Geldflussindex 5 Minuten Strategie über Zeit und Raum

Schriftsteller:ChaoZhang, Datum: 2024-01-23 14:46:55Tags:

Übersicht

Dies ist eine einfache quantitative Strategie, die den Money Flow Index verwendet, um

Strategieprinzip

Die Strategie verwendet einen 3-Perioden-Geldflussindex mit einem überkauften Niveau von 100 und einem überverkauften Niveau von 0. Die Strategie wartet darauf, dass der Geldflussindex überkaufte Niveaus erreicht, was auf das Vorhandensein von

Ein Long-Eintrag erfolgt, wenn der Money Flow Index = 100 beträgt und die nächste Kerze eine bullische Kerze mit kurzen Witzen ist.

Die obige Logik kann in einer spiegelhaften Art und Weise verwendet werden, um auch kurze Einträge zu nehmen.

Vorteile der Strategie

-

Die Verwendung des Money Flow Index kann das Akkumulationsverhalten von

großen Haien auf dem Markt, Aktien mit Fortführungspotenzial, effektiv identifizieren. -

Kerzenfilter helfen, stärkere Ausbrüche zu bestätigen und vermeiden viele falsche Ausbrüche.

-

Der SMA-Filter vermeidet den Kauf in Abwärtstrends und verringert damit effektiv das Risiko.

-

60-minütige Zeit-basierte Exits schließen schnell Gewinne ein und reduzieren Abzüge.

Risiken der Strategie

-

Der Geldflussindex kann falsche Signale erzeugen, was zu unnötigen Verlusten führt.

-

Bei Aktien mit hoher Volatilität sind 60-minütige Exits möglicherweise zu aggressiv.

-

Es werden keine großen Makroereignisse berücksichtigt, die Auswirkungen auf die Märkte haben können.

Möglichkeiten zur Verbesserung

-

Verschiedene Parameterkombinationen wie MFI-Länge, SMA-Perioden usw. testen.

-

Hinzufügen Sie andere Indikatoren wie Bollinger Bands, RSI, um die Signalgenauigkeit zu verbessern.

-

Die Testvergrößerung stoppt, um größere Gewinnziele zu erreichen.

-

Entwickeln Sie Versionen für andere Zeitrahmen wie 15 oder 30 Minuten basierend auf den gleichen Prinzipien.

Schlussfolgerung

Die Strategie ist einfach und leicht verständlich, im Einklang mit dem klassischen Ansatz der Verfolgung

Der 60-minütige Zeitrahmen ermöglicht schnelle Gewinne, bringt aber auch ein höheres Risiko mit sich.

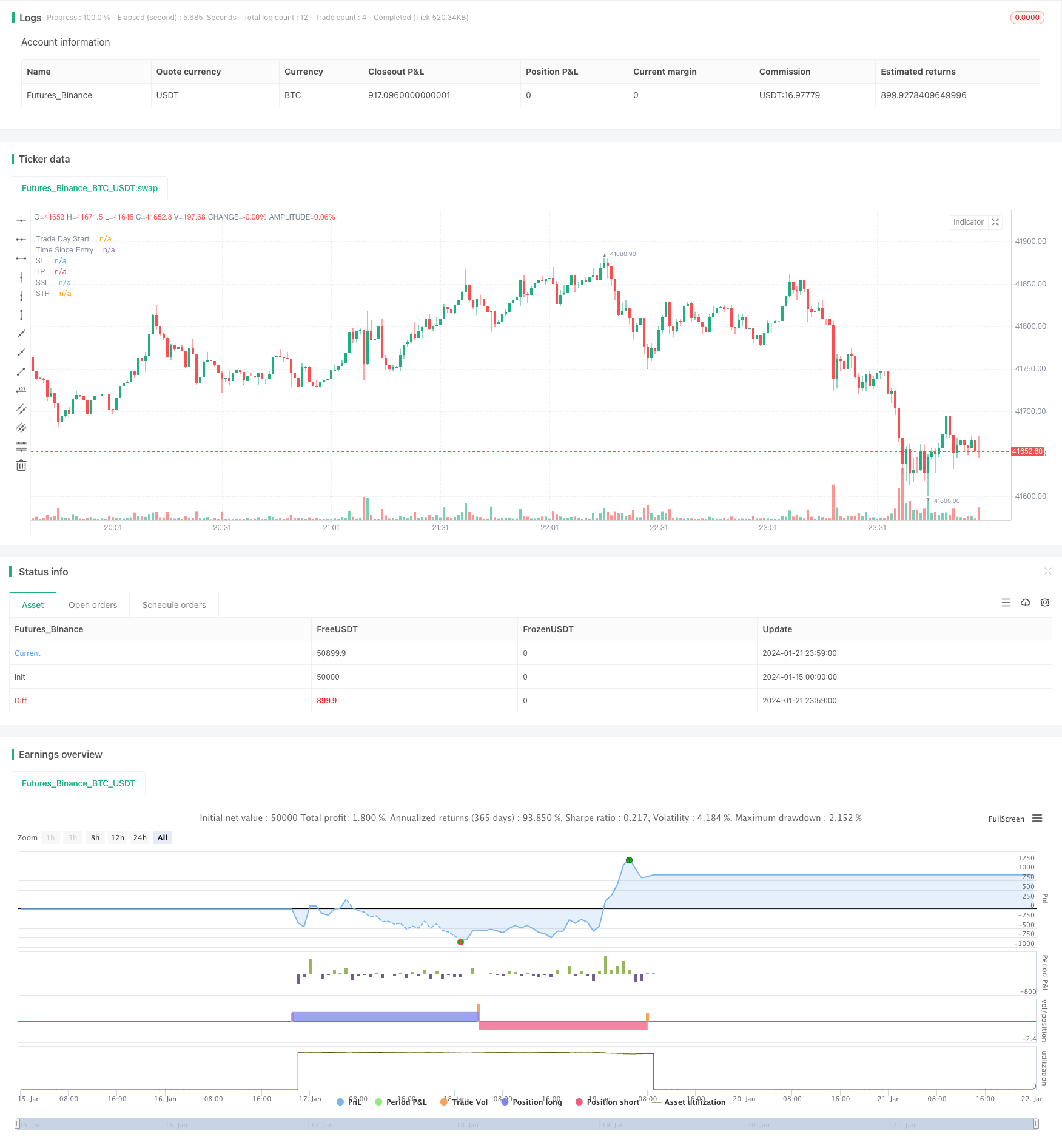

/*backtest

start: 2024-01-15 00:00:00

end: 2024-01-22 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// From "Crypto Day Trading Strategy" PDF file.

// * I'm using a SMA filter to avoid buying when the price is declining. Time frame was better at 15 min according to my test.

// 1 - Apply the 3 period Money Flow Index indicator to the 5 minute chart, using 0 and 100 as our oversold and overbought boundaries

// 2 - Wait for the MFI to reach overbought levels, that indicates the presence of "big sharks" in the market. Price needs to hold up

// the first two MFI overbought occurrences of the day to be considered as a bullish entry signal.*

// 3 - We buy when the MFI = 100 and the next candle is a bullish candle with short wicks.

// 4 - We place our Stop Loss below the low of the trading day and we Take Profit during the first 60 minutes after taking the trade.

// The logic above can be used in a mirrored fashion to take short entries, this is a custom parameter that can be modified from

// the strategy Inputs panel.

// © tweakerID

//@version=4

strategy("Money Flow Index 5 min Strategy",

overlay=true )

direction = input(0, title = "Strategy Direction", type=input.integer, minval=-1, maxval=1)

strategy.risk.allow_entry_in(direction == 0 ? strategy.direction.all : (direction < 0 ? strategy.direction.short : strategy.direction.long))

/////////////////////// STRATEGY INPUTS ////////////////////////////////////////

title1=input(true, "-----------------Strategy Inputs-------------------")

i_MFI = input(3, title="MFI Length")

OB=input(100, title="Overbought Level")

OS=input(0, title="Oversold Level")

barsizeThreshold=input(.5, step=.05, minval=.1, maxval=1, title="Bar Body Size, 1=No Wicks")

i_MAFilter = input(true, title="Use MA Trend Filter")

i_MALen = input(80, title="MA Length")

i_timedexit=input(false, title="Use 60 minutes exit rule")

short=input(true, title="Use Mirrored logic for Shorts")

/////////////////////// BACKTESTER /////////////////////////////////////////////

title2=input(true, "-----------------General Inputs-------------------")

// Backtester General Inputs

i_SL=input(true, title="Use Stop Loss and Take Profit")

i_SLType=input(defval="Strategy Stop", title="Type Of Stop", options=["Strategy Stop", "Swing Lo/Hi", "ATR Stop"])

i_SPL=input(defval=10, title="Swing Point Lookback")

i_PercIncrement=input(defval=3, step=.1, title="Swing Point SL Perc Increment")*0.01

i_ATR = input(14, title="ATR Length")

i_ATRMult = input(5, step=.1, title="ATR Multiple")

i_TPRRR = input(2.2, step=.1, title="Take Profit Risk Reward Ratio")

TS=input(false, title="Trailing Stop")

// Bought and Sold Boolean Signal

bought = strategy.position_size > strategy.position_size[1]

or strategy.position_size < strategy.position_size[1]

// Price Action Stop and Take Profit

LL=(lowest(i_SPL))*(1-i_PercIncrement)

HH=(highest(i_SPL))*(1+i_PercIncrement)

LL_price = valuewhen(bought, LL, 0)

HH_price = valuewhen(bought, HH, 0)

entry_LL_price = strategy.position_size > 0 ? LL_price : na

entry_HH_price = strategy.position_size < 0 ? HH_price : na

tp=strategy.position_avg_price + (strategy.position_avg_price - entry_LL_price)*i_TPRRR

stp=strategy.position_avg_price - (entry_HH_price - strategy.position_avg_price)*i_TPRRR

// ATR Stop

ATR=atr(i_ATR)*i_ATRMult

ATRLong = ohlc4 - ATR

ATRShort = ohlc4 + ATR

ATRLongStop = valuewhen(bought, ATRLong, 0)

ATRShortStop = valuewhen(bought, ATRShort, 0)

LongSL_ATR_price = strategy.position_size > 0 ? ATRLongStop : na

ShortSL_ATR_price = strategy.position_size < 0 ? ATRShortStop : na

ATRtp=strategy.position_avg_price + (strategy.position_avg_price - LongSL_ATR_price)*i_TPRRR

ATRstp=strategy.position_avg_price - (ShortSL_ATR_price - strategy.position_avg_price)*i_TPRRR

// Strategy Stop

DayStart = time == timestamp("UTC", year, month, dayofmonth, 0, 0, 0)

plot(DayStart ? 1e9 : na, style=plot.style_columns, color=color.silver, transp=80, title="Trade Day Start")

float LongStop = valuewhen(DayStart,low,0)*(1-i_PercIncrement)

float ShortStop = valuewhen(DayStart,high,0)*(1+i_PercIncrement)

float StratTP = strategy.position_avg_price + (strategy.position_avg_price - LongStop)*i_TPRRR

float StratSTP = strategy.position_avg_price - (ShortStop - strategy.position_avg_price)*i_TPRRR

/////////////////////// STRATEGY LOGIC /////////////////////////////////////////

MFI=mfi(close,i_MFI)

barsize=high-low

barbodysize=close>open?(open-close)*-1:(open-close)

shortwicksbar=barbodysize>barsize*barsizeThreshold

SMA=sma(close, i_MALen)

MAFilter=close > SMA

timesinceentry=(time - valuewhen(bought, time, 0)) / 60000

timedexit=timesinceentry == 60

BUY = MFI[1] == OB and close > open and shortwicksbar and (i_MAFilter ? MAFilter : true)

bool SELL = na

if short

SELL := MFI[1] == OS and close < open and shortwicksbar and (i_MAFilter ? not MAFilter : true)

//Debugging Plots

plot(timesinceentry, transp=100, title="Time Since Entry")

//Trading Inputs

DPR=input(true, "Allow Direct Position Reverse")

reverse=input(false, "Reverse Trades")

// Entries

if reverse

if not DPR

strategy.entry("long", strategy.long, when=SELL and strategy.position_size == 0)

strategy.entry("short", strategy.short, when=BUY and strategy.position_size == 0)

else

strategy.entry("long", strategy.long, when=SELL)

strategy.entry("short", strategy.short, when=BUY)

else

if not DPR

strategy.entry("long", strategy.long, when=BUY and strategy.position_size == 0)

strategy.entry("short", strategy.short, when=SELL and strategy.position_size == 0)

else

strategy.entry("long", strategy.long, when=BUY)

strategy.entry("short", strategy.short, when=SELL)

if i_timedexit

strategy.close_all(when=timedexit)

SL= i_SLType == "Swing Lo/Hi" ? entry_LL_price : i_SLType == "ATR Stop" ? LongSL_ATR_price : LongStop

SSL= i_SLType == "Swing Lo/Hi" ? entry_HH_price : i_SLType == "ATR Stop" ? ShortSL_ATR_price : ShortStop

TP= i_SLType == "Swing Lo/Hi" ? tp : i_SLType == "ATR Stop" ? ATRtp : StratTP

STP= i_SLType == "Swing Lo/Hi" ? stp : i_SLType == "ATR Stop" ? ATRstp : StratSTP

//TrailingStop

dif=(valuewhen(strategy.position_size>0 and strategy.position_size[1]<=0, high,0))

-strategy.position_avg_price

trailOffset = strategy.position_avg_price - SL

var tstop = float(na)

if strategy.position_size > 0

tstop := high- trailOffset - dif

if tstop<tstop[1]

tstop:=tstop[1]

else

tstop := na

StrailOffset = SSL - strategy.position_avg_price

var Ststop = float(na)

Sdif=strategy.position_avg_price-(valuewhen(strategy.position_size<0

and strategy.position_size[1]>=0, low,0))

if strategy.position_size < 0

Ststop := low+ StrailOffset + Sdif

if Ststop>Ststop[1]

Ststop:=Ststop[1]

else

Ststop := na

strategy.exit("TP & SL", "long", limit=TP, stop=TS? tstop : SL, when=i_SL)

strategy.exit("TP & SL", "short", limit=STP, stop=TS? Ststop : SSL, when=i_SL)

/////////////////////// PLOTS //////////////////////////////////////////////////

plot(i_SL and strategy.position_size > 0 and not TS ? SL : i_SL and strategy.position_size > 0 and TS ? tstop : na , title='SL', style=plot.style_cross, color=color.red)

plot(i_SL and strategy.position_size < 0 and not TS ? SSL : i_SL and strategy.position_size < 0 and TS ? Ststop : na , title='SSL', style=plot.style_cross, color=color.red)

plot(i_SL and strategy.position_size > 0 ? TP : na, title='TP', style=plot.style_cross, color=color.green)

plot(i_SL and strategy.position_size < 0 ? STP : na, title='STP', style=plot.style_cross, color=color.green)

// Draw price action setup arrows

plotshape(BUY ? 1 : na, style=shape.triangleup, location=location.belowbar,

color=color.green, title="Bullish Setup", size=size.auto)

plotshape(SELL ? 1 : na, style=shape.triangledown, location=location.abovebar,

color=color.red, title="Bearish Setup", size=size.auto)

- Handelsstrategie zur Trendumkehrung mit mehreren Indikatoren

- Bitcoin und Gold Doppel-Gap-Strategie

- MACD- und RSI-Kreuzungstrategie

- Momentum Pullback-Strategie

- Strategie für die Verlagerung des gleitenden Durchschnitts

- Gewinnnetzstrategie mit Schwankung

- Schwingungsdurchbruchstrategie auf Basis eines gleitenden Durchschnitts

- ZigZag-Mustererkennung Kurzfristige Handelsstrategie

- Volatilitäts- und Trendverfolgungsstrategie über Zeitrahmen hinweg basierend auf Williams VIX und DEMA

- Momentum-Breakout-Strategie basierend auf Zyklusbeurteilung mit gleitenden Durchschnitten

- Zweigleisige EMA-Kreuztrendhandelsstrategie

- Dynamische Handelsstrategie zur Optimierung des MACD

- Strategie zur Kombination von VWAP und RSI

- RSI-Handelsstrategie für Bollinger-Bänder

- Kurzfristige Handelsstrategie auf Basis des EMA-Kanals und des MACD

- Strategie zur Übertragung von Momentum und Angstindex

- Automatische Long/Short-Handelsstrategie auf Basis von täglichen Pivotpoints

- Strategie für den quantitativen Handel mit dreigliedrigem gleitendem Durchschnitt

- Eine auf dem exponentiellen gleitenden Durchschnitt basierende Momentum-Crossover-Strategie

- Adaptiver gleitender Durchschnitt und gewichteter gleitender Durchschnitt