)

// Draw dashboard table

if showDashboard

var bgcolor = color.new(color.black,0)

// Keep track of Wins/Losses streaks

newWin = (strategy.wintrades > strategy.wintrades[1]) and (strategy.losstrades == strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

newLoss = (strategy.wintrades == strategy.wintrades[1]) and (strategy.losstrades > strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

varip int winRow = 0

varip int lossRow = 0

varip int maxWinRow = 0

varip int maxLossRow = 0

if newWin

lossRow := 0

winRow := winRow + 1

if winRow > maxWinRow

maxWinRow := winRow

if newLoss

winRow := 0

lossRow := lossRow + 1

if lossRow > maxLossRow

maxLossRow := lossRow

// Prepare stats table

var table dashTable = table.new(position.bottom_right, 1, 15, border_width=1)

if barstate.islastconfirmedhistory

// Update table

dollarReturn = strategy.netprofit

f_fillCell(dashTable, 0, 0, "Start:", str.format("{0,date,long}", strategy.closedtrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.closedtrades.entry_time(0))

f_fillCell(dashTable, 0, 1, "End:", str.format("{0,date,long}", strategy.opentrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.opentrades.entry_time(0))

_profit = (strategy.netprofit / strategy.initial_capital) * 100

f_fillCell(dashTable, 0, 2, "Net Profit:", str.tostring(_profit, '##.##') + "%", _profit > 0 ? color.green : color.red, color.white)

_numOfDaysInStrategy = (strategy.opentrades.entry_time(0) - strategy.closedtrades.entry_time(0)) / (1000 * 3600 * 24)

f_fillCell(dashTable, 0, 3, "Percent Per Day", str.tostring(_profit / _numOfDaysInStrategy, '#########################.#####')+"%", _profit > 0 ? color.green : color.red, color.white)

_winRate = ( strategy.wintrades / strategy.closedtrades ) * 100

f_fillCell(dashTable, 0, 4, "Percent Profitable:", str.tostring(_winRate, '##.##') + "%", _winRate < 50 ? color.red : _winRate < 75 ? #999900 : color.green, color.white)

f_fillCell(dashTable, 0, 5, "Profit Factor:", str.tostring(strategy.grossprofit / strategy.grossloss, '##.###'), strategy.grossprofit > strategy.grossloss ? color.green : color.red, color.white)

f_fillCell(dashTable, 0, 6, "Total Trades:", str.tostring(strategy.closedtrades), bgcolor, color.white)

f_fillCell(dashTable, 0, 8, "Max Wins In A Row:", str.tostring(maxWinRow, '######') , bgcolor, color.white)

f_fillCell(dashTable, 0, 9, "Max Losses In A Row:", str.tostring(maxLossRow, '######') , bgcolor, color.white)

- Kryptowährungsmomentum-Breakout-Strategie

- Strategie für die Kombination von Dual-Stochastik und volumengewichtetem gleitendem Durchschnitt

- Trendhandel mit Doppel-EMA-Kreuzungssystem

- Gradueller gleitender Durchschnittswert nach Strategie

- RSI-Momentum Lang-Kurzstrategie

- Der kombinierte Stochastische Oszillator und die 123 Umkehrstrategie

- Doppel-Umkehrüberschneidungs-Selektivstrategie

- Handelsstrategie mit doppeltem gleitendem Durchschnittsumkehr und dreifachem Bottom-Flash-Combo

- Durchschnittliche stochastische Handelsstrategie

- Volatilitätsgewalt Durchbruchshandelsstrategie

- Strategie für den Gap-Handel mit gleitendem Durchschnitt

- Adaptive Trendstrategie für den Kanal Donchian

- MACD-Kontrollrisikohandelstrategie

- RSI-Trend nach Strategie

- Handelsstrategie zur Umkehrung der Mittelwerte auf der Grundlage gleitender Durchschnitte

- EMA-Geschäftsstrategie für den Handel mit mittlerer Reversion

- Multi-Indikator-Kombinationshandelsstrategie

- Kombination von mehrfachen Strategien

- Die Abstimmungsstrategie mit dem Stopp

- Zweistufige Stop-Loss-Strategie